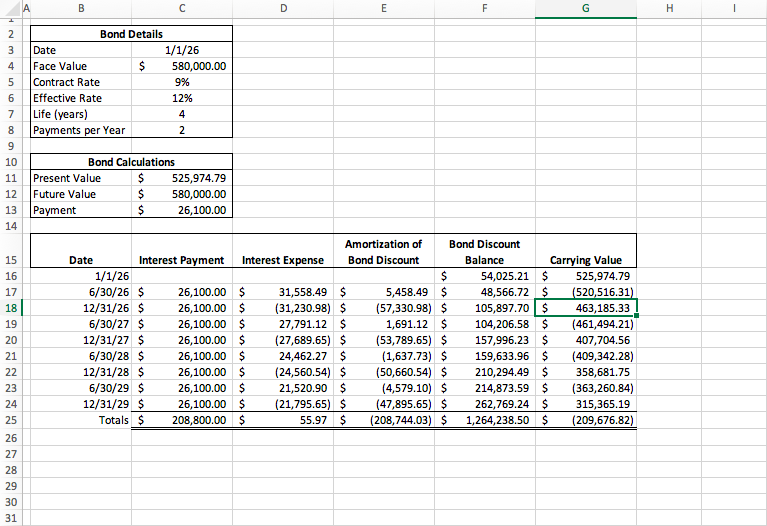

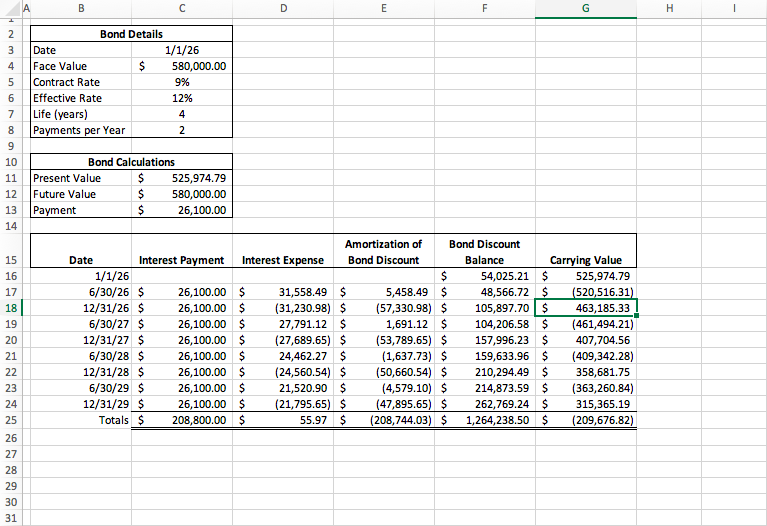

I need help with the following questions 1.) Record a macro that generates every formula in the worksheet after the bond details (in the range B2:C8) and dates have been entered. Run the macro to ensure it operates properly. Insert a text box in an appropriate location, add an appropriate name in it, and assign the macro to it. 2.) Then, using Word or another word-processing program, write a paragraph to summarize the results of the bond amortization schedule and indicate whether Caleb can purchase this bond with the $580,000 presently available.

234u 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 B Bond Details $ Date Face Value Contract Rate Effective Rate Life (years) Payments per Year Present Value Future Value Payment Date 1/1/26 580,000.00 9% 12% 4 2 Bond Calculations $ 525,974.79 $ 580,000.00 $ 26,100.00 Interest Payment Interest Expense 1/1/26 6/30/26 $ 26,100.00 $ 12/31/26 $ 26,100.00 $ 6/30/27 $ 26,100.00 $ 12/31/27 $ 26,100.00 $ 26,100.00 $ 6/30/28 $ 12/31/28 $ 26,100.00 $ 6/30/29 $ 26,100.00 $ 12/31/29 $ 26,100.00 $ Totals $ 208,800.00 $ D il E Amortization of Bond Discount 31,558.49 $ (31,230.98) $ 27,791.12 $ (27,689.65) $ 24,462.27 $ (24,560.54) $ 21,520.90 $ (21,795.65) $ 55.97 $ $ 5,458.49 $ (57,330.98) $ 1,691.12 $ (53,789.65) $ (1,637.73) $ (50,660.54) $ (4,579.10) $ (47,895.65) $ (208,744.03) $ F Bond Discount Balance 54,025.21 $ 48,566.72 $ 105,897.70 $ 104,206.58 $ 157,996.23 $ 159,633.96 $ 210,294.49 $ 214,873.59 $ 262,769.24 $ 1,264,238.50 $ G Carrying Value 525,974.79 (520,516.31) 463,185.33 (461,494.21) 407,704.56 (409,342.28) 358,681.75 (363,260.84) 315,365.19 (209,676.82) H 234u 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 B Bond Details $ Date Face Value Contract Rate Effective Rate Life (years) Payments per Year Present Value Future Value Payment Date 1/1/26 580,000.00 9% 12% 4 2 Bond Calculations $ 525,974.79 $ 580,000.00 $ 26,100.00 Interest Payment Interest Expense 1/1/26 6/30/26 $ 26,100.00 $ 12/31/26 $ 26,100.00 $ 6/30/27 $ 26,100.00 $ 12/31/27 $ 26,100.00 $ 26,100.00 $ 6/30/28 $ 12/31/28 $ 26,100.00 $ 6/30/29 $ 26,100.00 $ 12/31/29 $ 26,100.00 $ Totals $ 208,800.00 $ D il E Amortization of Bond Discount 31,558.49 $ (31,230.98) $ 27,791.12 $ (27,689.65) $ 24,462.27 $ (24,560.54) $ 21,520.90 $ (21,795.65) $ 55.97 $ $ 5,458.49 $ (57,330.98) $ 1,691.12 $ (53,789.65) $ (1,637.73) $ (50,660.54) $ (4,579.10) $ (47,895.65) $ (208,744.03) $ F Bond Discount Balance 54,025.21 $ 48,566.72 $ 105,897.70 $ 104,206.58 $ 157,996.23 $ 159,633.96 $ 210,294.49 $ 214,873.59 $ 262,769.24 $ 1,264,238.50 $ G Carrying Value 525,974.79 (520,516.31) 463,185.33 (461,494.21) 407,704.56 (409,342.28) 358,681.75 (363,260.84) 315,365.19 (209,676.82) H