I need help with these questions

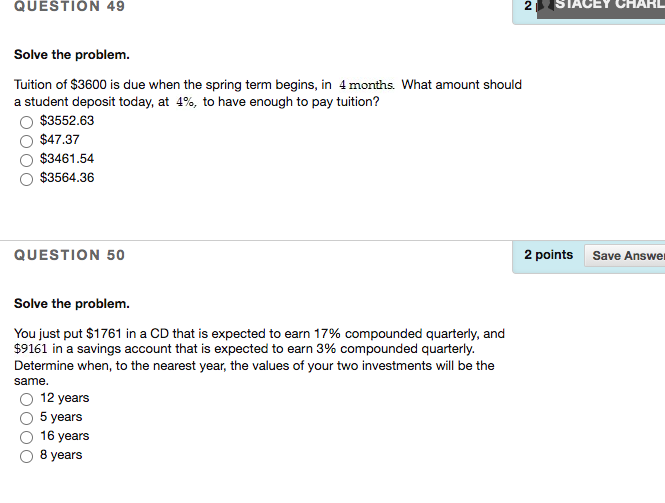

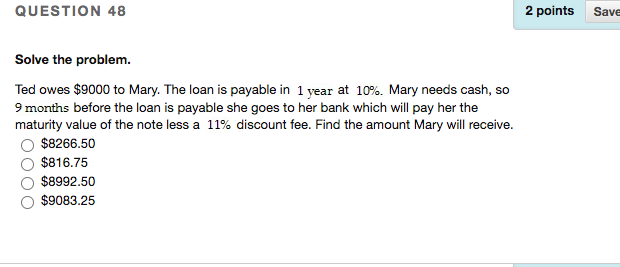

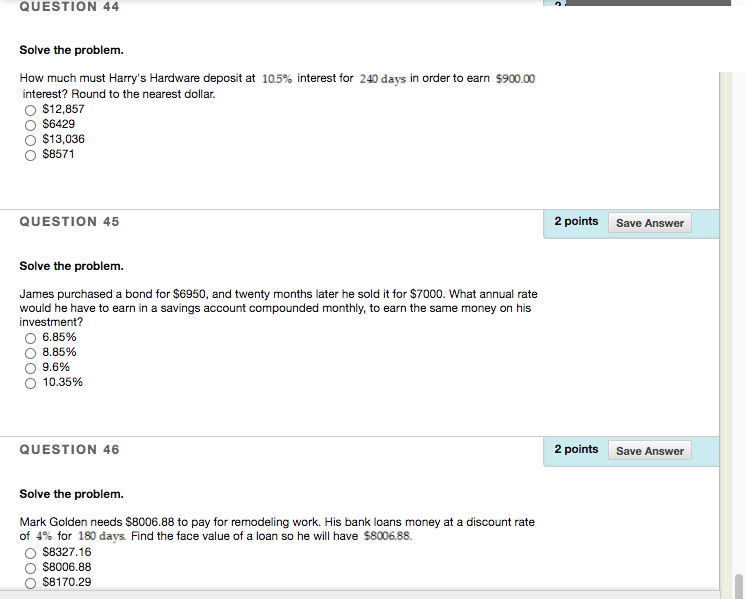

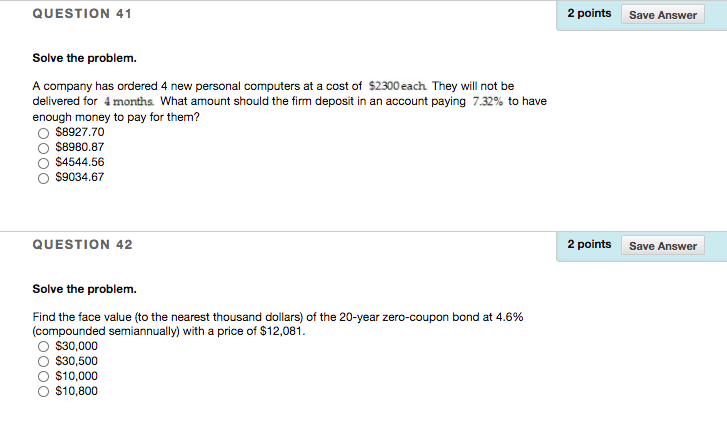

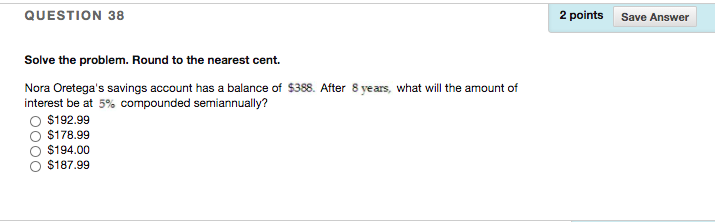

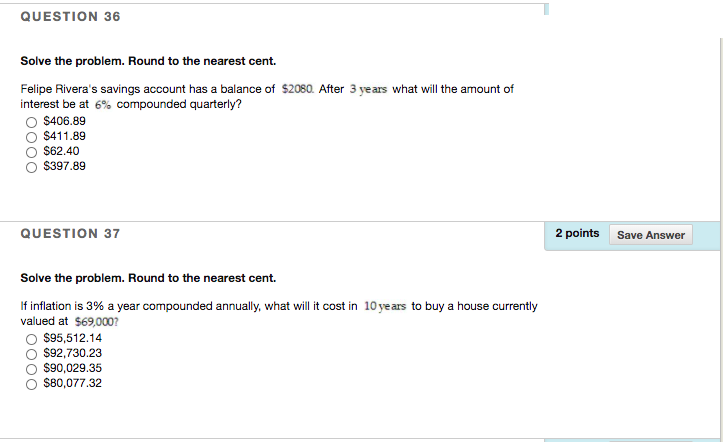

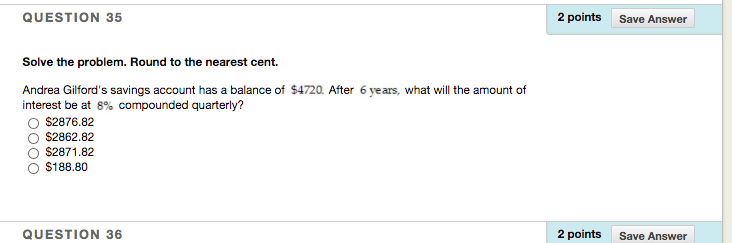

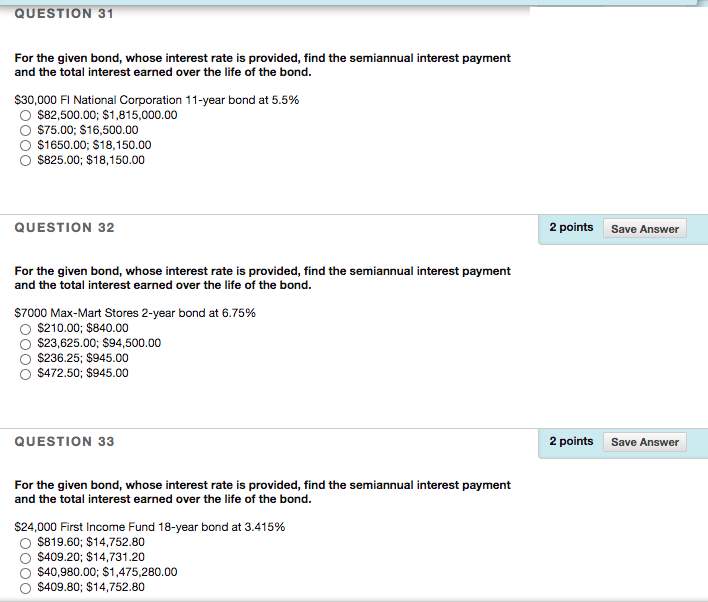

QUESTION 49 2 SIACEY CHARL Solve the problem. Tuition of $3600 is due when the spring term begins, in 4 months. What amount should a student deposit today, at 4%, to have enough to pay tuition? $3552.63 O $47.37 O $3461.54 O $3564.36 QUESTION 50 2 points Save Answer Solve the problem. You just put $1761 in a CD that is expected to earn 17% compounded quarterly, and $9161 in a savings account that is expected to earn 3% compounded quarterly. Determine when, to the nearest year, the values of your two investments will be the same. O 12 years 5 years O 16 years 8 yearsQUESTION 48 2 points Save Solve the problem. Ted owes $9000 to Mary. The loan is payable in 1 year at 10%. Mary needs cash, so 9 months before the loan is payable she goes to her bank which will pay her the maturity value of the note less a 11% discount fee. Find the amount Mary will receive. O $8266.50 OOO $816.75 $8992.50 $9083.25QUESTION 44 Solve the problem. How much must Harry's Hardware deposit at 105% interest for 240 days in order to earn $900.00 interest? Round to the nearest dollar. O $12,857 O $6429 O $13,036 $8571 QUESTION 45 2 