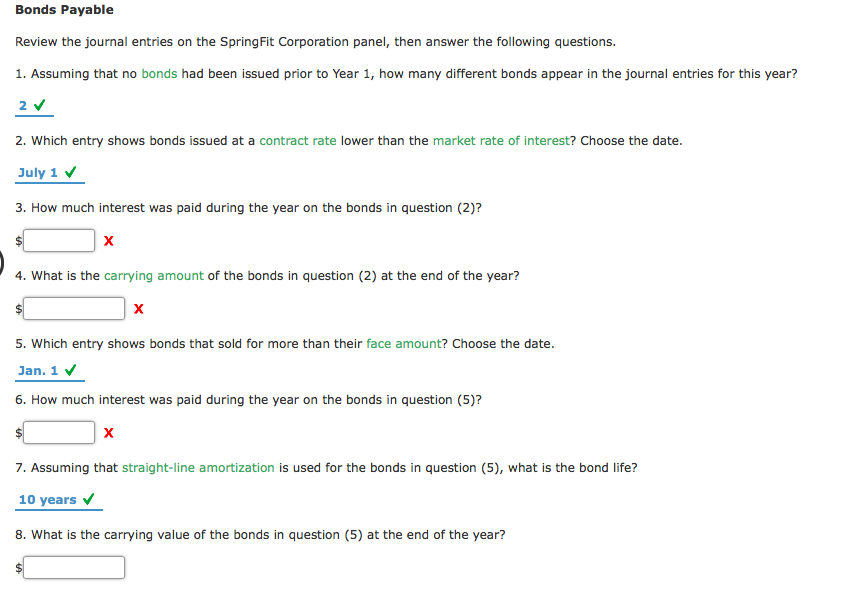

I need help with the unanswered questions. Thank you!

