I need help with the answers to the questions in the screenshots provided.

Page number and question needed are listed on each screenshot. Please help.

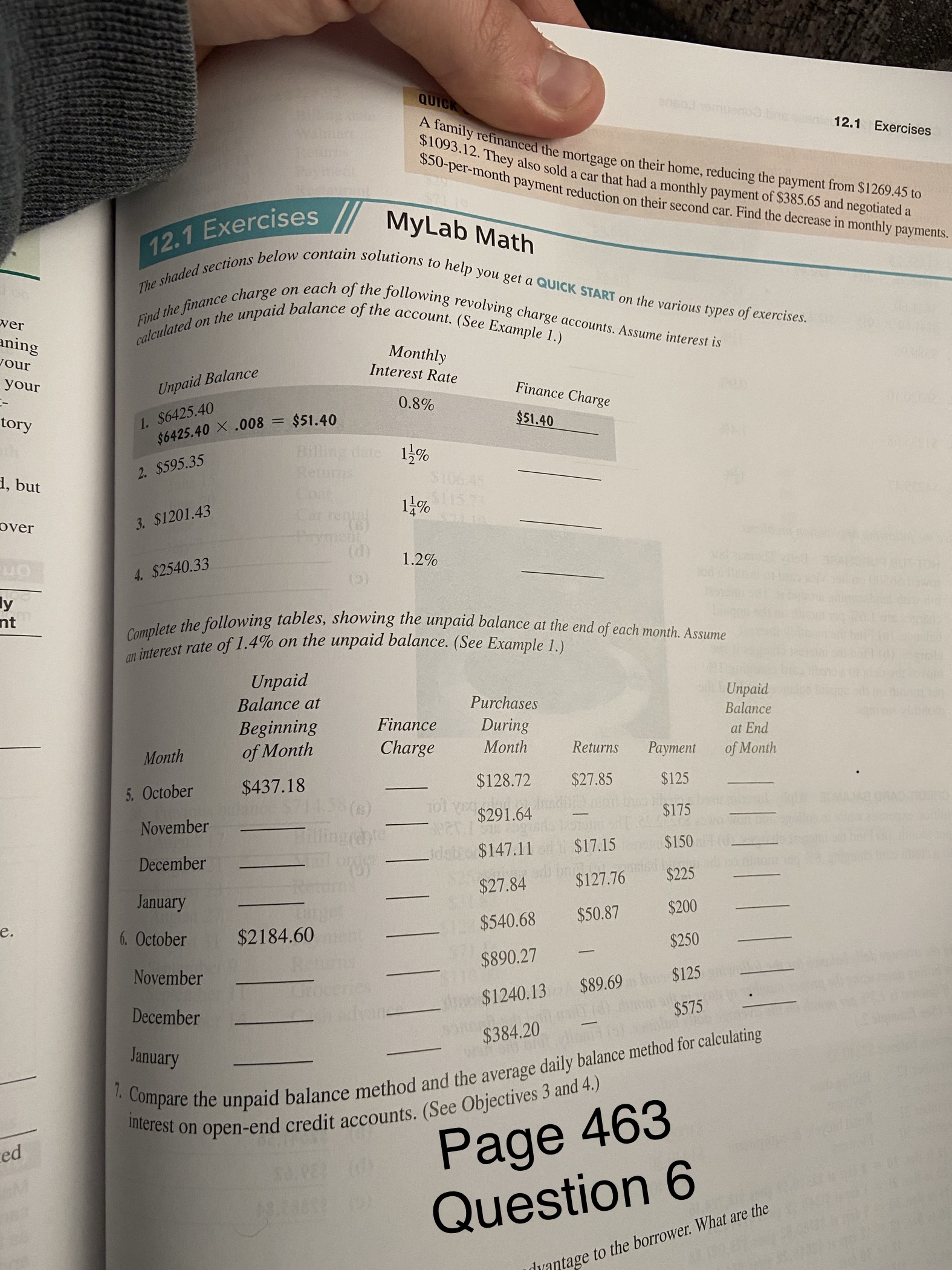

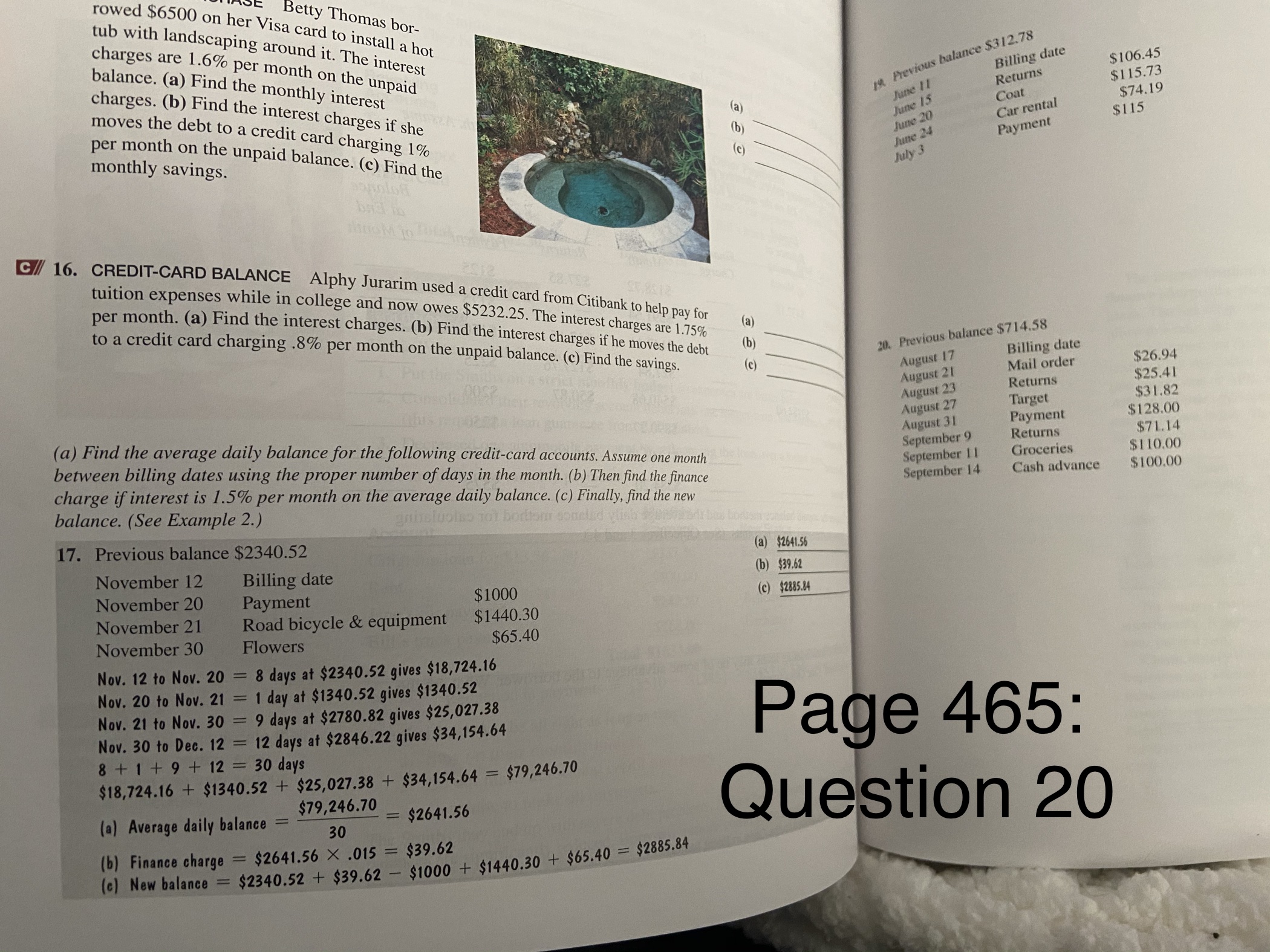

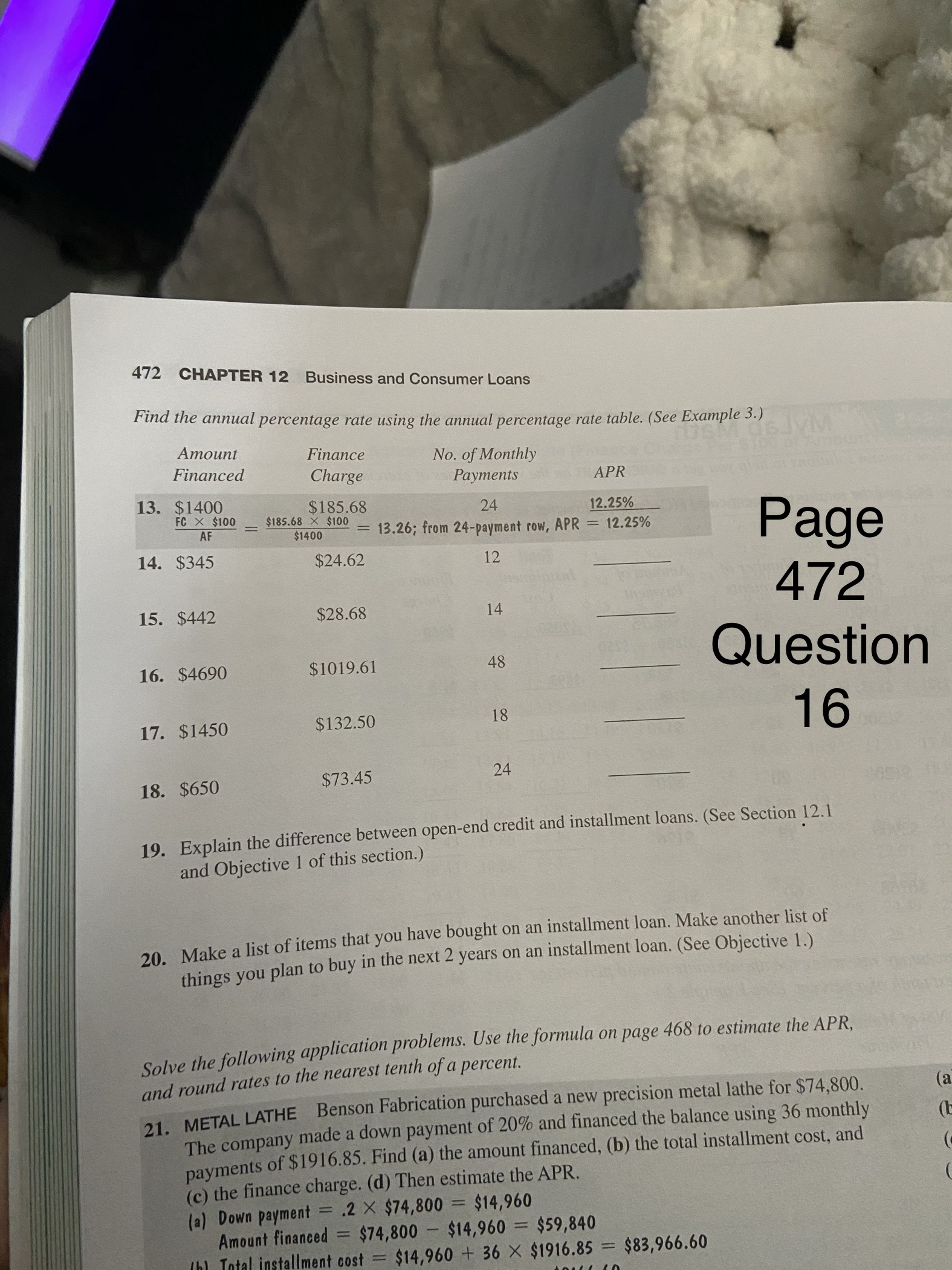

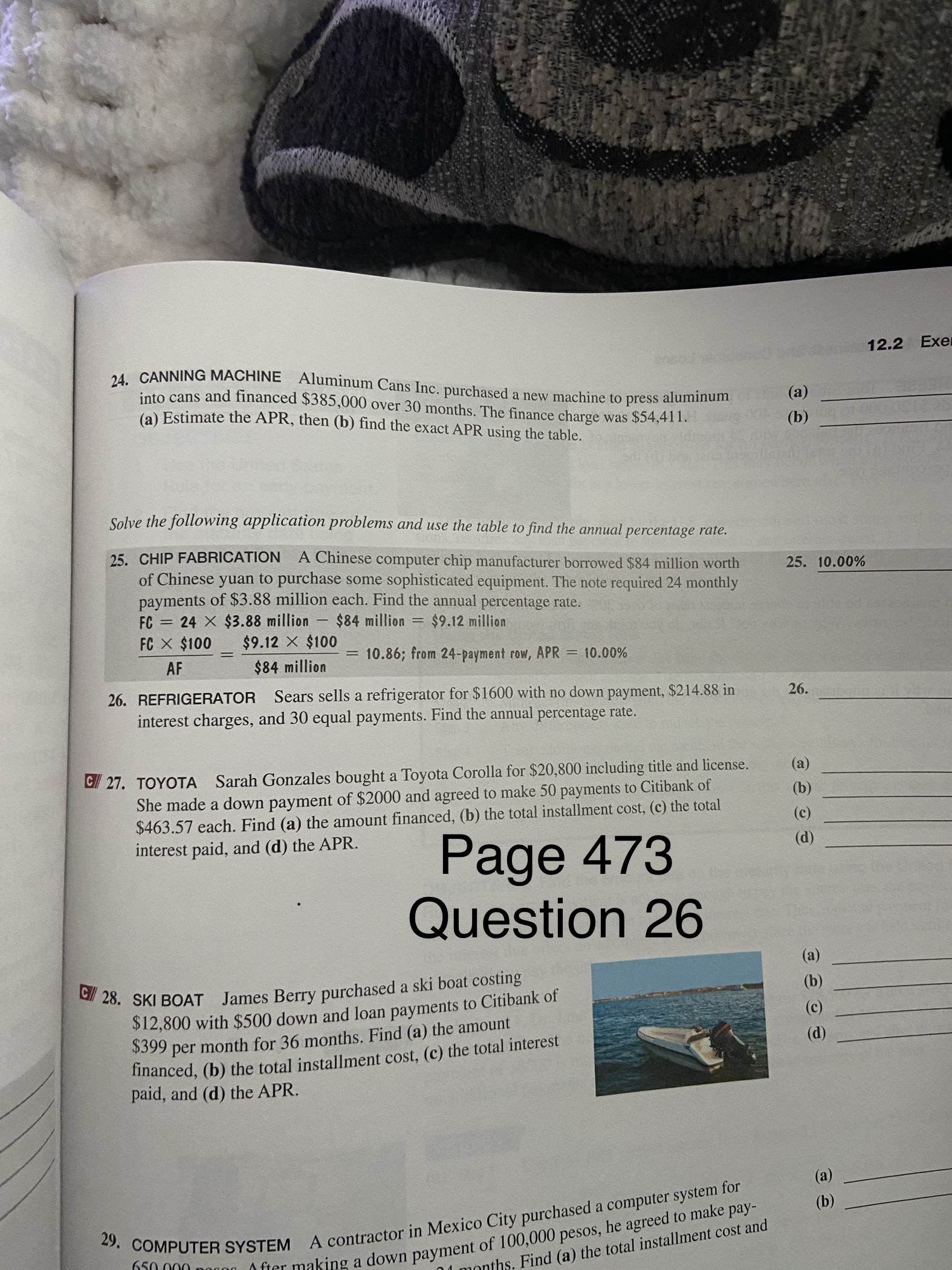

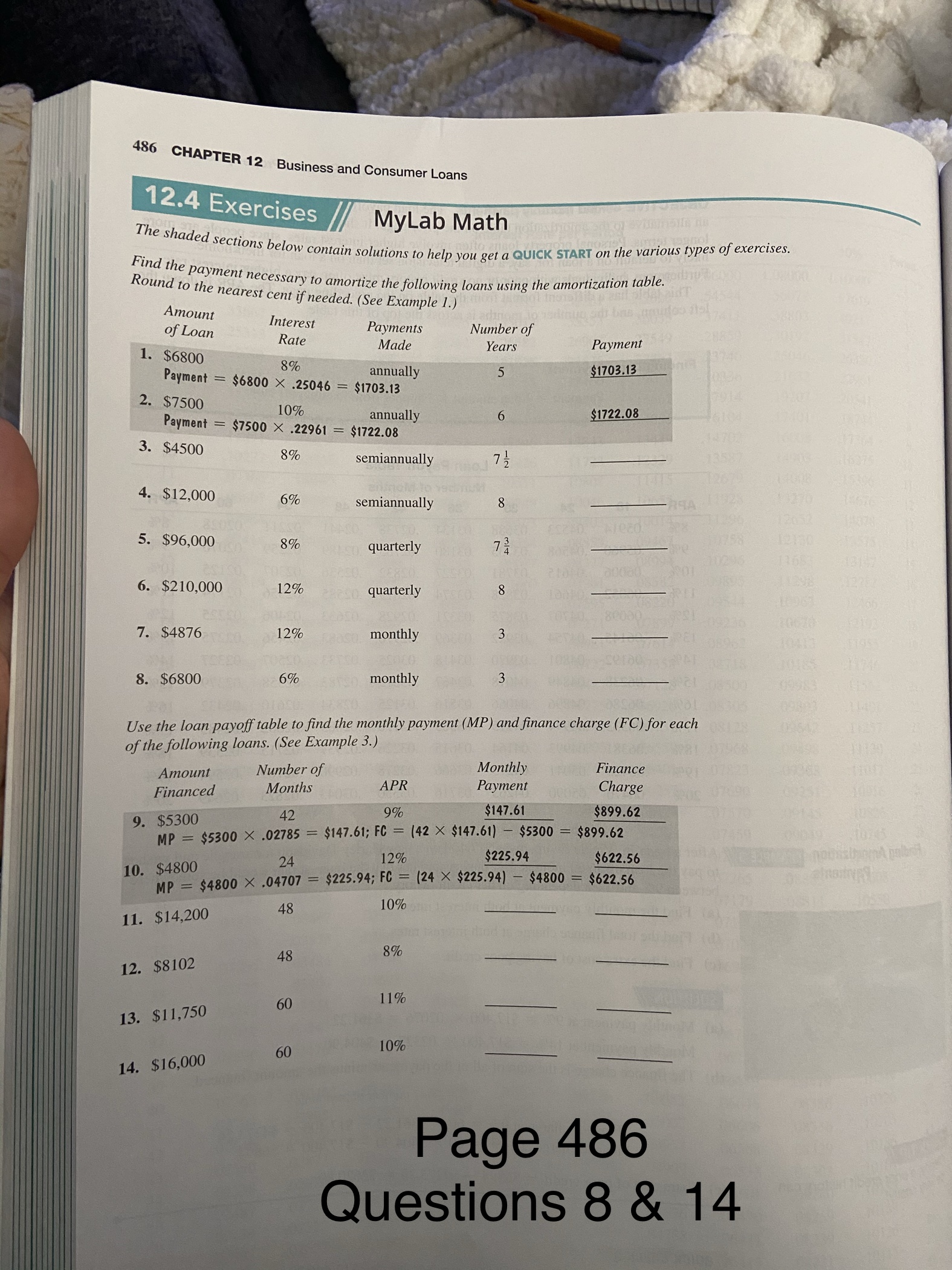

QUICK 12.1 Exercises A family refinanced the mortgage on their home, reducing the payment from $1269.45 to $1093.12. They also sold a car that had a monthly payment of $385.65 and negotiated a 12.1 Exercises $50-per-month payment reduction on their second car. Find the decrease in monthly payments MyLab Math shaded sections below contain solutions to help you get a QUICK START on the various types of exerc. ver ining Find the finance charge on each of the following revolving charge accounts. Assume interest calculated on the unpaid balance of the account. (See Example 1.) our Monthly your Unpaid Balance Interest Rate Finance Charge tory 1. $6425.40 0.8% $6425.40 X .008 = $51.40 $51.40 2. $595.35 Billing dare 15% , but 3. $1201.43 14% over Car rentgy 4. $2540.33 1.2% nt Complete the following tables, showing the unpaid balance at the end of each month. Assume an interest rate of 1.4% on the unpaid balance. (See Example 1.) Unpaid Balance at Purchases Unpaid Balance Beginning Finance During at End Month of Month Charge Month Returns Payment of Month 5. October $437.18 $128.72 $27.85 $125 November $291.64 $175 flingcate December $147.11 $17.15 $150 $127.76 $225 January $27.84 $540.68 $50.87 $200 6. October $2184.60 $250 November $890.27 $1240.13 $89.69 $125 December $575 $384.20 January 7. Compare the unpaid balance method and the average daily balance method for calculating interest on open-end credit accounts. (See Objectives 3 and 4.) ed Page 463 Question 6 ntage to the borrower. What are theBetty Thomas bor- rowed $6500 on her Visa card to install a hot tub with landscaping around it. The interest charges are 1.6% per month on the unpaid balance. (a) Find the monthly interest 19 Previous balance $312.78 Billing date $106.45 charges. (b) Find the interest charges if she Returns $115.73 moves the debt to a credit card charging 1% (a) June 11 June 15 Coat $74.19 per month on the unpaid balance. (c) Find the June 20 