Answered step by step

Verified Expert Solution

Question

1 Approved Answer

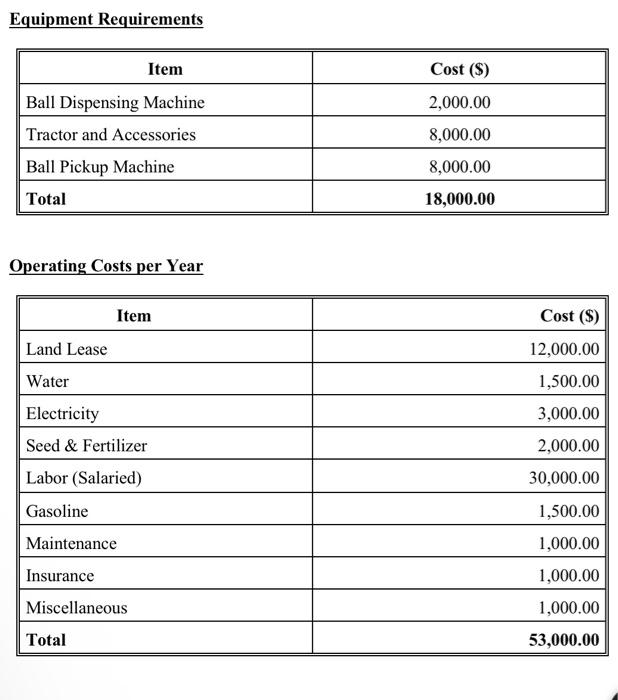

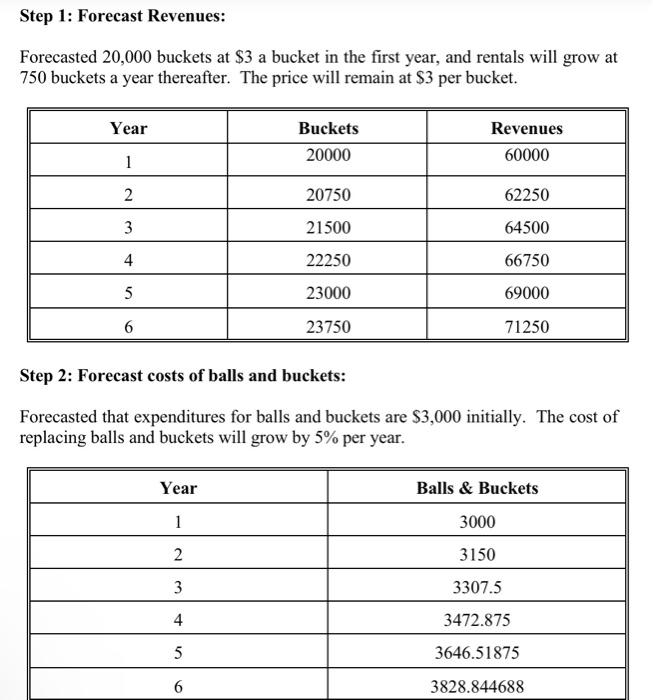

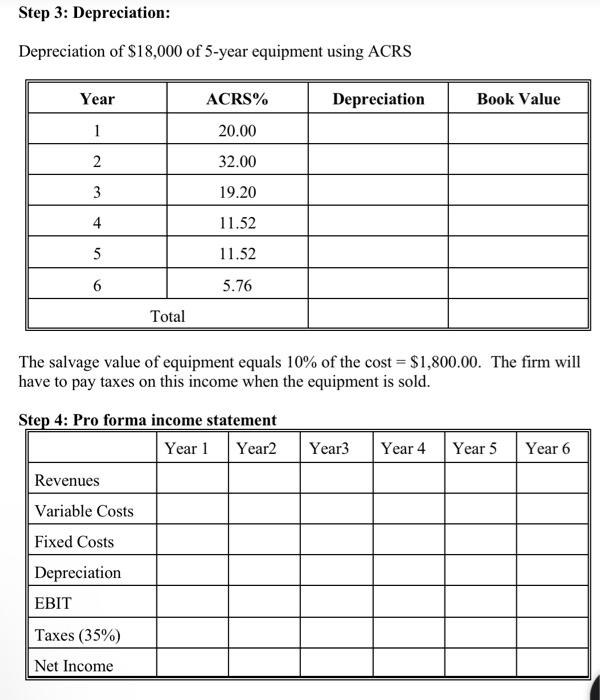

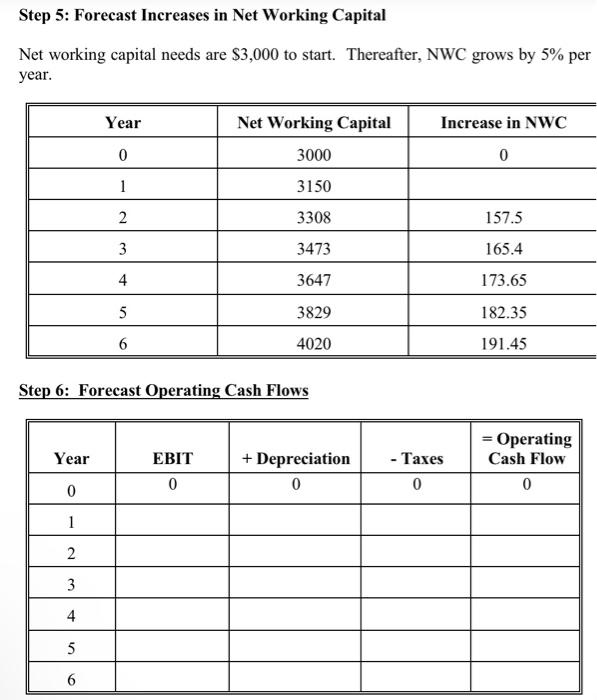

i need help with step 8 Equipment Requirements Operating Costs per Year Depreciation of $18,000 of 5-year equipment using ACRS The salvage value of equipment