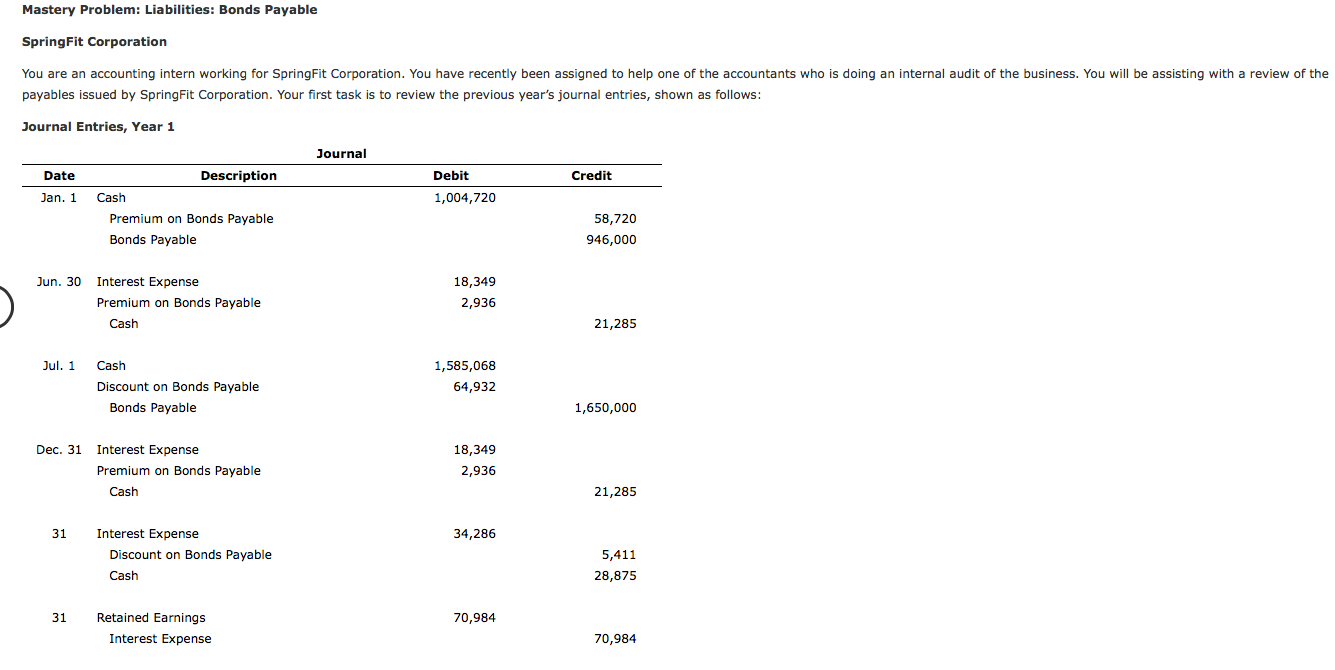

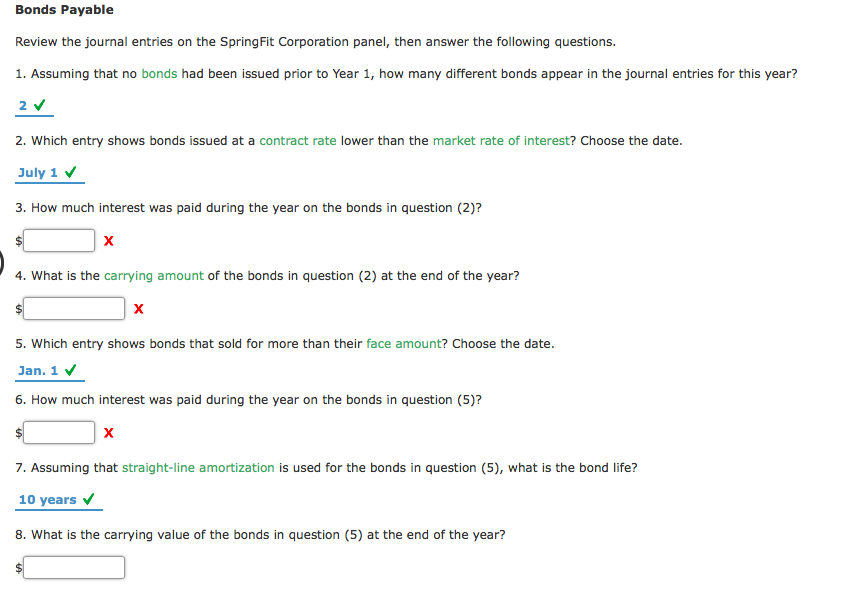

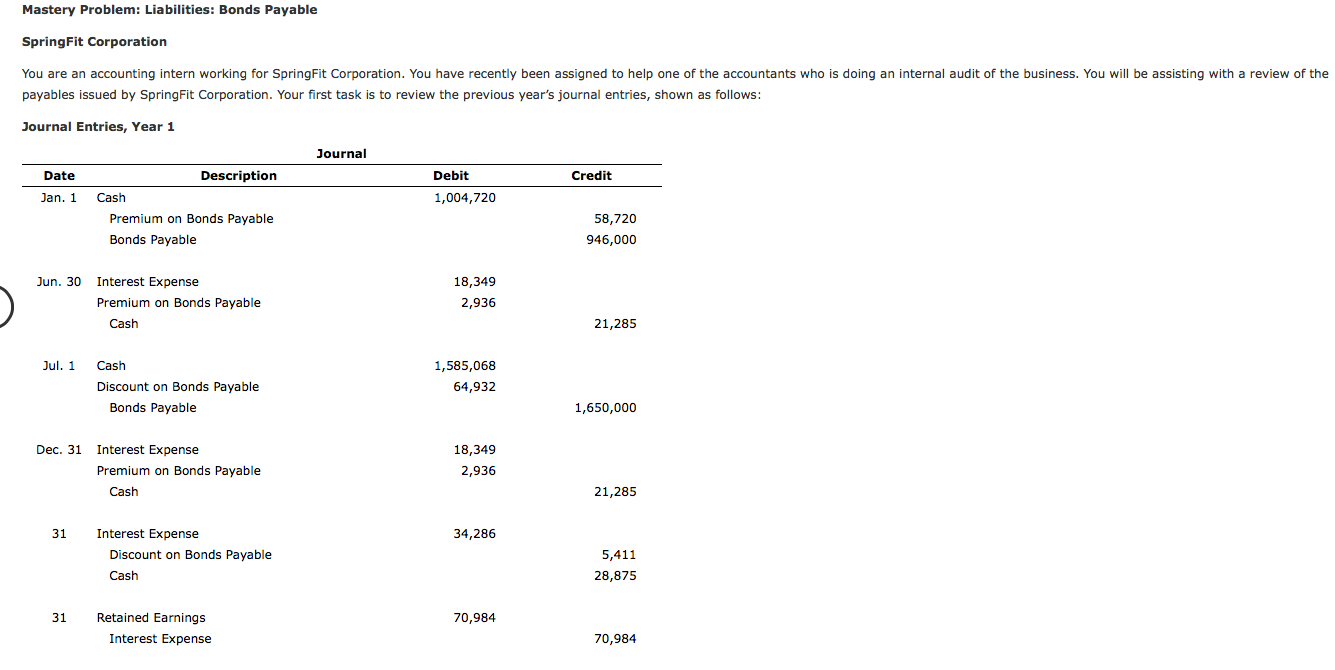

Mastery Problem: Liabilities: Bonds Payable SpringFit Corporation You are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year's journal entries, shown as follows: Journal Entries, Year 1 Journal Debit Credit Date Jan. 1 1,004,720 Description Cash Premium on Bonds Payable Bonds Payable 58,720 946,000 Jun. 30 Interest Expense Premium on Bonds Payable Cash 18,349 2,936 21,285 Jul. 1 Cash Discount on Bonds Payable Bonds Payable 1,585,068 64,932 1,650,000 Dec. 31 Interest Expense Premium on Bonds Payable Cash 18,349 2,936 21,285 31 34,286 Interest Expense Discount on Bonds Payable Cash 5,411 28,875 31 70,984 Retained Earnings Interest Expense 70,984 Bonds Payable Review the journal entries on the Spring Fit Corporation panel, then answer the following questions. 1. Assuming that no bonds had been issued prior to Year 1, how many different bonds appear in the journal entries for this year? 2 2. Which entry shows bonds issued at a contract rate lower than the market rate of interest? Choose the date. July 1 3. How much interest was paid during the year on the bonds in question (2)? 4. What is the carrying amount of the bonds in question (2) at the end of the year? 5. Which entry shows bonds that sold for more than their face amount? Choose the date. Jan. 1 6. How much interest was paid during the year on the bonds in question (5)? 