Answered step by step

Verified Expert Solution

Question

1 Approved Answer

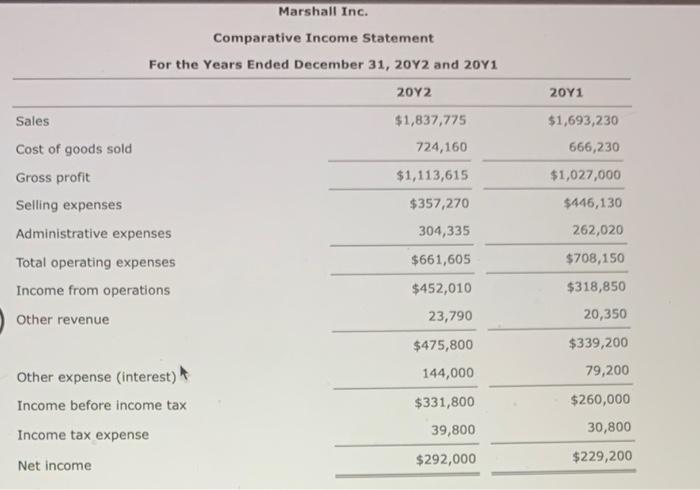

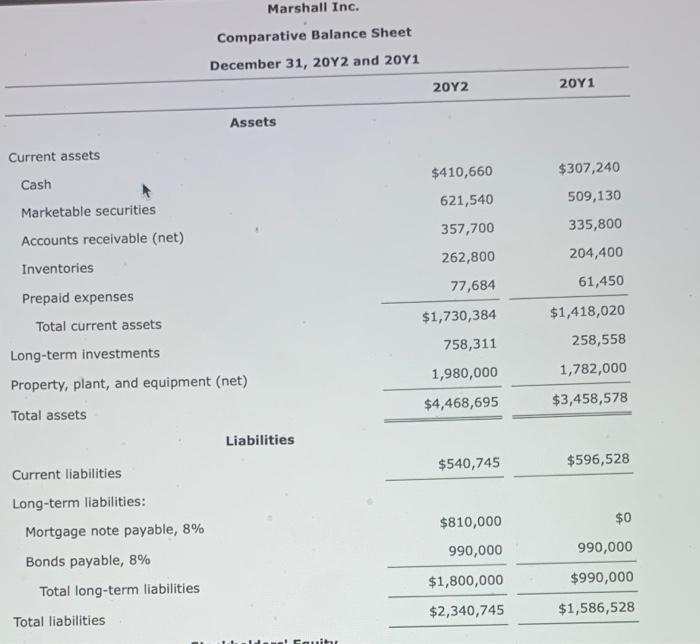

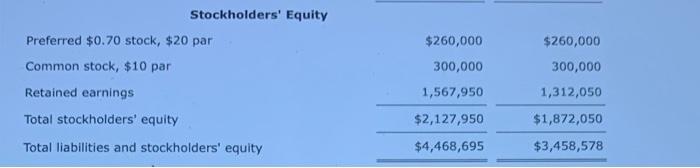

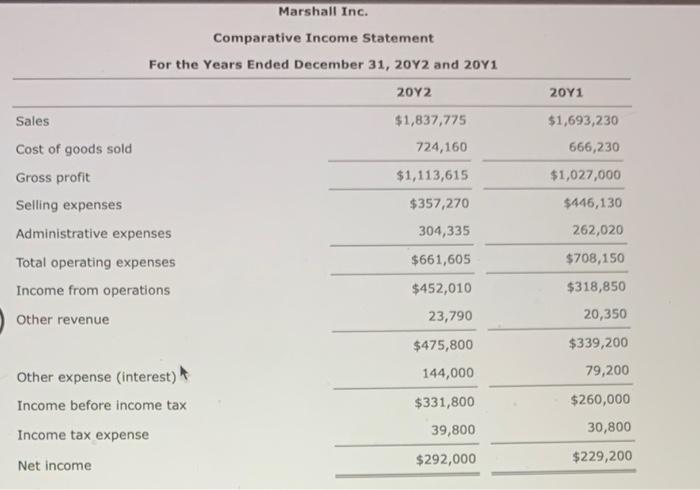

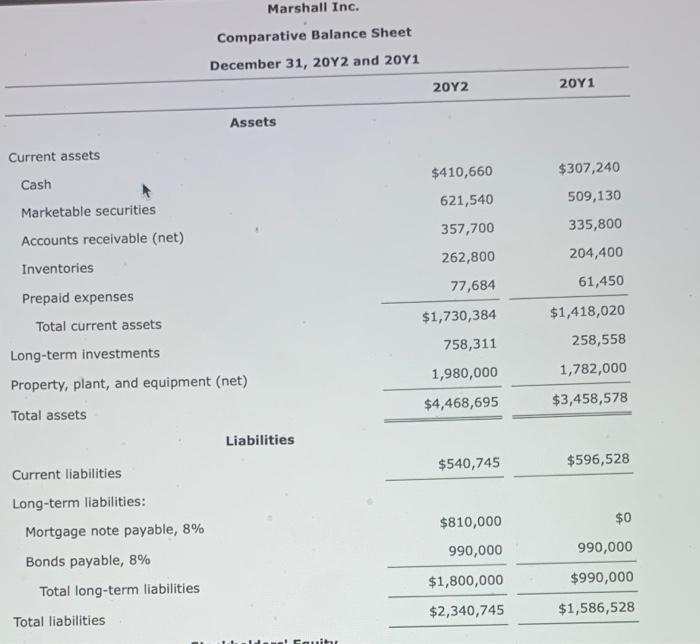

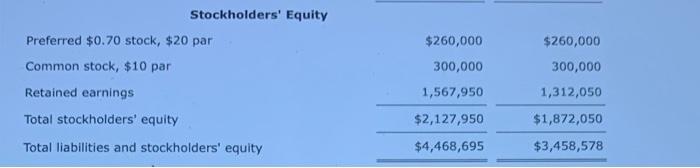

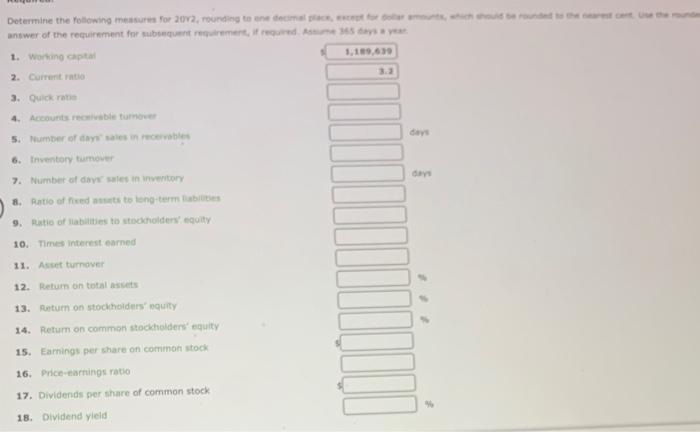

i need help with these questions Marshall Inc. Comparative Income Statement For the Years Ended December 31,20Y2 and 20Y1 Marshall Inc. Comparative Balance Sheet Stockholders'

i need help with these questions

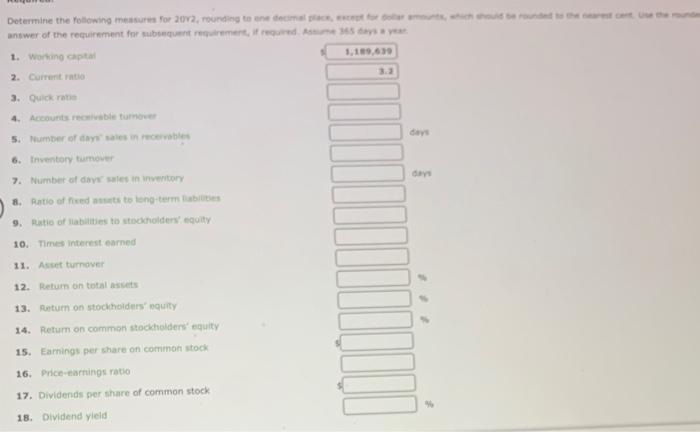

Marshall Inc. Comparative Income Statement For the Years Ended December 31,20Y2 and 20Y1 Marshall Inc. Comparative Balance Sheet Stockholders' Equity \begin{tabular}{lcc} Preferred $0.70 stock, $20 par & $260,000 & $260,000 \\ Common stock, $10 par & 300,000 & 300,000 \\ Retained earnings & 1,567,950 & 1,312,050 \\ Total stockholders' equity & $2,127,950 & $1,872,050 \\ \hline Total liabilities and stockholders' equity & $4,468,695 & $3,458,578 \\ \hline \end{tabular} answer of the requirement for mubsequent requiremert, if required ksw me 35 thas a yean: 1. Worthong capitail 2. Current.ratoo 3. Guick ratuat 4. Ackounta recoliebie turmover 5. Number of dayn naies in recessobles ders 6. Ifsentiony turneser 7. Number of dave" sales in inveritory 8. Rotio of fised ats-ts to tong-term i sbilities 9. Ratie of Mabliaies to utockiolden' ecuity 10. Times interest earned 11. Asset turnaver 12. Return on total assets 13. Return on stockielders" nquity darn 14. Peturn on comman stockholdens' equity? 