Answered step by step

Verified Expert Solution

Question

1 Approved Answer

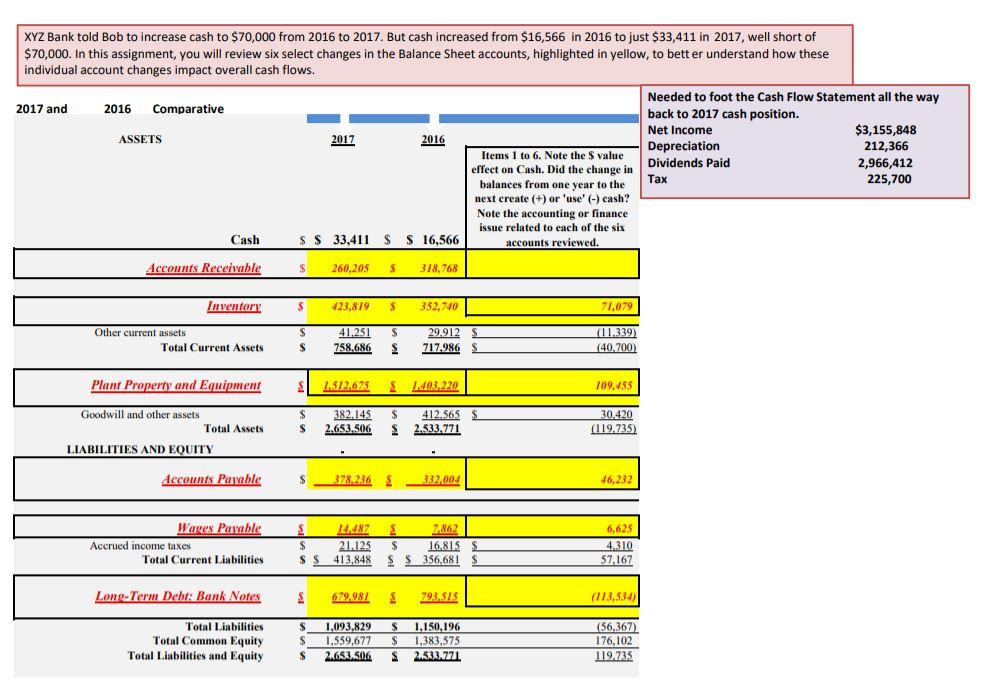

I need help with the Common Sized Financial Statements for the 2 years shown. XYZ Bank told Bob to increase cash to $70,000 from 2016

I need help with the Common Sized Financial Statements for the 2 years shown.

XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017. But cash increased from $16,566 in 2016 to just $33,411 in 2017, well short of $70,000. In this assignment, you will review six select changes in the Balance Sheet accounts, highlighted in yellow, to better understand how these individual account changes impact overall cash flows. 2017 and 2016 Comparative ASSETS 2017 2016 Needed to foot the Cash Flow Statement all the way back to 2017 cash position. Net Income $3,155,848 Depreciation 212,366 Dividends Paid 2,966,412 225,700 Tax Items 1 to 6. Note the value effect on Cash. Did the change in balances from one year to the next create (+) or 'use' (-) cash? Note the accounting or finance issue related to each of the six accounts reviewed. Cash $ $ 33,411 $ $ 16,566 Accounts Receivable $ 260,205 $ 318,768 Inventory S 423,819 $ 352,740 71,079 Other current assets Total Current Assets $ S 41.251 758.686 $ $ 29.912 S 717,986 S (11,339) (40.700) Plant Property and Equipment 1.512,625 403,220 109,455 $ Goodwill and other assets Total Assets S S 382.145 2.653.506 412.565 S 2.533.771 30,420 (119.735 LIABILITIES AND EQUITY Accounts Pawable $ 378,236 332004 46,232 Wages Pawable Accrued income taxes Total Current Liabilities $ SS 14.482 7.862 21.125 $ 16,815 S 413.848 $ $$ 356,681 S 6,623 4.310 57,167 Long-Term Debt: Bank Notes 679,981 79.3.SIS (113,534) S Total Liabilities Total Common Equity Total Liabilities and Equity 1,093.829 1.559,677 2.652.506 S 1,150,196 $ S 1,383,575 S 2.533.771 (56,367) ) 176,102 119.735 SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started