I need help with the two in red

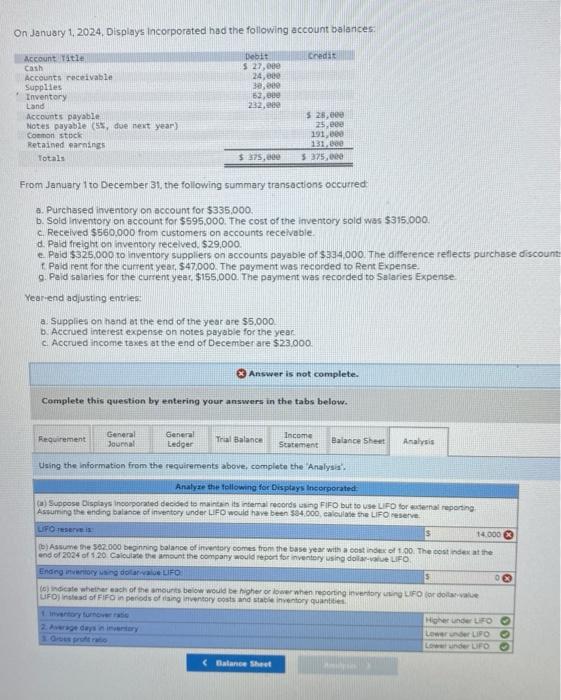

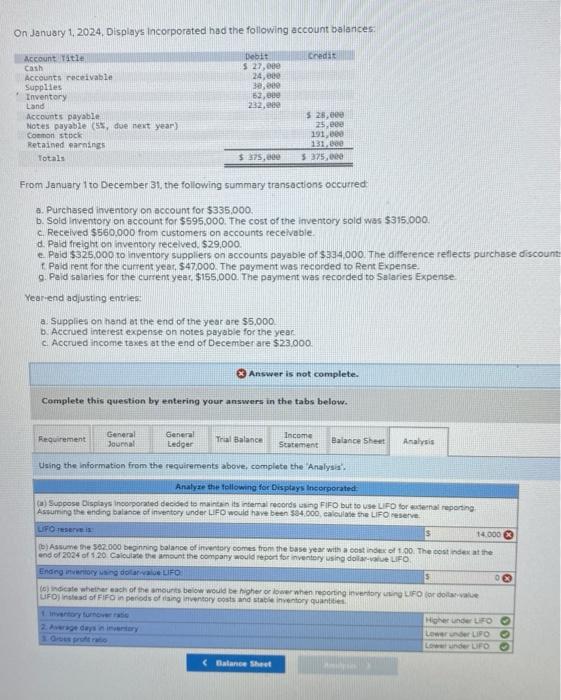

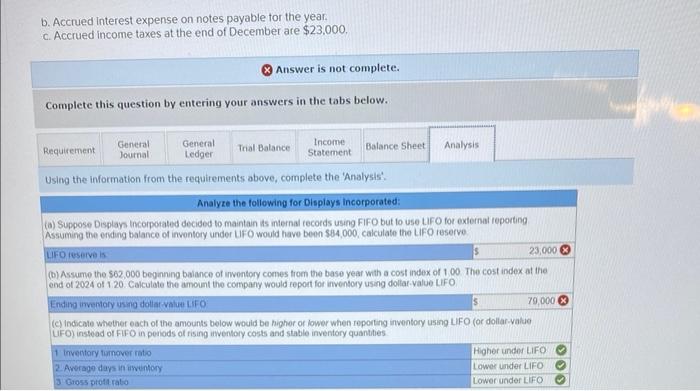

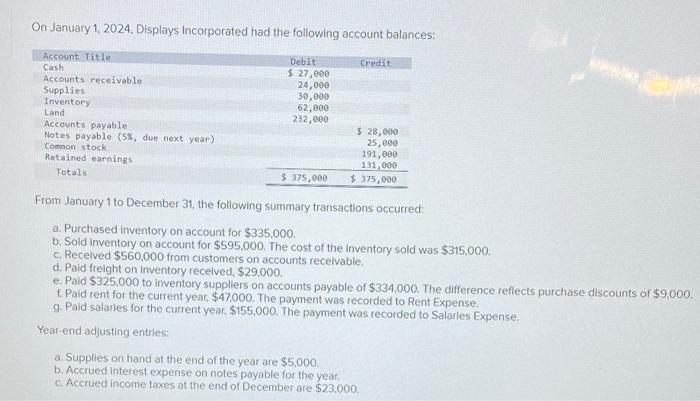

On Janusty 1, 2024. Displays incorporated had the following account balances: From January 1 to December 31 , the following summary transactions occurred: a. Purchased inventory on account for $335,000. b. Soid inventory on account for $595,000. The cost of the inventory sold was $315.000. c. Received $560,000 from customers on accounts recelvable. d. Paid freight on inventory recelved. $29.000 e. Paid $325,000 to inventory suppliers on accounts payable of $334,000. The diffetence retlects purchase discount f. Pad rent for the curtent year, $47,000. The payment was recorded to Rent Expense. g. Pald salaries for the curfent yeat, $155,000. The payment was recorded to 5alare. Expense: Yearrend adiusting entries: a. Supplies on hand at the end of the year are $5,000. b. Accued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $23.000. Answer is not complete. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Aralysia'. Analyze the following for Disptays incorporated (a) Supcose Displays insaiporxied decided to muntan its intemal resords uling FiFO but to use U Fo for widernal reporing Astuming the ending balinge of inventory under LIFO would have been 304,000 , ealculase the LIFO b. Accrued Interest expense on notes payable tor the year. c. Accrued income taxes at the end of December are $23,000. Answer is not complete. Complete this question by entering your answers in the tabs below. Using the information from the requirements above, complete the 'Analysis'. On January 1, 2024, Displays incorporated had the following account balances: From January 1 to December 31 , the following summary transactions occurred: a. Purchased inventory on account for $335,000. b. Sold inventory on account for $595.000. The cost of the inventory sold was $315,000. c. Recelved $560,000 from customers on accounts recelvable. d. Paid freight on inventory received, $29,000. e. Paid $325.000 to inventory suppliers on accounts payable of $334,000. The difference reflects purchase discounts of $9,000. f. Paid rent for the current year, $47,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $155,000. The payment was recorded to Salarles Expense. Year-end adjusting entries: a. Supplies on hand at the end of the yeat are $5,000. b. Accrued Interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $23,000