Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the setup on this please Problem 1-P14.15 Close Book and Prepare Cash Distribution Plan Arnold, Bell and Crane agree to liquidate

I need help with the setup on this please

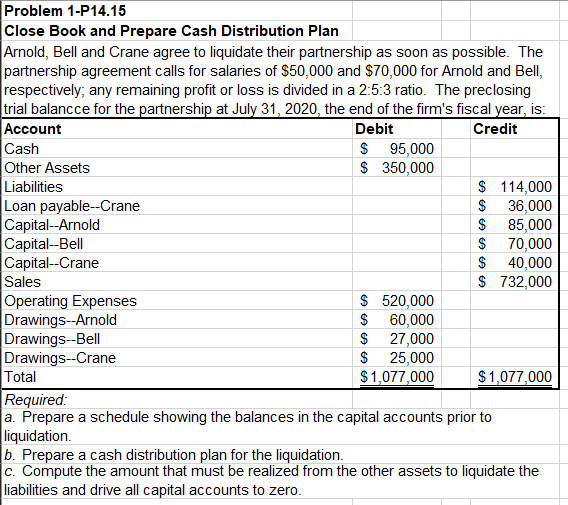

Problem 1-P14.15 Close Book and Prepare Cash Distribution Plan Arnold, Bell and Crane agree to liquidate their partnership as soon as possible. The partnership agreement calls for salaries of $50,000 and $70,000 for Arnold and Bell, respectively, any remaining profit or loss is divided in a 2:5:3 ratio. The preclosing trial balancce for the partnership at July 31, 2020, the end of the firm's fiscal year, is: Account Debit Credit Cash $ 95,000 Other Assets $ 350,000 Liabilities $ 114,000 Loan payable--Crane $ 36,000 Capital--Arnold $ 85,000 Capital--Bell $ 70,000 Capital--Crane $ 40,000 Sales $ 732,000 Operating Expenses $ 520,000 Drawings--Arnold $ 60,000 Drawings--Bell $ 27,000 Drawings--Crane $ 25,000 Total $1,077,000 $1,077,000 Required: a. Prepare a schedule showing the balances in the capital accounts prior to liquidation. b. Prepare a cash distribution plan for the liquidation. c. Compute the amount that must be realized from the other assets to liquidate the liabilities and drive all capital accounts to zeroStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started