Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED HELP WITH THIS a YourTech began operations on January 1, 2022, and manufactures electronic components for the aerospace industry. YourTech follows USGAAP, has

I NEED HELP WITH THIS

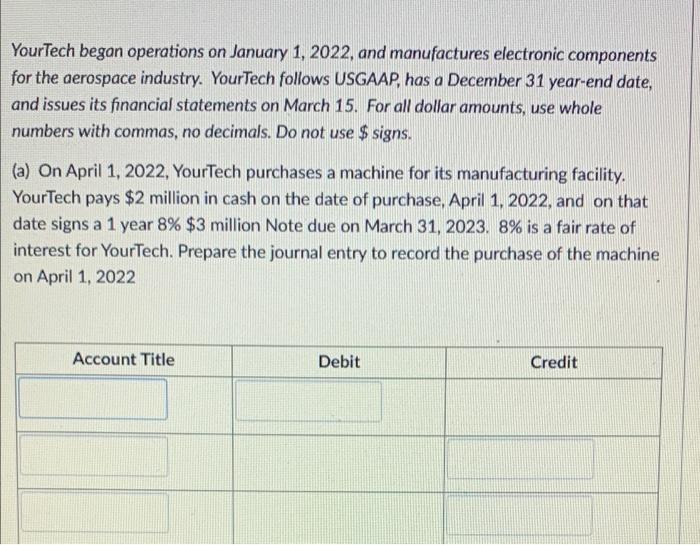

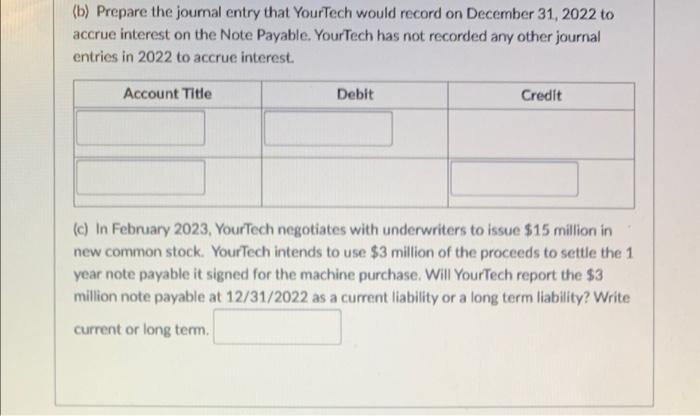

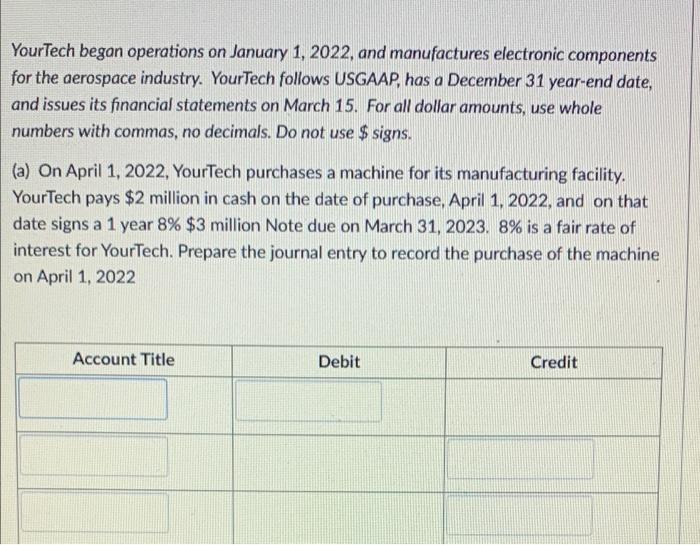

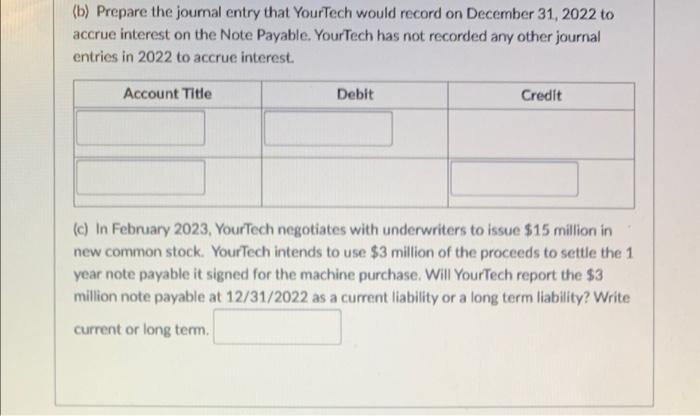

a YourTech began operations on January 1, 2022, and manufactures electronic components for the aerospace industry. YourTech follows USGAAP, has a December 31 year-end date, and issues its financial statements on March 15. For all dollar amounts, use whole numbers with commas, no decimals. Do not use $ signs. (a) On April 1, 2022, YourTech purchases a machine for its manufacturing facility. YourTech pays $2 million in cash on the date of purchase, April 1, 2022, and on that date signs a 1 year 8% $3 million Note due on March 31, 2023. 8% is a fair rate of interest for YourTech. Prepare the journal entry to record the purchase of the machine on April 1, 2022 Account Title Debit Credit (b) Prepare the journal entry that YourTech would record on December 31, 2022 to accrue interest on the Note Payable. YourTech has not recorded any other journal entries in 2022 to accrue interest. Account Title Debit Credit (c) in February 2023, YourTech negotiates with underwriters to issue $15 million in new common stock. YourTech intends to use $3 million of the proceeds to settle the 1 year note payable it signed for the machine purchase. Will YourTech report the $3 million note payable at 12/31/2022 as a current liability or a long term liability? Write current or long term

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started