Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the wrong answers! Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees' well-being. The company offers its employees

I need help with the wrong answers!

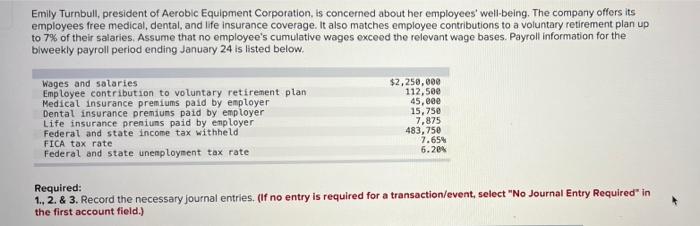

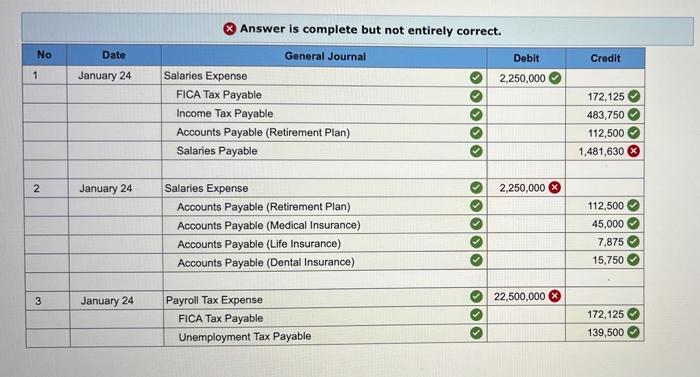

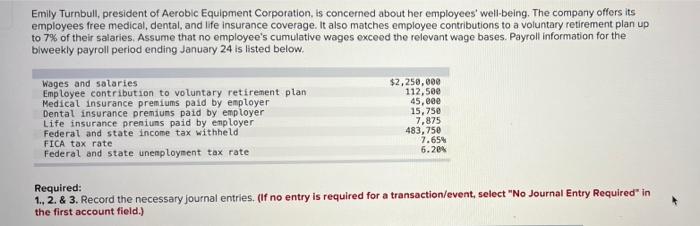

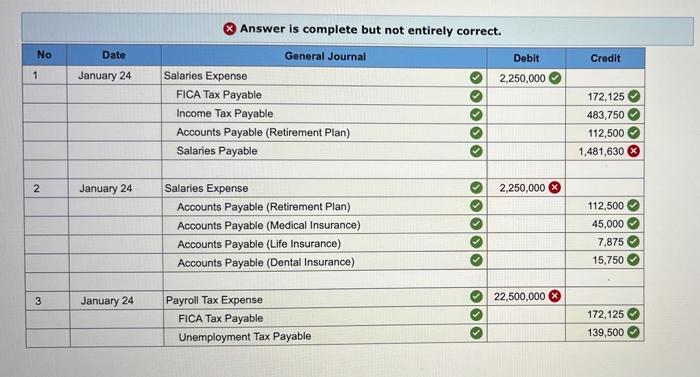

Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees' well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 7% of their salaries. Assume that no employee's cumulative wages exceed the relevant wage bases. Payroll information for the biweekly payroll period ending January 24 is listed below. Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Dental insurance premiums paid by employer Life insurance preniuns paid by employer Federal and state income tax withheld FICA tax rate Federal and state unemployment tax rate $2,250,000 112,500 45,000 15,750 7,875 483,750 7.654 6.204 Required: 1..2. & 3. Record the necessary journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is complete but not entirely correct. No Date Credit 1 January 24 Debit 2,250,000 General Journal Salaries Expense FICA Tax Payable Income Tax Payable Accounts Payable (Retirement Plan) Salaries Payable 172,125 483,750 112,500 1,481,630 2 January 24 2,250,000 Salaries Expense Accounts Payable (Retirement Plan) Accounts Payable (Medical Insurance) Accounts Payable (Life Insurance) Accounts Payable (Dental Insurance) OOOO 112,500 45,000 7,875 15,750 3 22,500,000 January 24 Payroll Tax Expense FICA Tax Payable Unemployment Tax Payable >>> 172,125 139,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started