Car rental $115 monthly savings. June 24 Payment July 3 MUGM 10 C// 16. CREDIT-CARD BALANCE Alphy Jurarim used a credit card from Citibank to help pay for tuition expenses while in college and now owes $5232.25. The interest charges are 1.75% per month. (a) Find the interest charges. (b) Find the interest charges if he moves the debt to a credit card charging .8% per month on the unpaid balance. (c) Find the savings. (a) (b) 20. Previous balance $714.58 ( c) August 17 Billing date August 21 Mail order $26.94 August 23 Returns $25.41 August 27 Target $31.82 (a) Find the average daily balance for the following credit-card accounts. Assume one month August 31 Payment $128.00 between billing dates using the proper number of days in the month. (b) Then find the finance September 9 Returns $71.14 September 11 Groceries $110.00 charge if interest is 1.5% per month on the average daily balance. (c) Finally, find the new September 14 Cash advance $100.00 balance. (See Example 2.) 17. Previous balance $2340.52 November 12 (a) $2641.56 November 20 Billing date (b) $39.62 Payment $1000 November 21 (c) $2885.84 Road bicycle & equipment $1440.30 November 30 Flowers $65.40 Nov. 12 to Nov. 20 = 8 days at $2340.52 gives $18, 724.16 Nov. 20 to Nov. 21 = 1 day at $1340.52 gives $1340.52 Nov. 21 to Nov. 30 = 9 days at $2780.82 gives $25,027.38 Nov. 30 to Dec. 12 = 12 days at $2846.22 gives $34, 154.64 8 + 1 + 9+12 = 30 days $18,724.16 + $1340.52 + $25,027.38 + $34, 154.64 = $79, 246.70 Page 465: (a) Average daily balance = $79,246.70 30 = $2641.56 (b) Finance charge = $2641.56 X .015 = $39.62 Question 20 (c) New balance = $2340.52 + $39.62 - $1000 + $1440.30 + $65.40 = $2885.84472 CHAPTER 12 Business and Consumer Loans Find the annual percentage rate using the annual percentage rate table. (See Example 3.) Amount Finance No. of Monthly JVM Financed Charge Payments APR 13. $1400 FC X $100 $185.68 $185.68 X $100 24 12.25% AF $1400 = 13.26; from 24-payment row, APR = 12.25% 14. $345 $24.62 12 Page 15. $442 $28.68 14 472 16. $4690 $1019.61 48 Question 17. $1450 $132.50 18 16 18. $650 $73.45 24 19. Explain the difference between open-end credit and installment loans. (See Section 12.1 and Objective 1 of this section.) 