Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these WITHIN 10 MINUTES PLEASE !! Question 49 (1 point) In a recent pay period. Blue Company employees have gross salaries

I need help with these WITHIN 10 MINUTES PLEASE !!

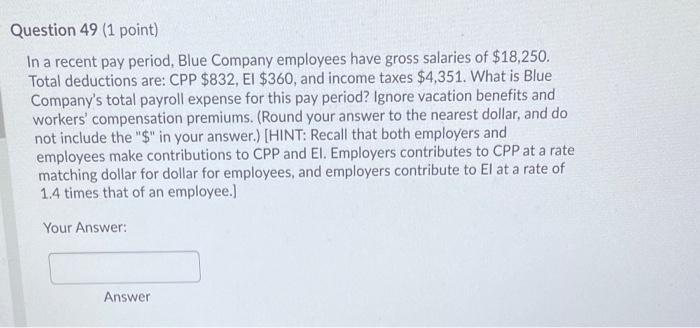

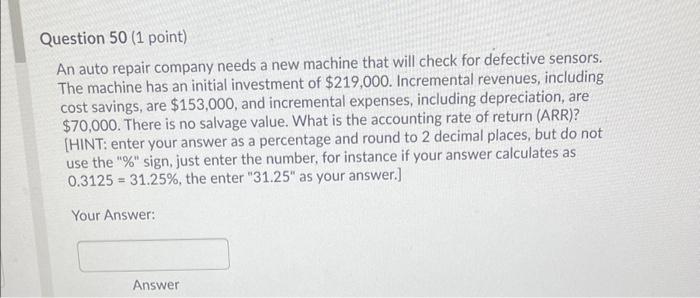

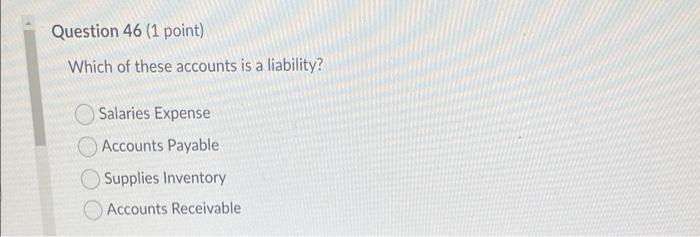

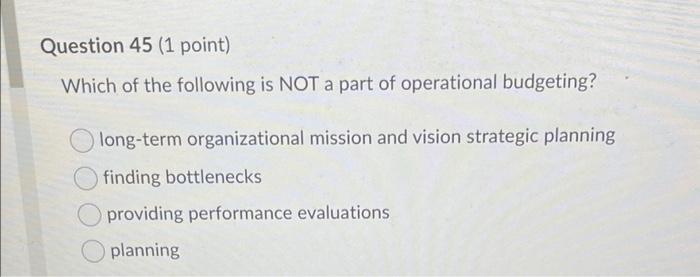

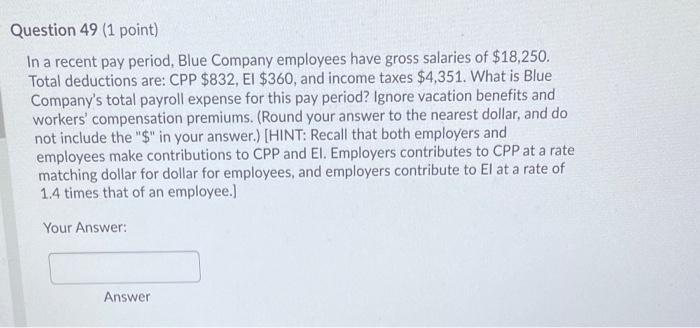

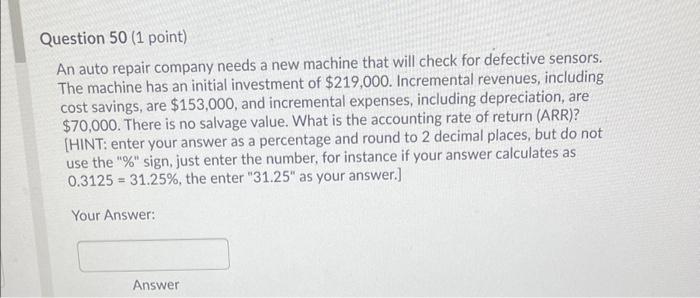

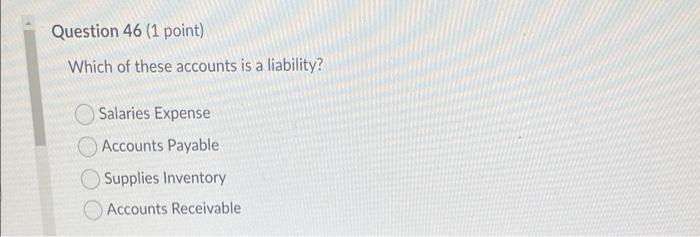

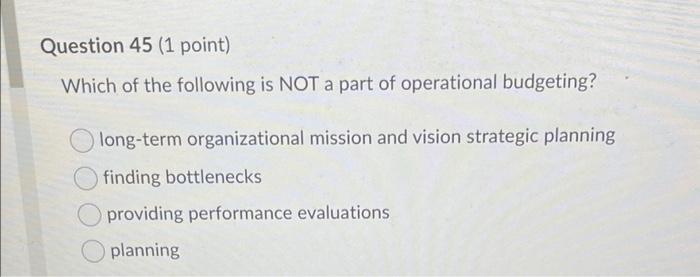

Question 49 (1 point) In a recent pay period. Blue Company employees have gross salaries of $18,250. Total deductions are: CPP $832, El $360, and income taxes $4,351. What is Blue Company's total payroll expense for this pay period? Ignore vacation benefits and workers' compensation premiums. (Round your answer to the nearest dollar, and do not include the "$" in your answer.) [HINT: Recall that both employers and employees make contributions to CPP and El. Employers contributes to CPP at a rate matching dollar for dollar for employees, and employers contribute to El at a rate of 1.4 times that of an employee. Your Answer: Answer Question 50 (1 point) An auto repair company needs a new machine that will check for defective sensors. The machine has an initial investment of $219,000. Incremental revenues, including cost savings, are $153,000, and incremental expenses, including depreciation, are $70,000. There is no salvage value. What is the accounting rate of return (ARR)? [HINT: enter your answer as a percentage and round to 2 decimal places, but do not use the "%" sign, just enter the number, for instance if your answer calculates as 0.3125 = 31.25%, the enter "31.25" as your answer.] Your Answer: Answer Question 46 (1 point) Which of these accounts is a liability? Salaries Expense Accounts Payable Supplies Inventory Accounts Receivable Question 45 (1 point) Which of the following is NOT a part of operational budgeting? long-term organizational mission and vision strategic planning finding bottlenecks providing performance evaluations planning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started