i need help with this all questions are attached all are multiple choice

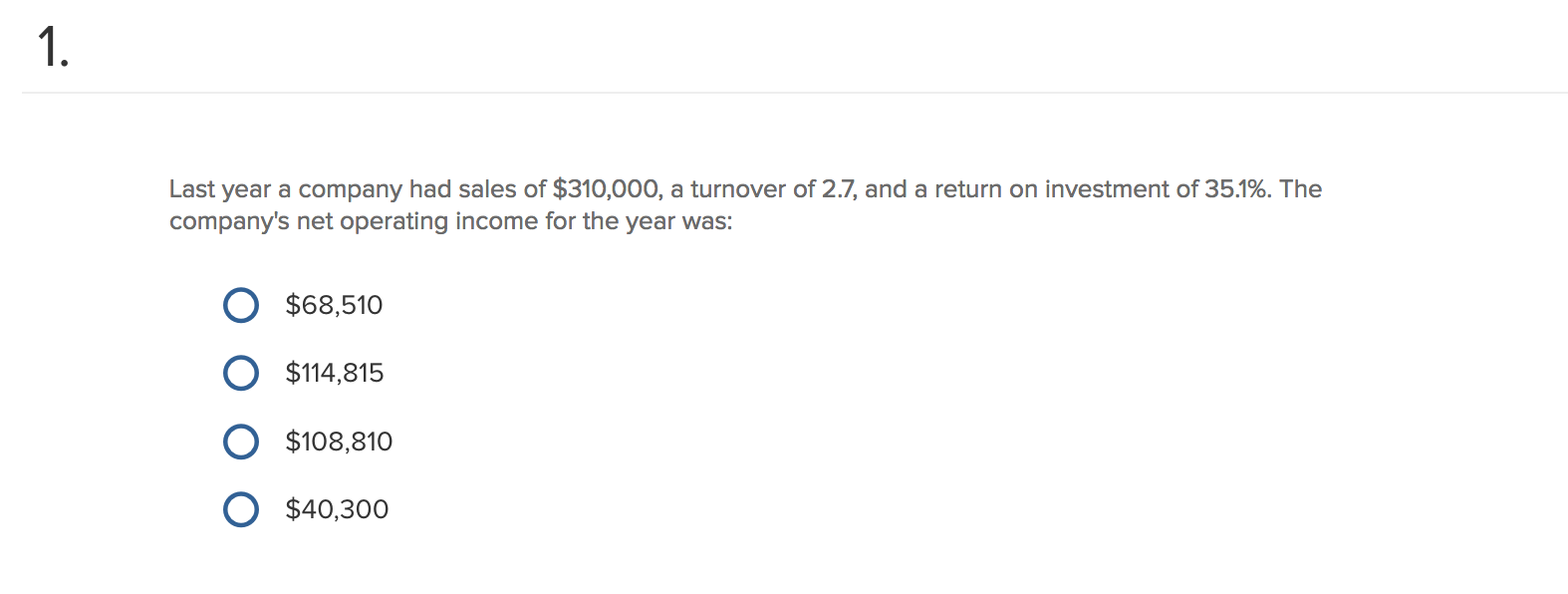

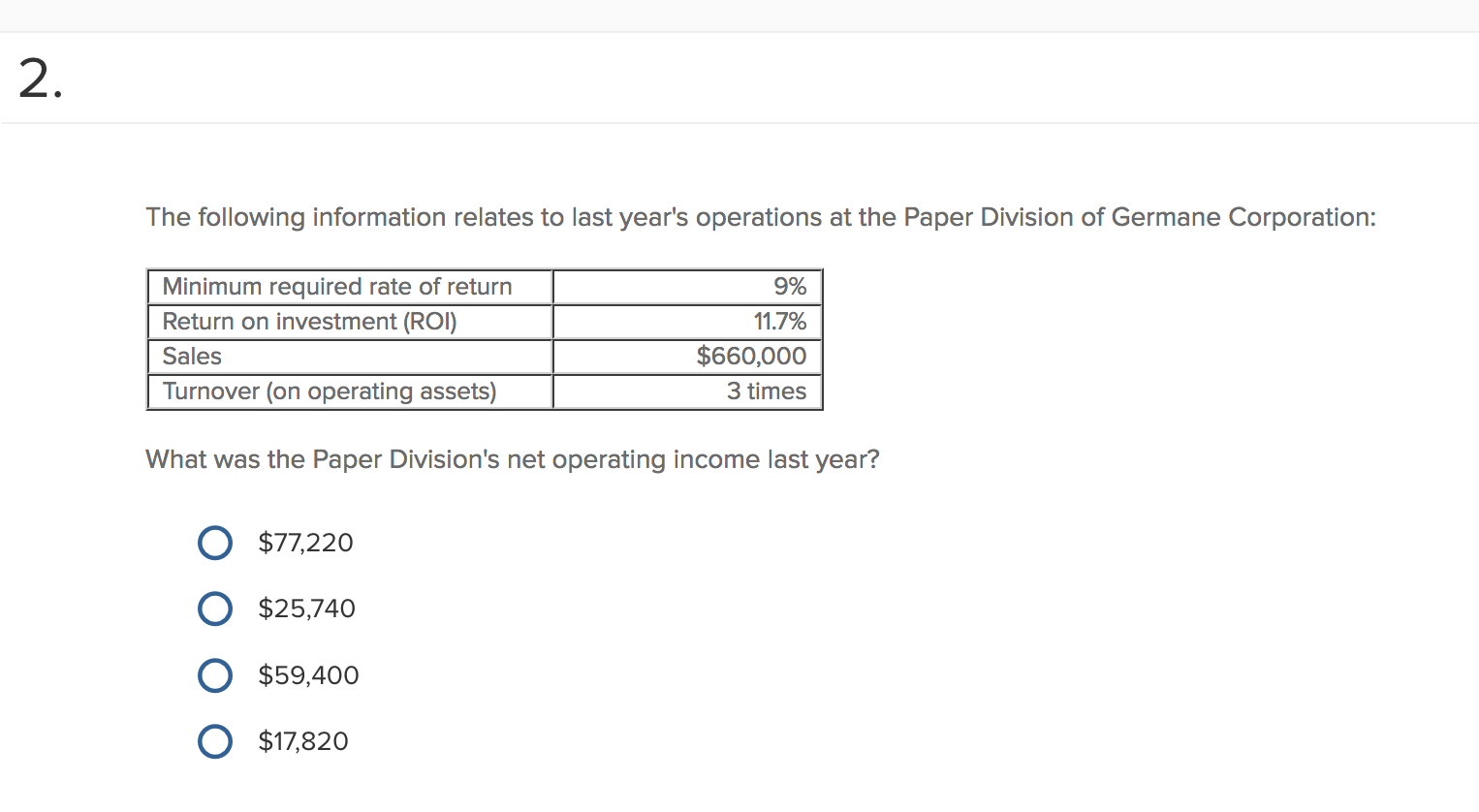

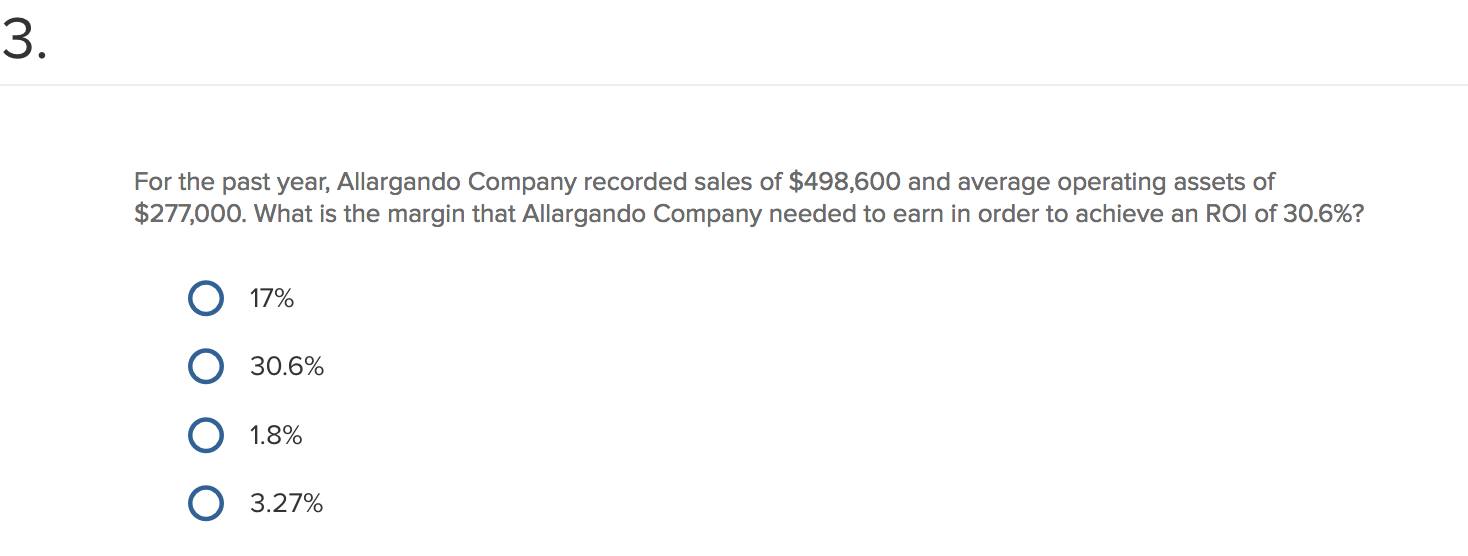

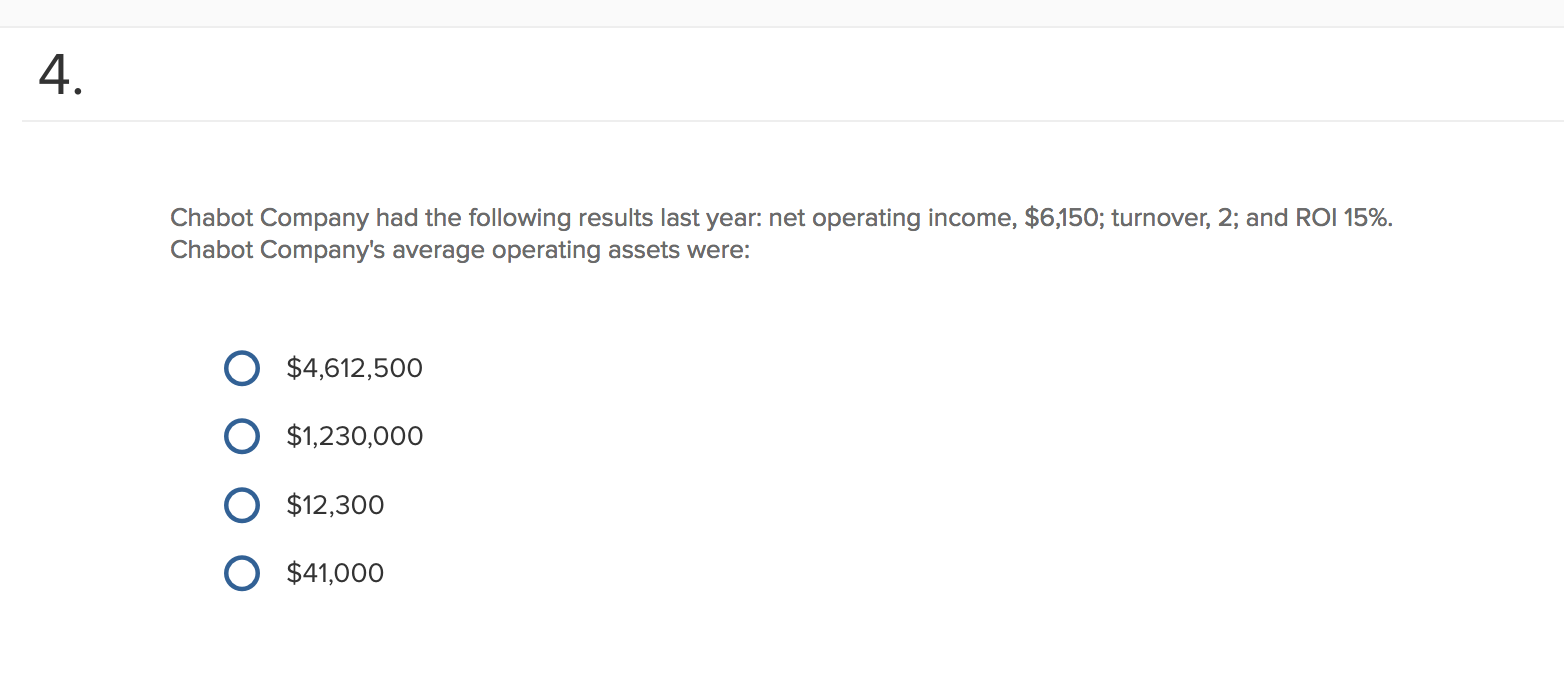

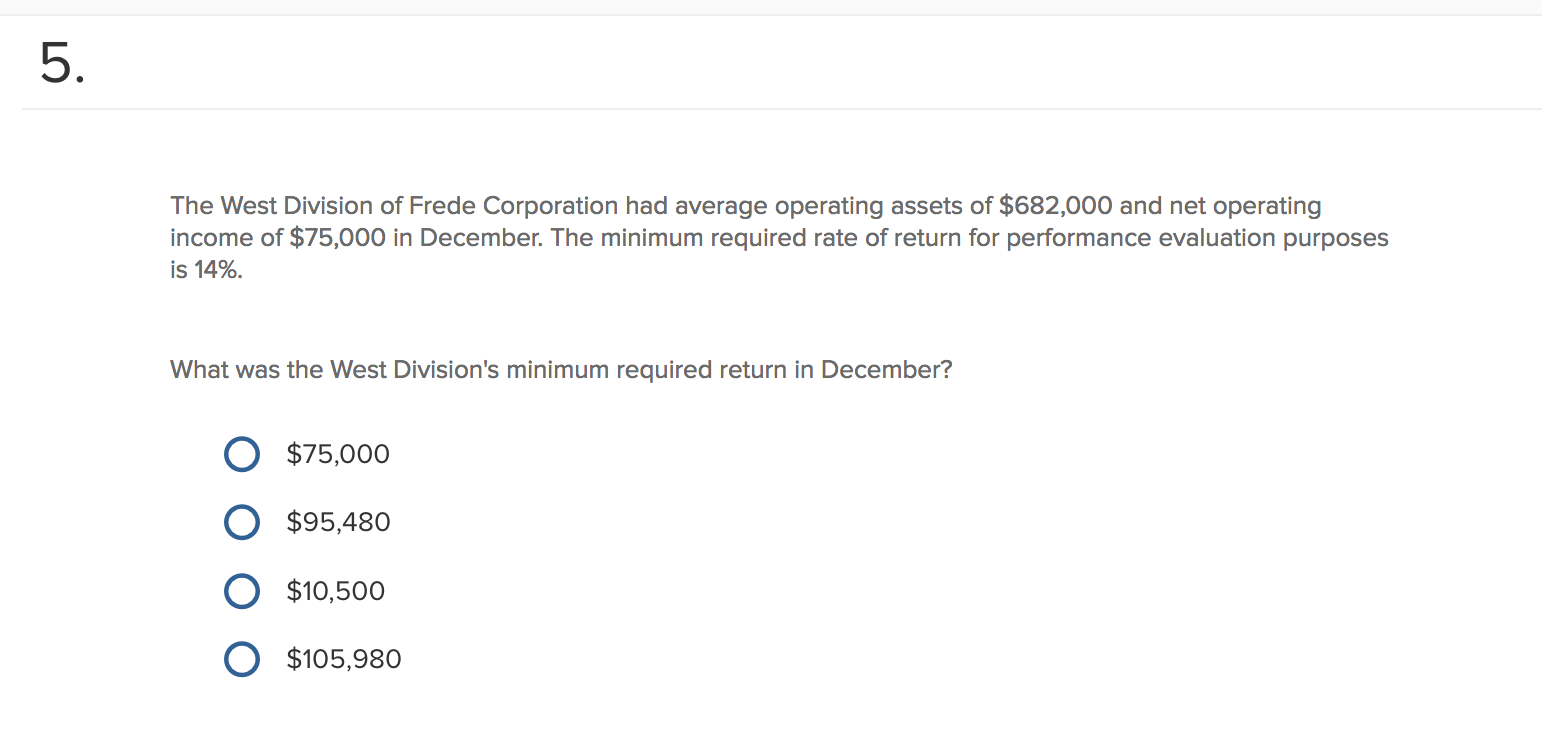

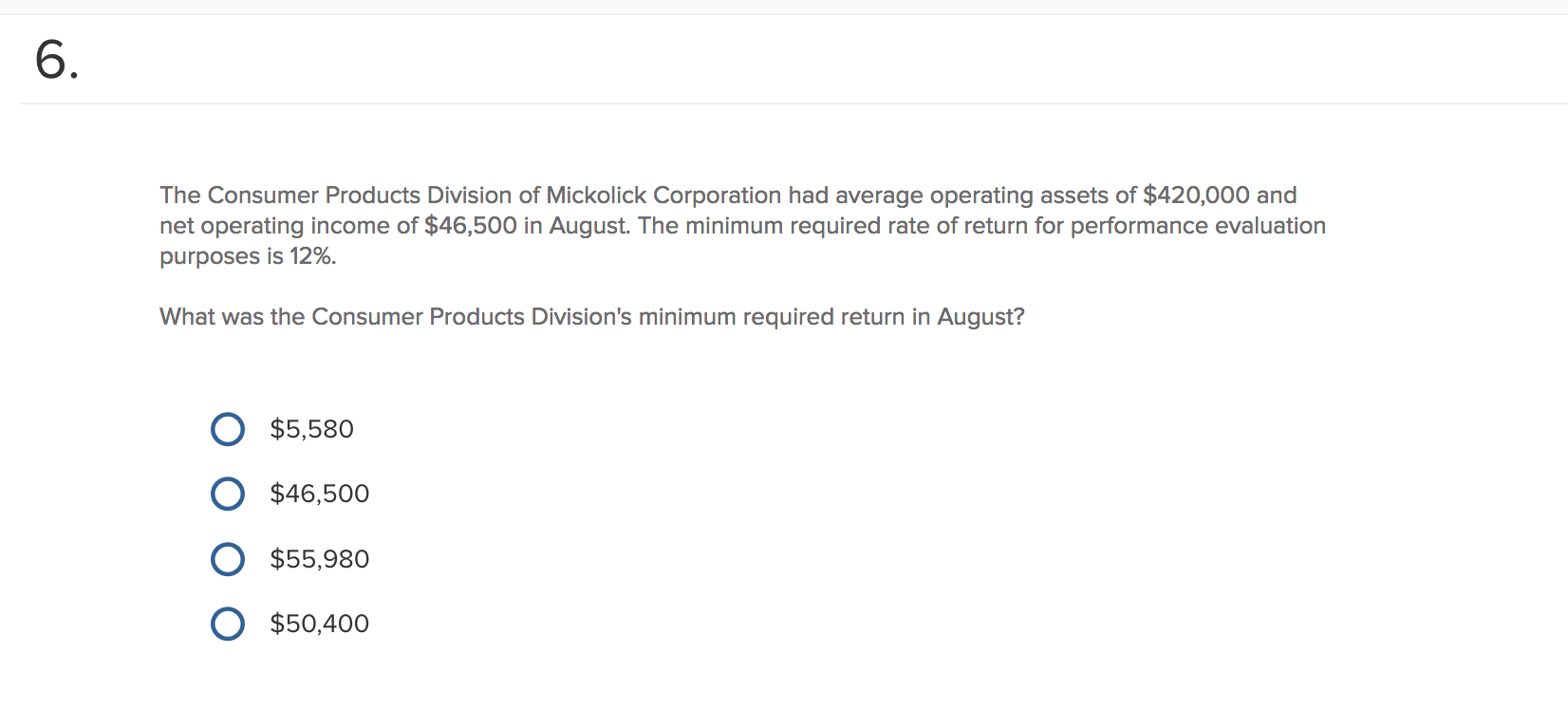

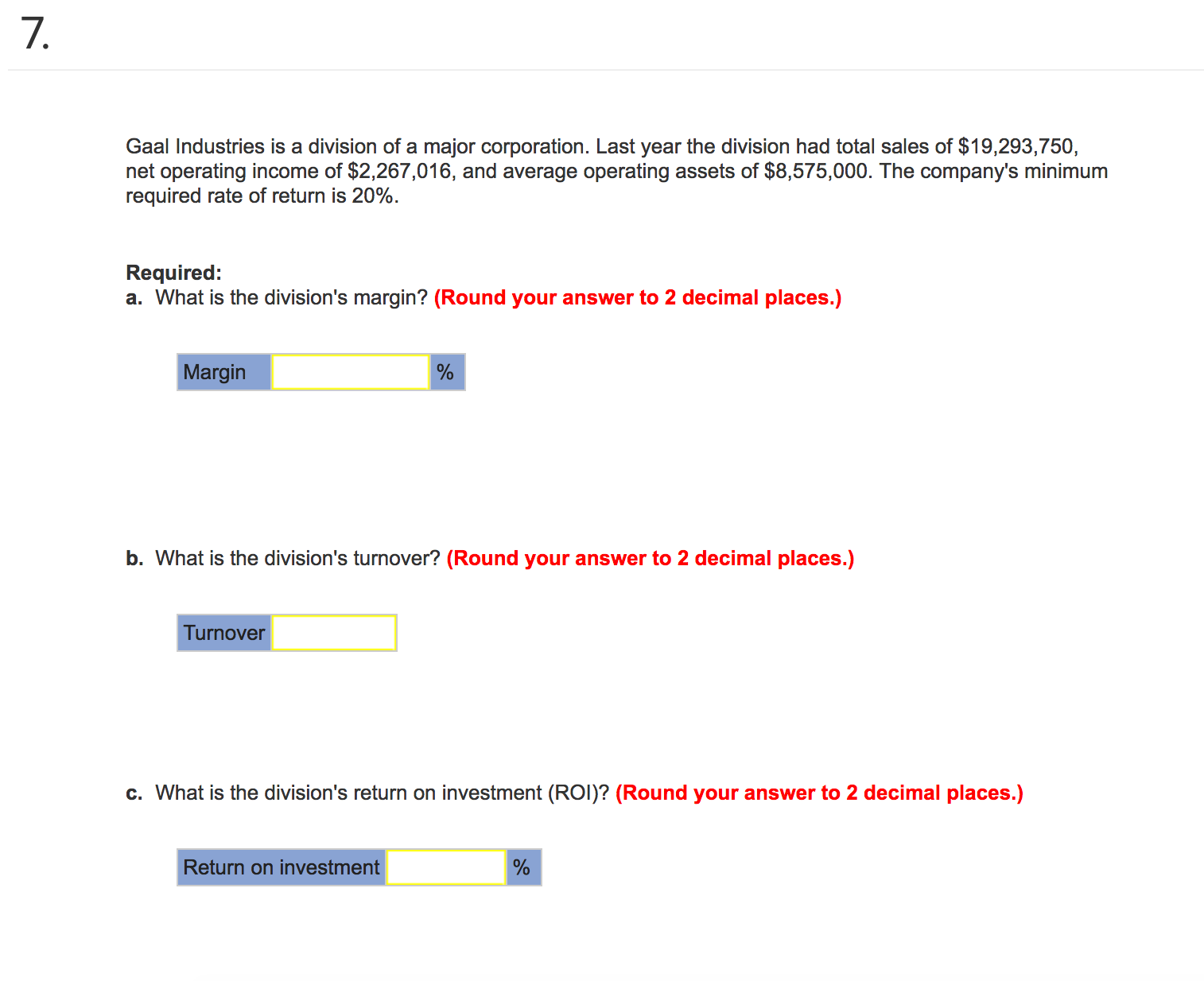

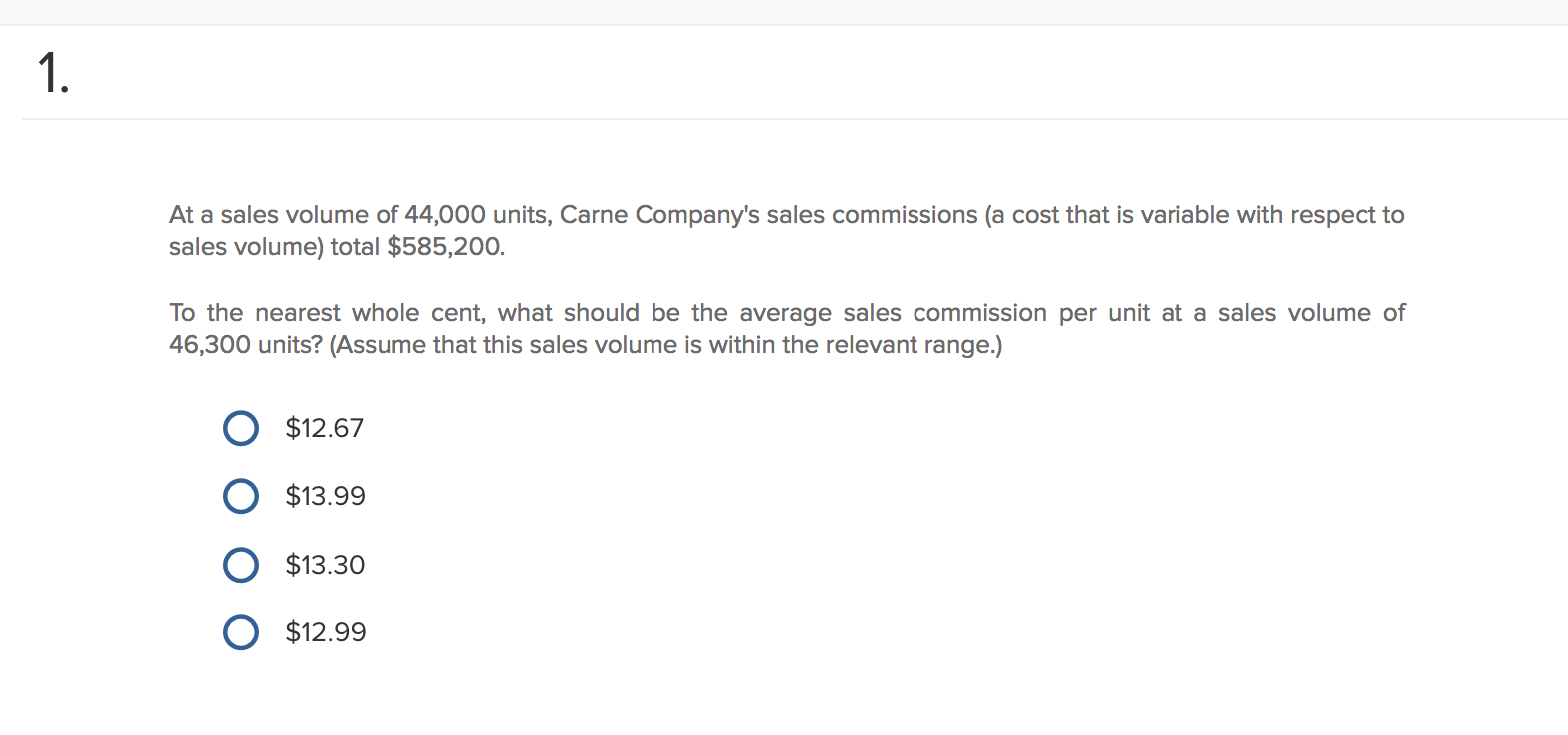

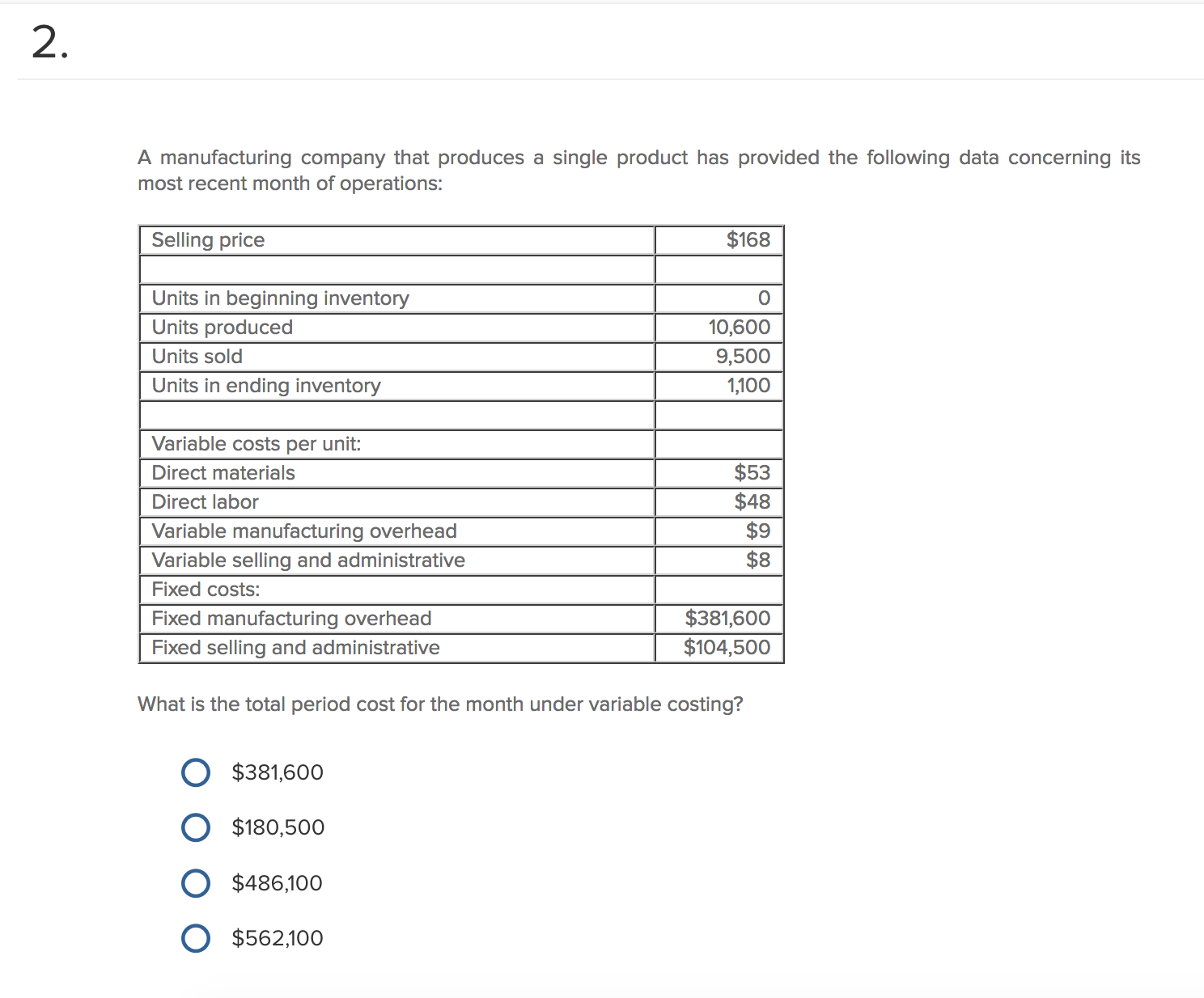

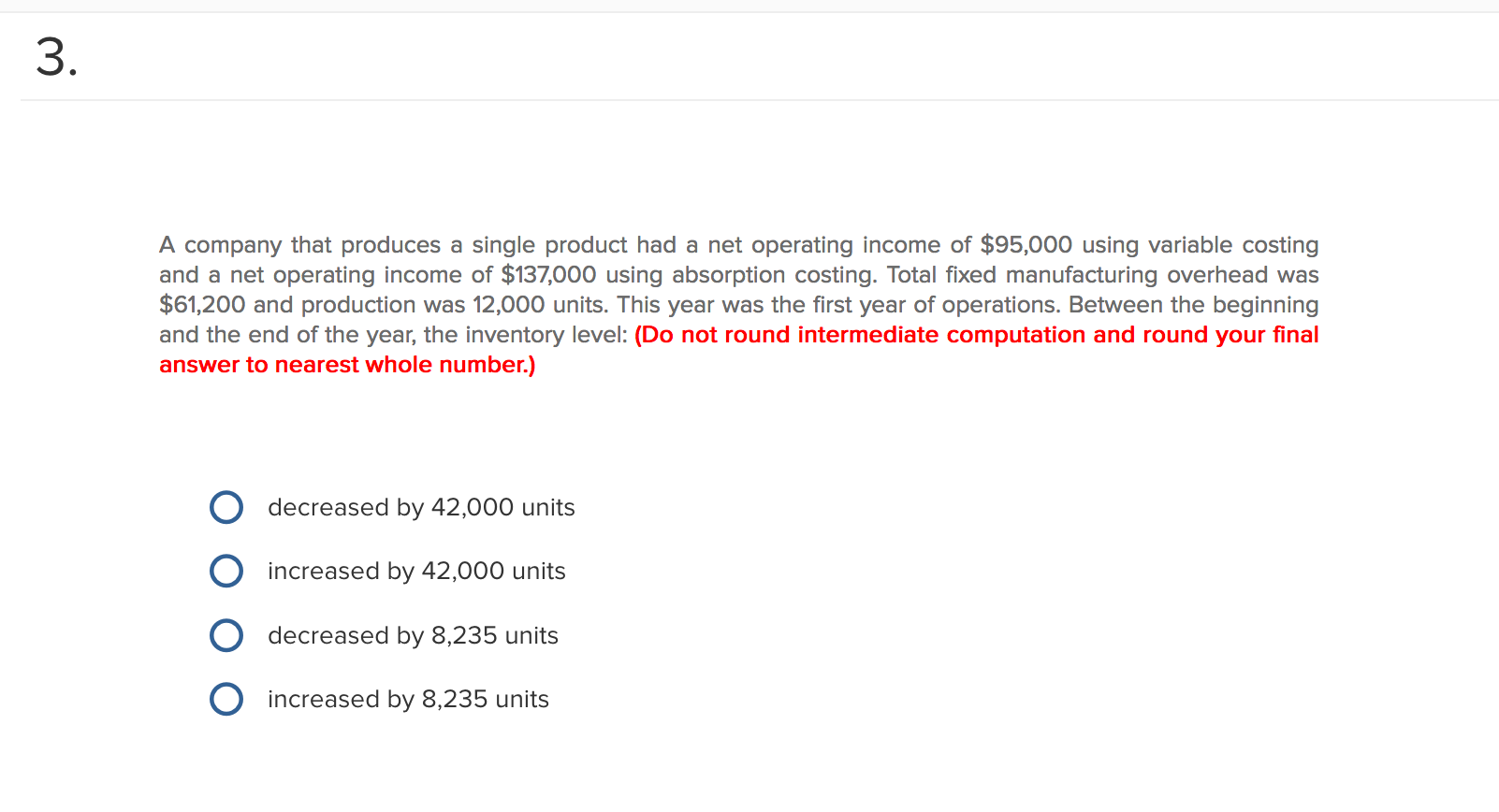

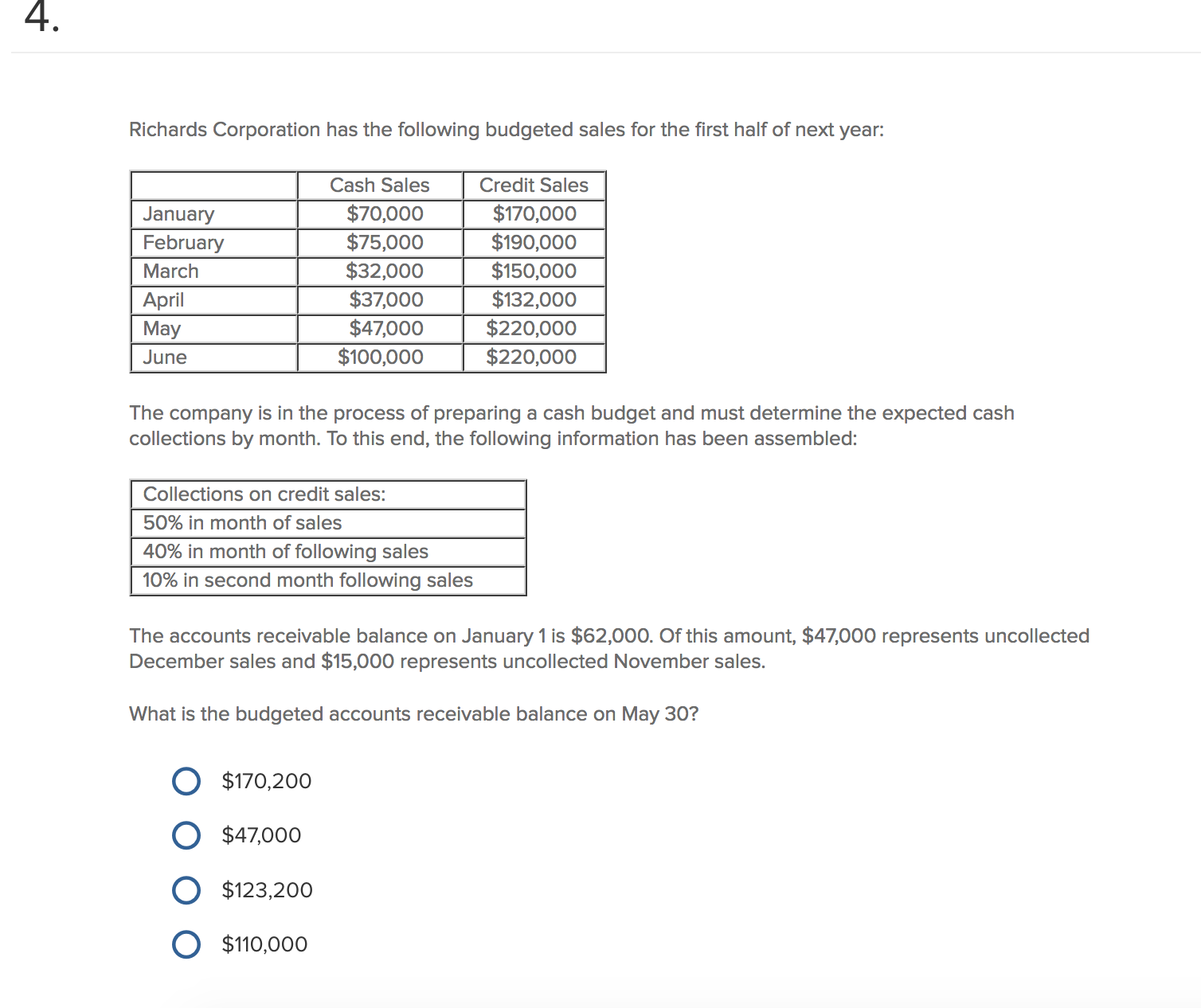

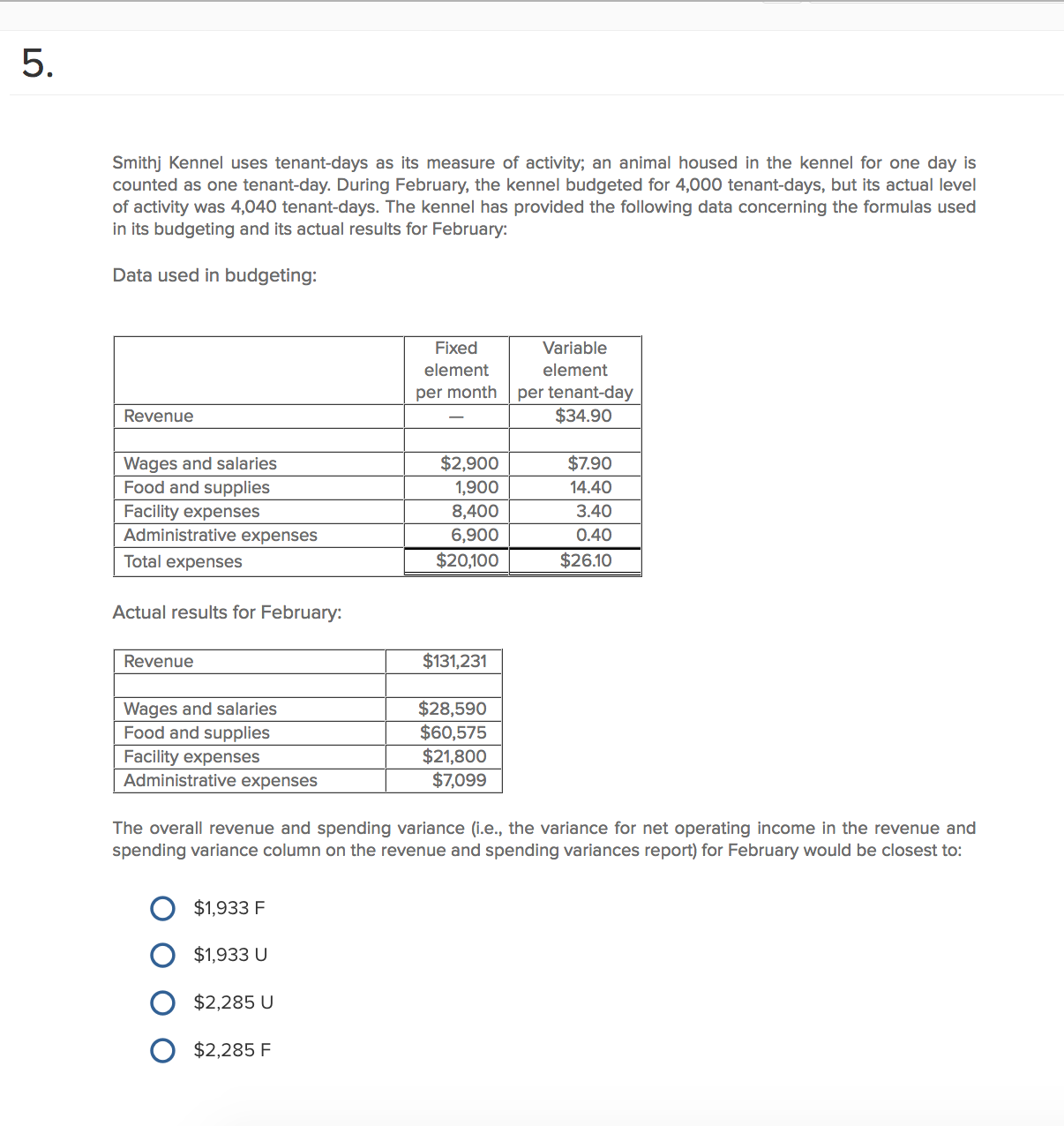

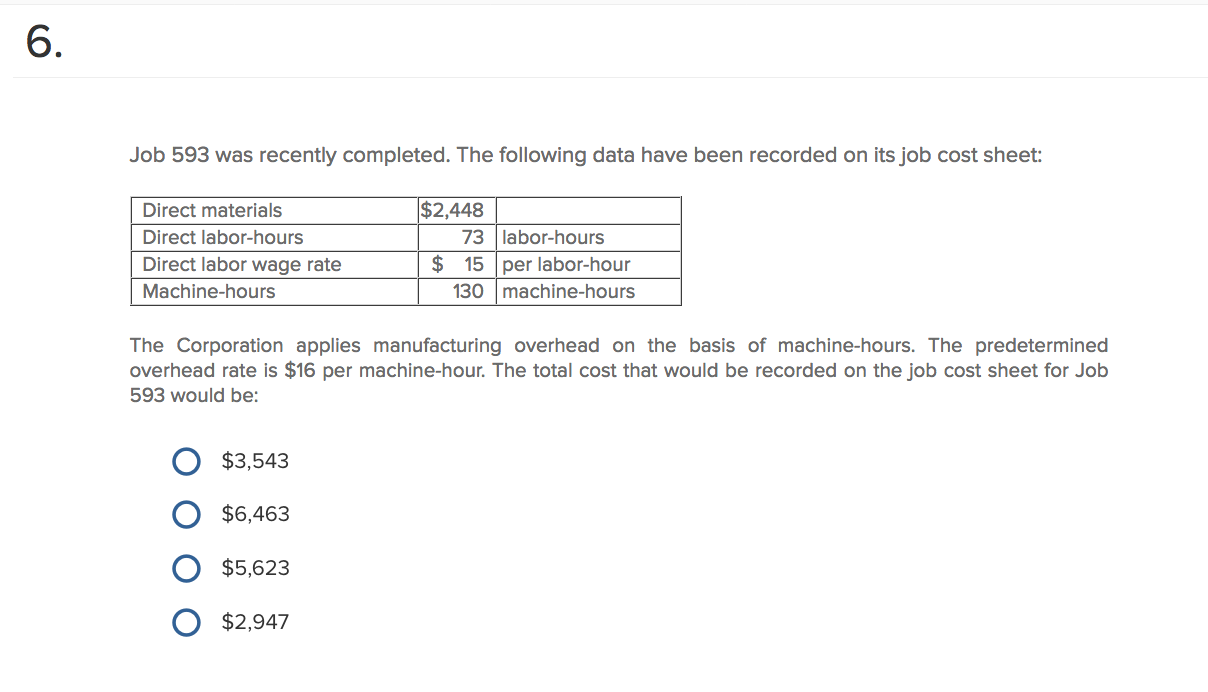

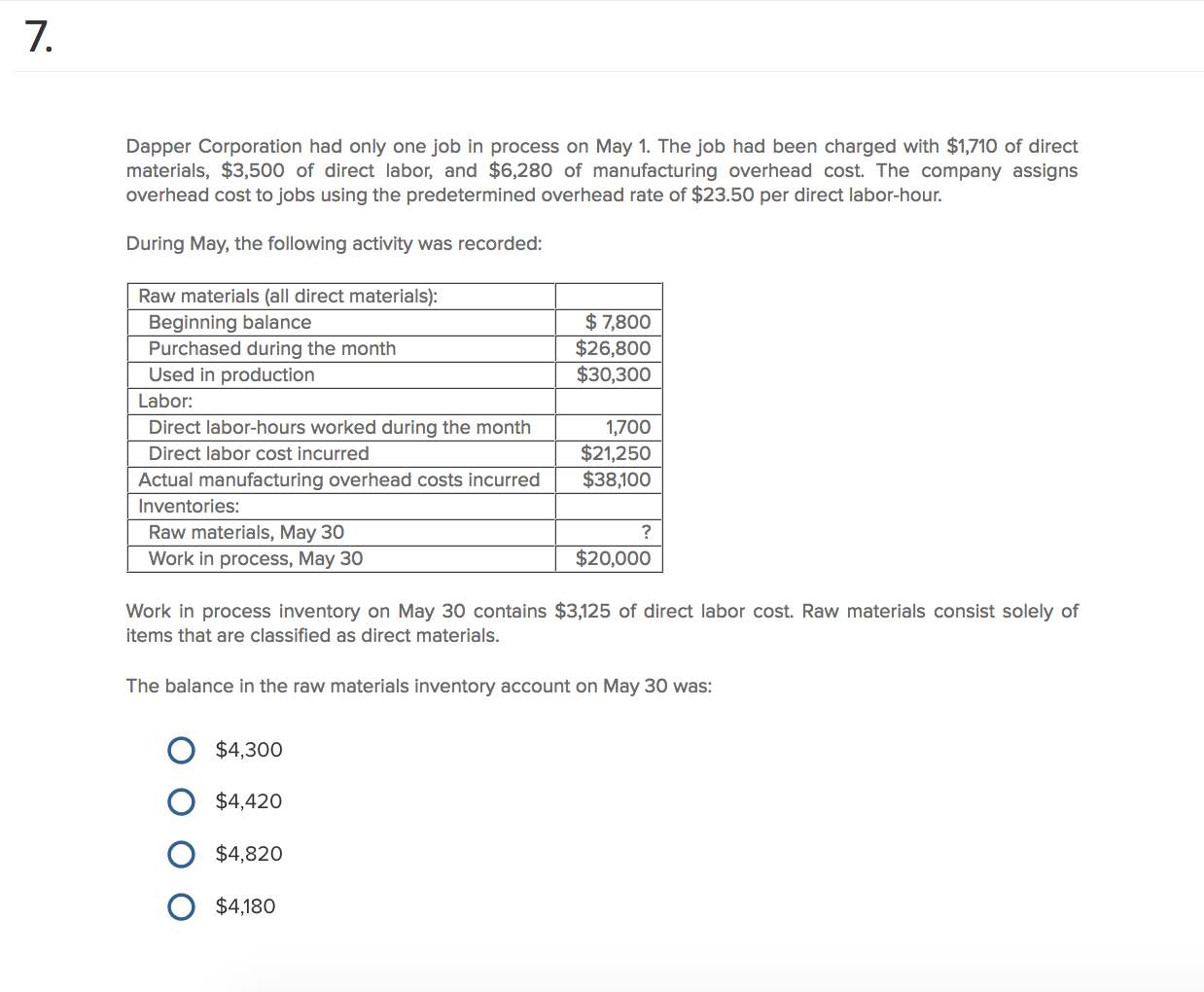

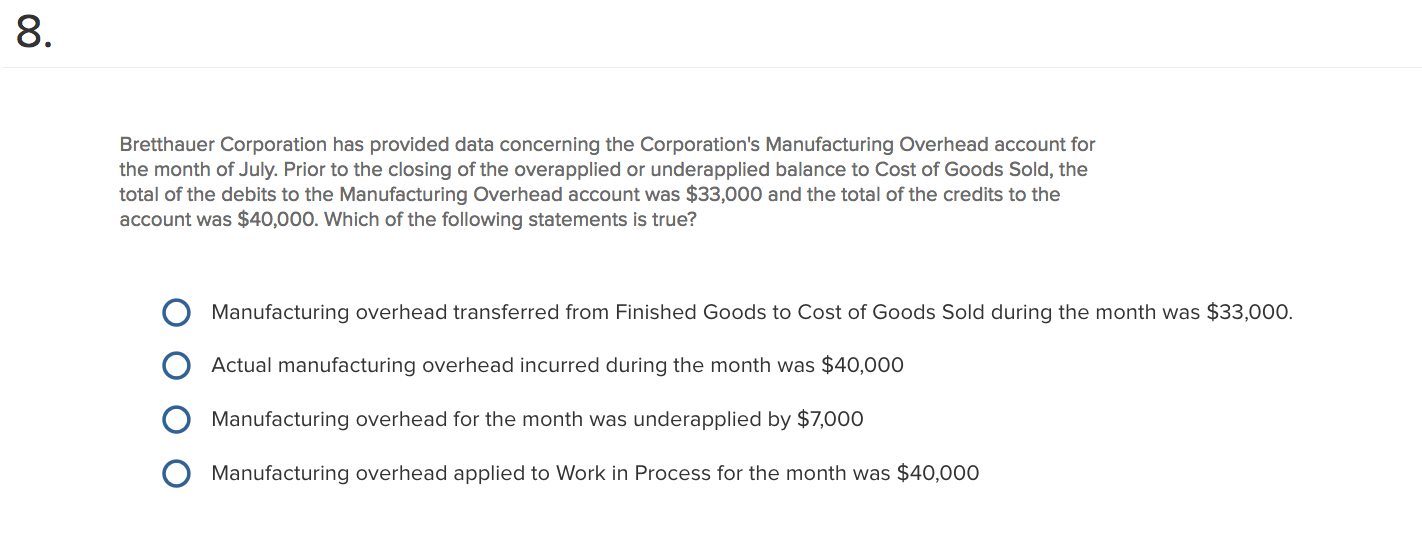

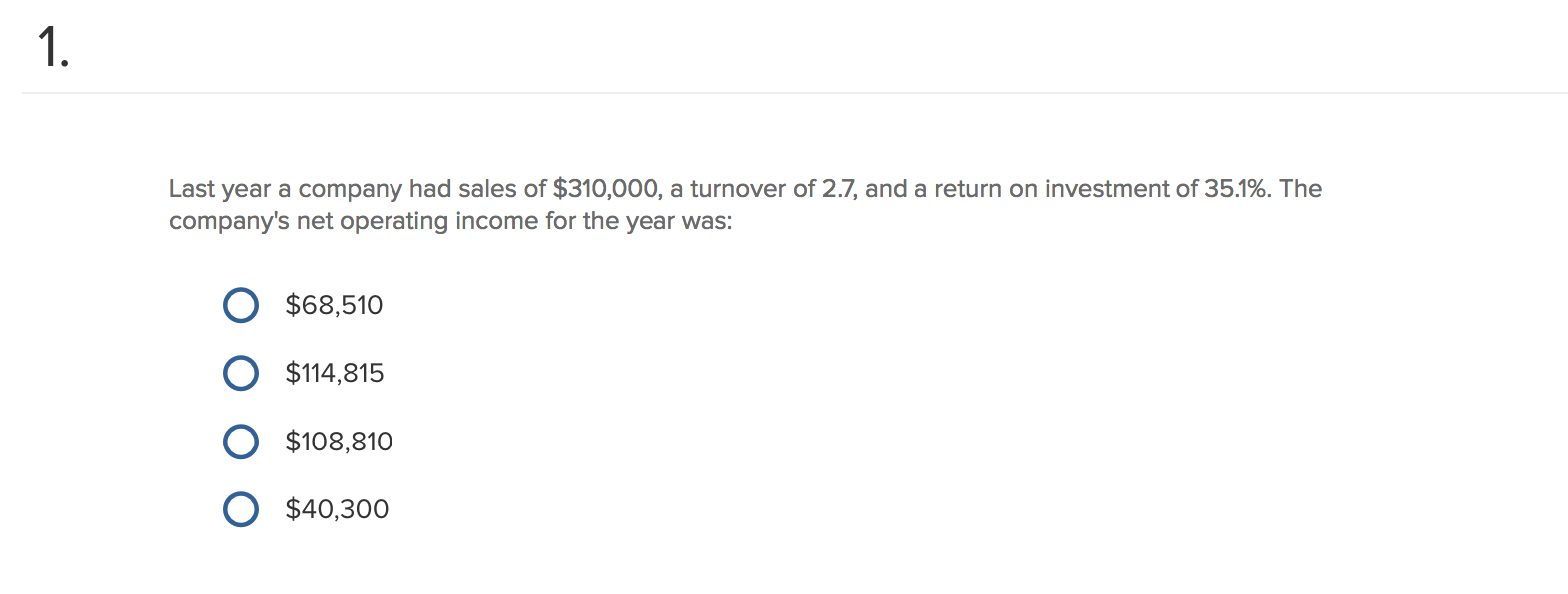

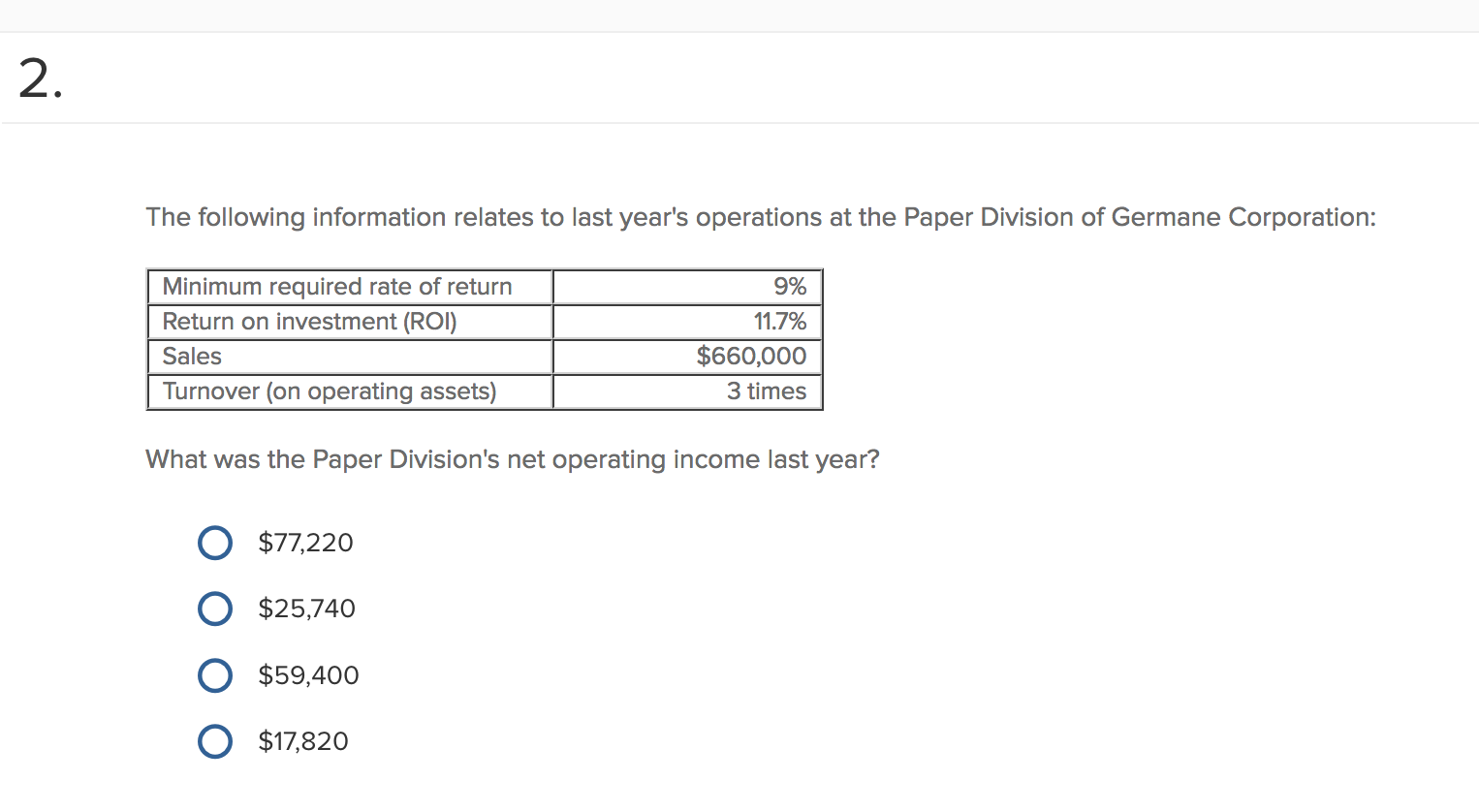

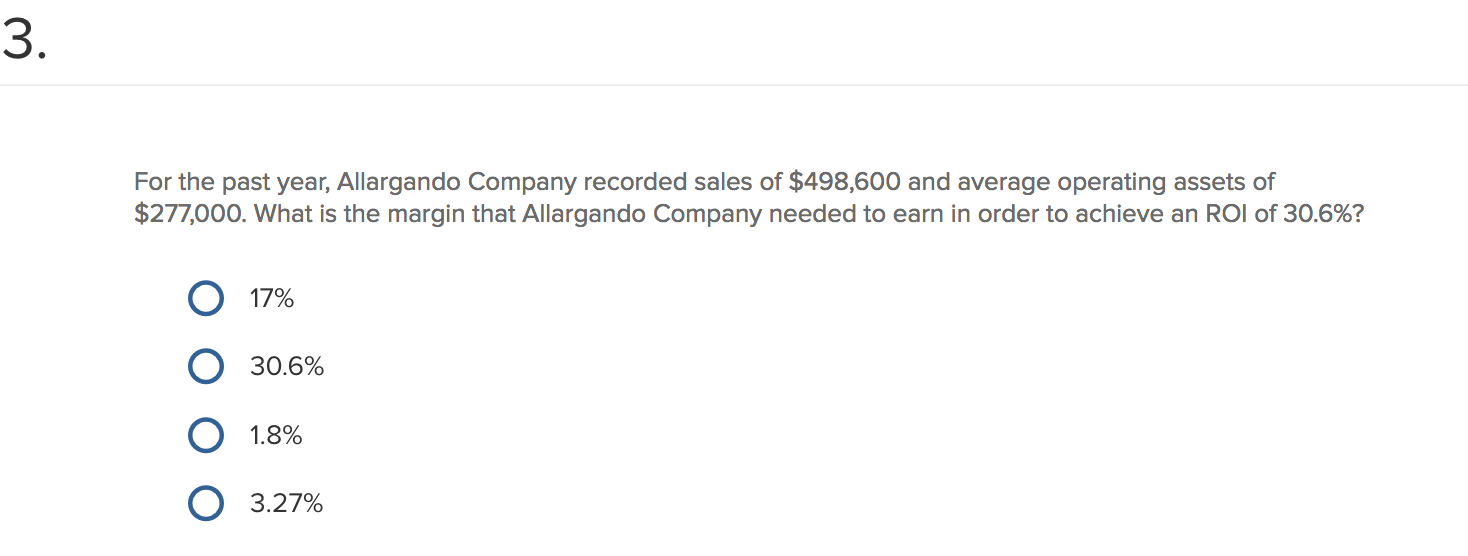

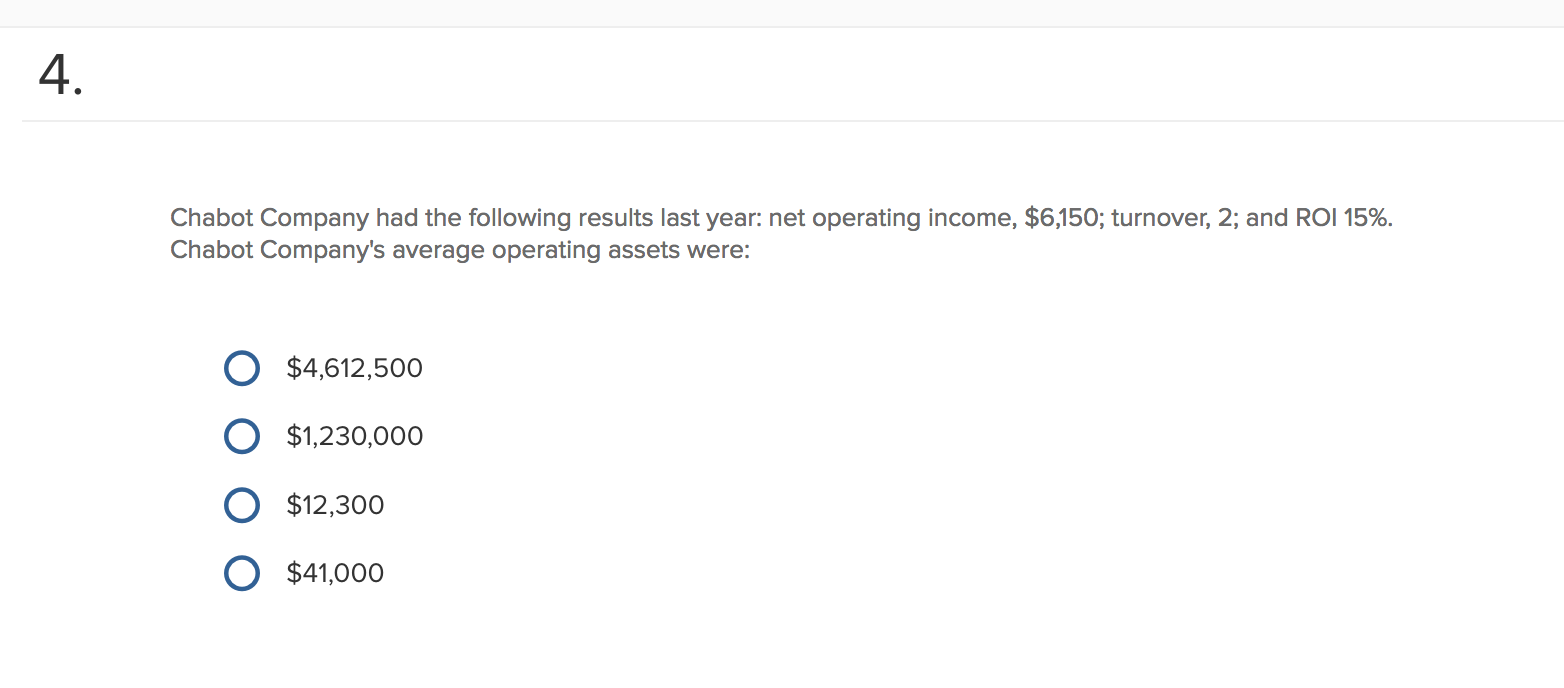

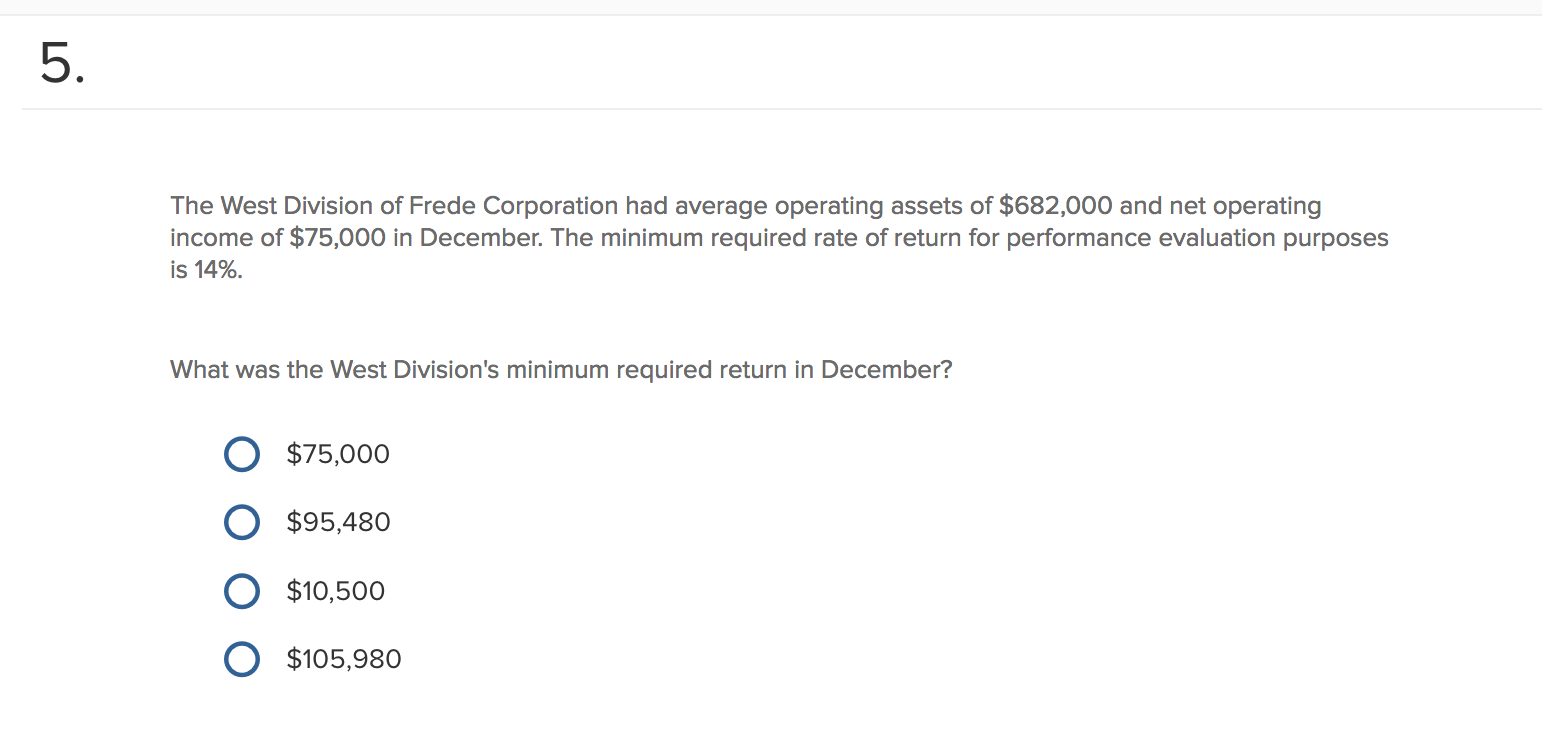

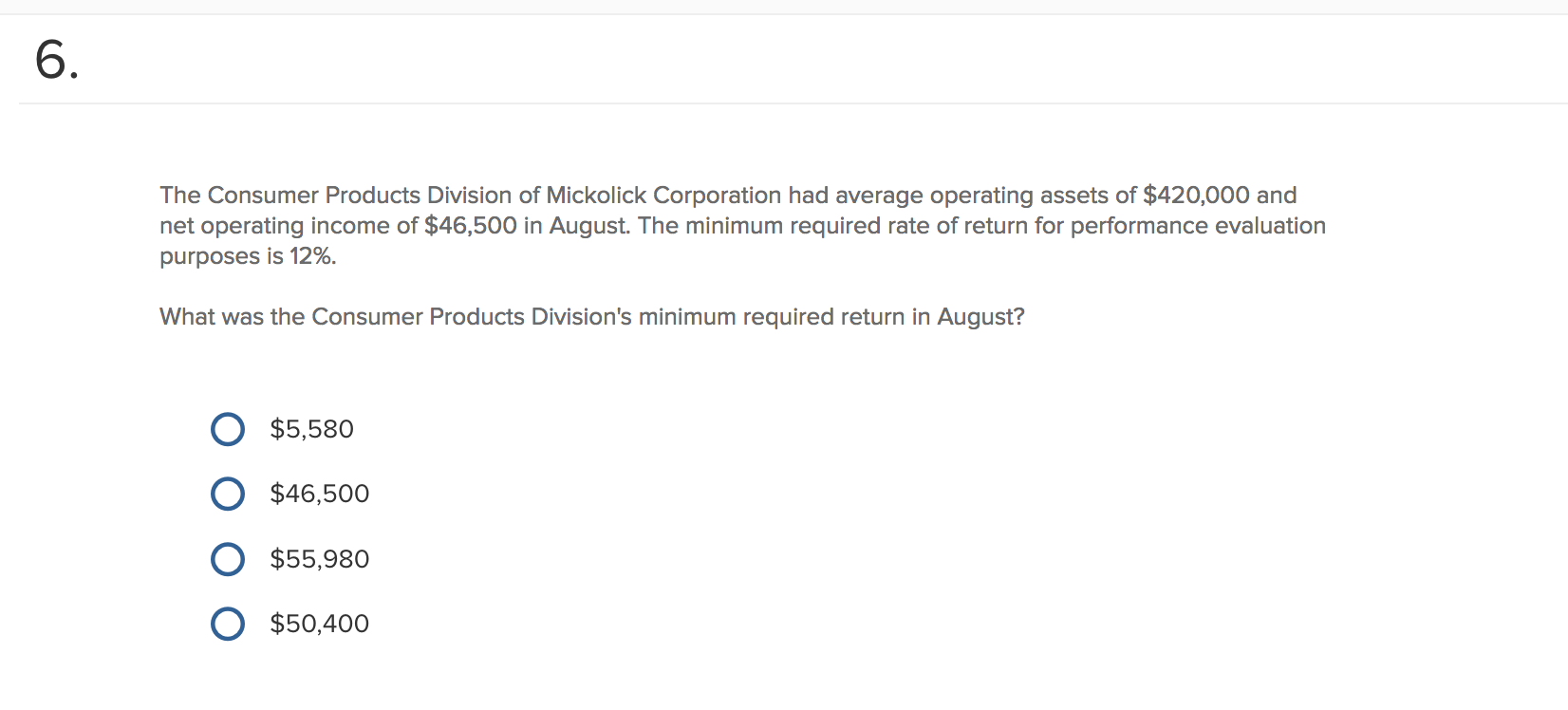

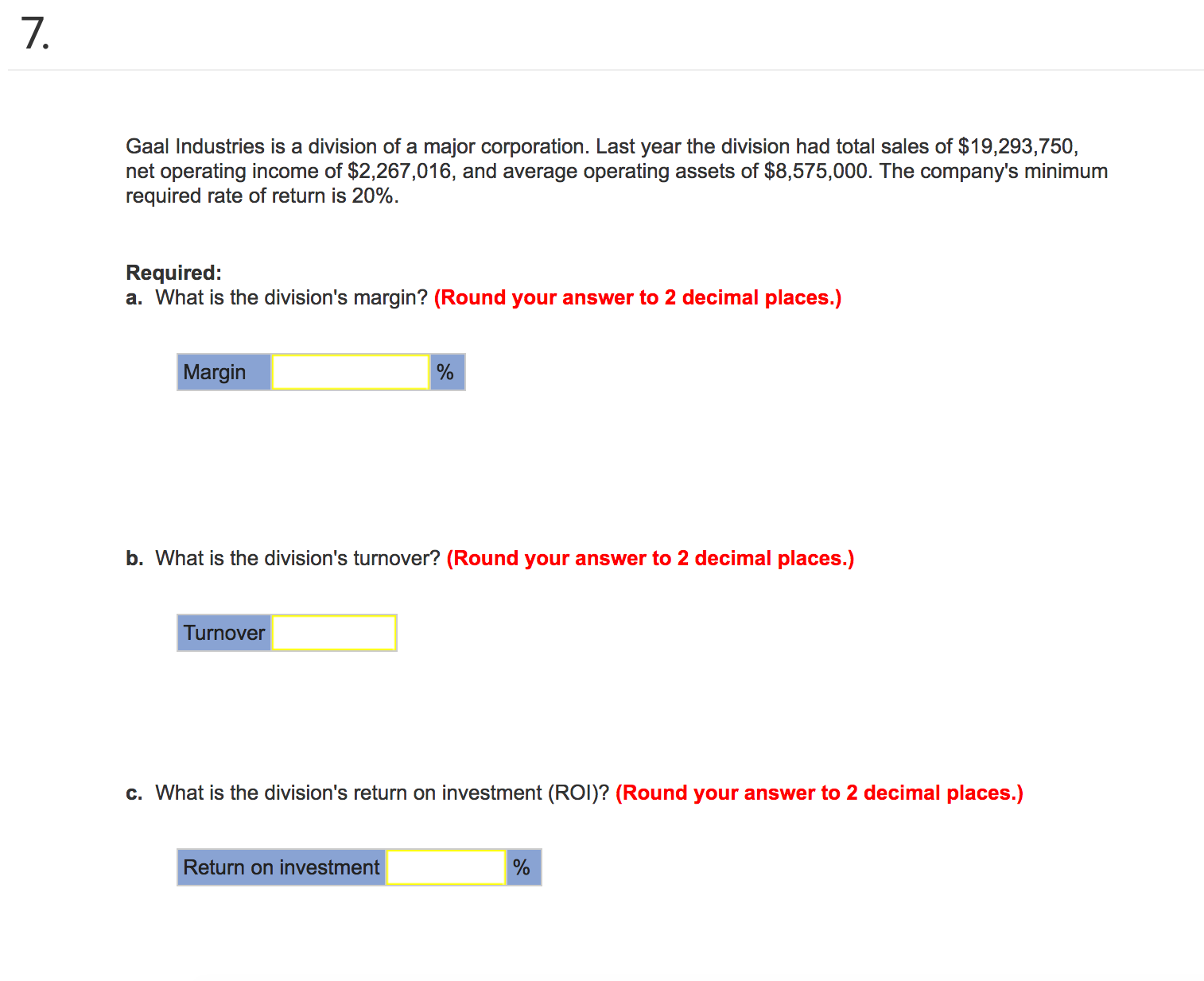

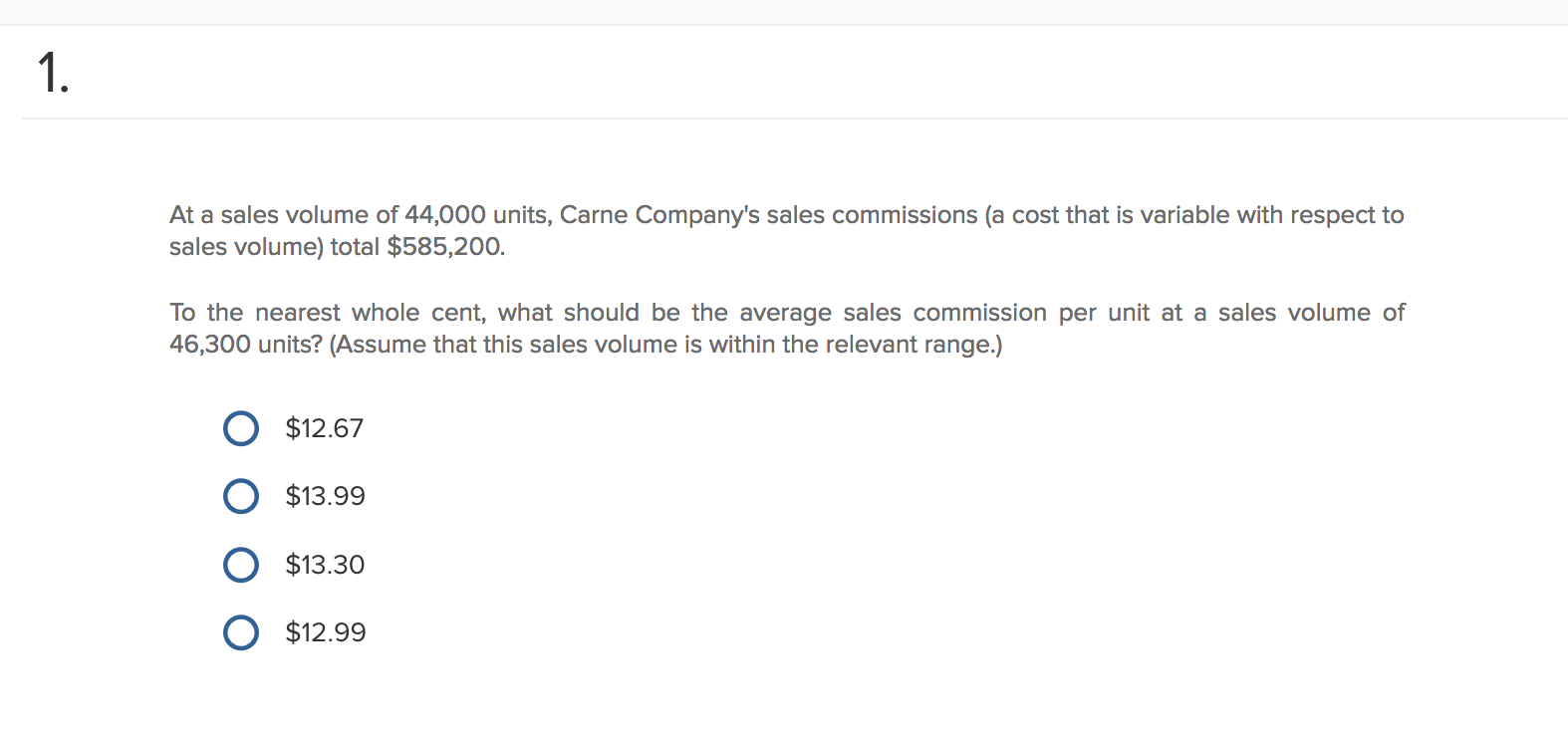

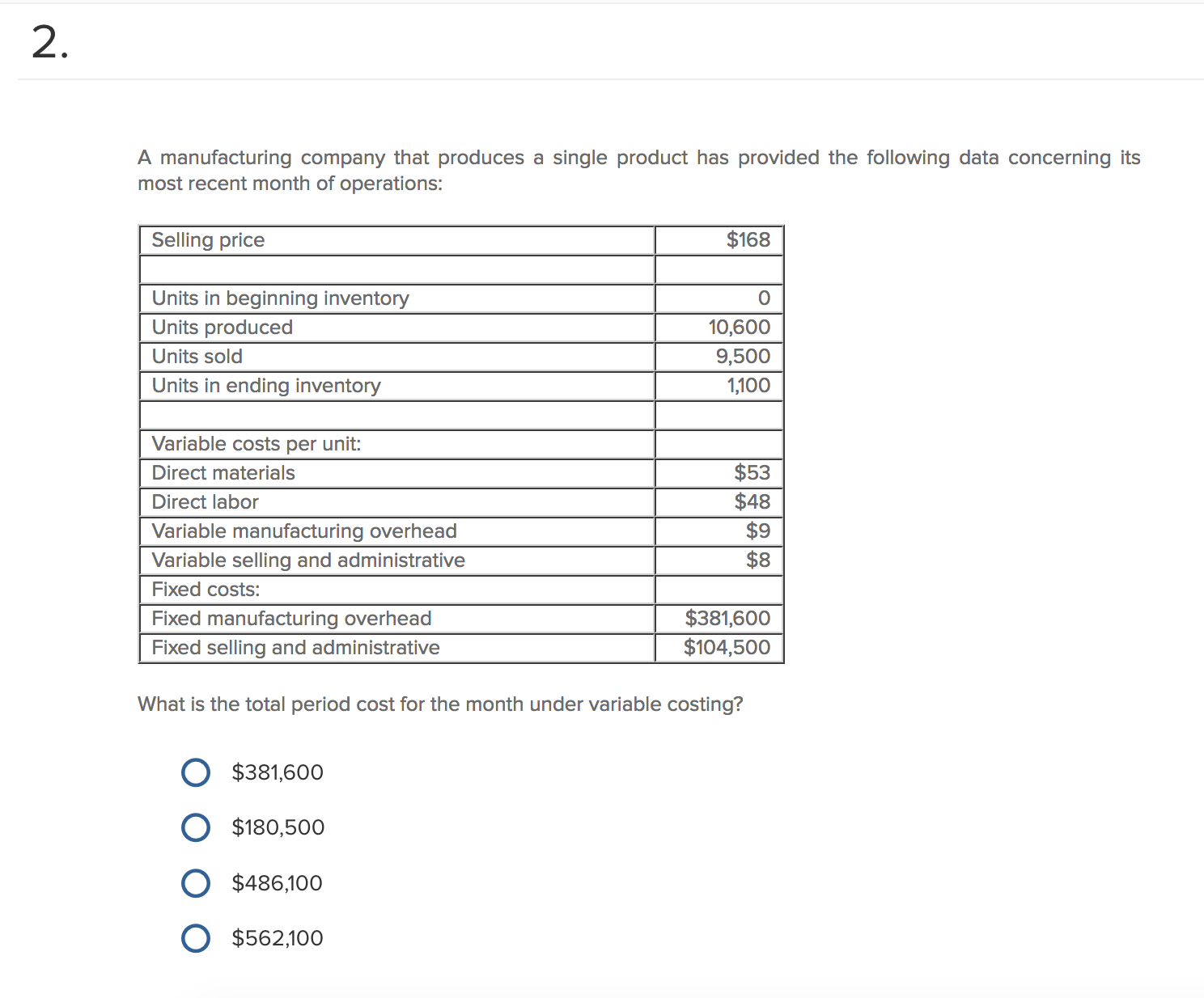

