Answered step by step

Verified Expert Solution

Question

1 Approved Answer

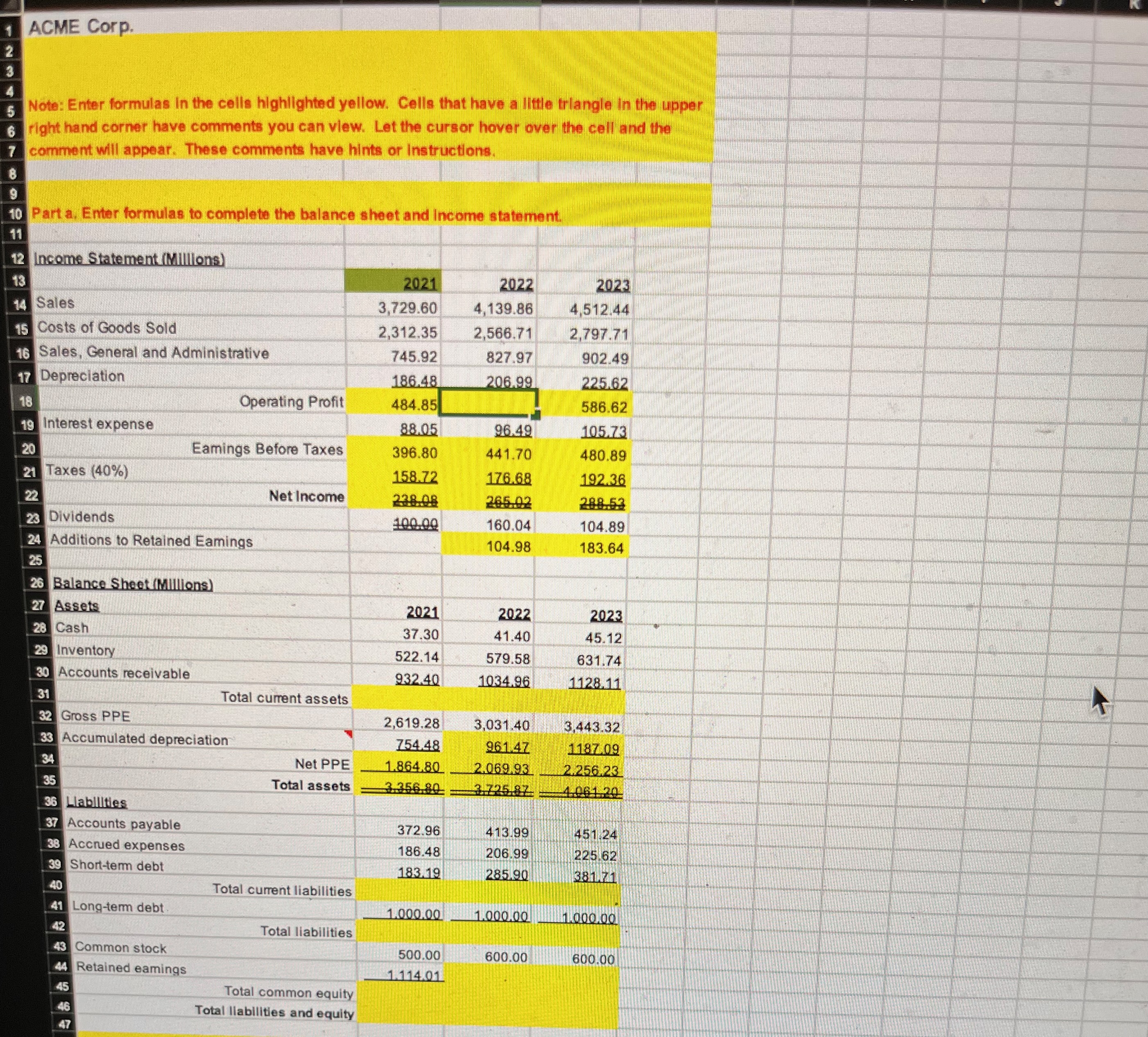

I need help with the highlighted portion of this problem. Formulas written out would be great thanks! ACME Corp. Note: Enter formulas in the cells

I need help with the highlighted portion of this problem. Formulas written out would be great thanks! ACME Corp.

Note: Enter formulas in the cells highlighted yellow. Cells that have a little triangle in the upper right hand corner have comments you can vlew. Let the cursor hover over the cell and the comment will appear. These comments have hints or Instructions.

Part a Enter formulas to complete the balance sheet and income statement.

Income StatementMilllons

Sales

Costs of Goods Sold

Sales, General and Administrative

Depreciation

Interest expense

Taxes

Net Income

Dividends

Additions to Retained Eamings

Balance SheetMillions

Assets

Cash

Inventory

Accounts receivable

Total current assets

Gross PPE

Accumulated depreciation

Labllities

Accounts payable

Accrued expenses

Shortterm debt

Longterm debt

Total current liabilities

Common stock

Retained eamings

Total liabilities

Part b Enter formulas to complete the statement of shareholders' equity and

statement of cash flow.

Statement of Shareholders' Equity

Balance as of December of previous

year

Net Income

Dividends on Common Stock

Issuance of Common Stock

Common Stock Repurchases

Balance as of December

Statement of Cash Flows

Operating Activities

Net Income

Depreciation & Amortization

Change in Inventory

Change in Accounts Receivable

Change in Accounts Payable

Change in Accruals

Net cash from operating activities

Investing Activities

Investment in PPE

Net cash from investing activities

Financing Activities

Change in shortterm debt

Change in longterm debt

Change in common stock

Common dividends

Net cash from financing activities

Net cash flow

Starting cash

Ending cash Part c Free Cash Flow

Cash Flow Identity

Operating profit

Taxes

NOPAT

Depreciation

Operating Cash Flow OCF

Investment in NOWC

CAPEX Net Capital Spending

Total Investment

Free Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started