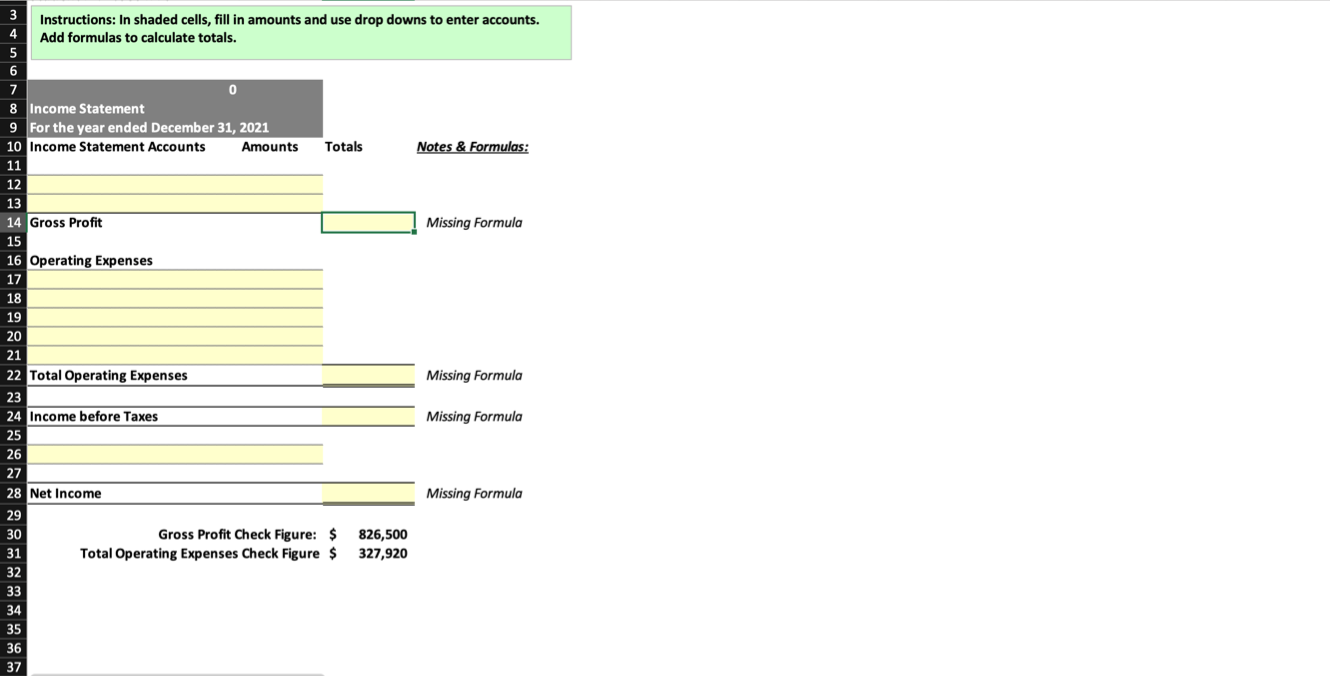

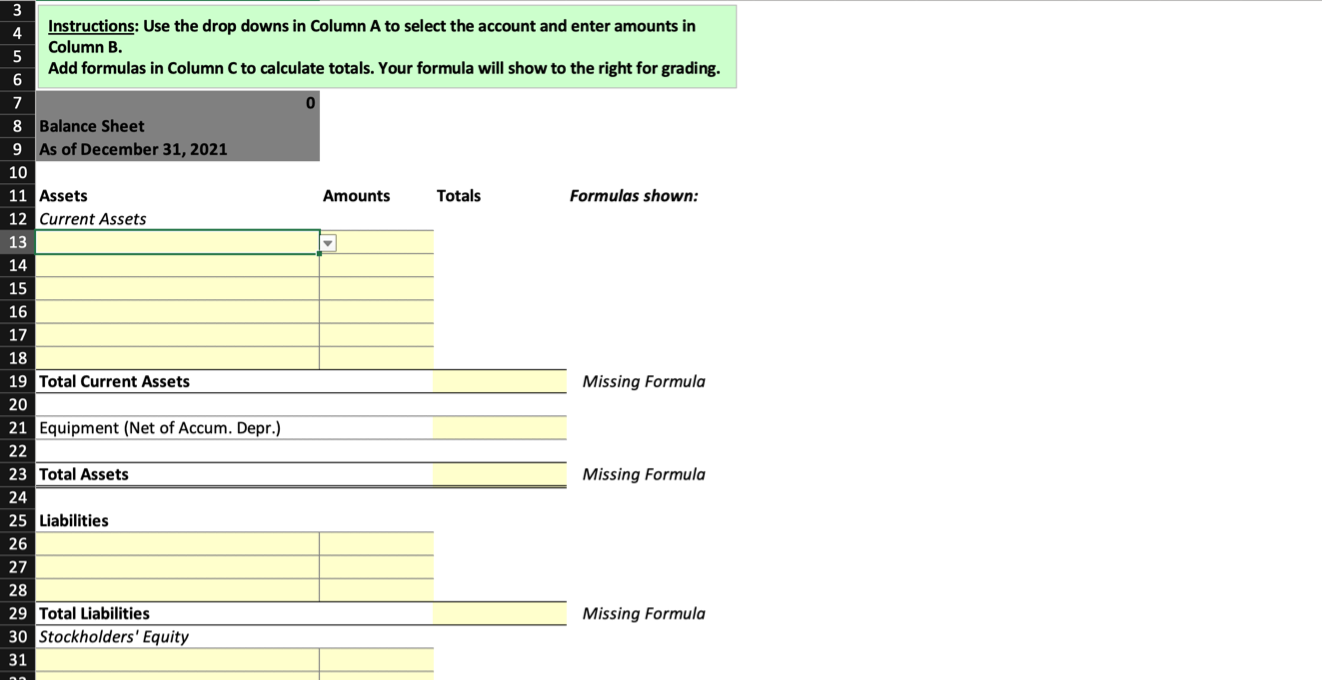