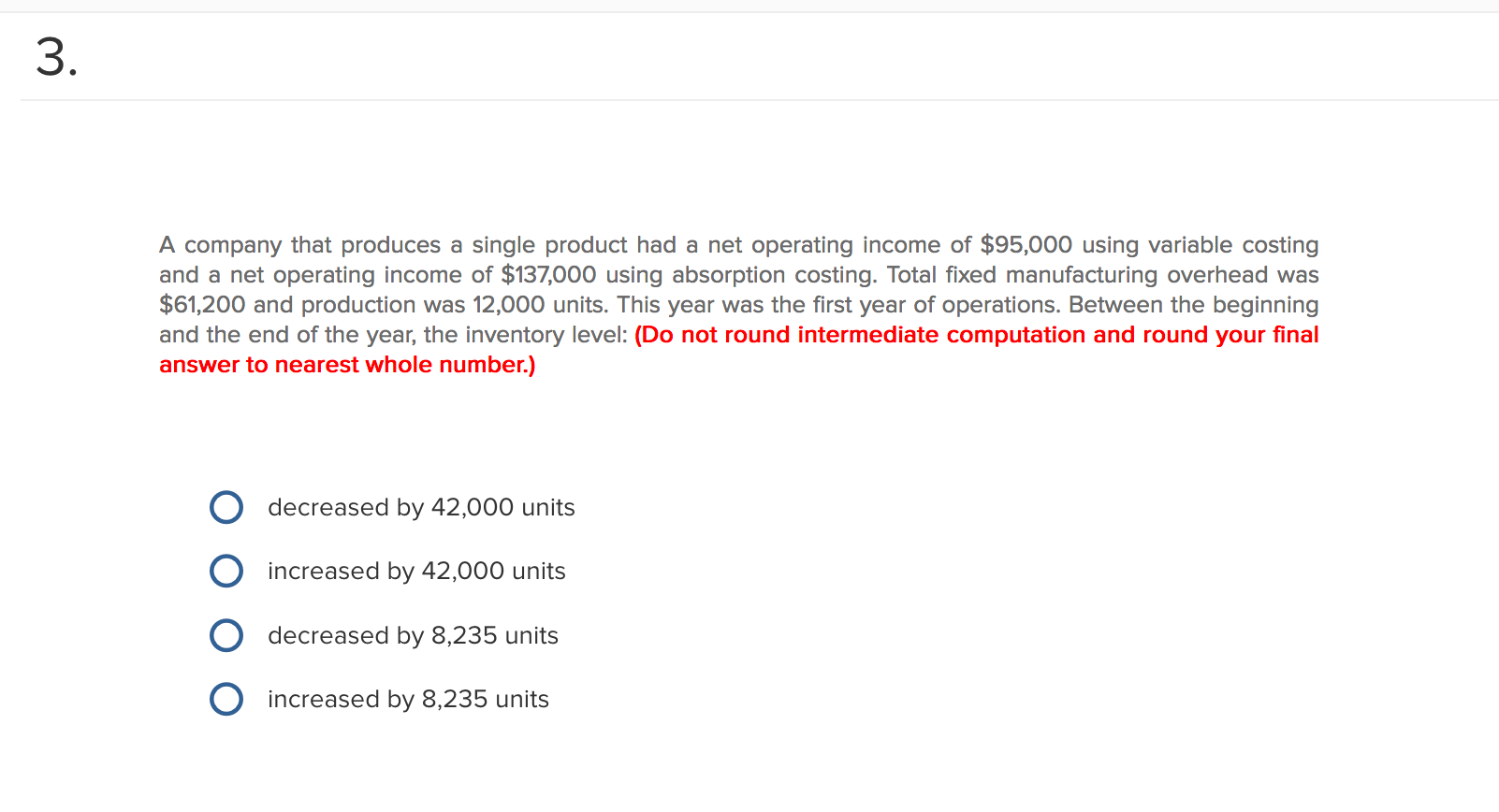

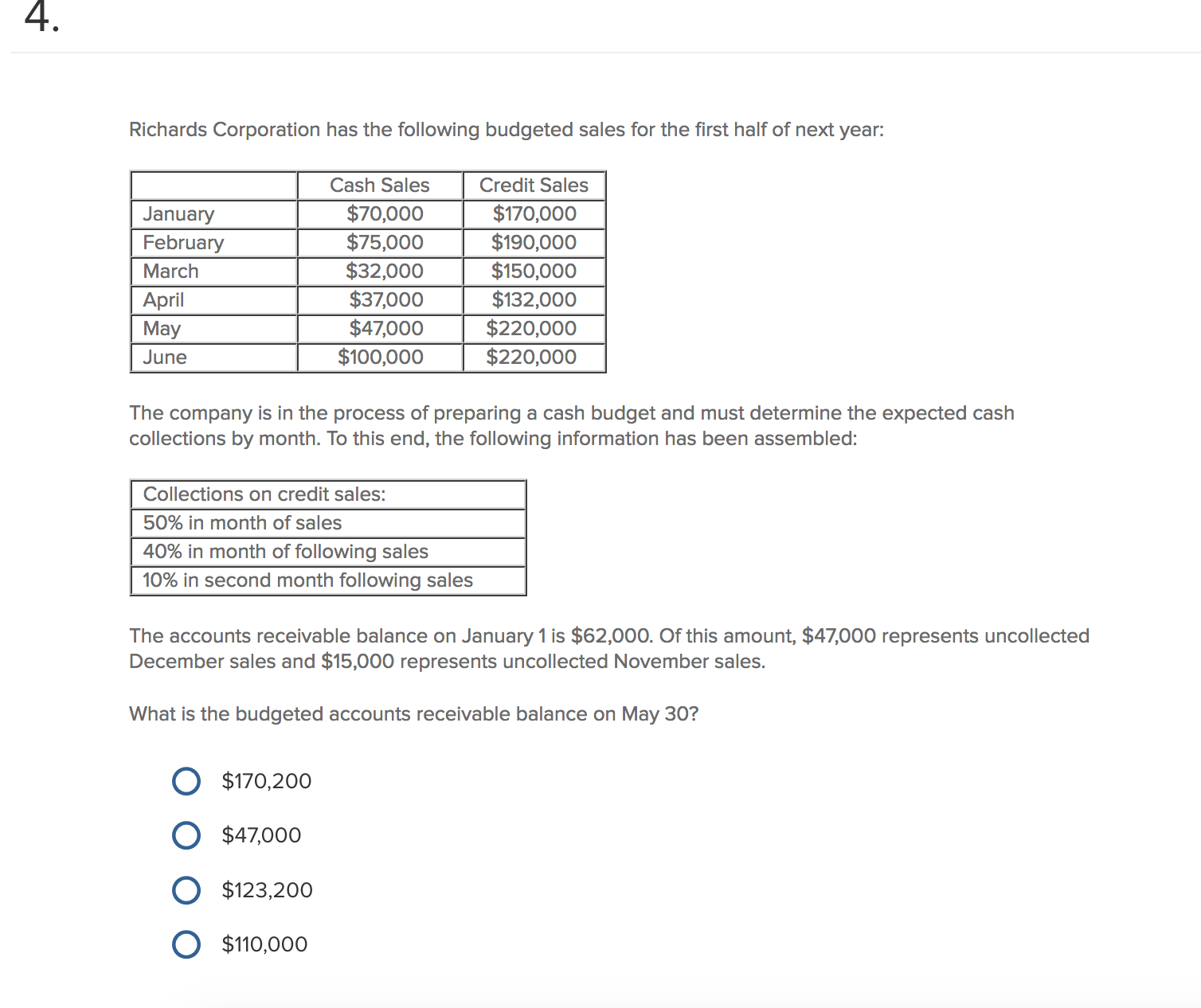

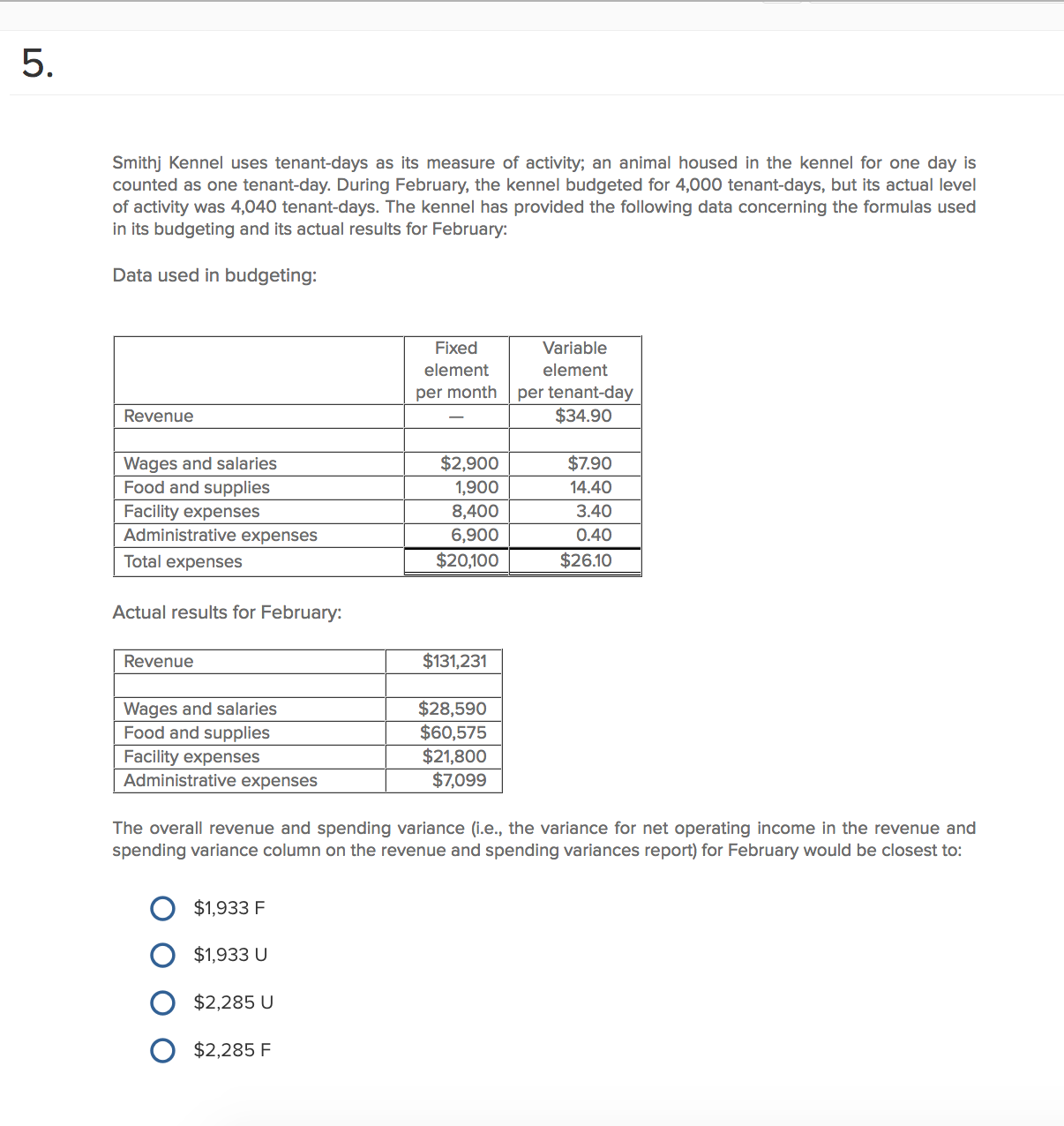

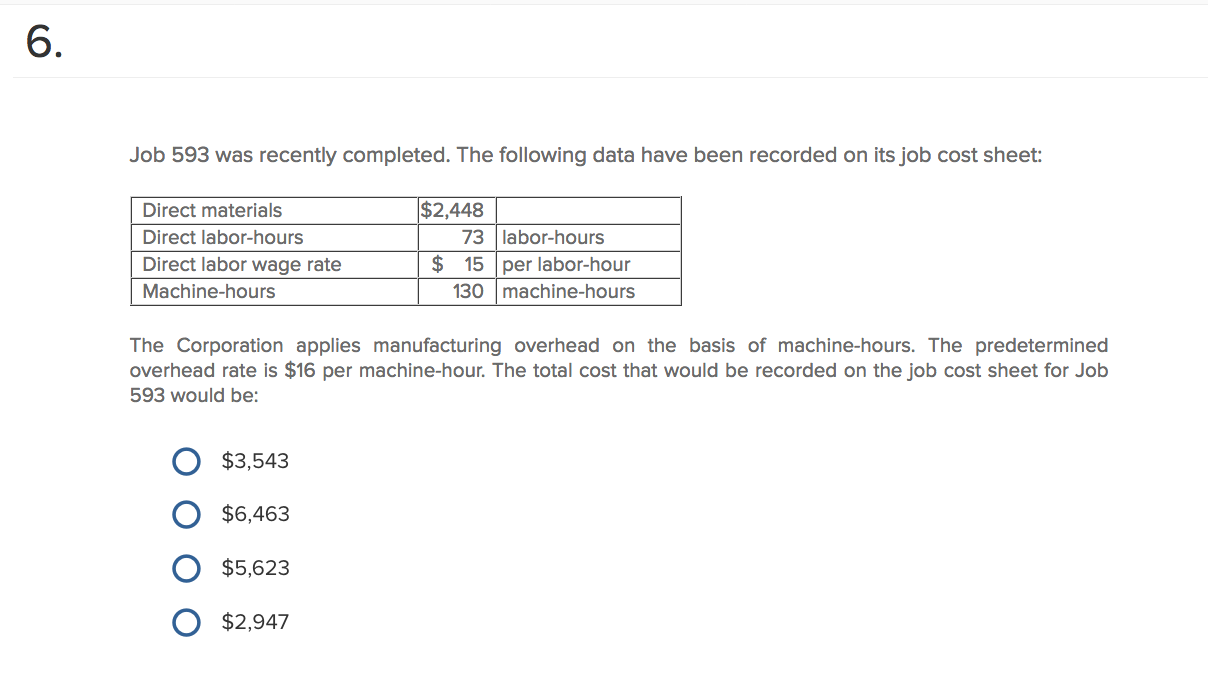

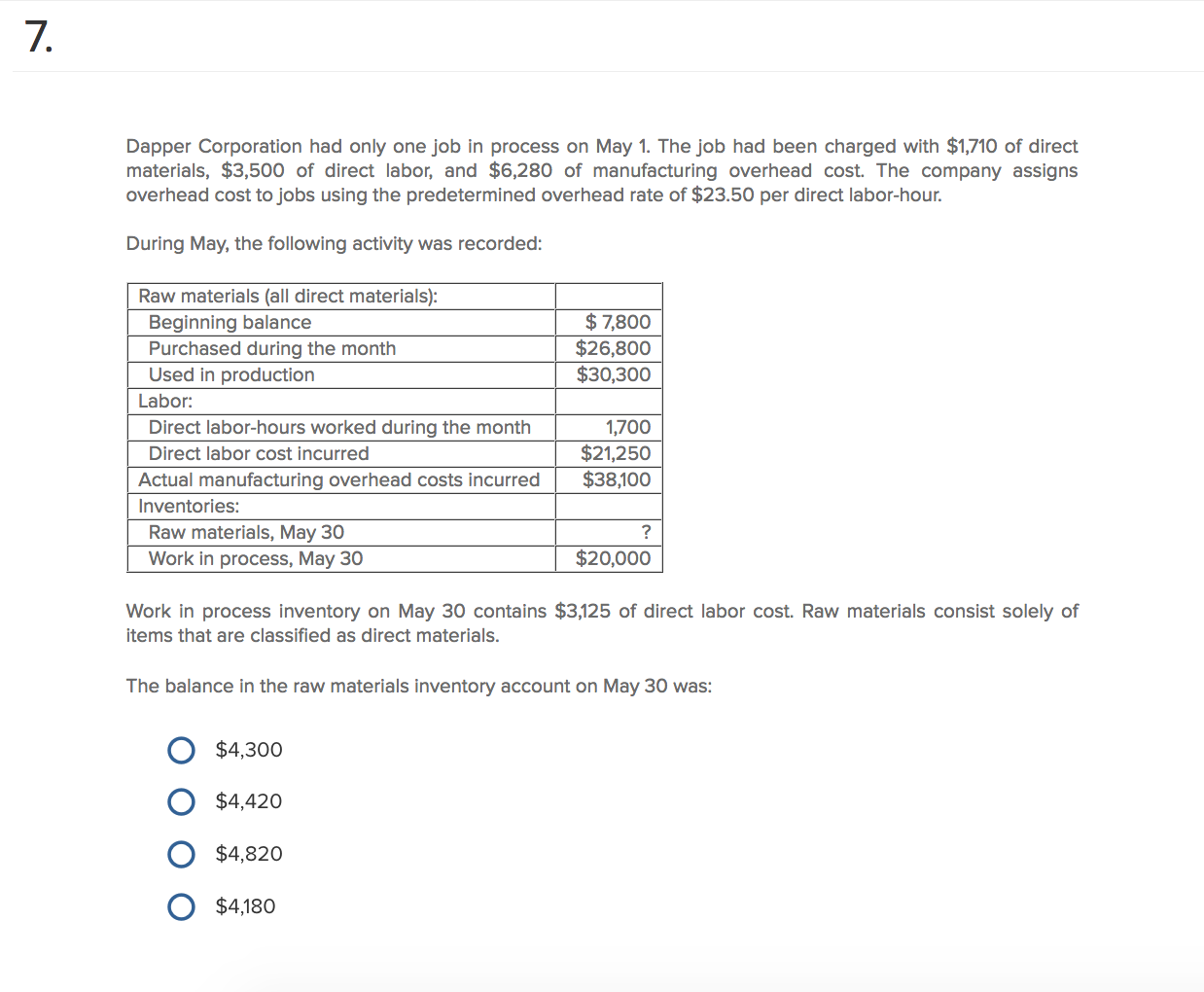

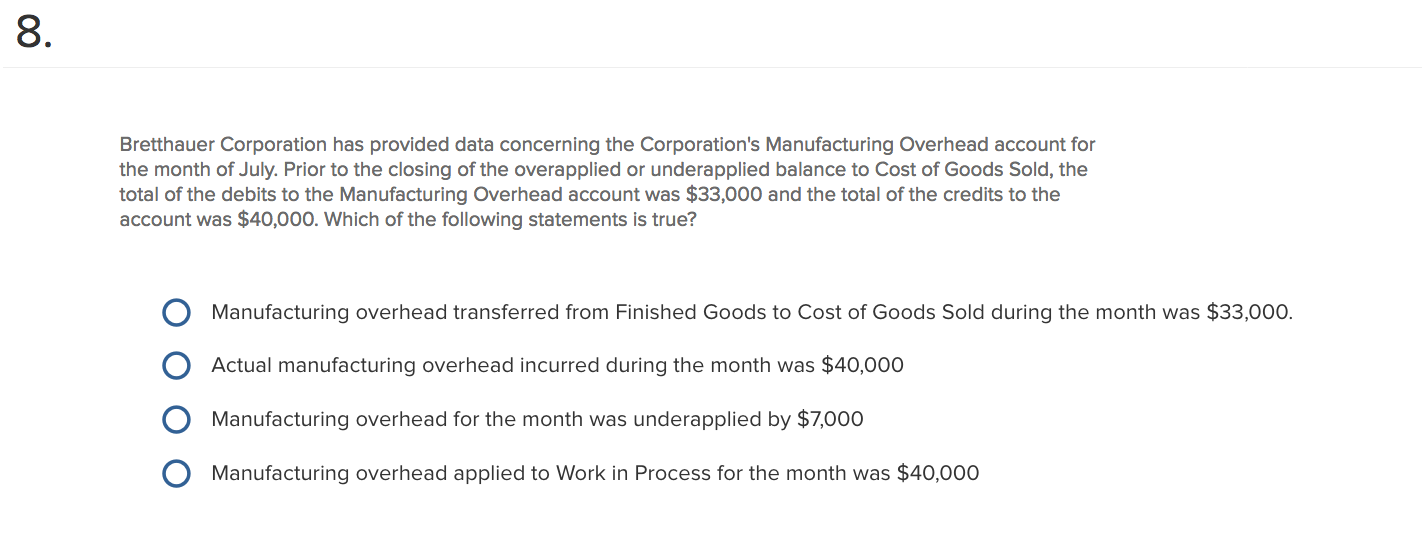

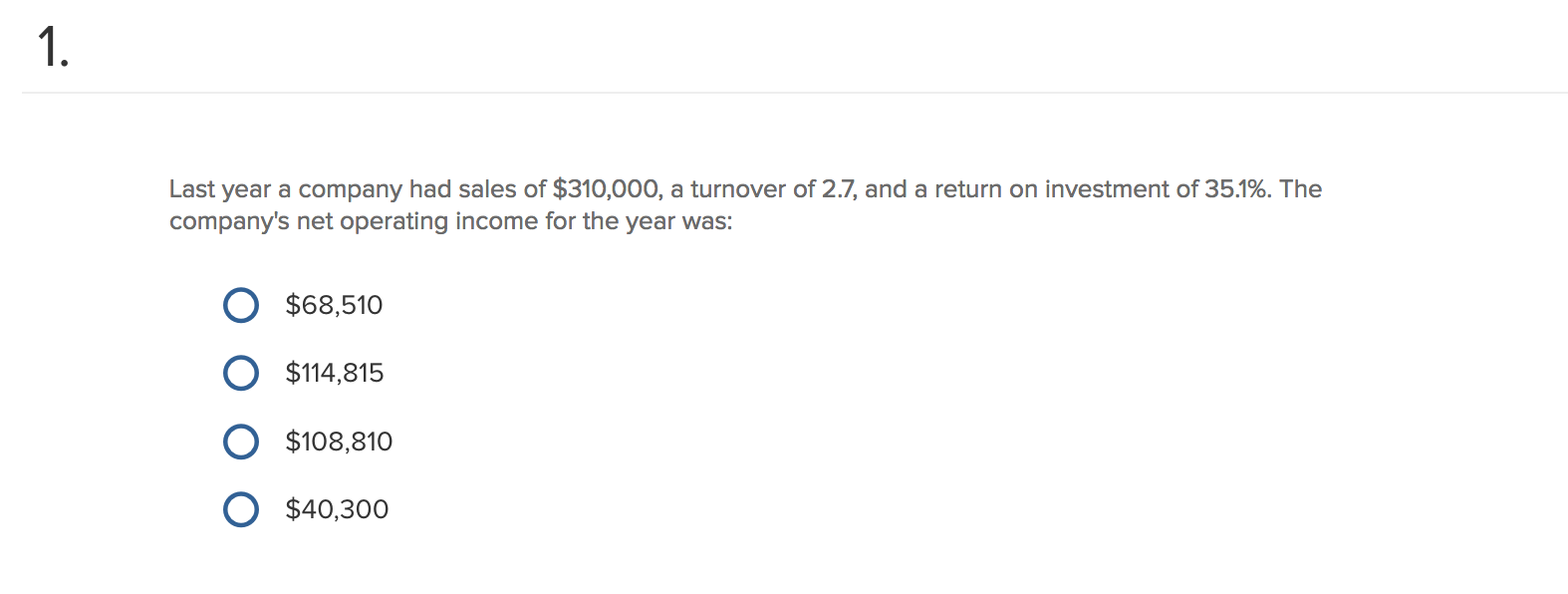

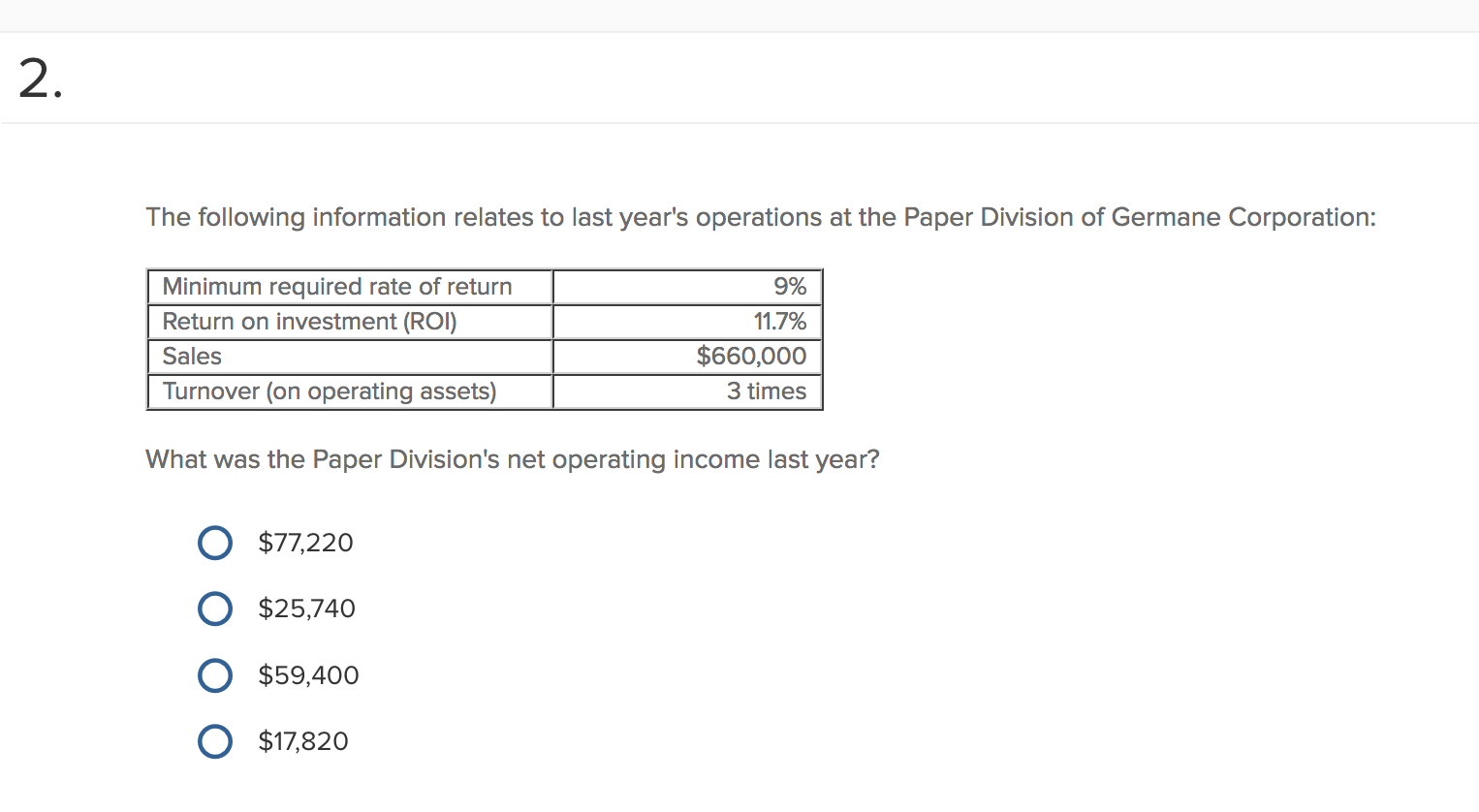

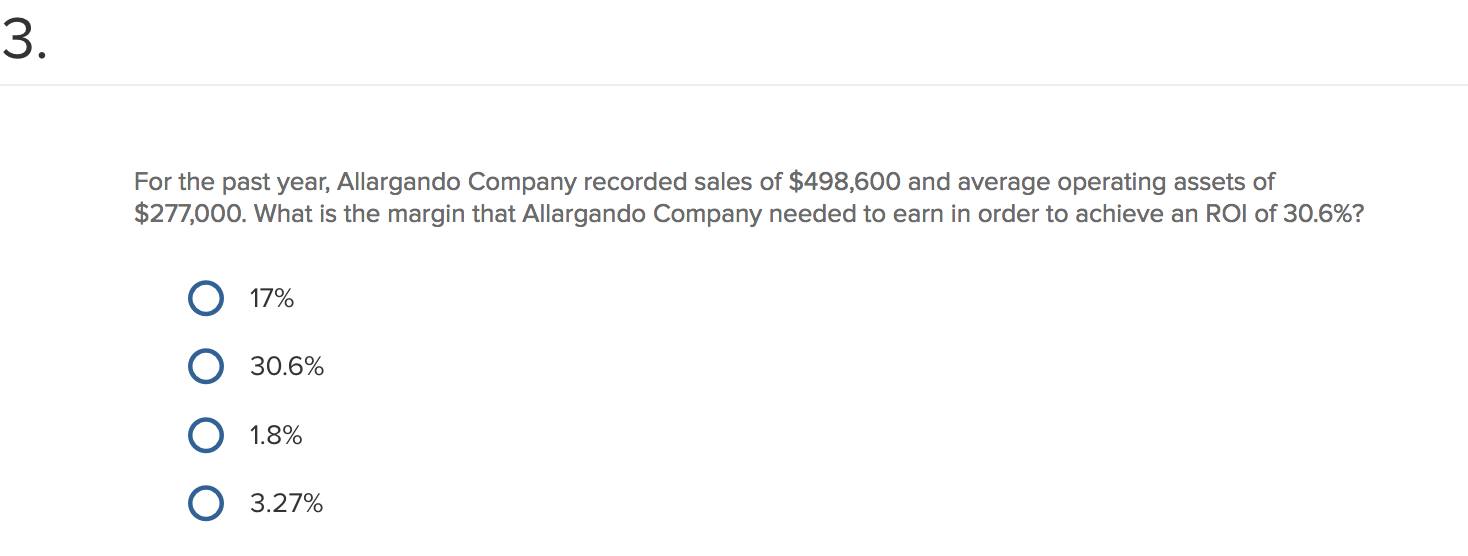

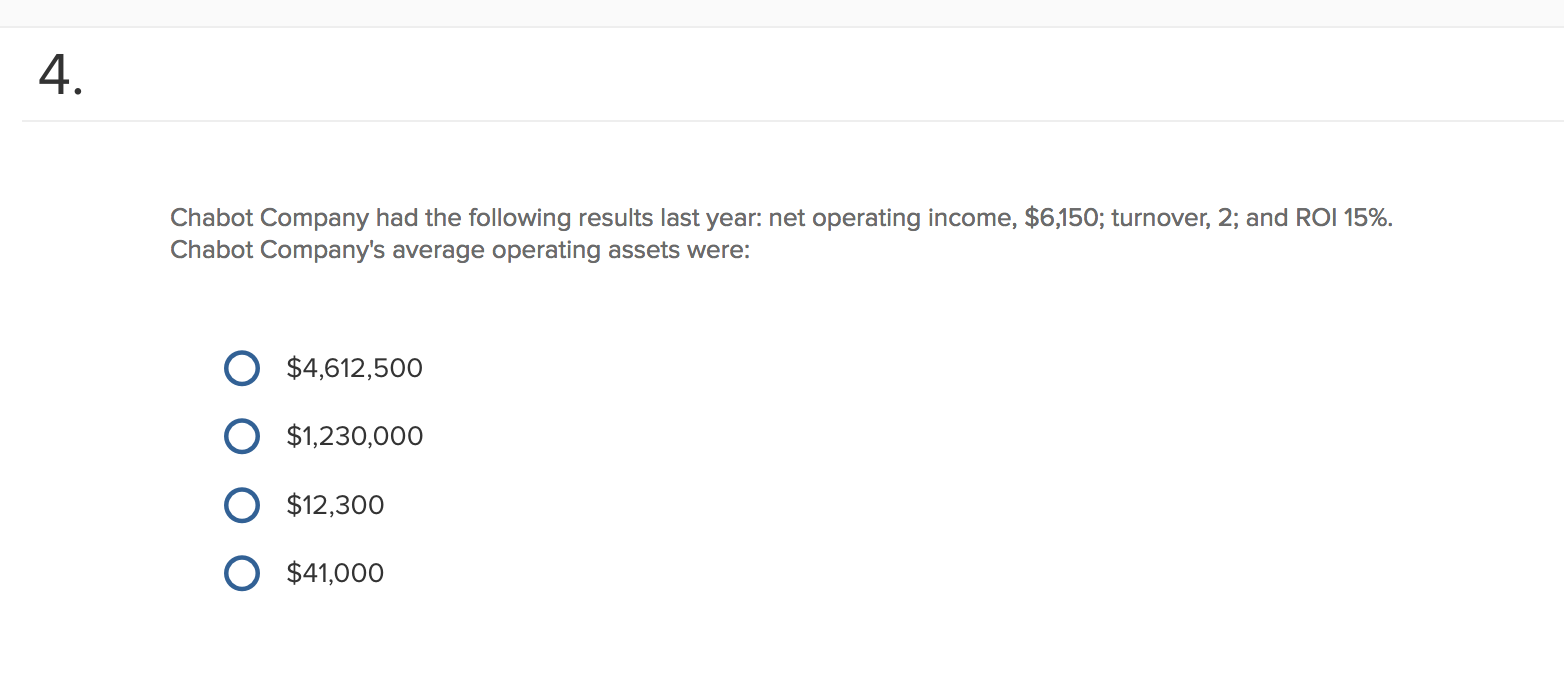

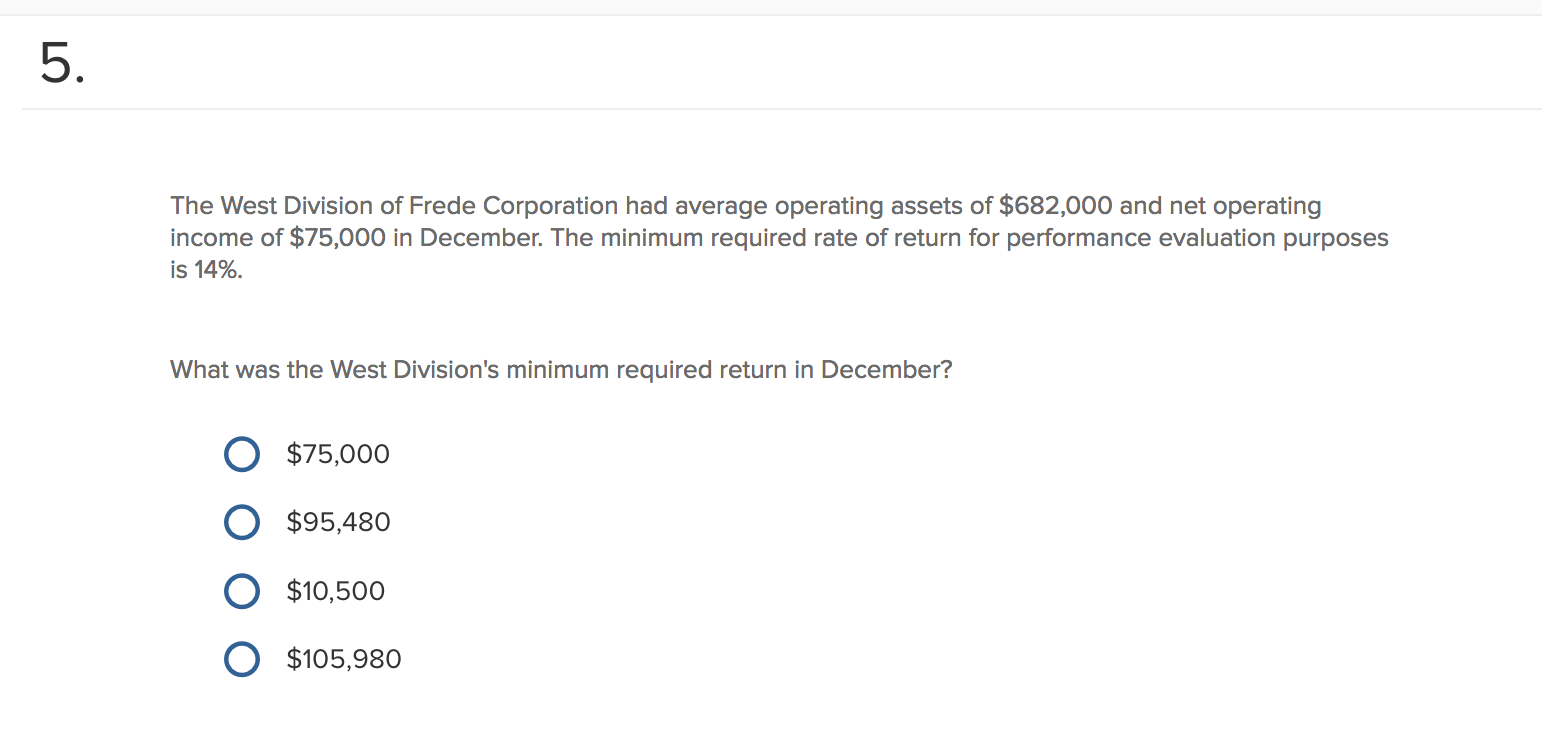

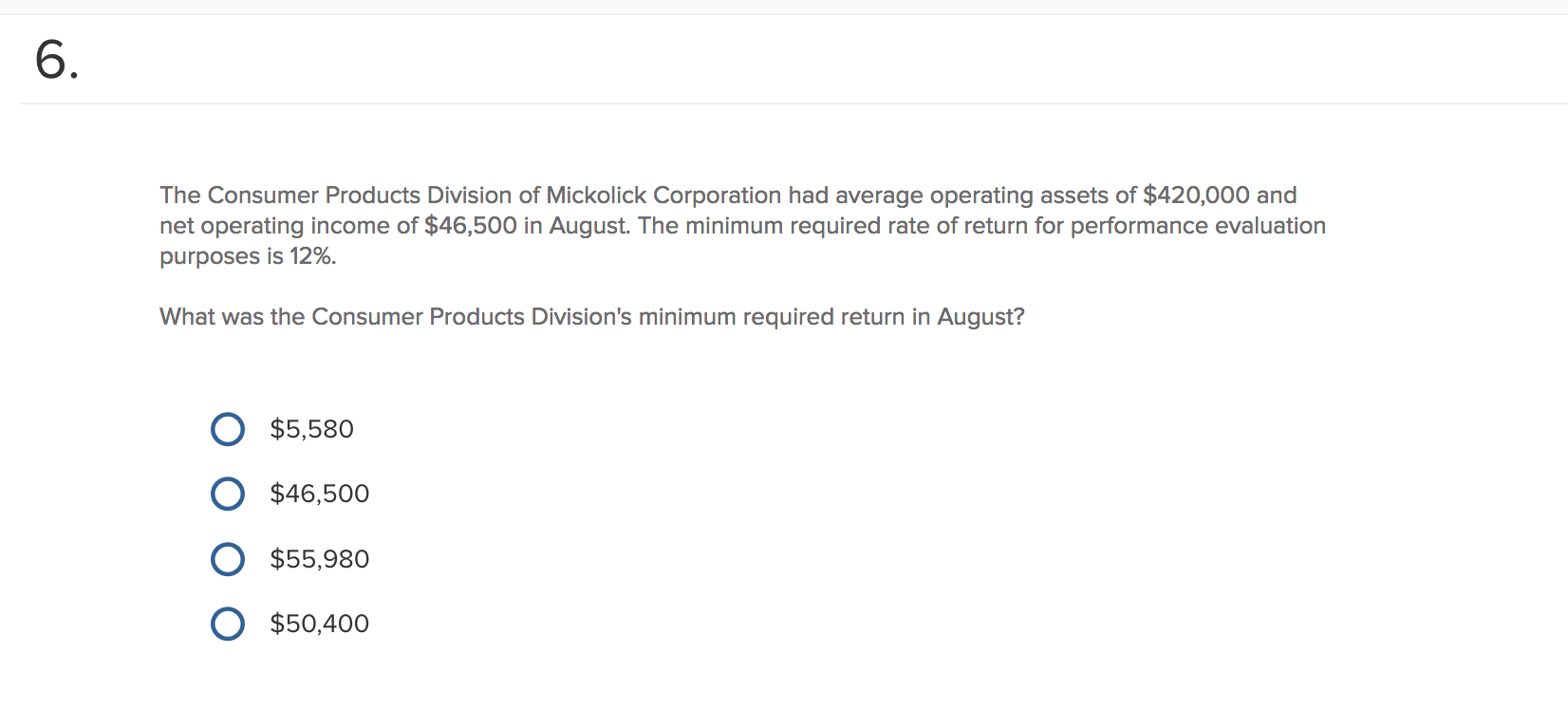

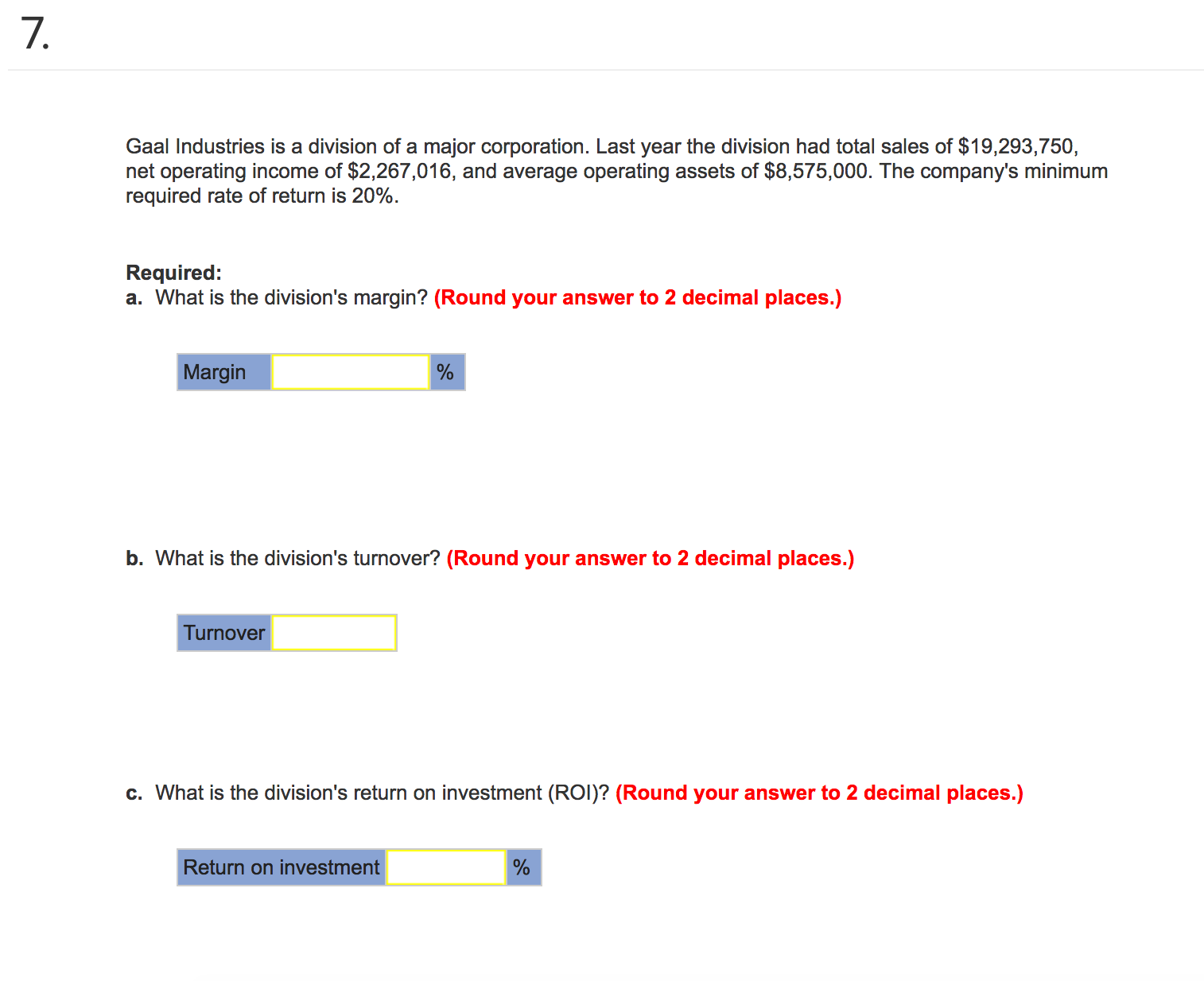

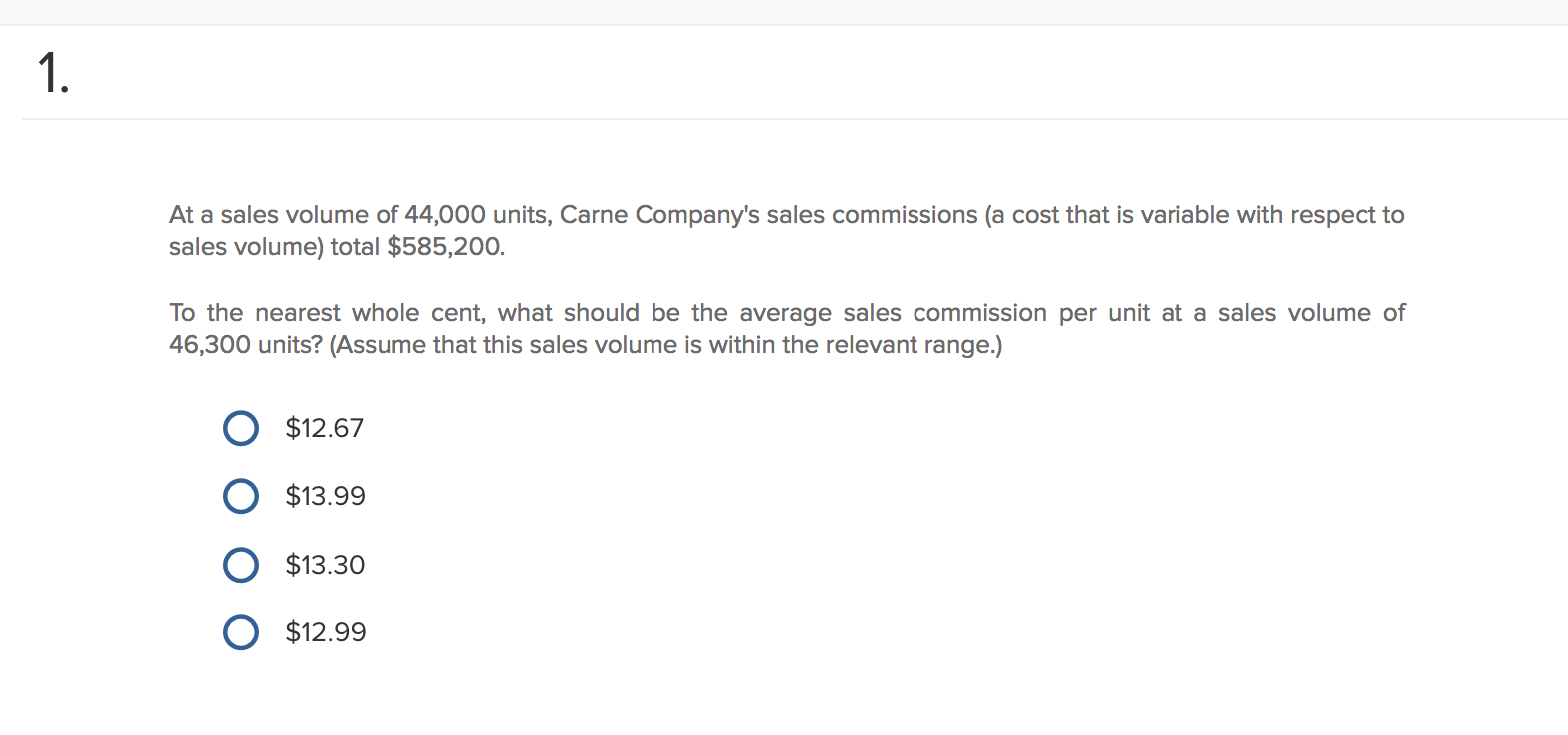

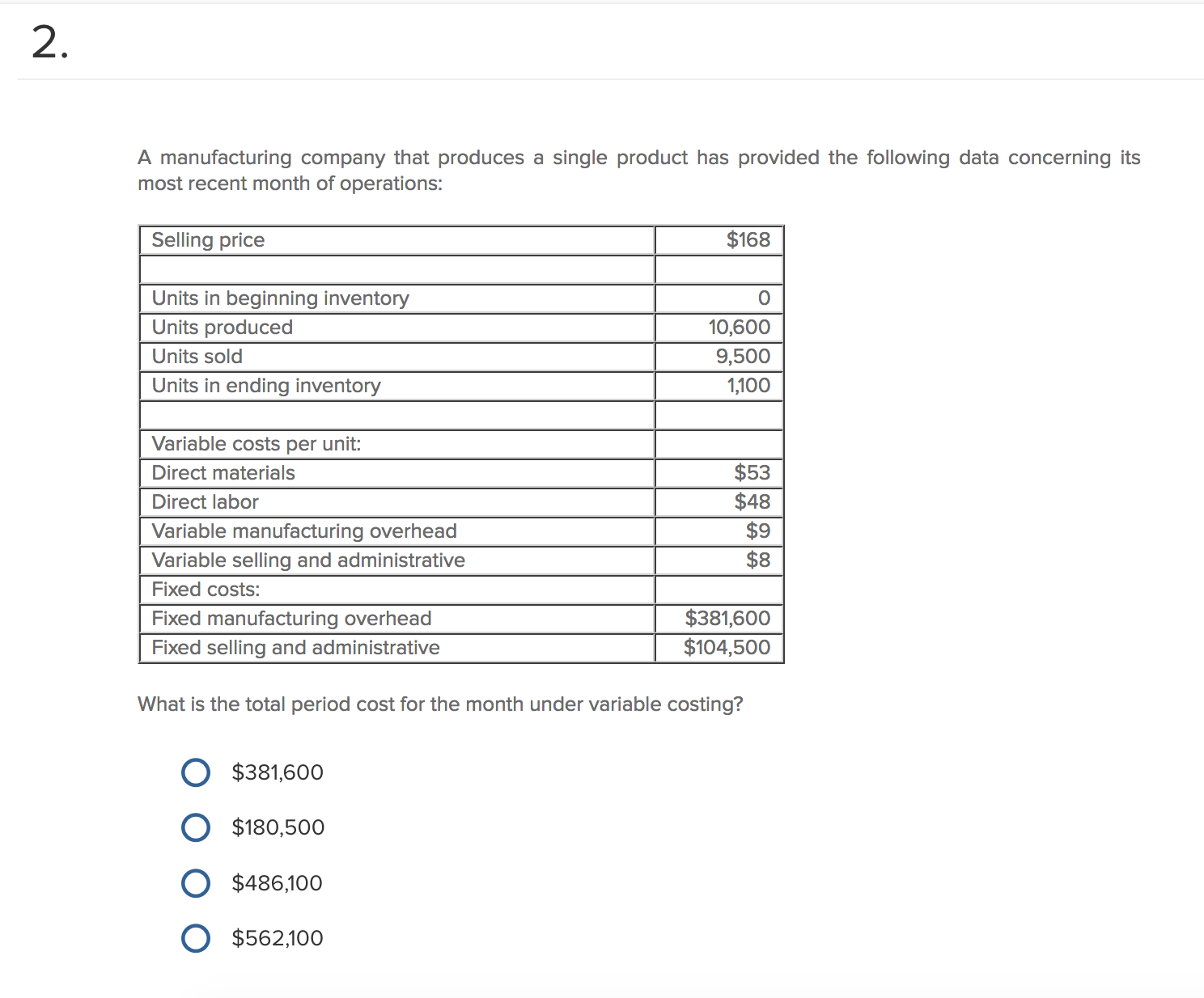

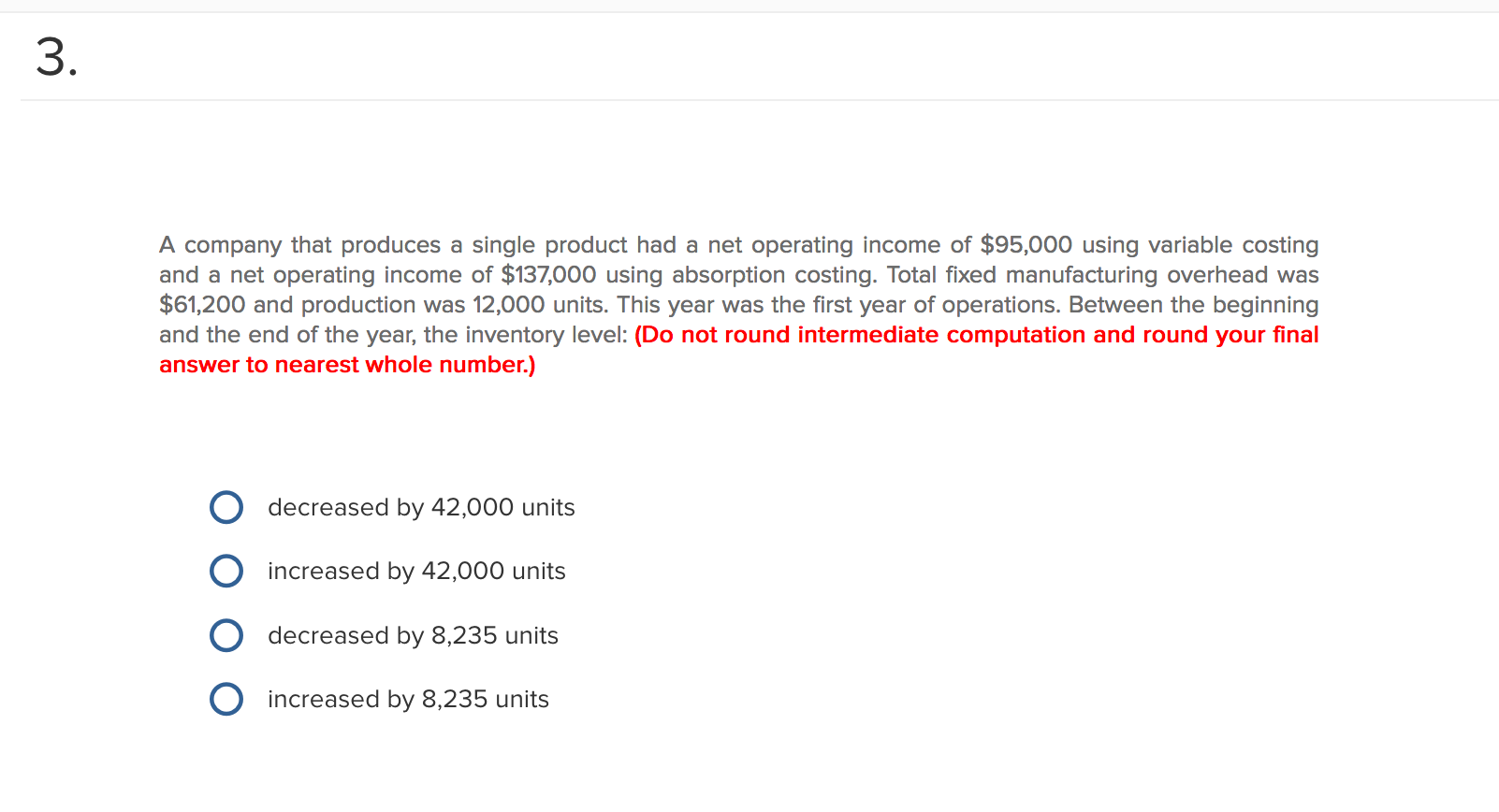

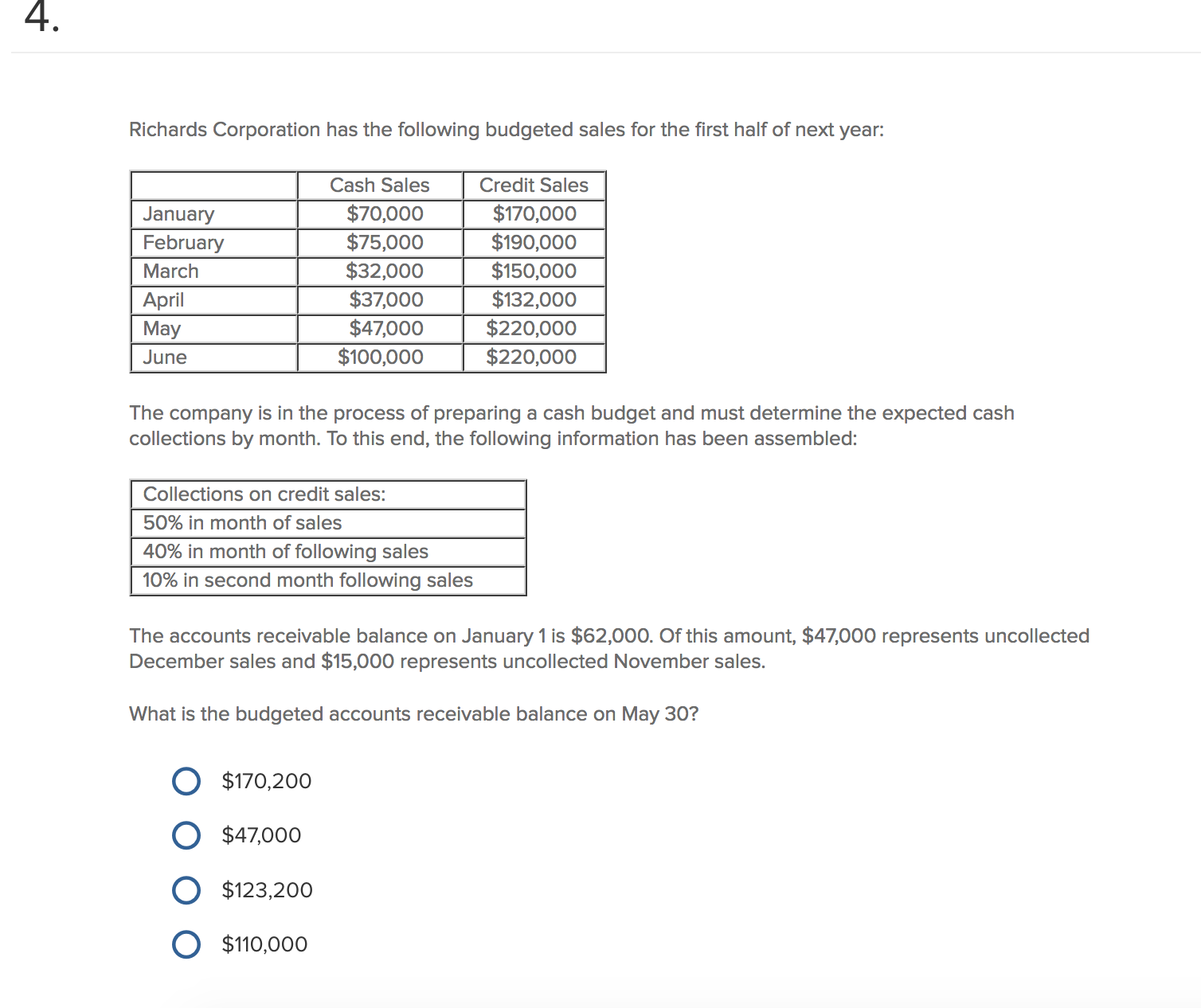

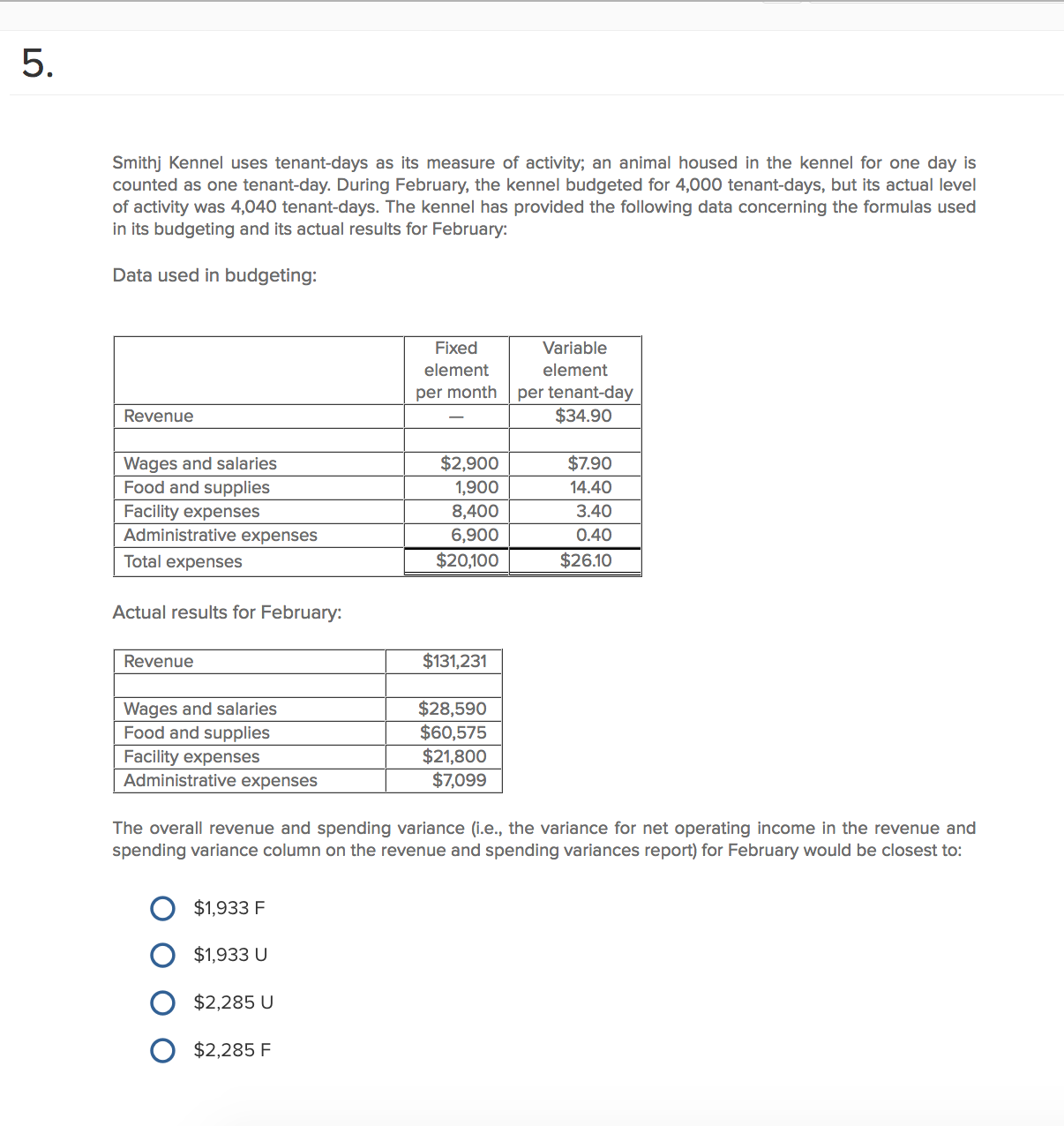

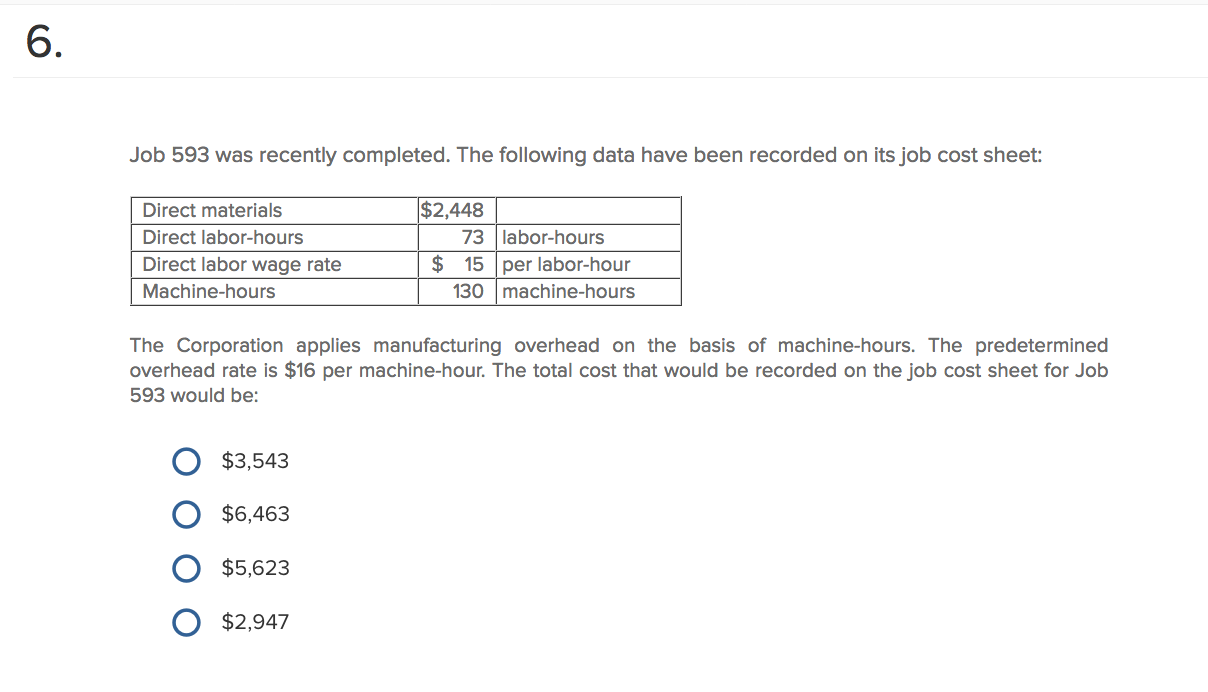

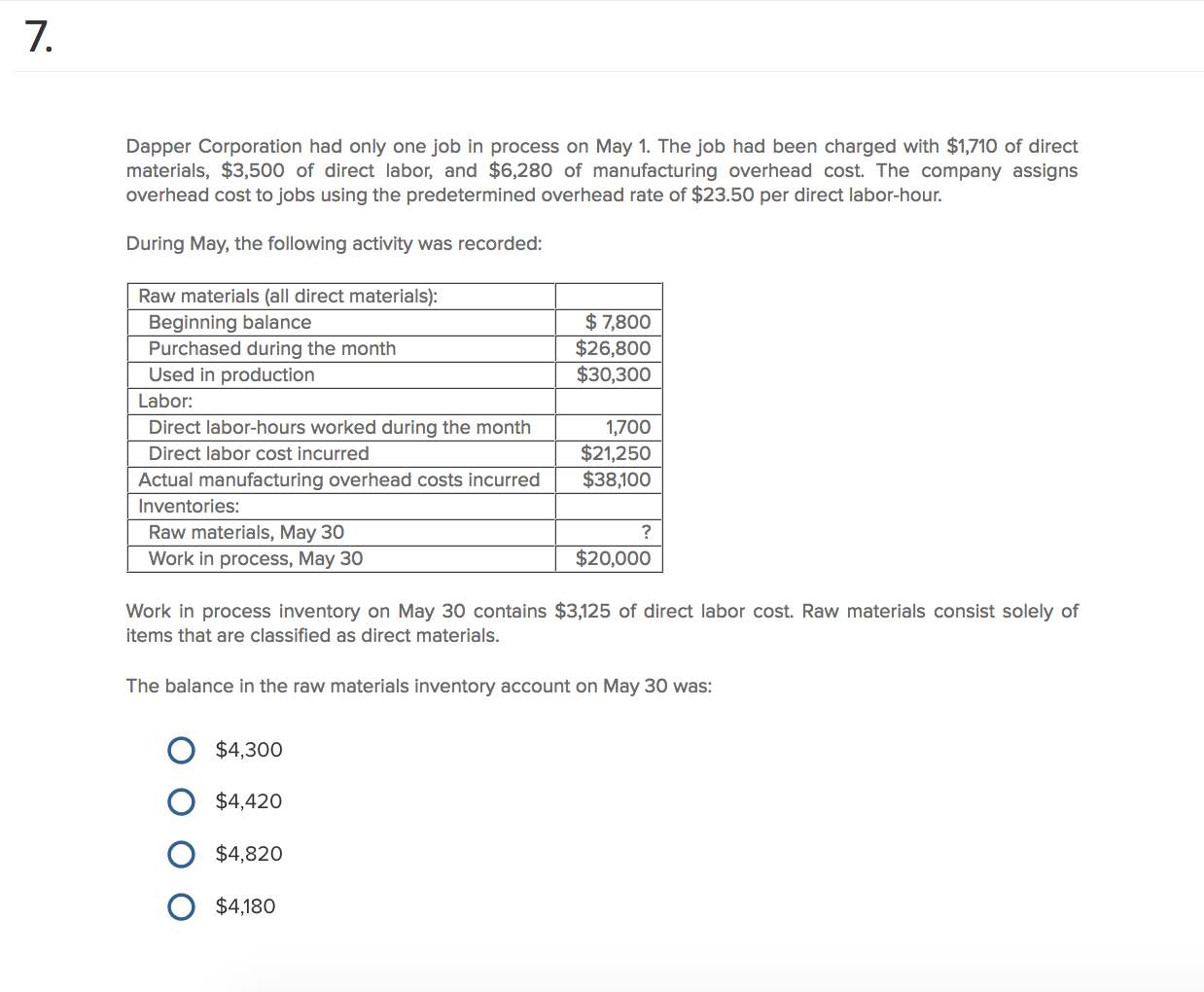

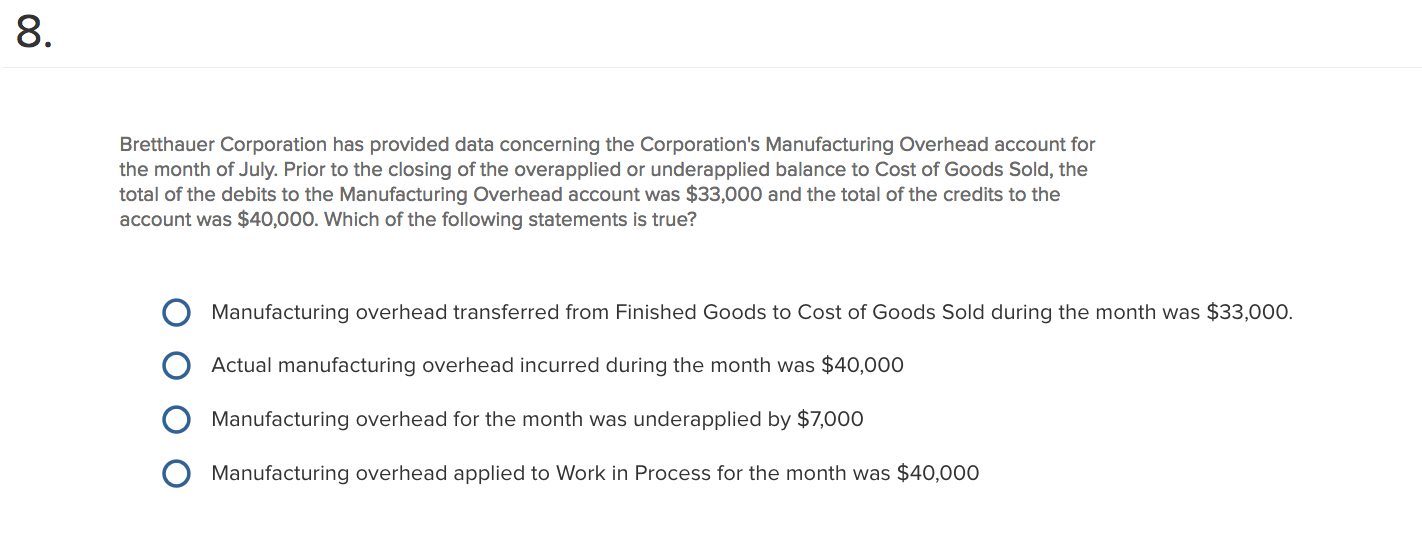

Last year a company had sales of $310,000, a turnover of 2.7, and a return on investment of 35.1%. The company's net operating income for the year was: 0 $68,510 0 $114,815 0 $108,810 0 $40,300 The following information