I need help with this assignment. I attached the template for the journal entries.

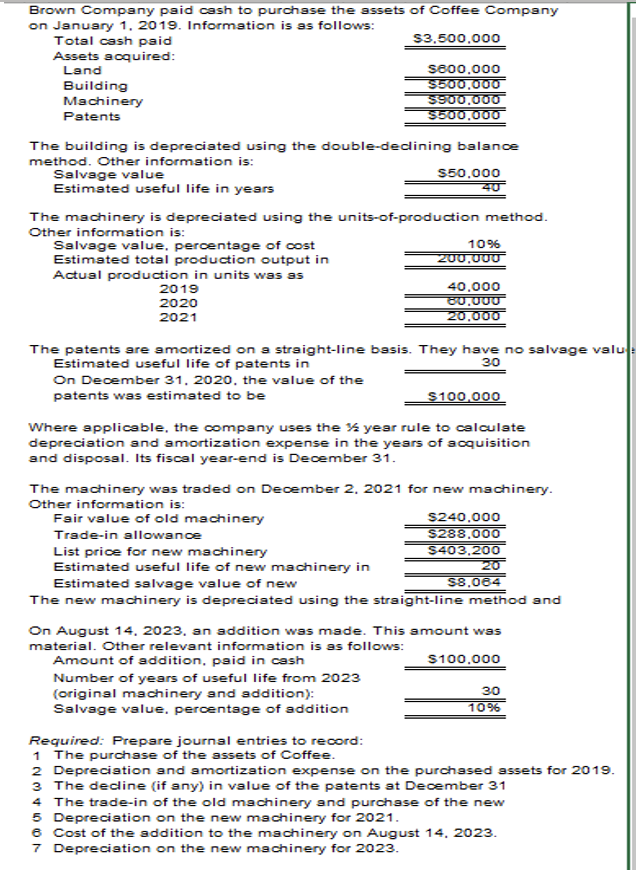

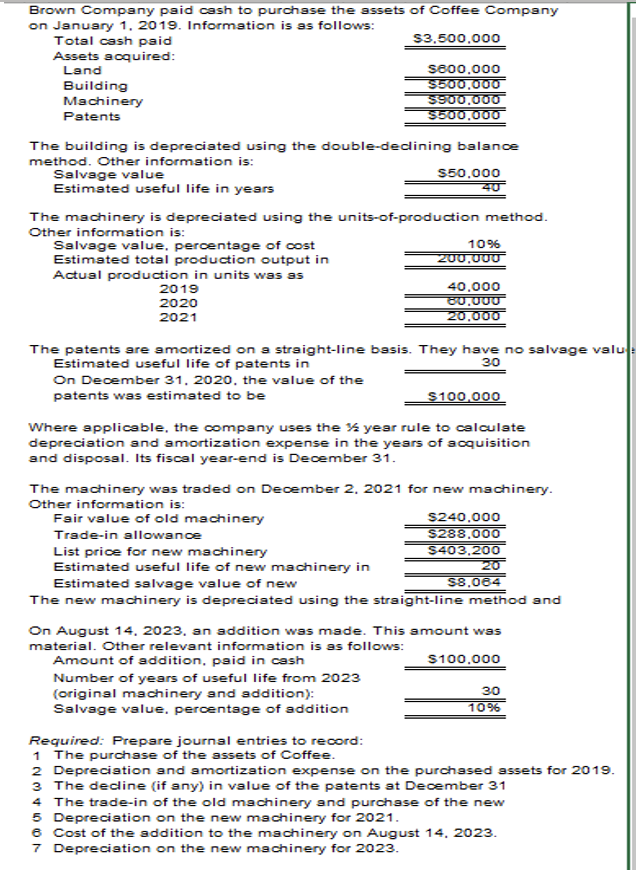

Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: The patents are amortized on a straight-line basis. They have no salvage valu Estimated useful life of patents in On December 31, 2020, the value of the patents was estimated to be 30$100,000 Where applicable, the company uses the 1/2 year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31 . The machinery was traded on December 2. 2021 for new machinery. On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $100,000 Number of years of useful life from 2023 (original machinery and addition): Salvage value, percentage of addition =1096 Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019. 3 The dedine (if any) in value of the patents at December 31 4 The trade-in of the old machinery and purchase of the new 5 Depreciation on the new machinery for 2021. 6 Cost of the addition to the machinery on August 14. 2023. 7 Depreciation on the new machinery for 2023 . Brown Company GENERAL JOURNAL Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: The patents are amortized on a straight-line basis. They have no salvage valu Estimated useful life of patents in On December 31, 2020, the value of the patents was estimated to be 30$100,000 Where applicable, the company uses the 1/2 year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31 . The machinery was traded on December 2. 2021 for new machinery. On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $100,000 Number of years of useful life from 2023 (original machinery and addition): Salvage value, percentage of addition =1096 Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019. 3 The dedine (if any) in value of the patents at December 31 4 The trade-in of the old machinery and purchase of the new 5 Depreciation on the new machinery for 2021. 6 Cost of the addition to the machinery on August 14. 2023. 7 Depreciation on the new machinery for 2023 . Brown Company GENERAL JOURNAL