Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these ASAP please. thank you. Barbara Bailey does not believe in analyst predictions. She feels that the company could maintain a

I need help with these ASAP please. thank you.

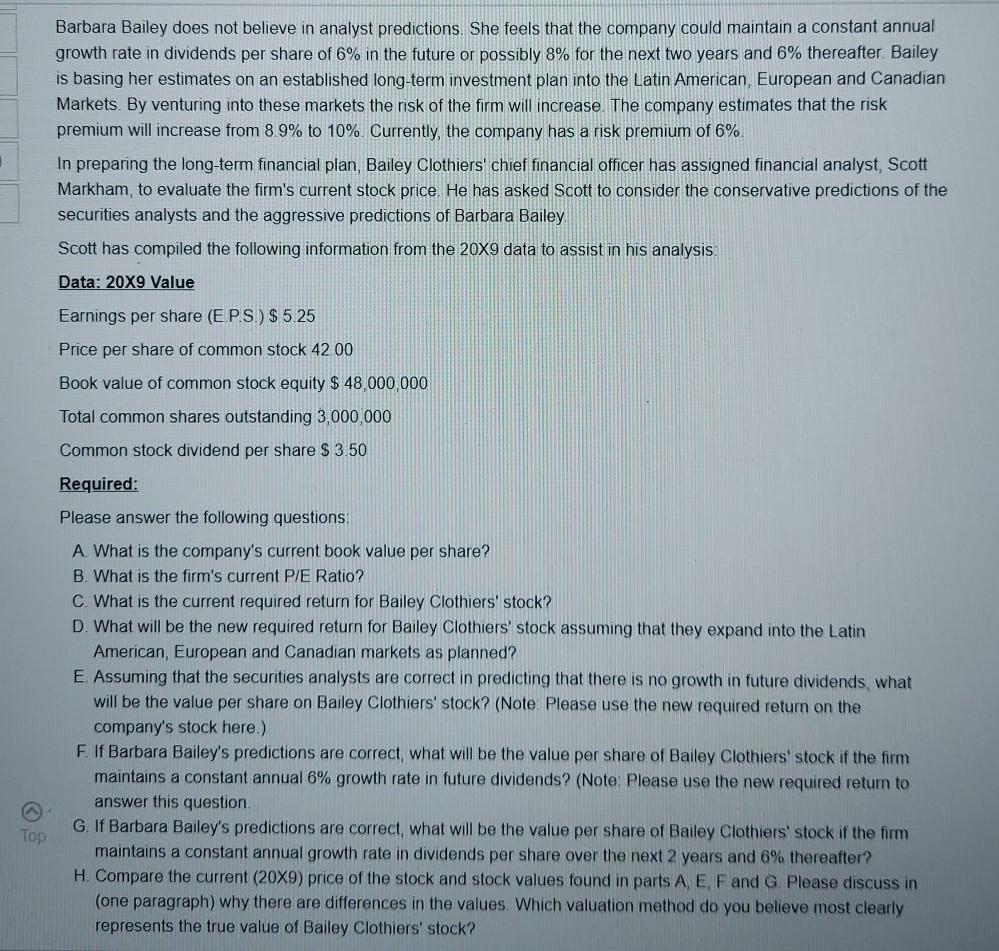

Barbara Bailey does not believe in analyst predictions. She feels that the company could maintain a constant annual growth rate in dividends per share of 6% in the future or possibly 8% for the next two years and 6% thereafter Bailey is basing her estimates on an established long-term investment plan into the Latin American, European and Canadian Markets. By venturing into these markets the risk of the firm will increase. The company estimates that the risk premium will increase from 89% to 10%. Currently, the company has a risk premium of 6% In preparing the long-term financial plan, Bailey Clothiers' chief financial officer has assigned financial analyst, Scott Markham, to evaluate the firm's current stock price. He has asked Scott to consider the conservative predictions of the securities analysts and the aggressive predictions of Barbara Bailey Scott has compiled the following information from the 20x9 data to assist in his analysis. Data: 20X9 Value Earnings per share (EPS) $5.25 Price per share of common stock 42 00 Book value of common stock equity $ 48,000,000 Total common shares outstanding 3,000,000 Common stock dividend per share $ 3.50 Required: Please answer the following questions A. What is the company's current book value per share? B. What is the firm's current P/E Ratio? C. What is the current required return for Bailey Clothiers' stock? D. What will be the new required return for Bailey Clothiers' stock assuming that they expand into the Latin American, European and Canadian markets as planned? E. Assuming that the securities analysts are correct in predicting that there is no growth in future dividends what will be the value per share on Bailey Clothiers' stock? (Note: Please use the new required return on the company's stock here.) F. If Barbara Bailey's predictions are correct, what will be the value per share of Bailey Clothiers' stock if the firm maintains a constant annual 6% growth rate in future dividends? (Note: Please use the new required return to answer this question. G. If Barbara Bailey's predictions are correct, what will be the value per share of Bailey Clothiers' stock if the firm maintains a constant annual growth rate in dividends per share over the next 2 years and 6% thereafter? H. Compare the current (20/9) price of the stock and stock values found in parts A E, F and G. Please discuss in (one paragraph) why there are differences in the values. Which valuation method do you believe most clearly represents the true value of Bailey Clothiers' stock? TopStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started