relates to last year's operations at the Paper Division of Germane Corporation: Minimum required rate of return m Return on investment (ROI) 11.7% _ 0000.000 Turnover (on operating assets) What was the Paper Division's net operating income last year? 0 $77,220 0 $25,740 0 $59,400 0 $17,820 For the past year, Allargando Company recorded sales of $498,600 and average operating assets of $277,000. What is the margin that Allargando Company needed to earn in order to achieve an ROI of 30.6%? 17% 30.6% 1.8% 3.27% 0000 Chabot Company had the following results last year: net operating income, $6,150; turnover, 2; and ROI 15%. Chabot Company's average operating assets were: 0 $4,612,500 0 $1,230,000 0 $12,300 0 $41,000 The West Division of Frede Corporation had average operating assets of $682,000 and net operating income of $75,000 in December. The minimum required rate of return for performance evaluation purposes is 14%. What was the West Division's minimum required return in December? 0 $75,000 0 $95,480 0 $10,500 O $105,980 The Consumer Products Division of Mickolick Corporation had average operating assets of $420,000 and net operating income of $46,500 in August. The minimum required rate of return for performance evaluation purposes is 12%. What was the Consumer Products Division's minimum required return in August? 0 $5,580 0 $46,500 0 $55,980 0 $50,400 Gaal Industries is a division of a major corporation. Last year the division had total sales of $1 9,293,750, net operating income of $2,267,016, and average operating assets of $8,575,000. The company's minimum required rate of return is 20%. Required: a. What is the division's margin? (Round your answer to 2 decimal places.) -:I b. What is the division's tumover'? (Round your answer to 2 decimal places.) -: c. What is the division's retum on investment (ROI)? (Round your answer to 2 decimal places.) :I At a sales volume of 44,000 units, Carne Company's sales commissions (a cost that is variable with respect to sales volume) total $585,200. To the nearest whole cent, what should be the average sales commission per unit at a sales volume of 46,300 units? (Assume that this sales volume