20. Make a list of items that you have bought on an installment loan. Make another list of things you plan to buy in the next 2 years on an installment loan. (See Objective 1.) Solve the following application problems. Use the formula on page 468 to estimate the APR, and round rates to the nearest tenth of a percent. 21. METAL LATHE Benson Fabrication purchased a new precision metal lathe for $74,800. The company made a down payment of 20% and financed the balance using 36 monthly payments of $1916.85. Find (a) the amount financed, (b) the total installment cost, and (c) the finance charge. (d) Then estimate the APR. (a) Down payment = .2 X $74,800 = $14,960 Amount financed = $74,800 - $14,960 = $59,840 Total installment cost = $14,960 + 36 X $1916.85 = $83,966.6012.2 Exe 24. CANNING MACHINE Aluminum Cans Inc. purchased a new machine to press aluminum into cans and financed $385,000 over 30 months. The finance charge was $54,411. (a) (a) Estimate the APR, then (b) find the exact APR using the table. ( b ) Solve the following application problems and use the table to find the annual percentage rate. 25. CHIP FABRICATION A Chinese computer chip manufacturer borrowed $84 million worth of Chinese yuan to purchase some sophisticated equipment. The note required 24 monthly 25. 10.00% payments of $3.88 million each. Find the annual percentage rate. FC = 24 X $3.88 million - $84 million = $9.12 million FC X $100 $9.12 X $100 AF $84 million = 10.86; from 24-payment row, APR = 10.00% 26. REFRIGERATOR Sears sells a refrigerator for $1600 with no down payment, $214.88 in 26. interest charges, and 30 equal payments. Find the annual percentage rate. c/ 27. TOYOTA Sarah Gonzales bought a Toyota Corolla for $20,800 including title and license. (a) She made a down payment of $2000 and agreed to make 50 payments to Citibank of (b) $463.57 each. Find (a) the amount financed, (b) the total installment cost, (c) the total (c) interest paid, and (d) the APR. Page 473 (d) Question 26 C/ 28. SKI BOAT James Berry purchased a ski boat costing $12,800 with $500 down and loan payments to Citibank of $399 per month for 36 months. Find (a) the amount financed, (b) the total installment cost, (c) the total interest paid, and (d) the APR. (a) 29. COMPUTER SYSTEM A contractor in Mexico City purchased a computer system for (b ) king a down payment of 100,000 pesos, he agreed to