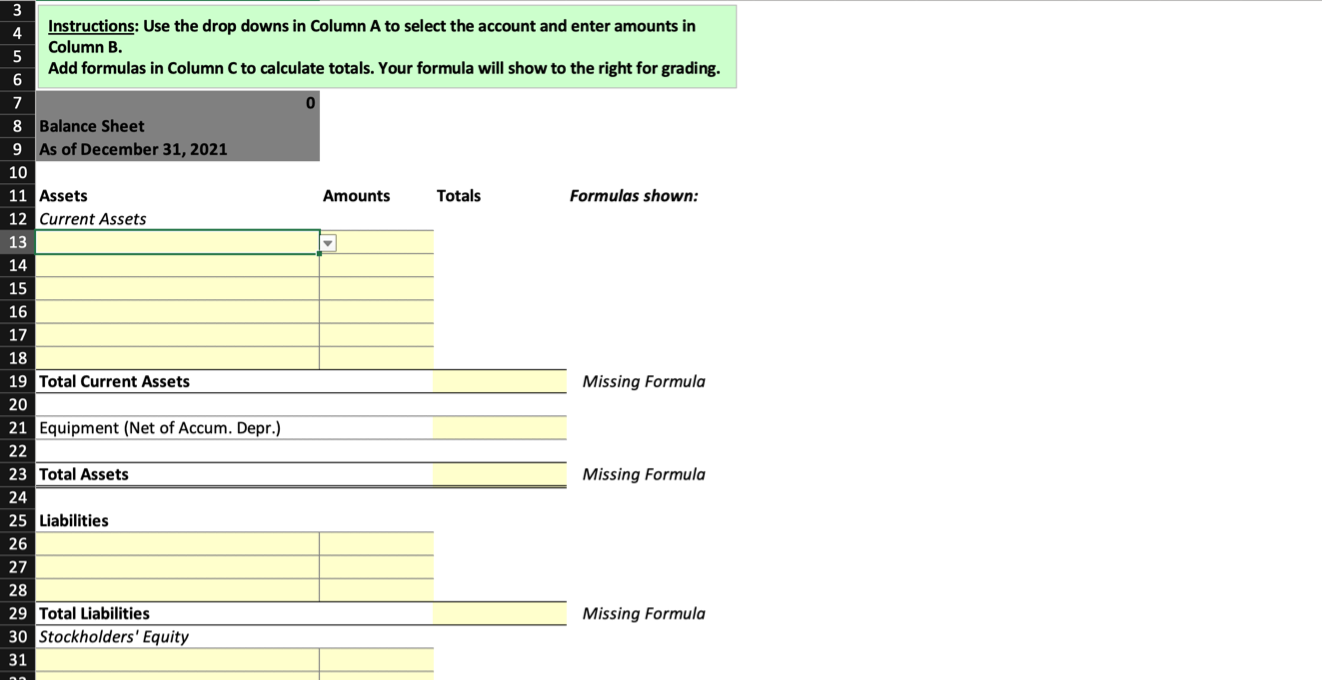

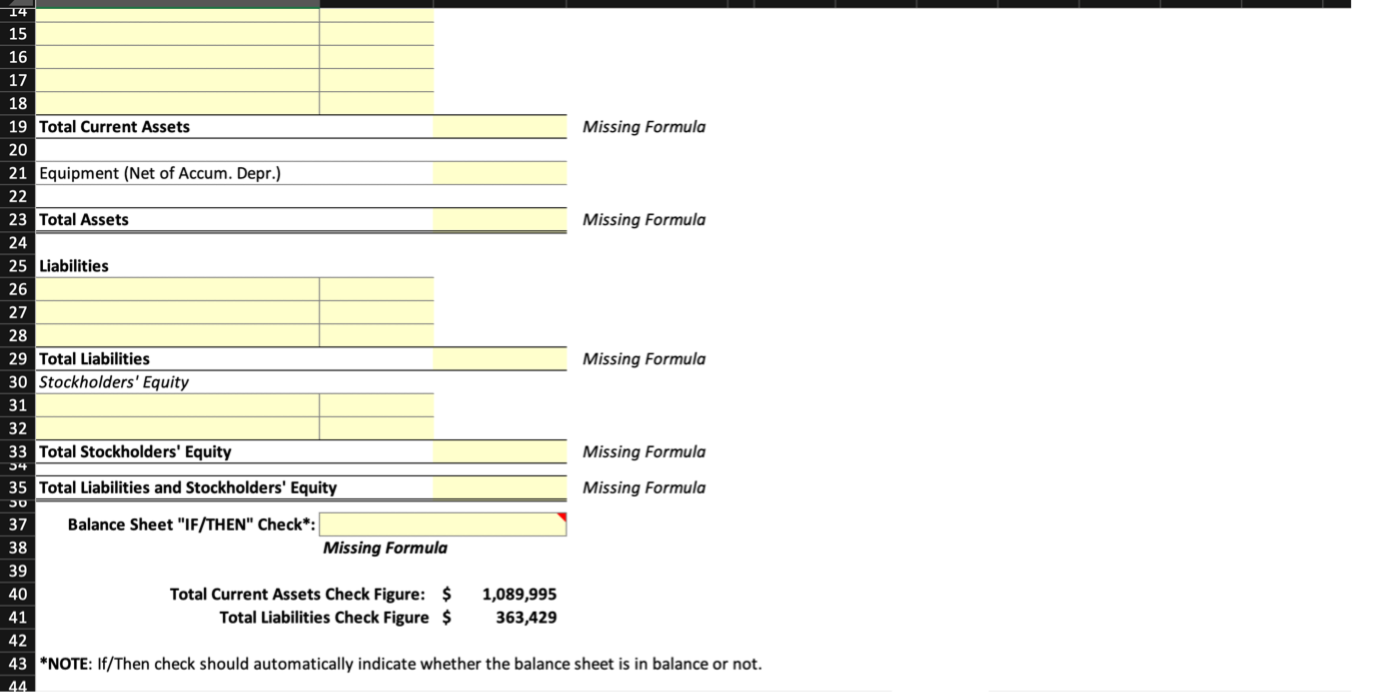

I need help with this homework, I tried completing it but my accounts are never in balance. Not sure what I'm doing wrong, Please help!

