Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with step 3 only im just not sure what info is needed to complete step 3 Equipment Requirements begin{tabular}{||l|c||} hline multicolumn{1}{|c|}{ Item

i need help with step 3 only im just not sure what info is needed to complete step 3

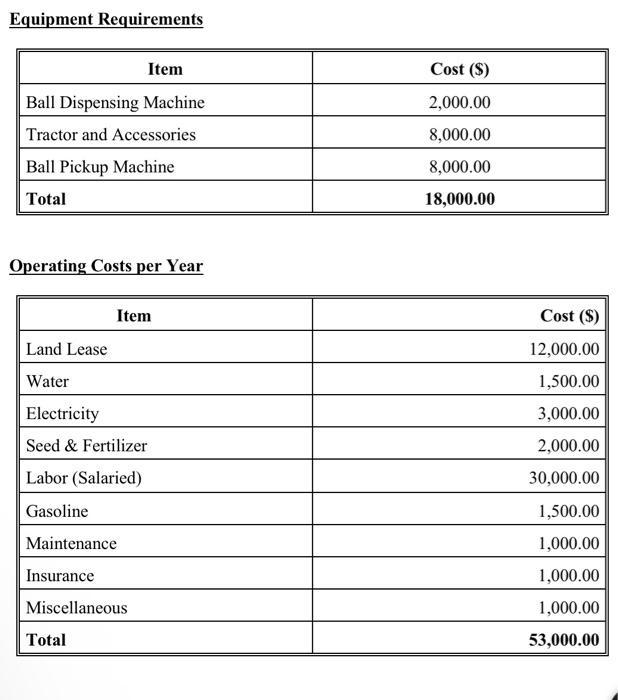

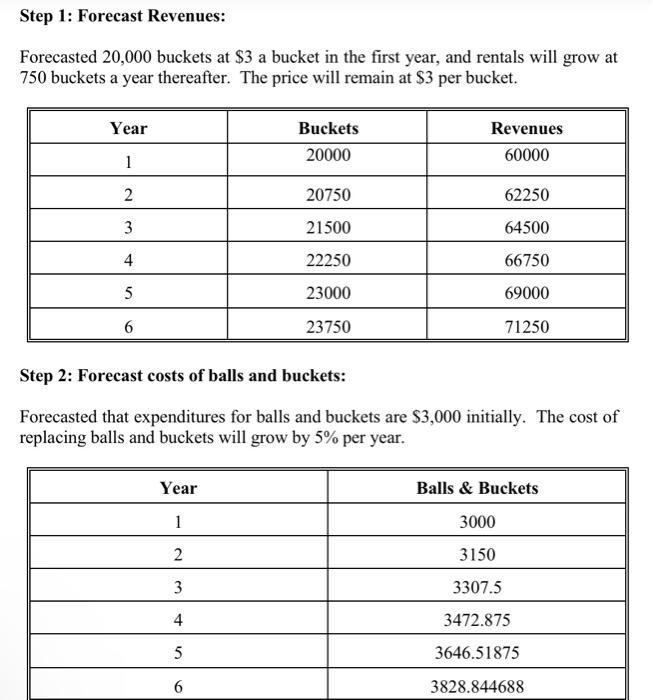

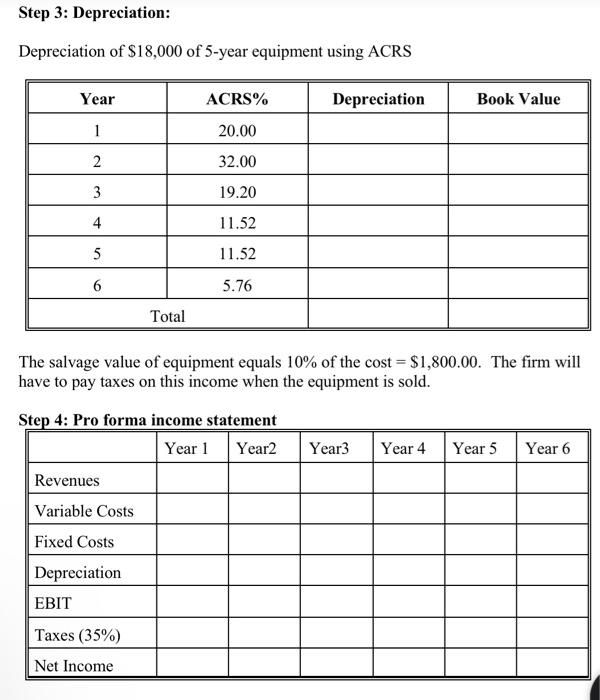

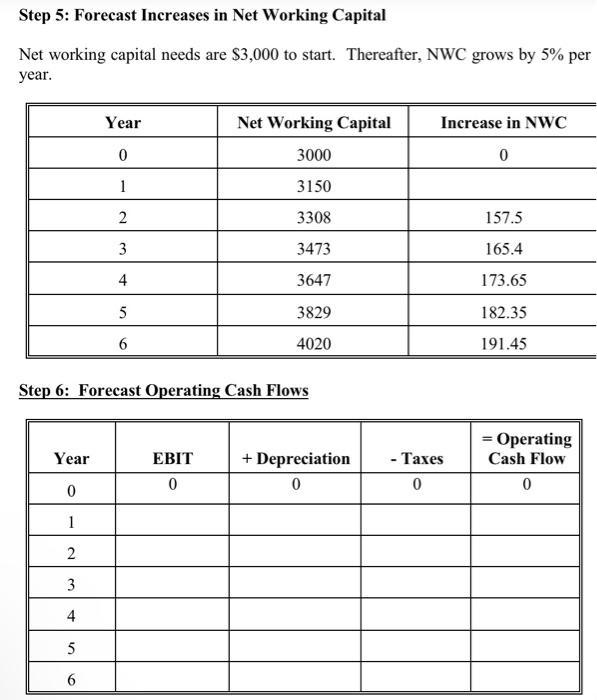

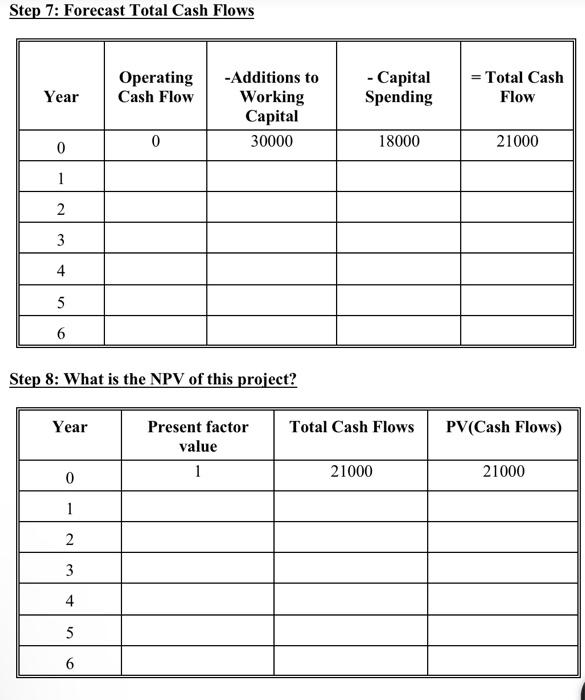

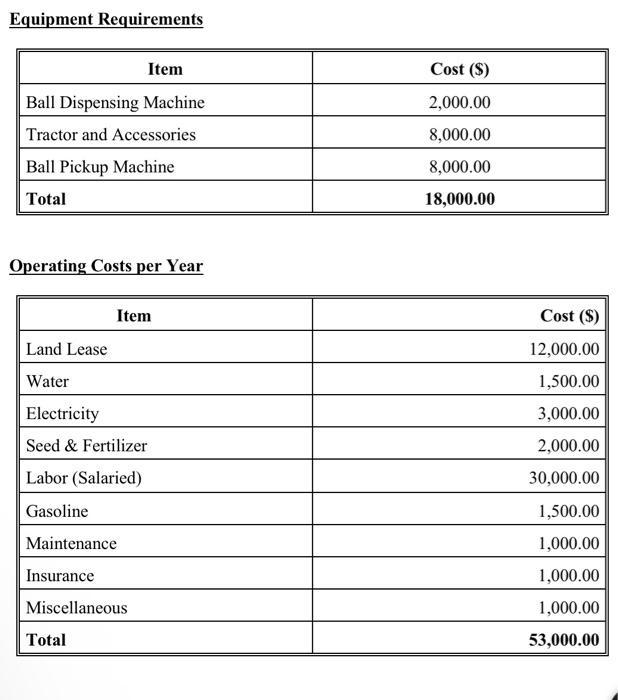

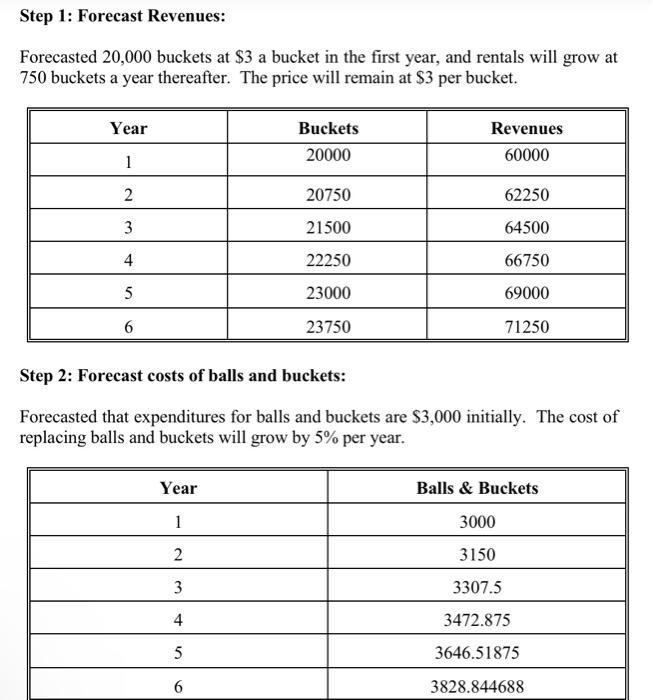

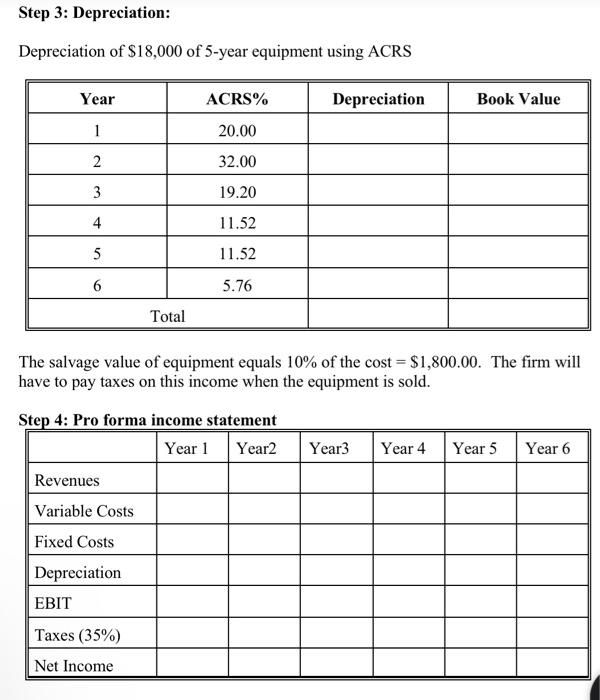

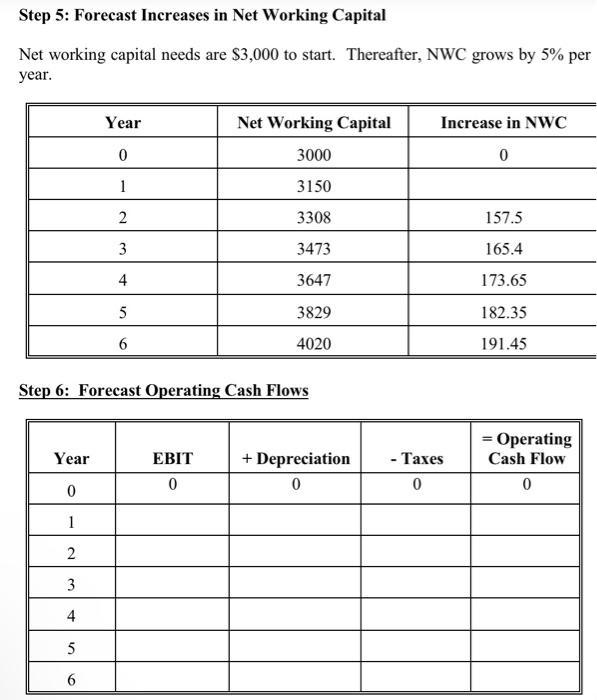

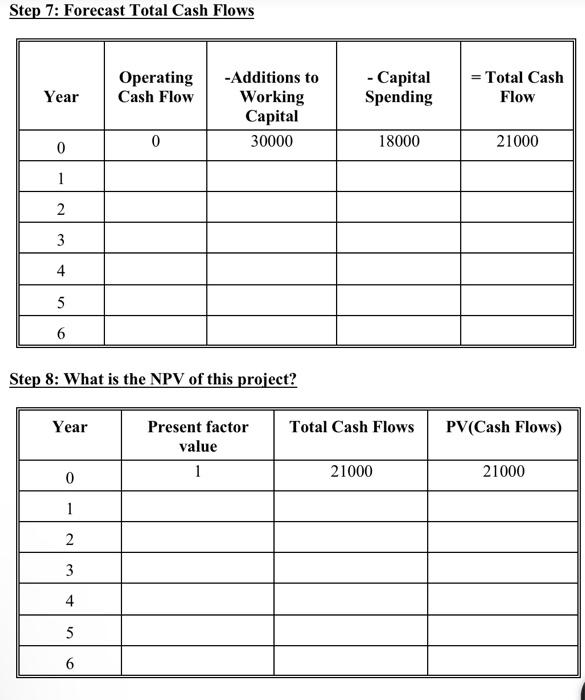

Equipment Requirements \begin{tabular}{||l|c||} \hline \multicolumn{1}{|c|}{ Item } & Cost (\$) \\ \hline Ball Dispensing Machine & 2,000.00 \\ \hline Tractor and Accessories & 8,000.00 \\ \hline Ball Pickup Machine & 8,000.00 \\ \hline Total & 18,000.00 \\ \hline \end{tabular} Operating Costs per Year \begin{tabular}{||l|r|} \hline \multicolumn{1}{|c|}{ Item } & Cost (\$) \\ \hline Land Lease & 12,000.00 \\ \hline Water & 1,500.00 \\ \hline Electricity & 3,000.00 \\ \hline Seed \& Fertilizer & 2,000.00 \\ \hline Labor (Salaried) & 30,000.00 \\ \hline Gasoline & 1,500.00 \\ \hline Maintenance & 1,000.00 \\ \hline Insurance & 1,000.00 \\ \hline Miscellaneous & 1,000.00 \\ \hline Total & 53,000.00 \\ \hline \end{tabular} Step 1: Forecast Revenues: Forecasted 20,000 buckets at $3 a bucket in the first year, and rentals will grow at 750 buckets a year thereafter. The price will remain at $3 per bucket. Step 2: Forecast costs of balls and buckets: Forecasted that expenditures for balls and buckets are $3,000 initially. The cost of replacing balls and buckets will grow by 5% per year. Step 3: Depreciation: Depreciation of $18,000 of 5-year equipment using ACRS The salvage value of equipment equals 10% of the cost =$1,800.00. The firm will have to pay taxes on this income when the equipment is sold. Step 4: Pro forma income statement Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows by 5% per year. Step 6: Forecast Operating Cash Flows Step7:ForecastTotalCashFlows \begin{tabular}{||c|c|c|c|c||} \hline \hline Year & OperatingCashFlow & -AdditionstoWorkingCapital & -CapitalSpending & TotalCashFlow \\ \hline 0 & 0 & 30000 & 18000 & 21000 \\ \hline 1 & & & & \\ \hline 2 & & & & \\ \hline 3 & & & & \\ \hline 4 & & & & \\ \hline 5 & & & & \\ \hline 6 & & & & \\ \hline \end{tabular} Step 8: What is the NPV of this project? \begin{tabular}{||c|c|c|c||} \hline Year & Presentfactorvalue & Total Cash Flows & PV(Cash Flows) \\ \hline 0 & 1 & 21000 & 21000 \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline 6 & & & \\ \hline \hline \end{tabular} Equipment Requirements \begin{tabular}{||l|c||} \hline \multicolumn{1}{|c|}{ Item } & Cost (\$) \\ \hline Ball Dispensing Machine & 2,000.00 \\ \hline