make pay- Find (a) the total installment cost and474 CHAPTER 12 Business and Consumer Loans 32. GOAT CHEESE Toni Smith wants to produce goat cheese (a) and needs $120,000 to purchase 400 goats. He pays $30,000 (b) down and finances the balance with 24 monthly payments of $4253.44. Find (a) the total installment cost and (b) the annual percentage rate. 33. Should businesses be able to charge interest rates of over 20% to customers with very poor credit histories? Why or why not? If not, do you think any firm would lend to these customers? 34. Explain why it is important for the government to regulate the way in which interest rates are stated. Page 474 Question 34480 CHAPTER 12 Business and Consumer Loans 18. REMODELING The Second Avenue Butcher Shop financed a remodeling program by giving the builder a (a) note for $32,500. The note was made on September 14 and (b ) is due in 120 days. Interest on the note is 9.75%. On December 9, the firm makes a partial payment of $9000. Find (a) the amount due on the maturity date of the note and (b) the interest paid on the note. 19. INVENTORY The Washington News signed a note on February 18, maturing on May 15. The face value of the note was $104,500, with interest of 11%. The firm made a partial (b ) payment of $38,000 on March 20 and a second partial payment of $27,200 on April 16. Find (a) the amount due on the maturity date of the note and (b) the amount of interest paid on the note. Page 480 Question 18 C// 20. SURVEILLANCE CAMERAS To help detect trespassers at night, a small security firm pur- chased some high-technology cameras using a note from Citibank for $32,000. The note (a) was signed on July 26 and was due on November 20. The interest rate is 13%. The firm ( b ) made a partial payment of $6000 on August 31 and a second partial payment of $11,700 on October 4. Find (a) the amount due on the maturity date of the note and (b) the interest paid on the note.22. GARBAGE TRUCK Haul-it-Away, Inc., pur- 12.3 Exercis chased a dump truck for $62,000. The owners made a down payment of $22,000 and financed (a) the remainder with 36 payments of $1328.57 (b ) each. They paid off the note with 12 payments remaining. Find (a) the amount of unearned interest and (b) the amount necessary to pay the loan in full. Page 481 Question 24 C/ 