Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these problems please. Ch 23 Problem 2 Transfer Pricing - Materials used by Best Bread Company in producing Division A's product

I need help with these problems please.

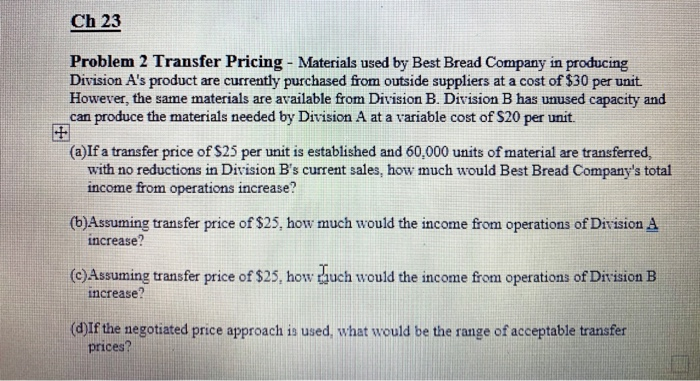

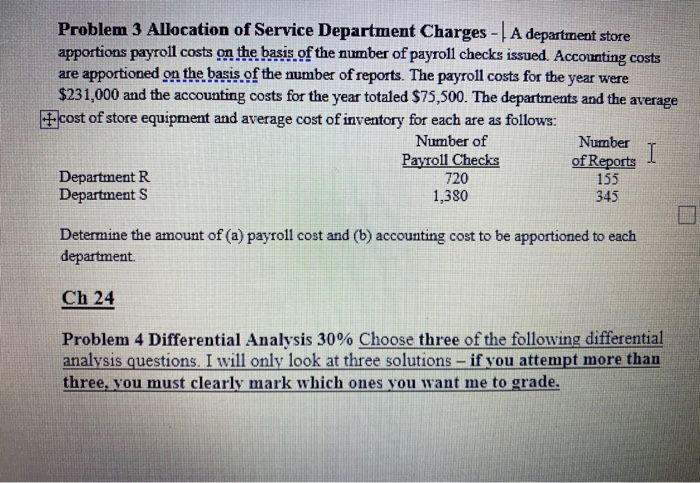

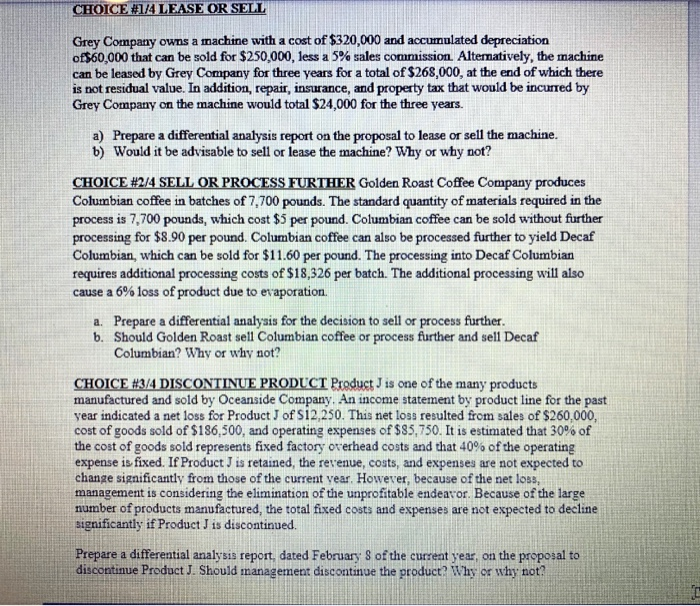

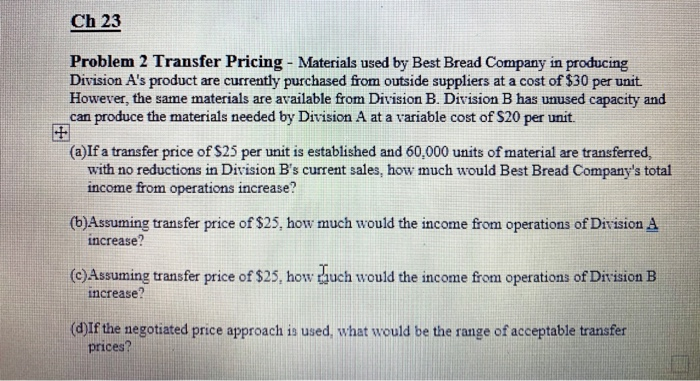

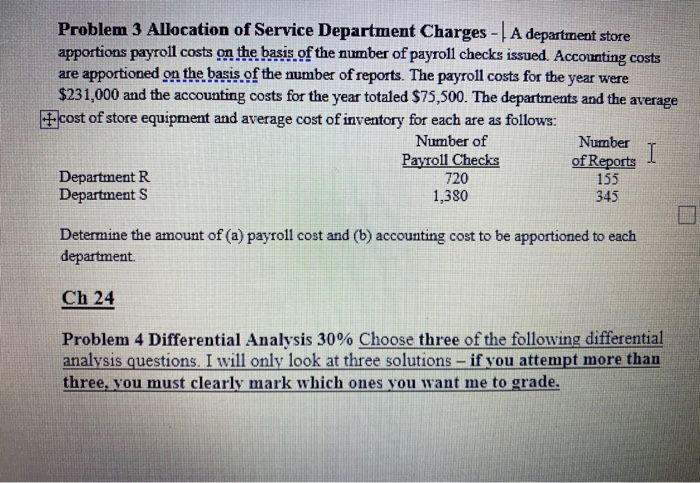

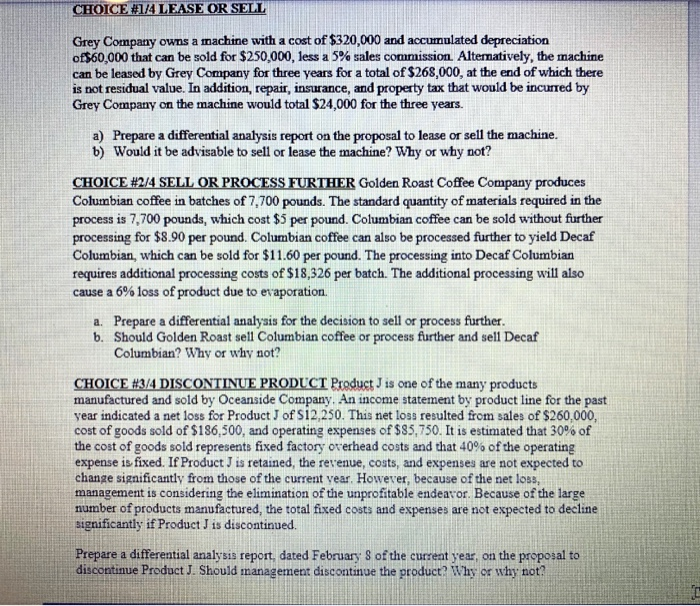

Ch 23 Problem 2 Transfer Pricing - Materials used by Best Bread Company in producing Division A's product are currently purchased from outside suppliers at a cost of $30 per unit. However, the same materials are available from Division B. Division B has unused capacity and can produce the materials needed by Division A at a variable cost of $20 per unit. (a)If a transfer price of $25 per unit is established and 60.000 units of material are transferred, with no reductions in Division B's current sales, how much would Best Bread Company's total income from operations increase? (b)Assuming transfer price of $25, how much would the income from operations of Division A increase? (c)Assuming transfer price of $25, how duch would the income from operations of Division B increase? (d)If the negotiated price approach is used, what would be the range of acceptable transfer prices? Problem 3 Allocation of Service Department Charges - A department store apportions payroll costs on the basis of the number of payroll checks issued. Accounting costs are apportioned on the basis of the number of reports. The payroll costs for the year were $231,000 and the accounting costs for the year totaled $75,500. The departments and the average -cost of store equipment and average cost of inventory for each are as follows: Number of Number Payroll Checks of Reports Department R Departments 1,380 345 720 155 Determine the amount of (a) payroll cost and (b) accounting cost to be apportioned to each department. Ch 24 Problem 4 Differential Analysis 30% Choose three of the following differential analysis questions. I will only look at three solutions - if you attempt more than three, you must clearly mark which ones you want me to