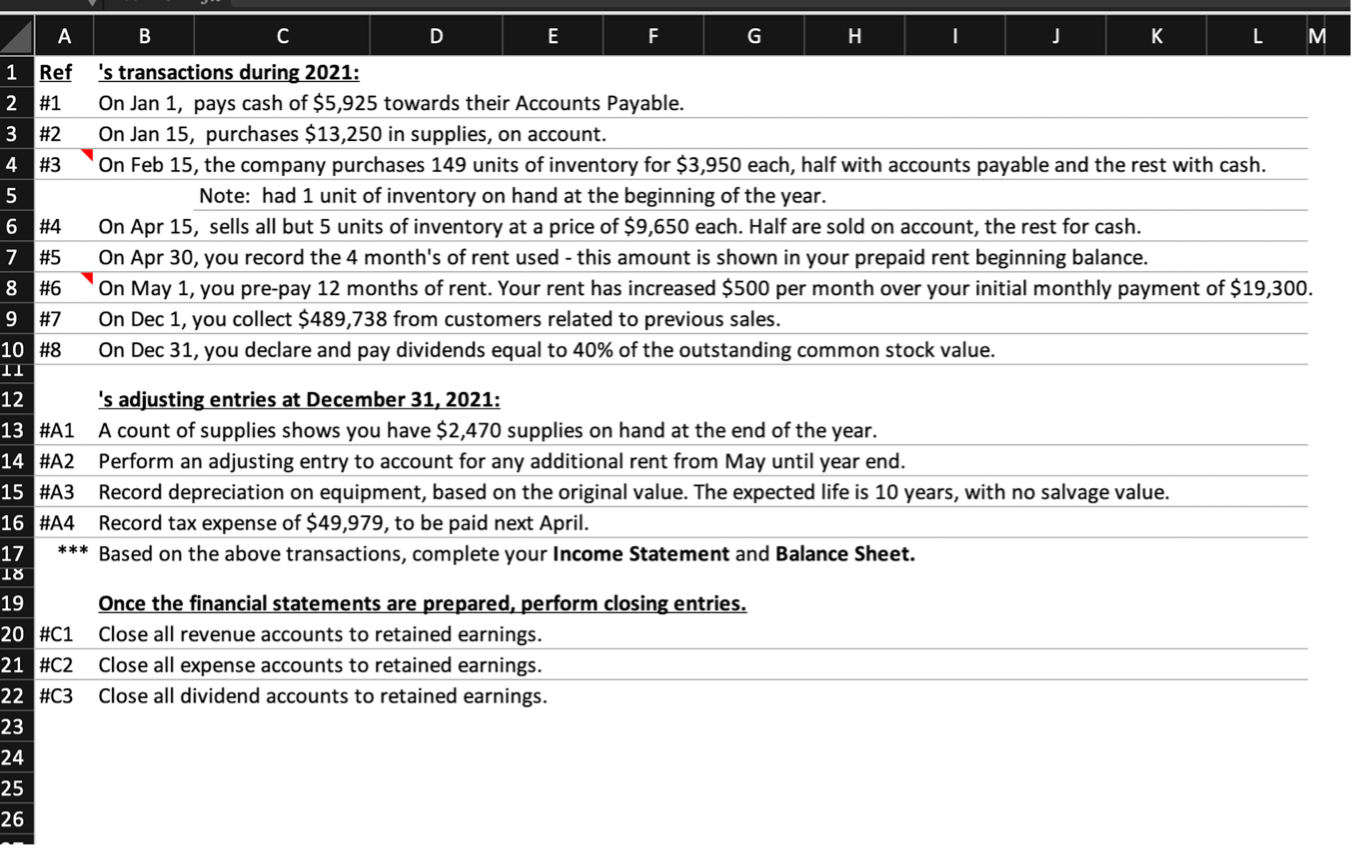

