I need help with the SUA month-end procedures.

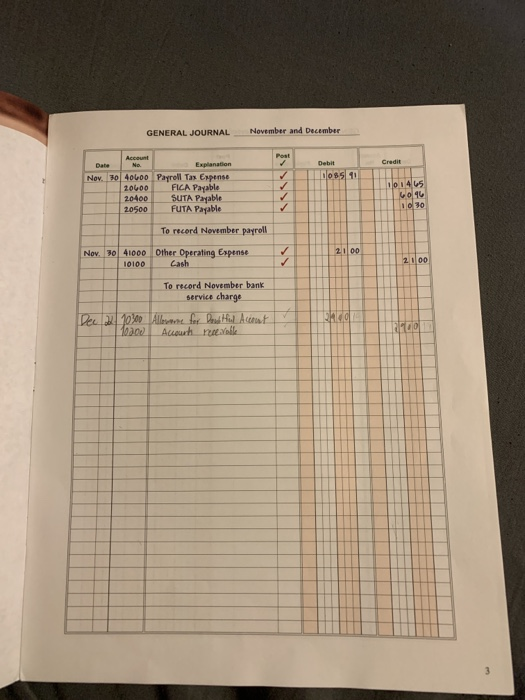

welope in accordan fot vi File documents in the appropriate filetab in the envel the flowchart description. See pages 5 and 6 of this box guidance vil. Proceed to the next transaction. Repeat this process all transactions on the transactions list (Document No and year-end procedures. abis process until you have 1 have WAREN'S MONTH-END PROCEDURES Following are the procedures performed at the end of each month by w after all transactions are recorded in the journals and subsidiary ledgers the roles of Ray Kramer, Nancy Ford, and Jim Adams and perform each end procedures for December. The only materials needed are this list of procedures, all journals and ledgers, and four items from the loose does monthly statement (Doc. No. 15), bank reconciliation for November (Doc. No statement (Doc. No. 23), and the list of items clearing with the bank statement other documents and records temporarily aside. Wares em You are to ich of these list of seven month Roche Decibe et (Doc. No. 2,50 es, cash he following symbo 1. Jim Adams foots and crossfoots each of the five special journals (sales.ca purchases, cash disbursements, and payroll). He uses the following the special journals to indicate that his work has been performed: F for C for Cross-footing for focing 2 lim Adams posts the column totals and individual transactions in "Othere the appropriate general ledger account and updates each general ledger account bala He places a posting reference check mark under each column total in the ouma and by each of the individual transactions in the "Other" columns to show that numbers have been posted 3. Ray Kramer prepares a bank reconciliation on a separate working paper (not provided After receiving the bank statement (Doc. No. 23) and list of items clearing with the bes statement (Doc. No. 24) from the bank, he performs the following procedures a. Traces and agrees the monthly totals from the cash account columns of the cash receipts and cash disbursements journals to the posting in the general ledger cash account. He initials the cash account column totals in the journals as well as the general ledger lines where the totals are posted. b. Compares each entry in the cash receipts prelist (Doc. No. 9) to the cash receipts journal for name, date, and amount, and puts a check mark [] by each entry in the prelist. c. Prepares a bank reconciliation using the procedures outlined in the system, Understanding Aid Reference book on pages 62 through 65. You ca November's bank reconciliation (Doc. No. 22) as a model. Deposits in trans outstanding checks at November 30 are listed there. ment No. 15 REQUIREMENTS d. Adjusts the cash general leder account using the everal journal, regardless of materiality for all reconciling items requiring an adjustment e Attaches together and files the bank c h ok statment, list of items claring soith bank statement, and the cash cripts prelist in the file labeled "Shipping/Banking." 4. Jim Adams calculates and records the unemployment taxes paid by employers, and Waren's portion of the FICA payroll tax. These p roll taxes are calculated at the end of the month on gross payroll and recorded in the general journal. The taxes are paid the following month State and federal unemployment taxes are imposed on the first $7,000 of wages paid to covered employees in 2017. Thus, a review of the employee earnings subsidiary ledger on pages 40 and 41 of this book indicates that only one of Waren's employees remains subject to this tax (ie, has not yet exceeded the wage base maximum). The same wage base maximum is used in the project for both state and federal unemployment taxes to simplify the calculations. The state unemployment tax (SUTA) rate is 3.55%. Because employers are allowed credits against the federal unemployment tax (FUTA) rate for participation in state unemployment programs, the net FUTA rate is .6%. 5. Jim Adams posts transactions from the general journal to the general ledger (and subsidiary if applicable), places a posting reference check mark in the general journal post reference column for each item posted, and updates each general ledger balance. 