23. PRINTING BlackTop Printing made a $5000 down payment on a special copy machine costing $23,800. The loan agreement with Citibank called for 20 monthly payments of (a) $1025 each. Find (a) the finance charge, (b) the unearned interest, and (c) the amount nec- (b) essary to pay the loan in full after the 14th payment. (c) 24. MOVIE PROJECTORS Movie 6, Inc., purchased two movie projectors at a total cost of (a) $12,200 with a down payment of $1500. The company agreed to make 12 monthly payments of $945 each. Find (a) the finance charge, (b) the unearned interest, and (c) the ( b ) amount necessary to pay the loan in full after the 8th payment. 25. WEB DESIGN Blackstone Web Design needed $76,800 to purchase computers, software, (a) and network equipment. The owners paid $15,000 down and financed the balance with (b) 30 monthly payments of $2423.89 each. Find (a) the total installment cost, (b) the finance charge, (c) the unearned interest, and (d) the amount needed to pay the loan in full after the 10th payment. 26. ASPHALT CRUMB Binston Asphalt borrowed $850,000 to purchase a machine that (a) converts old tires into asphalt crumb for use as a base material under sports arenas. The (b) company paid $200,000 of the cost up front and financed the balance with 36 monthly (c) Payments of $20,821.42 each. Find (a) the total installment cost, (b) the finance charge, (@ the unearned interest, and (d) the amount needed to pay the loan in full after the 25th payment.486 CHAPTER 12 Business and Consumer Loans 12.4 Exercises 7/ MyLab Math The shaded sections below contain solutions to help you get a QUICK START on the various types of exercises. Find the payment necessary to amortize the following loans using the amortization table. Round to the nearest cent if needed. (See Example 1.) Amount of Loan Interest Payments Number of Rate Made Years Payment 1. $6800 8% annually $1703.13 Payment = $6800 X .25046 = $1703.13 2. $7500 10% Payment = $7500 X .22961 = $1722.08 annually 6 $1722.08 3. $4500 8% semiannually 4. $12,000 6% semiannually 8 5. $96,000 8% quarterly 6. $210,000 12% quarterly 8 7. $4876 12% monthly w 8. $6800 6% monthly 3 Use the loan payoff table to find the monthly payment (MP) and finance charge (FC) for each of the following loans. (See Example 3. Amount Number of