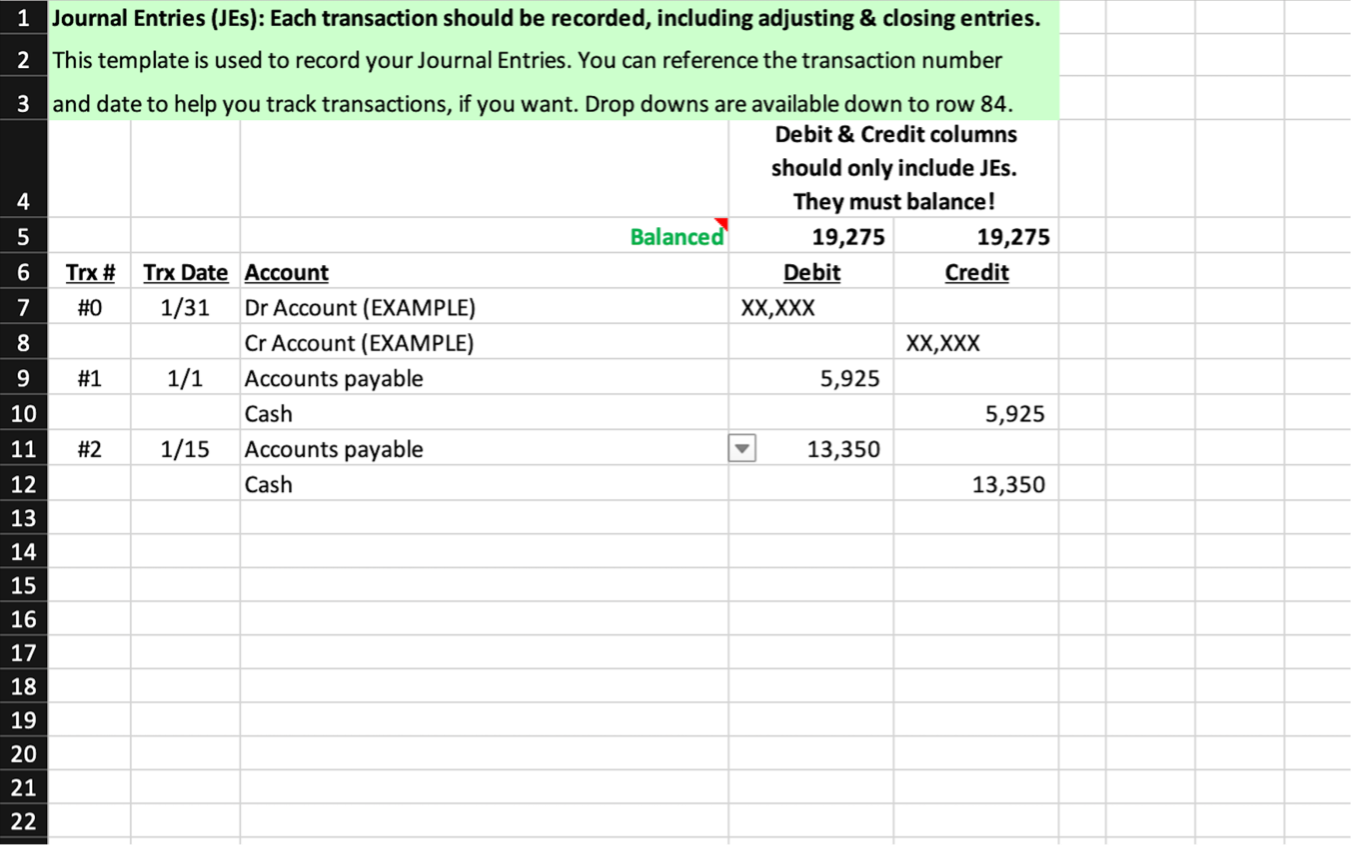

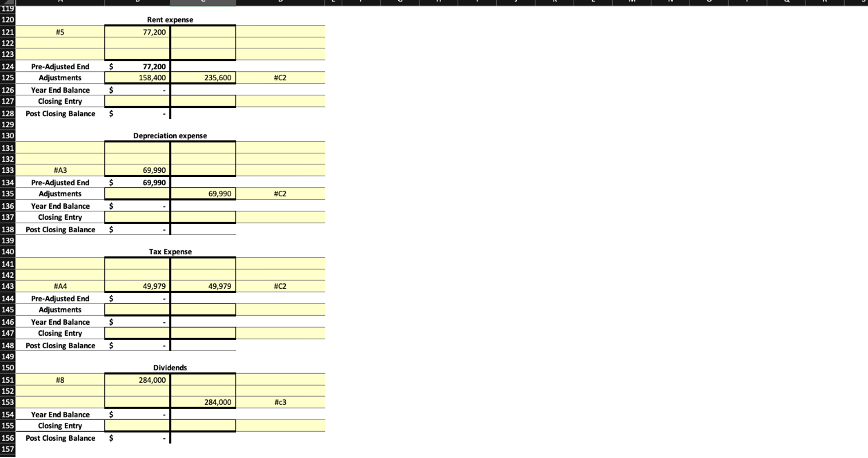