6. Nancy Ford foots the balances of each subsidiary for the accounts receivable, accounts payable, employee earnings, and fixed assets subsidiaries, and compares the total to the appropriate general ledger control account (G/L accounts 10200, 20100, 40500, 10800, and 10900, respectively). She initials each general ledger control account to indicate that she has made the comparison Jim Adams prepares a monthly statement (Doc. No. 15) for each customer with a balance He includes information about each unpaid invoice including its aging status. Aging totals and the total amount due are shown at the bottom. He completes the remittance advice attached to the monthly statement in a similar fashion except that no aging is included. Ray Kramer reviews each statement and initials it before it is mailed to the customer. In this project, you are to prepare a December monthly statement for only one customer and file it in the "Mailed to Outsiders" file tab. The name of the selected customer is stated in the transactions list (Doc. No. 1) provided with your loose document set in this package. After completing all seven month-end procedures for December, continue to the next section and perform Waren's year-end procedures. GENERAL JOURNAL November and December DOS591 Explanation Nov. 30 40600 Payroll Tax Expense 20600 FICA Payable 20-400 SUTA Payable 20500 FUTA Payable To record November payroll 2000 Nov. 30 41000 10100 Other Operating Expense Cash To record November bank service charge Alle for Dead Hul. Acest Acous recevable Dec 10% 1920 SALES JOURNAL November and December Customer Nov. 1 Stevenson College Nov. 1 Rosement University Nov. 10 Branch College Nov. 14 Eastern Wisconsin Univ 2.460 OD 22 200 2.49000 2AL000 3241200 24 10 500 720 410 Monthly Totals FC 372000 230000 G021100 Dec. Rosemont University Dec. 7 Clayborn University Dec. $ Eastern Wisconsin Univ. Dec 19 Branch College De 19 University of these lo Dec. Este con Univ AD1400 1252.00 21812100 5600 1181217 0752 I wa Medely Titas CASH RECEIPTS JOURNAL November and December Acer Omer Trans 411 49200 NF 17100 Date Description Nov. 1 Stevenson College NF 02.00 Nov. 13 McClain College Nov 17 Rosemont University Nov. 17 Branch College Nov. 21 Eastern Wisconsin Univ. NF500000 NF 4920 400 2990,00 65824 40022411200 41050 000 Monthly Totals F.C RK S2003 54 1505400 774100 591109 411400 53000 725200 312.00 $2500 21000 60 000.00 Dec 6 Cales University NF5B9000 Dec 8 Roumont University 4090 52 83 48 40L Dec. 12 Hancock College 52040 Dec. 14 Clayborn University 11049014504 407 Dec. 14 Atwood Brothers $2.500 Dec. 18 Est Ames. Berk KOLOD Der Branche Collane De dat Wii De 16 Arelles Colle Monthly tools FL 107 2 RIGO 7855.00 1149700 PURCHASES JOURNAL. November and December Vendor Purchases G/L 30500 272B000 Date Vendor Nov. 3 Velocity Sporting Goods Nov. 21 Chicago Office Supply 33371 2 275 252 253 212 8000 15500 5580 Monthly Totals FC 252 301500 BU115.00 136700 10900 756700 4 132722 29 Dec. 5 Velocity Sporting Goods 39965 Dec. 12 Chicago Office Supply 2344 Dec. 18 Velocity Sports Club Dee. 26 DERES Dee, 4 Chicago office sea 2037 6251 (1 760.00 CASH DISBURSEMENTS JOURNAL Member 1551 Ne c h Office 1550 News Wocy Sporting 100 Now Se Paprile Novas Price A4 New era en Service Nov. State of in How Werele Manage4 New and of Water Light a Melert 11 NTUAN Now, chce of Supply 5 560 Now. No 19-See Parell Tournal Monthly Tel 55 N Cash Dishmensjonale on est page Dec 1 1140 First Security Insurance Dec. 12 11:41 Chicago Office Supply Dec, 1142 Vilacity Sporting Goods Dec 19 1143 Worldwide Management Dec 1144 Bund of Water Light Dec 1145 Interstate Meter Freight Dec, 141146 Internal Revue Service 251500 136700 95% 12.10 4800 00 30 25 176 25 s De 141 Innal Revenue Service Dec 14 1146 State of Wines De 15 141-150 See Pagoh Journal W M2 Hileleri Dec. Wiley Es Abela 27053 akan Morbely Taals EL MIONZ 235 w Regular Regular Employee Nov. 15 Ray Kramer Jim Adams Nancy Ford GIL 20000 2017578500284125 126 07091 2.84 001142 08 11 TL 8 12 160 55 128 3500 00 3500.00 184800 12 70400 0522405 92300 873 00 88 00 4900 20115 Nov. 30 Ray Kramer Jim Adams Nancy Ford 450 45 350.000 1848 00 14 30 88400 88 00 52 00 3500.00 22.9845 884 OG 385.00 284725 37 29600 1920 62 139 1103805 35 1139 850 50 13 23.50 DE 69 15 1097410 Monthly Totals F4 12AL200 Dec. 15 Ray Kramer Jim Adams Nancy Ford 350 000 350000 88 00 1848 00 11 36540 22 13 40 88 00049400 120 13000 1526 60 20175 16432 110 74 385 00 2847 25 149 27500 1769 08 1150 98000241BI 1151 13001015 V 27 op 212B TV 11.06 72 47 V 9380 31 La kc 71 Ray King Ado 1823 I Nerey Ford 