Monthly Finance Financed Months APR Payment Charge 9. $5300 42 9% $147.61 $899.62 MP = $5300 X .02785 = $147.61; FC = (42 X $147.61) - $5300 = $899.62 24 12% $225.94 $622.56 10. $4800 MP = $4800 X .04707 = $225.94; FC = (24 X $225.94) - $4800 = $622.56 10% 11. $14,200 48 8% 12. $8102 13. $11,750 60 1 1% 60 10% 14. $16,000 Page 486 Questions 8 & 1415. Explain the difference between personal property and real property. Why do you some- times need to borrow to buy personal property? (See Objective 1.) 12.4 Exercises 487 16. Explain why a loan officer always looks at a credit report before making a loan. What should you do if your credit report is not accurate? Page 487 Solve the following application problems using the amortization table. Question 18 17. FORESTRY OPERATIONS Blackstone Logging borrowed $62,400 to purchase a used truck to haul (a) $1900.70 logs. The loan has a rate of 12% per year and (b) $13, 628 requires 40 monthly payments. Find (a) the monthly payment and (b) the total interest paid. (a) Monthly payment = $62,400 X .03046 = $1900.70 (6) Total interest = (40 X $1900.70) - $62,400 = $13, 628 18. OPENING A RESTAURANT Chuck and Judy Nielson opened a restaurant at a cost of $340,000. They paid $40,000 of their own money and agreed to pay the remainder in quar- (a) (b ) terly payments over 7 years at 12%. Find (a) the quarterly payment and (b) the total amount of interest paid over 7 years. 19. PRINTER An insurance firm pays $4000 for a new high-speed color printer. It amortizes the loan for the printer in 4 annual payments at 8%. Prepare an amortization schedule for this machine. Payment Principal at Number Amount of Interest Portion to Payment for Period Principal End of Period 20. TRACTOR PURCHASE Long Haul Trucking purchases a tractor for pulling 18-wheel on interstate highways at a cos t a cost of $72,000. It agrees to pay for it with a loan from Citibank that will be amortized over 9 annual payments at 8% interest. Prepare an amorti- zation schedule for th e for the truck. Payment Interest Portion to Principal at Amount of End of Period Number Payment for Period Principal488 CHAPTER 12 Business and Consumer Loans Solve the following application problems. Use the loan payoff table. (See Objective 3.) c/ 21. ELECTRONIC EQUIPMENT An engineering firm purchases