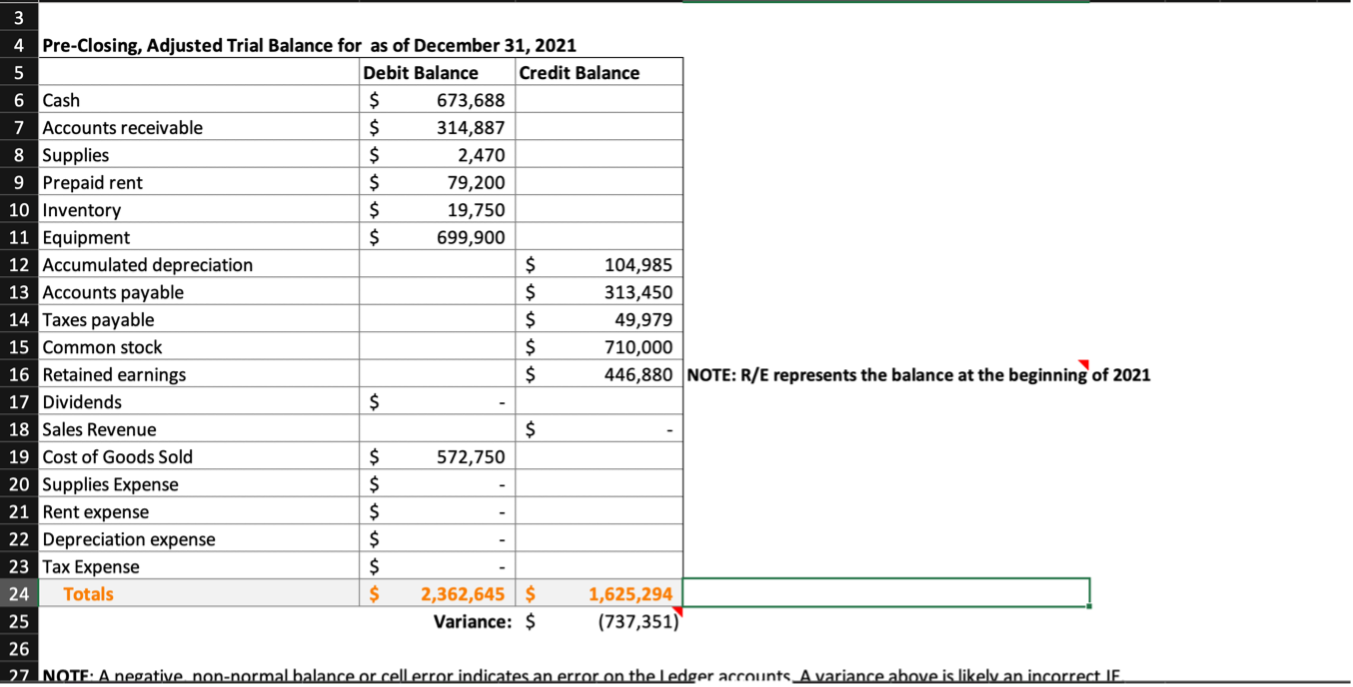

