Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these questions. Can you all explain with explanations? QUESTION 12 Frank and Sally, aged 46, are married and together have AGI

I need help with these questions. Can you all explain with explanations?

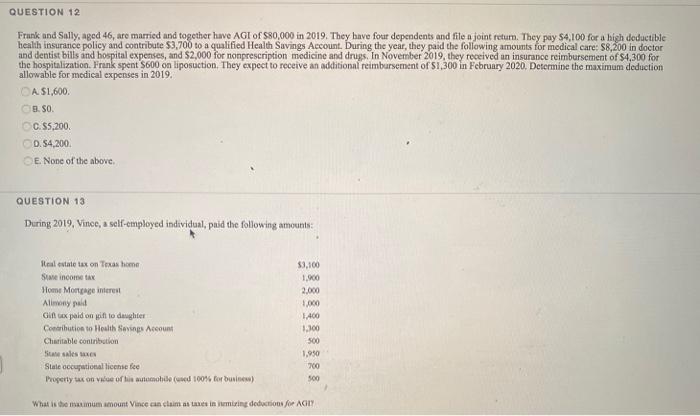

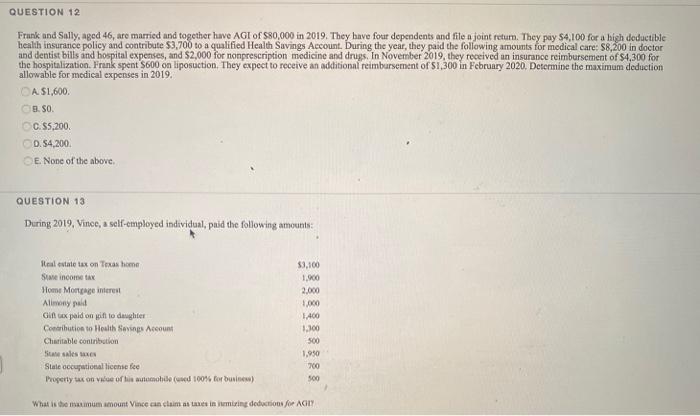

QUESTION 12 Frank and Sally, aged 46, are married and together have AGI of $80,000 in 2019. They have four dependents and file a joint retum. They pay $4,100 for a high deductible health insurance policy and contribute $3,700 to a qualified Health Savings Account. During the year, they paid the following amounts for medical care: $8,200 in doctor and dentist bills and hospital expenses, and $2,000 for nonprescription medicine and drugs. In November 2019, they received an insurance reimbursement of $4,300 for the hospitalization. Frank spent $600 on liposuction. They expect to receive an additional reimbursement of $1,300 in February 2020. Determine the maximum deduction allowable for medical expenses in 2019. CA $1,600. 8. SO C. 5,200 D.S4.2002 E. None of the above QUESTION 13 During 2019, Vino, a self-employed individual, puid the following amounts Ileal estate tax on Texas home Se income tax Home Mortgage interest Almond Gix paid on gift to dager Contribution to Health Savings Account Charitable contribution Se sales Stale occupational license fee Property tax on Vale of low 100% for business) $3,100 1.600 2.000 1.000 1.400 1.300 500 1,950 700 500 What is the maumum amount Vince can claim as an in umiring deductions for AGILY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started