specialized software for $24,500. The firm makes a down payment of $10,000 and amortizes the balance with monthly loan payments to Citibank of 11% for 4 years. Prepare an amortization schedule showing the first 5 payments. Payment Number Amount of Principal at Payment Interest Portion to for Period Principal End of Period Page 488 Question 22 22. AMORTIZING A LOAN Rebecca Reed just graduated from dental school and borrows $120,000 from Citibank to purchase equipment. She agreed to amortize the loan with monthly payments at 10% for 4 years. Prepare an amortization schedule for the first 5 payments. Payment Amount of Interest Portion to Principal at Number Payment for Period Principal End of Period 23. APPLIANCE REPAIR Jessica Navarro needs $50,000 to expand her business. She has $15,000 and was forced to finance the balance at a high 14% interest rate for 36 months due to not having much credit history and also making a couple of late payments on a Mastercard. Prepare an amortization schedule showing the first 5 payments. Payment Amount of Interest Portion to Payment for Period Principal Principal at Number End of Period12.5 Exercises / MyLab Math of exercises. The shaded sections below contain solutions to help you get a QUICK START on the various types 12.5 Exercises 495 (See Example 1.) Use the real estate amortization table to find the monthly payment for the following loans. Amount Interest of Loan Rate Term of Loan Monthly 1. $340,000 4 -% Payment Payment = 340 X $7.65 = $2601 15 years $2601.00 2. $263,100 4% Payment = 263.1 X $4.77 = $1254.99 30 years $1254.99 3. $168,500 4% 25 years Page 495 on borrowing cond Here taken out in 2018 Mins 4. $132,000 65% 25 years Question 6 5. $187,900 5% 20 years Total Interest over 30-Year Legs 6. $280,000 6% 15 years $179.840 $260.840 7. Explain how different interest rates can make a large difference in interest charges over a number of years. (See Example 1.) lice. as much as 100 pains In mm $225 and increase the able 8. Explain why long-term loans result in a lot of interest. Also explain the effects of shortening ke a late payment the term of a loan. (See Example 1.) he following factors Find the total monthly payment, including taxes and insurance, for the following loans. (See Example 3. Amount Interest Term of Annual