Tractor and Accessories & 8,000.00 \\ \hline Ball Pickup Machine & 8,000.00 \\ \hline Total & 18,000.00 \\ \hline \end{tabular} Operating Costs per Year \begin{tabular}{||l|r|} \hline \multicolumn{1}{|c|}{ Item } & Cost (\$) \\ \hline Land Lease & 12,000.00 \\ \hline Water & 1,500.00 \\ \hline Electricity & 3,000.00 \\ \hline Seed \& Fertilizer & 2,000.00 \\ \hline Labor (Salaried) & 30,000.00 \\ \hline Gasoline & 1,500.00 \\ \hline Maintenance & 1,000.00 \\ \hline Insurance & 1,000.00 \\ \hline Miscellaneous & 1,000.00 \\ \hline Total & 53,000.00 \\ \hline \end{tabular} Step 1: Forecast Revenues: Forecasted 20,000 buckets at $3 a bucket in the first year, and rentals will grow at 750 buckets a year thereafter. The price will remain at $3 per bucket. Step 2: Forecast costs of balls and buckets: Forecasted that expenditures for balls and buckets are $3,000 initially. The cost of replacing balls and buckets will grow by 5% per year. Step 3: Depreciation: Depreciation of $18,000 of 5-year equipment using ACRS The salvage value of equipment equals 10% of the cost =$1,800.00. The firm will have to pay taxes on this income when the equipment is sold. Step 4: Pro forma income statement Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows by 5% per year. Step 6: Forecast Operating Cash Flows Step7:ForecastTotalCashFlows \begin{tabular}{||c|c|c|c|c||} \hline \hline Year & OperatingCashFlow & -AdditionstoWorkingCapital & -CapitalSpending & TotalCashFlow \\ \hline 0 & 0 & 30000 & 18000 & 21000 \\ \hline 1 & & & & \\ \hline 2 & & & & \\ \hline 3 & & & & \\ \hline 4 & & & & \\ \hline 5 & & & & \\ \hline 6 & & & & \\ \hline \end{tabular} Step 8: What is the NPV of this project? \begin{tabular}{||c|c|c|c||} \hline Year & Presentfactorvalue & Total Cash Flows & PV(Cash Flows) \\ \hline 0 & 1 & 21000 & 21000 \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline 6 & & & \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started