947 Duty TailFC 15400 1970 1951 1950 11200804 welope in accordan fot vi File documents in the appropriate filetab in the envel the flowchart description. See pages 5 and 6 of this box guidance vil. Proceed to the next transaction. Repeat this process all transactions on the transactions list (Document No and year-end procedures. abis process until you have 1 have WAREN'S MONTH-END PROCEDURES Following are the procedures performed at the end of each month by w after all transactions are recorded in the journals and subsidiary ledgers the roles of Ray Kramer, Nancy Ford, and Jim Adams and perform each end procedures for December. The only materials needed are this list of procedures, all journals and ledgers, and four items from the loose does monthly statement (Doc. No. 15), bank reconciliation for November (Doc. No statement (Doc. No. 23), and the list of items clearing with the bank statement other documents and records temporarily aside. Wares em You are to ich of these list of seven month Roche Decibe et (Doc. No. 2,50 es, cash he following symbo 1. Jim Adams foots and crossfoots each of the five special journals (sales.ca purchases, cash disbursements, and payroll). He uses the following the special journals to indicate that his work has been performed: F for C for Cross-footing for focing 2 lim Adams posts the column totals and individual transactions in "Othere the appropriate general ledger account and updates each general ledger account bala He places a posting reference check mark under each column total in the ouma and by each of the individual transactions in the "Other" columns to show that numbers have been posted 3. Ray Kramer prepares a bank reconciliation on a separate working paper (not provided After receiving the bank statement (Doc. No. 23) and list of items clearing with the bes statement (Doc. No. 24) from the bank, he performs the following procedures a. Traces and agrees the monthly totals from the cash account columns of the cash receipts and cash disbursements journals to the posting in the general ledger cash account. He initials the cash account column totals in the journals as well as the general ledger lines where the totals are posted. b. Compares each entry in the cash receipts prelist (Doc. No. 9) to the cash receipts journal for name, date, and amount, and puts a check mark [] by each entry in the prelist. c. Prepares a bank reconciliation using the procedures outlined in the system, Understanding Aid Reference book on pages 62 through 65. You ca November's bank reconciliation (Doc. No. 22) as a model. Deposits in trans outstanding checks at November 30 are listed there. ment No. 15 REQUIREMENTS d. Adjusts the cash general leder account using the everal journal, regardless of materiality for all reconciling items requiring an adjustment e Attaches together and files the bank c h ok statment, list of items claring soith bank statement, and the cash cripts prelist in the file labeled "Shipping/Banking." 4. Jim Adams calculates and records the unemployment taxes paid by employers, and Waren's portion of the FICA payroll tax. These p roll taxes are calculated at the end of the month on gross payroll and recorded in the general journal. The taxes are paid the following month State and federal unemployment taxes are imposed on the first $7,000 of wages paid to covered employees in 2017. Thus, a review of the employee earnings subsidiary ledger on pages 40 and 41 of this book indicates that only one of Waren's employees remains subject to this tax (ie, has not yet exceeded the wage base maximum). The same wage base maximum is used in the project for both state and federal unemployment taxes to simplify the calculations. The state unemployment tax (SUTA) rate is 3.55%. Because employers are allowed credits against the federal unemployment tax (FUTA) rate for participation in state unemployment programs, the net FUTA rate is .6%. 5. Jim Adams posts transactions from the general journal to the general ledger (and subsidiary if applicable), places a posting reference check mark in the general journal post reference column for each item posted, and updates each general ledger balance. 