Annual Monthly Payment of Loan Rate Loan Taxes Insurance 30 years $2870 $825 $1495.92 9. $198,000 6% 198 X $6.00 = $1188; $1188.00 + $2870 - $825 = $1495.92 $940 $2349.93 10. $368,000 4 -% 30 years $4870 368 X $5.07 = $1865.76; $1865.76 + $4870 + $940 = $2349.93 $680 11. $232,900 4% 15 years $3250 $850 5% 30 years $3920 12. $195,000496 CHAPTER 12 Business and Consumer Loans Amount of Loan Interest Rate Term of 13. $149,400 Loan Annual Annual Monthly Taxes 5 5% Insurance Payment 20 years $2840 $665 14. $283,000 5% 30 years $3450 $850 Solve the following application problems. C/ 15. HOME PURCHASE The Potters want to buy a small cottage costing $127,000 with 15. Yes, qualified annual insurance and taxes of $720 and $2300, respectively. They have saved $10,000 for a down payment, and they can get a 5%, 30-year mortgage from Citibank. They are quali- fied for a home loan as long as the total monthly payment does not exceed $1000. Are they qualified? Loan amount = $127,000 - $10,000 = $117,000 Monthly payment = 117 X $5.37 = $628.29 Total payment = $628.29 + $720 + $2300 Do = $879.96; Yes, qualified 16. CONDOMINIUM PURCHASE The Polinki family wants to buy a condominium that costs 16. $225,000 with annual insurance and taxes of $850 and $3200, respectively. They plan to pay $20,000 down and amortize the balance at 42% per year for 25 years. They are quali- fied for a loan as long as the payments do not exceed $1350. Are they qualified for the loan? 17. HOME LOAN June and Bill Able borrow $122,500 on a duplex they own at 7 7% for 15 years. Prepare a repayment schedule for the first two payments. (See Example 2.) Payment Total Interest Principal Remaining Number Payment Payment Payment Balance 18. ELDERLY HOUSING Gabriel Godwin purchases a tiny home for his elderly mother. After a large down payment, he finances $88,600 at 5% for 10 years. Prepare a repayment schedule for the first two payments. (See Example 2.) Total Interest Principal Remaining Payment Number Payment Payment Payment Page 496 Questions 14 & 16 QUICK CHECK ANSWERS 1. (a) $1115.40; $401,544 (b) $1463; $526,680 2. Monthly payment = $814.04 Interest Principal Remaining Payment Payment Payment Balance Number $128,600.00 $482.25 $331.79 $128,268.21 W N $481.01 $333.03 $127,935.18 $479.76 $334.28 $127,600.90 3. $1350.54