points Save Answer Solve the problem. James purchased a bond for $6950, and twenty months later he sold it for $7000. What annual rate would he have to earn in a savings account compounded monthly, to earn the same money on his investment? O 6.85% O 8.85% 0 9.6% O 10.35% QUESTION 46 2 points Save Answer Solve the problem. Mark Golden needs $8006.88 to pay for remodeling work. His bank loans money at a discount rate of 4% for 180 days. Find the face value of a loan so he will have $8006.88. O $8327.16 $8006.88 $8170.29QUESTION 41 2 points Save Answer Solve the problem. A company has ordered 4 new personal computers at a cost of $2300each They will not be delivered for 4 months What amount should the firm deposit in an account paying 7.32% to have enough money to pay for them? O $8927.70 $8980.87 $4544.56 O $9034.67 QUESTION 42 2 points Save Answer Solve the problem. Find the face value (to the nearest thousand dollars) of the 20-year zero-coupon bond at 4.6% (compounded semiannually) with a price of $12,081. $30,000 $30,500 O $10,000 O $10,800QUESTION 38 2 points Save Answer Solve the problem. Round to the nearest cent. Nora Oretega's savings account has a balance of $388. After 8 years, what will the amount of interest be at 5% compounded semiannually? OO $192.99 $178.99 O $194.00 O $187.99QUESTION 36 Solve the problem. Round to the nearest cent. Felipe Rivera's savings account has a balance of $2080. After 3 years what will the amount of interest be at 6% compounded