I need help with this audit question

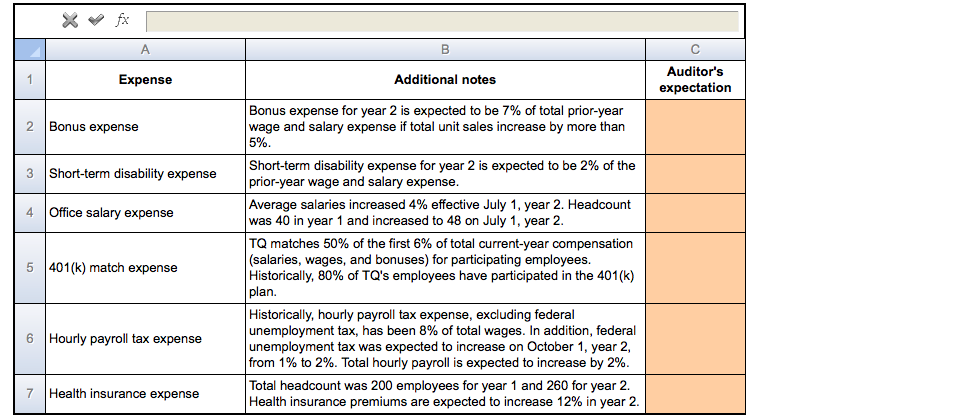

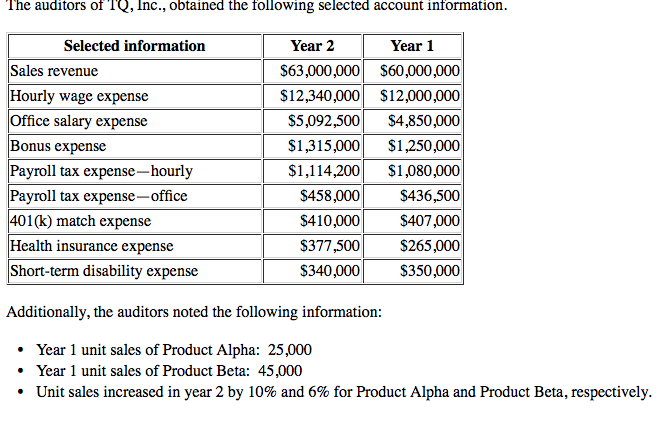

Auditor's expectation Expense Additional not es Bonus expense for year 2 is expected to be 7% of total prior-year wage and salary expense if total unit sales increase by more than 5% 2 Bonus expense Short-term disability expense for year 2 is expected to be 2% of the prior-year wage and salary expense 3 Short-term disability expense 4 Office salary expens Average salaries increased 4% effective July 1, year 2. Headcount was 40 in year 1 and increased to 48 on July 1, year 2 TQ matches 50% of the first 6% of total current-year compensation (salaries, w Historically, 80% of TQ's employees have participated in the 401(k) plan. ages, and bonuses) for participating employees. 5 401(k) match expense Historically, hourly payroll tax expense, excluding federal unemployment tax, has been 8% of total wages. In addition, federal unemployment tax was expected to increase on October 1, year 2, from 1% to 2%. Total hourly payroll is expected to increase by 2% 6 Hourly payroll tax expense Total headcount was 200 employees for year 1 and 260 for year 2. Health insurance premiums are expected to increase 12% in year 2 7 Health insurance expense Auditor's expectation Expense Additional not es Bonus expense for year 2 is expected to be 7% of total prior-year wage and salary expense if total unit sales increase by more than 5% 2 Bonus expense Short-term disability expense for year 2 is expected to be 2% of the prior-year wage and salary expense 3 Short-term disability expense 4 Office salary expens Average salaries increased 4% effective July 1, year 2. Headcount was 40 in year 1 and increased to 48 on July 1, year 2 TQ matches 50% of the first 6% of total current-year compensation (salaries, w Historically, 80% of TQ's employees have participated in the 401(k) plan. ages, and bonuses) for participating employees. 5 401(k) match expense Historically, hourly payroll tax expense, excluding federal unemployment tax, has been 8% of total wages. In addition, federal unemployment tax was expected to increase on October 1, year 2, from 1% to 2%. Total hourly payroll is expected to increase by 2% 6 Hourly payroll tax expense Total headcount was 200 employees for year 1 and 260 for year 2. Health insurance premiums are expected to increase 12% in year 2 7 Health insurance expense