I need help with these two problems please

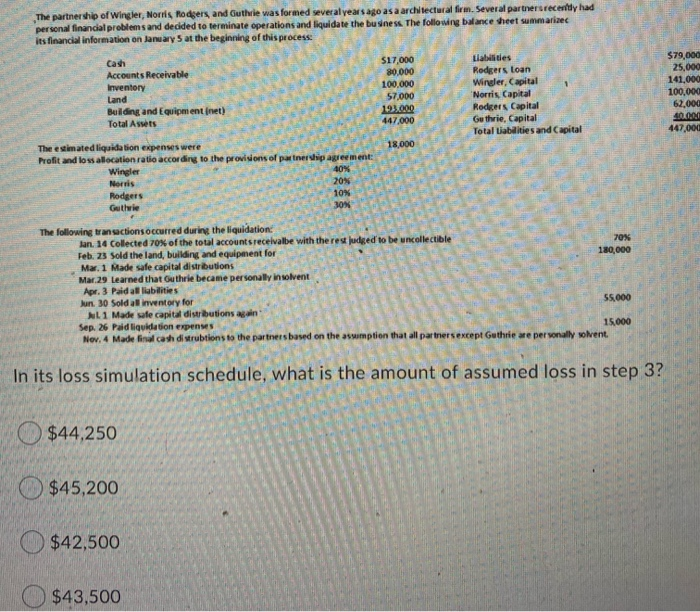

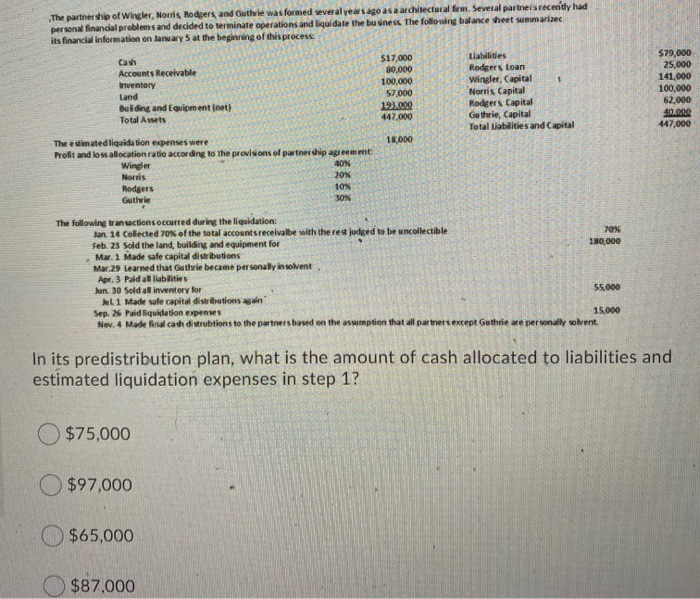

The partnership of Wingler, Norris, Rodgers and Guthrie was formed several years ago as a architectural firm. Several partners recently had personal financial problems and decided to terminate operations and liquidate the business. The following balance sheet summarizec its financial information on January 5 at the beginning of this process: Cash Accounts Receivable Inventory Land Building and Equipment (net) Total Assets $17,000 80,000 100.000 57,000 19.000 447,000 Llabilities Rodgers Loan Wingler, Capital Norris Capital Rodgers Capital Guthrie, Capital Total Liabilities and Capital $79,000 25,000 141,000 100,000 62,000 447,001 18,000 The estimated liquidation expenses were Profit and loss allocation ratio according to the provisions of partner hip agreement: Wingler 40% 20% Rodgers 10% Guthie 30% Norris The following transactions occurred during the liquidation: lan. 14 Collected 70% of the total accounts receivalbe with the rest judged to be uncollectible 70% Feb. 23 Sold the land, building and equipment for 180,000 Mar. 1 Made safe capital distributions Mar 29 Learned that Guthrie became personally insolvent Apr. 3 Paidal liabilities Jun 30 Sold a inventory for 55.000 AL 1 Made safe capital distributions again Sep. 26 Paid liquidation expenses 15.000 Nev, 4 Mache final cash distrubtions to the partners based on the assumption that all partners except Guthrie me personally solvent In its loss simulation schedule, what is the amount of assumed loss in step 3? $44,250 $45,200 $42,500 $43,500 The partnership of Wingler, Norris Rodgers, and Gutlvie was formed several years ago as a architectural firm. Several partners recently had personal financial problems and decided to terminate operations and liquidate the business. The following balance sheet summarizec its financial information on January 5 at the beginning of this process 1 Accounts Receivable Inventory Land Building and Equipment inet) Total Awets $17,000 80,000 100.000 57 000 19.00 447,000 Liabilities Rodgers Loan Wingler, Capital Norris Capital Rodgers Capital Guthrie, Capital Total abilities and Capital $79,000 25,000 141,000 100,000 62,000 40.00 447,000 18 ODO The estimated liquidation expenses were Profit and loss allocation ratio according to the provisions of partnership agreement Wingler 40% Morris 20% Rodgers 10% Gutie 30% The following transactions occurred during the liquidation Jan 14 Collected 70% of the total accounts receivalbe with the res judged to be uncollectible 70% Feb. 23 Sold the land, building and equipment for 180,000 Mar. 1 Made safe capital distributions Mar.29 Learned that Guthrie became personally insolvent Apr. 3 Poldal liabilities Jun 30 Sold at inventory for 55,000 AL 1 Made safe capital distributions again Sep. 26 Paid liquidation expenses 15,000 Nov. 4 Made final cash distrubtions to the partners based on the assumption that all partners except Guthrie are personally solvent. In its predistribution plan, what is the amount of cash allocated to liabilities and estimated liquidation expenses in step 1? $75,000 $97,000 $65,000 $87.000