i need help with step 8

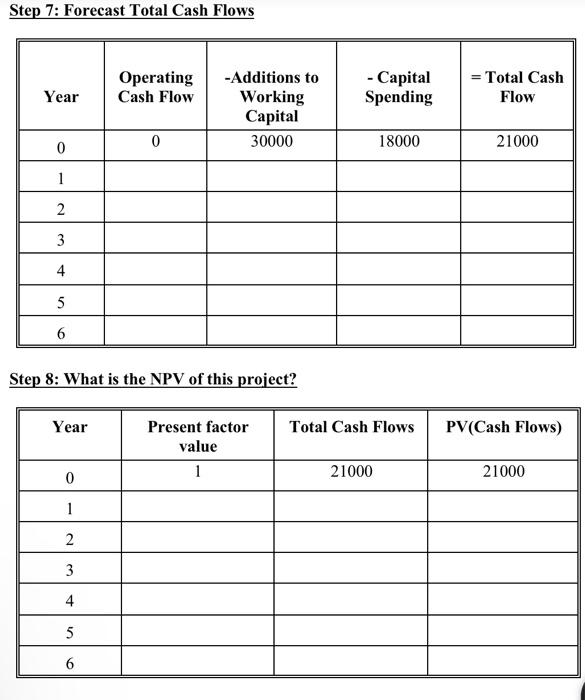

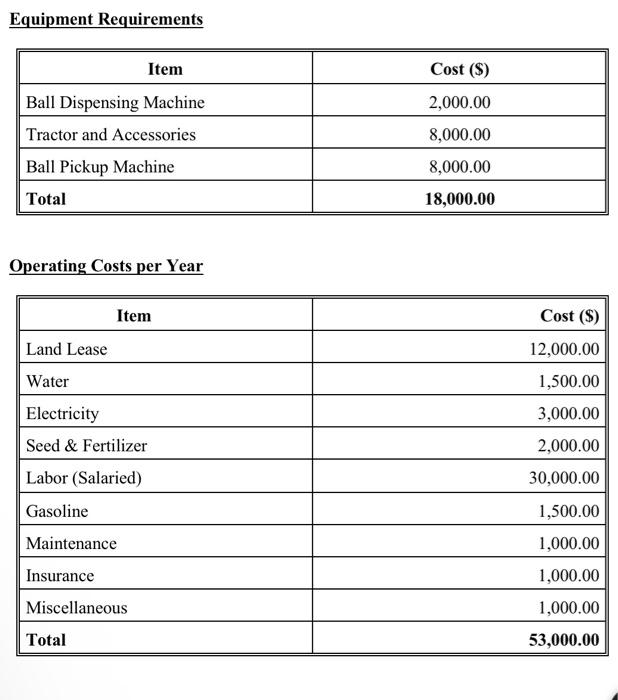

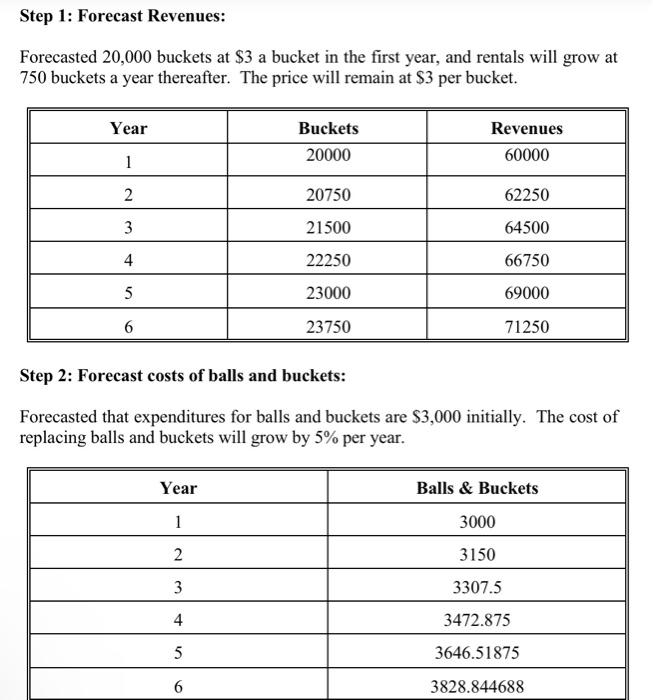

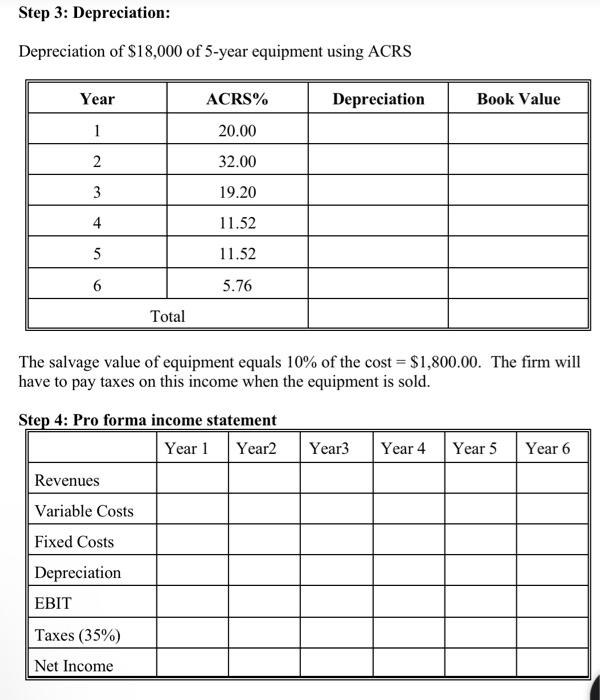

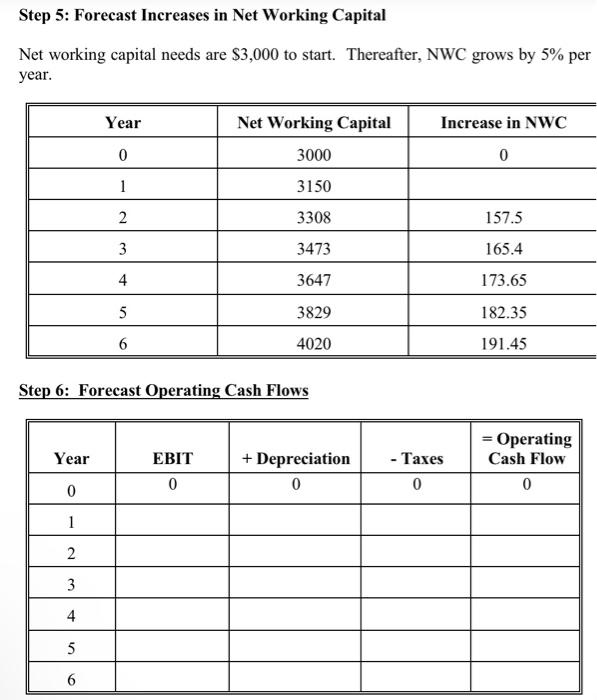

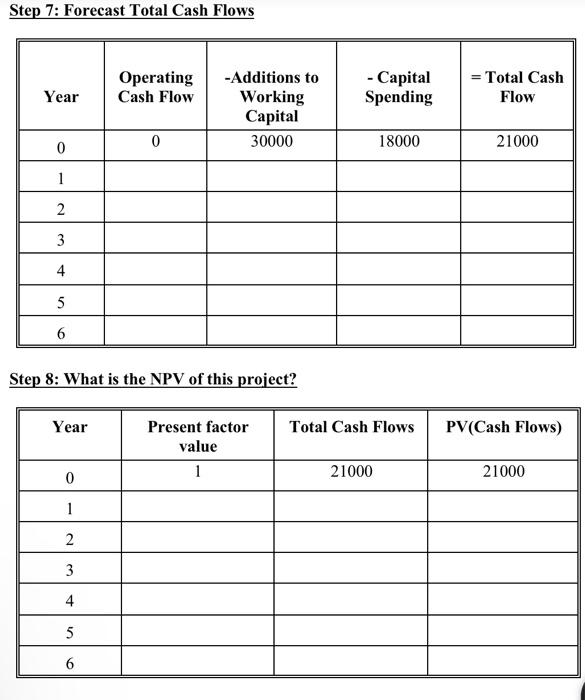

Equipment Requirements Operating Costs per Year Depreciation of $18,000 of 5-year equipment using ACRS The salvage value of equipment equals 10% of the cost =$1,800.00. The firm will have to pay taxes on this income when the equipment is sold. Step 4: Pro forma income statement Step 1: Forecast Revenues: Forecasted 20,000 buckets at $3 a bucket in the first year, and rentals will grow at 750 buckets a year thereafter. The price will remain at $3 per bucket. Step 2: Forecast costs of balls and buckets: Forecasted that expenditures for balls and buckets are $3,000 initially. The cost of replacing balls and buckets will grow by 5% per year. Step7:ForecastTotalCashFlows Step 8: What is the NPV of this project? Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows by 5% per year. Step 6: Forecast Operating Cash Flows Equipment Requirements Operating Costs per Year Depreciation of $18,000 of 5-year equipment using ACRS The salvage value of equipment equals 10% of the cost =$1,800.00. The firm will have to pay taxes on this income when the equipment is sold. Step 4: Pro forma income statement Step 1: Forecast Revenues: Forecasted 20,000 buckets at $3 a bucket in the first year, and rentals will grow at 750 buckets a year thereafter. The price will remain at $3 per bucket. Step 2: Forecast costs of balls and buckets: Forecasted that expenditures for balls and buckets are $3,000 initially. The cost of replacing balls and buckets will grow by 5% per year. Step7:ForecastTotalCashFlows Step 8: What is the NPV of this project? Step 5: Forecast Increases in Net Working Capital Net working capital needs are $3,000 to start. Thereafter, NWC grows by 5% per year. Step 6: Forecast Operating Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started