grade. CHOICE #1/4 LEASE OR SELL Grey Company owns a machine with a cost of $320,000 and accumulated depreciation of$60,000 that can be sold for $250,000, less a 5% sales commission. Alternatively, the machine can be leased by Grey Company for three years for a total of $268,000, at the end of which there is not residual value. In addition, repair, insurance, and property tax that would be incurred by Grey Company on the machine would total $24,000 for the three years. a) Prepare a differential analysis report on the proposal to lease or sell the machine. b) Would it be advisable to sell or lease the machine? Why or why not? CHOICE #2/4 SELL OR PROCESS FURTHER Golden Roast Coffee Company produces Columbian coffee in batches of 7,700 pounds. The standard quantity of materials required in the process is 7,700 pounds, which cost $5 per pound. Columbian coffee can be sold without further processing for $8.90 per pound. Columbian coffee can also be processed further to yield Decaf Columbian, which can be sold for $11.60 per pound. The processing into Decaf Columbian requires additional processing costs of $18,326 per batch. The additional processing will also cause a 6% loss of product due to evaporation. a. Prepare a differential analysis for the decision to sell or process further. b. Should Golden Roast sell Columbian coffee or process further and sell Decaf Columbian? Why or why not? CHOICE #3/4 DISCONTINUE PRODUCT Product is one of the many products manufactured and sold by Oceanside Company. An income statement by product line for the past year indicated a net loss for Product of $12,250. This net loss resulted from sales of $260.000, cost of goods sold of $186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed. If Product is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current vear. However, because of the net loss, management is considering the elimination of the unprofitable endeavor. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued. Prepare a differential analysis report, dated February 8 of the current year, on the proposal to discontinue Product J. Should management discontinue the product? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started