6. Nancy Ford foots the balances of each subsidiary for the accounts receivable, accounts payable, employee earnings, and fixed assets subsidiaries, and compares the total to the appropriate general ledger control account (G/L accounts 10200, 20100, 40500, 10800, and 10900, respectively). She initials each general ledger control account to indicate that she has made the comparison Jim Adams prepares a monthly statement (Doc. No. 15) for each customer with a balance He includes information about each unpaid invoice including its aging status. Aging totals and the total amount due are shown at the bottom. He completes the remittance advice attached to the monthly statement in a similar fashion except that no aging is included. Ray Kramer reviews each statement and initials it before it is mailed to the customer. In this project, you are to prepare a December monthly statement for only one customer and file it in the "Mailed to Outsiders" file tab. The name of the selected customer is stated in the transactions list (Doc. No. 1) provided with your loose document set in this package. After completing all seven month-end procedures for December, continue to the next section and perform Waren's year-end procedures. GENERAL JOURNAL November and December DOS591 Explanation Nov. 30 40600 Payroll Tax Expense 20600 FICA Payable 20-400 SUTA Payable 20500 FUTA Payable To record November payroll 2000 Nov. 30 41000 10100 Other Operating Expense Cash To record November bank service charge Alle for Dead Hul. Acest Acous recevable Dec 10% 1920 SALES JOURNAL November and December Customer Nov. 1 Stevenson College Nov. 1 Rosement University Nov. 10 Branch College Nov. 14 Eastern Wisconsin Univ 2.460 OD 22 200 2.49000 2AL000 3241200 24 10 500 720 410 Monthly Totals FC 372000 230000 G021100 Dec. Rosemont University Dec. 7 Clayborn University Dec. $ Eastern Wisconsin Univ. Dec 19 Branch College De 19 University of these lo Dec. Este con Univ AD1400 1252.00 21812100 5600 1181217 0752 I wa Medely Titas CASH RECEIPTS JOURNAL November and December Acer Omer Trans 411 49200 NF 17100 Date Description Nov. 1 Stevenson College NF 02.00 Nov. 13 McClain College Nov 17 Rosemont University Nov. 17 Branch College Nov. 21 Eastern Wisconsin Univ. NF500000 NF 4920 400 2990,00 65824 40022411200 41050 000 Monthly Totals F.C RK S2003 54 1505400 774100 591109 411400 53000 725200 312.00 $2500 21000 60 000.00 Dec 6 Cales University NF5B9000 Dec 8 Roumont University 4090 52 83 48 40L Dec. 12 Hancock College 52040 Dec. 14 Clayborn University 11049014504 407 Dec. 14 Atwood Brothers $2.500 Dec. 18 Est Ames. Berk KOLOD Der Branche Collane De dat Wii De 16 Arelles Colle Monthly tools FL 107 2 RIGO 7855.00 1149700 PURCHASES JOURNAL. November and December Vendor Purchases G/L 30500 272B000 Date Vendor Nov. 3 Velocity Sporting Goods Nov. 21 Chicago Office Supply 33371 2 275 252 253 212 8000 15500 5580 Monthly Totals FC 252 301500 BU115.00 136700 10900 756700 4 132722 29 Dec. 5 Velocity Sporting Goods 39965 Dec. 12 Chicago Office Supply 2344 Dec. 18 Velocity Sports Club Dee. 26 DERES Dee, 4 Chicago office sea 2037 6251 (1 760.00 CASH DISBURSEMENTS JOURNAL Member 1551 Ne c h Office 1550 News Wocy Sporting 100 Now Se Paprile Novas Price A4 New era en Service Nov. State of in How Werele Manage4 New and of Water Light a Melert 11 NTUAN Now, chce of Supply 5 560 Now. No 19-See Parell Tournal Monthly Tel 55 N Cash Dishmensjonale on est page Dec 1 1140 First Security Insurance Dec. 12 11:41 Chicago Office Supply Dec, 1142 Vilacity Sporting Goods Dec 19 1143 Worldwide Management Dec 1144 Bund of Water Light Dec 1145 Interstate Meter Freight Dec, 141146 Internal Revue Service 251500 136700 95% 12.10 4800 00 30 25 176 25 s De 141 Innal Revenue Service Dec 14 1146 State of Wines De 15 141-150 See Pagoh Journal W M2 Hileleri Dec. Wiley Es Abela 27053 akan Morbely Taals EL MIONZ 235 w Regular Regular Employee Nov. 15 Ray Kramer Jim Adams Nancy Ford GIL 20000 2017578500284125 126 07091 2.84 001142 08 11 TL 8 12 160 55 128 3500 00 3500.00 184800 12 70400 0522405 92300 873 00 88 00 4900 20115 Nov. 30 Ray Kramer Jim Adams Nancy Ford 450 45 350.000 1848 00 14 30 88400 88 00 52 00 3500.00 22.9845 884 OG 385.00 284725 37 29600 1920 62 139 1103805 35 1139 850 50 13 23.50 DE 69 15 1097410 Monthly Totals F4 12AL200 Dec. 15 Ray Kramer Jim Adams Nancy Ford 350 000 350000 88 00 1848 00 11 36540 22 13 40 88 00049400 120 13000 1526 60 20175 16432 110 74 385 00 2847 25 149 27500 1769 08 1150 98000241BI 1151 13001015 V 27 op 212B TV 11.06 72 47 V 9380 31 La kc 71 Ray King Ado 1823 I Nerey Ford 947 Duty TailFC 15400 1970 1951 1950 11200804