is within the relevant range.) A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit Direct materials -8I Fixed selling and administrative $104,500 What is the total period cost for the month under variable costing? 0 $381,600 0 $180,500 0 $488,100 0 $562,100 A company that produces a single product had a net operating income of $95,000 using variable costing and a net operating income of $137,000 using absorption costing. Total xed manufacturing overhead was $61,200 and production was 12,000 units. This year was the rst year of operations. Between the beginning and the end of the year, the inventory level: (Do not round intermediate computation and round your nal answer to nearest whole number.) decreased by 42,000 units increased by 42,000 units decreased by 8,235 units 0000 increased by 8,235 units Richards Corporation has the following budgeted sales for the first half of next year: ___ $37 000 $132 000 _ 007000 0220 000 $100 000 $220 000 The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled: Collections on credit sales: 50% in month of sales 40% in month of following sales 10% in second month following sales The accounts receivable balance on January1 is $62,000. Of this amount. $47,000 represents uncollected December sales and $15,000 represents uncollected November sales. What is the budgeted accounts receivable balance on May 30? 0 $170,200 0 $47,000 0 $123,200 0 $110,000 Smith] Kennel uses tenant-days as Its measure of activity; an animal housed in the kennel for one day ls counted as one tenant-day. During February, the kennel budgeted for 4,000 tenant-days, but its actual level of activity was 4,040 tenantdays. The kennel has provided the following data concerning the formulas used In its budgetlng and its actual results for February: Data used in budgeting: Fixed Variable element element per month per tena nt-day Revenue $34.90 Wages and salarles $2,900 $7.90 Food and supplies 1,900 14.40 Facl Iity expenses 8.400 3.40 Administrative expenses 6,900 0.40 Total expenses $20,100 $26.10 Actual results for February: Revenue $131,231 Wages and salarles $28,590 Food and supplies $60,575 Facility expenses $21,800 Administrative