Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this accounting question. This is one entire question. Required information [The following information applies to the questions displayed below.] Valley Company's

I need help with this accounting question. This is one entire question.

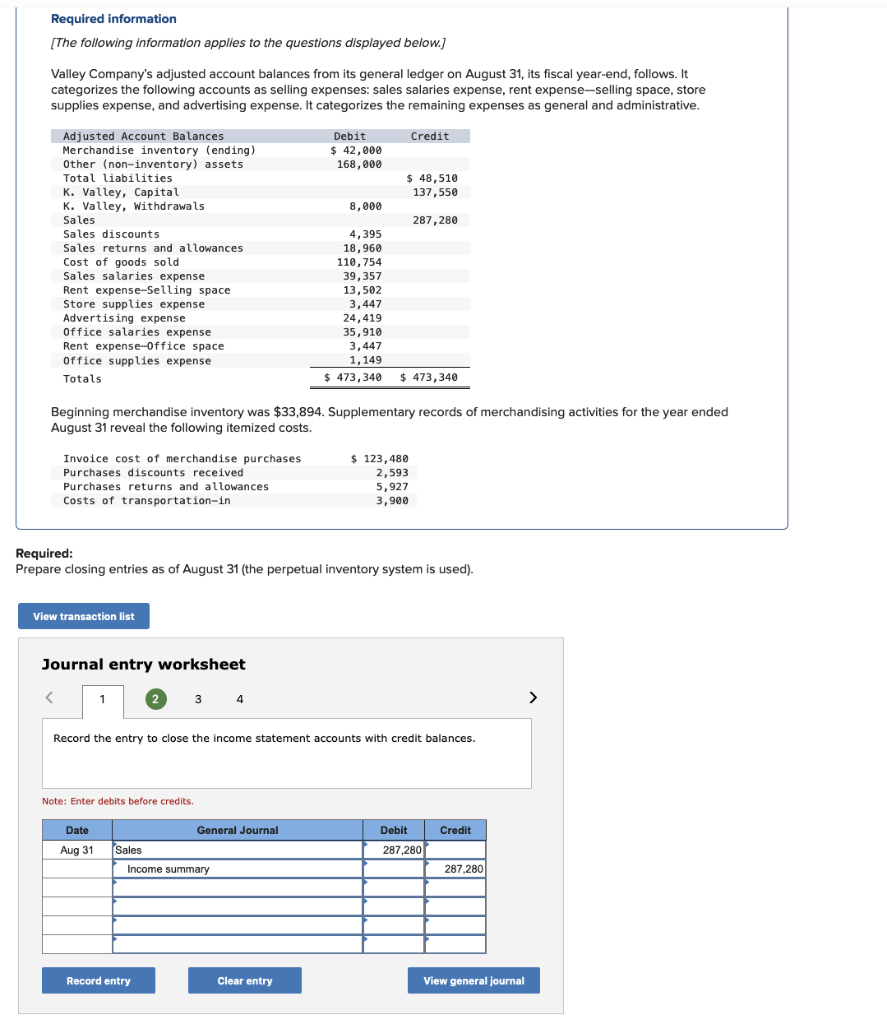

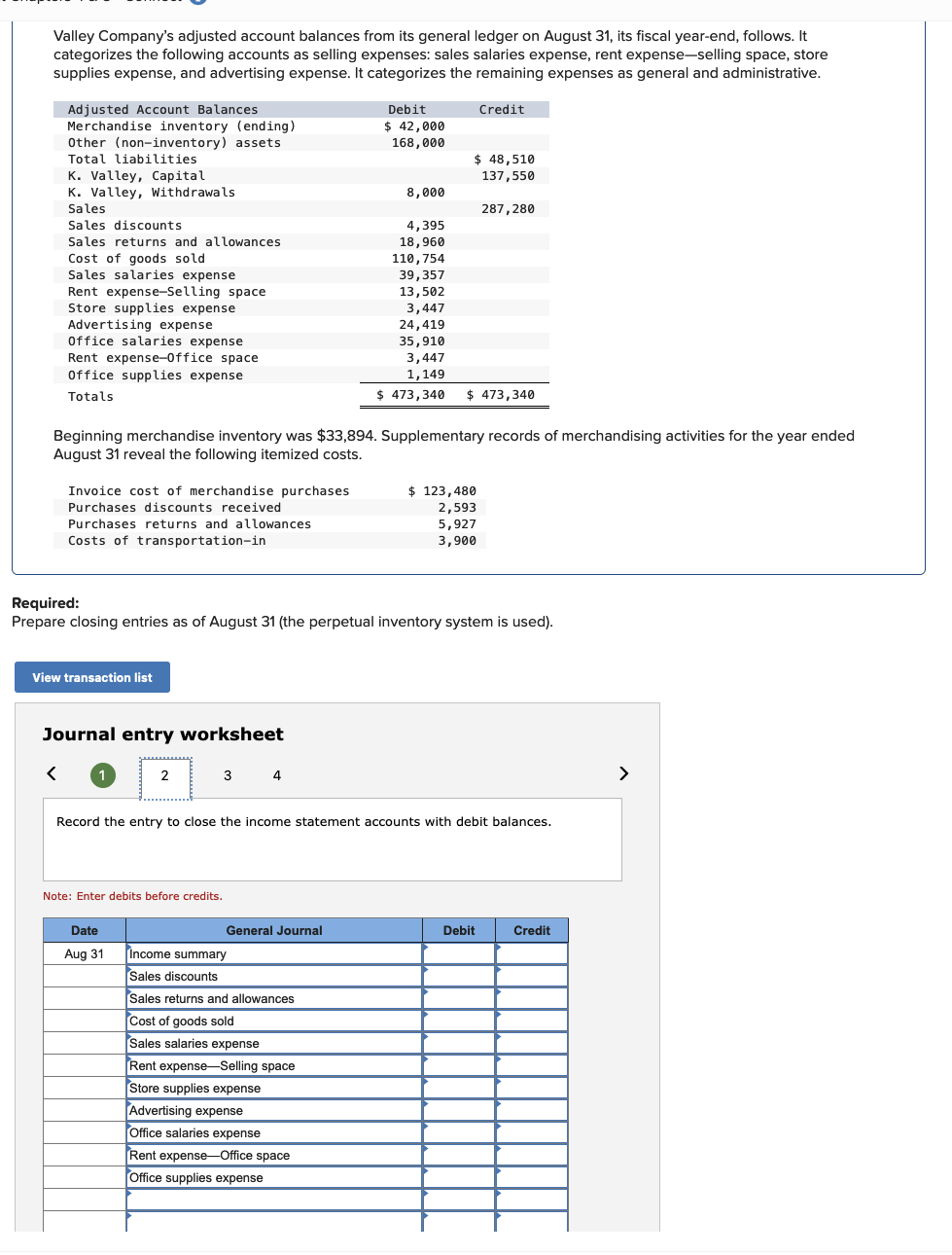

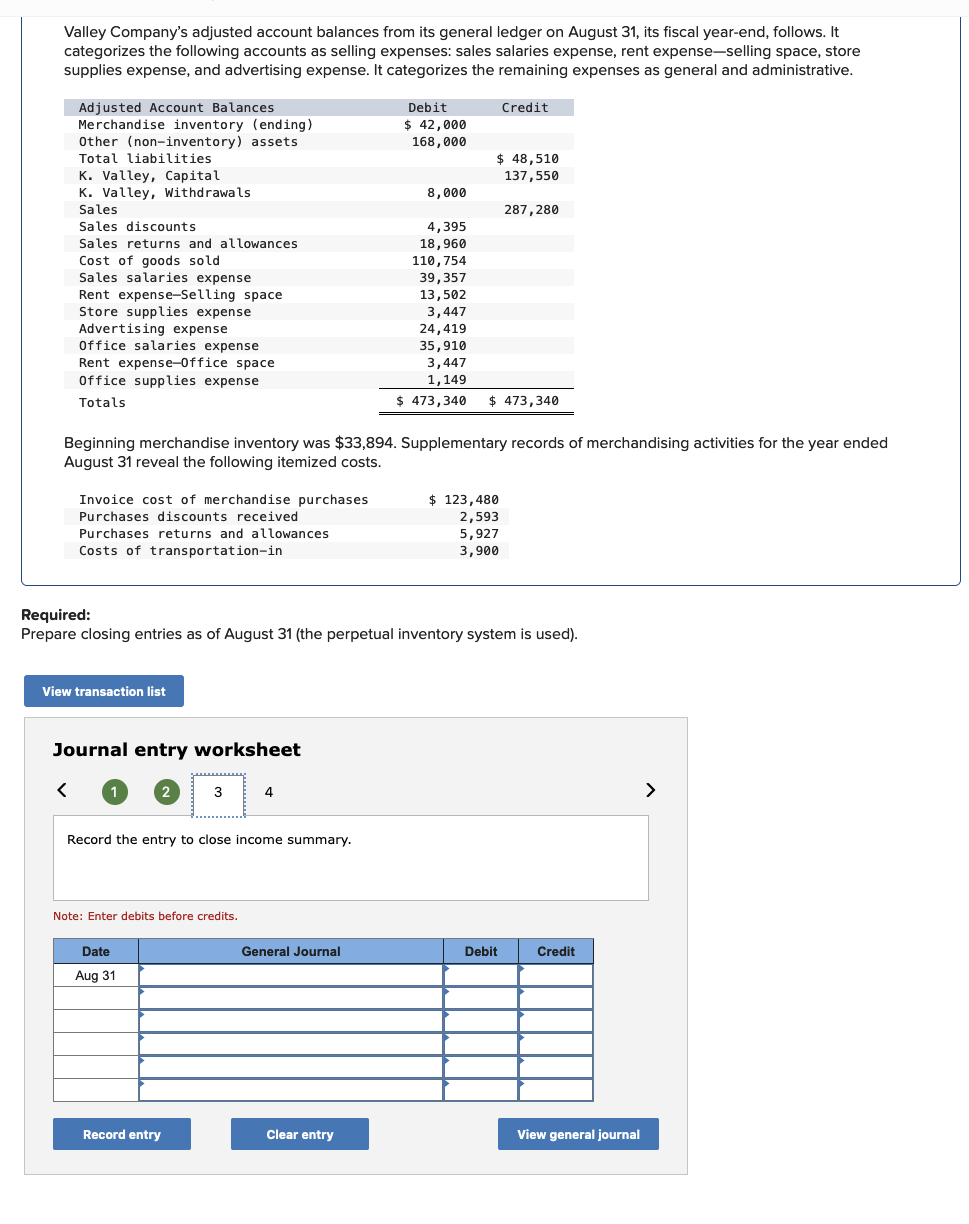

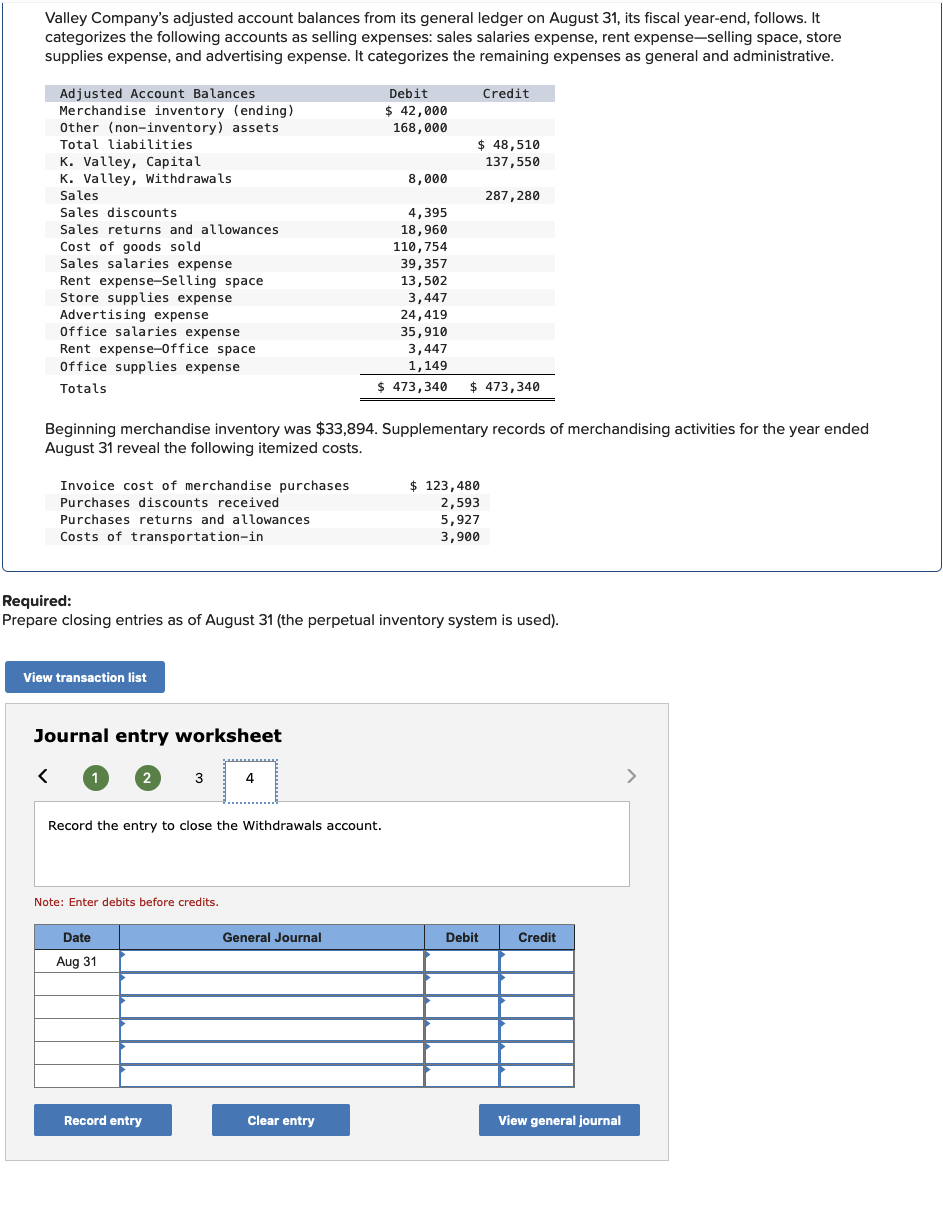

Required information [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $33,894. Supplementary records of merchandising activities for the year endec August 31 reveal the following itemized costs. Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). Journal entry worksheet Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. Valley Company's adjusted account balances from its general ledger on August 31 , its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $33,894. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). Journal entry worksheet Record the entry to close the income statement accounts with debit balances. Note: Enter debits before credits. Valley Company's adjusted account balances from its general ledger on August 31 , its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $33,894. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). Journal entry worksheet Record the entry to close income summary. Note: Enter debits before credits. Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $33,894. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). Journal entry worksheet Record the entry to close the Withdrawals account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started