quarterly? O $406.89 $411.89 $62.40 $397.89 QUESTION 37 2 points Save Answer Solve the problem. Round to the nearest cent. If inflation is 3% a year compounded annually, what will it cost in 10 years to buy a house currently valued at $69,000? O $95,512.14 $92,730.23 O $90,029.35 $80,077.32QUESTION 35 2 points Save Answer Solve the problem. Round to the nearest cent. Andrea Gilford's savings account has a balance of $4720. After 6 years, what will the amount of interest be at 8% compounded quarterly? OO $2876.82 $2862.82 O $2871.82 O $188.80 QUESTION 36 2 points Save AnswerQUESTION 31 For the given bond, whose interest rate is provided, find the semiannual interest payment and the total interest earned over the life of the bond. $30,000 FI National Corporation 11-year bond at 5.5% O $82,500.00; $1,815,000.00 O $75.00; $16,500.00 $1650.00; $18,150.00 $825.00; $18,150.00 QUESTION 32 2 points Save Answer For the given bond, whose interest rate is provided, find the semiannual interest payment and the total interest earned over the life of the bond. $7000 Max-Mart Stores 2-year bond at 6.75% $210.00; $840.00 $23,625.00; $94,500.00 $236.25; $945.00 $472.50; $945.00 QUESTION 33 2 points Save Answer For the given bond, whose interest rate is provided, find the semiannual interest payment and the total interest earned over the life of the bond. $24,000 First Income Fund 18-year bond at 3.415% $819.60; $14,752.80 $409.20; $14,731.20 $40,980.00; $1,475,280.00 $409.80; $14,752.80