expenses $7,099 The overall revenue and spending variance (i.e., the variance for net operating income In the revenue and spending variance column on the revenue and spending variances report) for February would be closest to: O $1,933F O $1,933u O $2.285U O $2.285F Job 593 was recently completed. The following data have been recorded on itsjob cost sheet: Direct materials $2.448 Direct labor-hours 73 labor-hours Direct labor wage rate $ 15 perlabor-hour Machine-hours 130 machine-hours The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate ls $16 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 593 would be: 0 $3,543 0 $6,463 0 $5.523 O $2.947 Dapper Corporation had only one job In process on May 1. The job had been charged with $1,710 of direct materials. $3,500 of direct labor, and $6,280 of manufacturing overhead cost The company assigns overhead cost to Jobs using the predetermined overhead rate of $23.50 per direct labor-hour. During May, the following activity was recorded: Raw materials (all direct materials): Beginning balance $ 7,800 Purchased during the month $26,800 Used In production $30,300 Labor: Direct labor-hours worked during the month 1,700 Direct labor cost Incurred $21,250 Actual manufacturing overhead costs incurred $38,100 Inventories: Raw materials, May 30 ? Work in process, May 30 $20,000 Work In process Inventory on May 30 contains $3,125 of direct labor cost. Raw materials consist solely of Items that are classied as direct materials. The balance in the raw materials Inventory account on May 30 was: 0 $4,300 0 $4,420 0 $4,820 0 $4,180 Bretthauer Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of July. Prior to the closing of the overappiied or underappiled balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $33,000 and the total of the credits to the account was $40,000. Which of the following statements is true? 0 Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the month was $33,000. 0 Actual manufacturing overhead incurred during the month was $40,000 0 Manufacturing overhead for the month was underapplied by $7,000 0 Manufacturing overhead applied to Work in Process for the month was $40,000