7. Assuming that straight-line amortization is used for the bonds in question (5), what is the bond life? 10 years 8. What is the carrying value of the bonds in question (5) at the end of the year? Mastery Problem: Liabilities: Bonds Payable SpringFit Corporation You are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year's journal entries, shown as follows: Journal Entries, Year 1 Journal Debit Credit Date Jan. 1 1,004,720 Description Cash Premium on Bonds Payable Bonds Payable 58,720 946,000 Jun. 30 Interest Expense Premium on Bonds Payable Cash 18,349 2,936 21,285 Jul. 1 Cash Discount on Bonds Payable Bonds Payable 1,585,068 64,932 1,650,000 Dec. 31 Interest Expense Premium on Bonds Payable Cash 18,349 2,936 21,285 31 34,286 Interest Expense Discount on Bonds Payable Cash 5,411 28,875 31 70,984 Retained Earnings Interest Expense 70,984 Bonds Payable Review the journal entries on the Spring Fit Corporation panel, then answer the following questions. 1. Assuming that no bonds had been issued prior to Year 1, how many different bonds appear in the journal entries for this year? 2 2. Which entry shows bonds issued at a contract rate lower than the market rate of interest? Choose the date. July 1 3. How much interest was paid during the year on the bonds in question (2)? 4. What is the carrying amount of the bonds in question (2) at the end of the year? 5. Which entry shows bonds that sold for more than their face amount? Choose the date. Jan. 1 6. How much interest was paid during the year on the bonds in question (5)? 7. Assuming that straight-line amortization is used for the bonds in question (5), what is the bond life? 10 years 8. What is the carrying value of the bonds in question (5) at the end of the year