15. Earnings per share on common stock. 16. Price-earnings ratio 17. Dividends ser share of common stock 18. Dividend yield a4 Marshall Inc. Comparative Income Statement For the Years Ended December 31,20Y2 and 20Y1 Marshall Inc. Comparative Balance Sheet Stockholders' Equity \begin{tabular}{lcc} Preferred $0.70 stock, $20 par & $260,000 & $260,000 \\ Common stock, $10 par & 300,000 & 300,000 \\ Retained earnings & 1,567,950 & 1,312,050 \\ Total stockholders' equity & $2,127,950 & $1,872,050 \\ \hline Total liabilities and stockholders' equity & $4,468,695 & $3,458,578 \\ \hline \end{tabular} answer of the requirement for mubsequent requiremert, if required ksw me 35 thas a yean: 1. Worthong capitail 2. Current.ratoo 3. Guick ratuat 4. Ackounta recoliebie turmover 5. Number of dayn naies in recessobles ders 6. Ifsentiony turneser 7. Number of dave" sales in inveritory 8. Rotio of fised ats-ts to tong-term i sbilities 9. Ratie of Mabliaies to utockiolden' ecuity 10. Times interest earned 11. Asset turnaver 12. Return on total assets 13. Return on stockielders" nquity darn 14. Peturn on comman stockholdens' equity? 15. Earnings per share on common stock. 16. Price-earnings ratio 17. Dividends ser share of common stock 18. Dividend yield a4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started