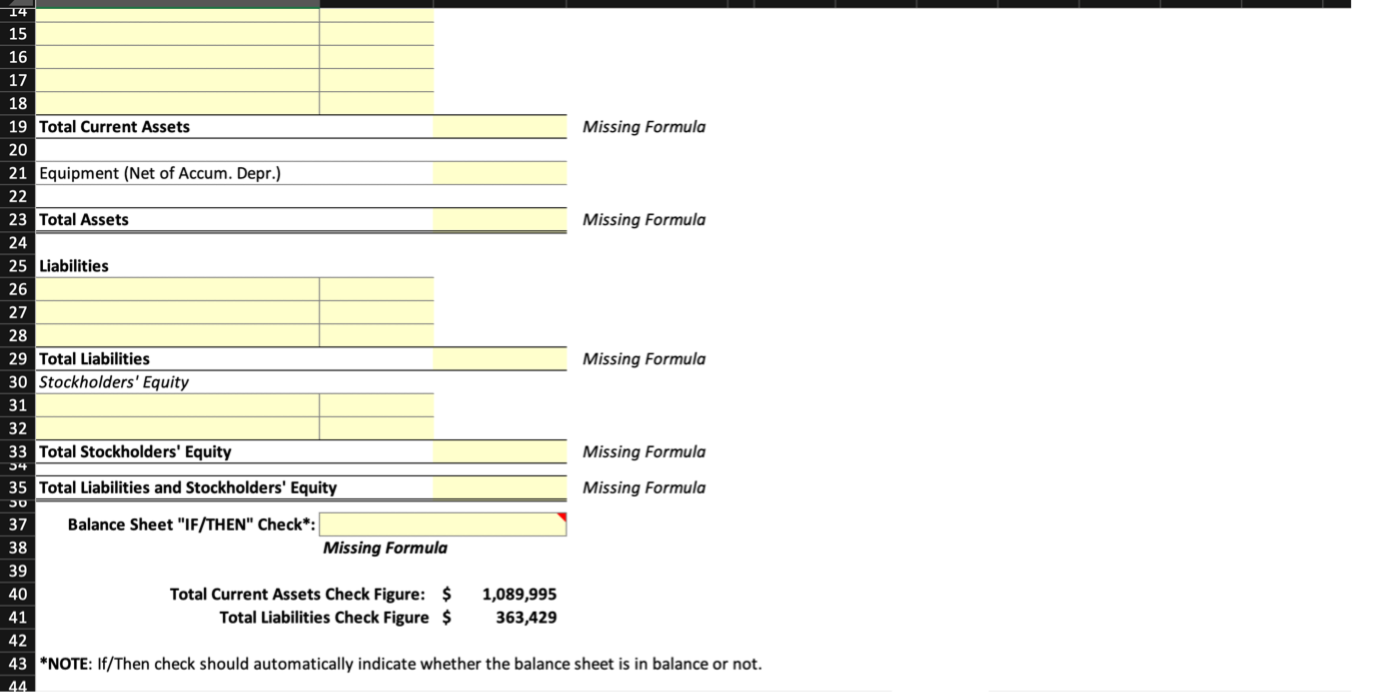

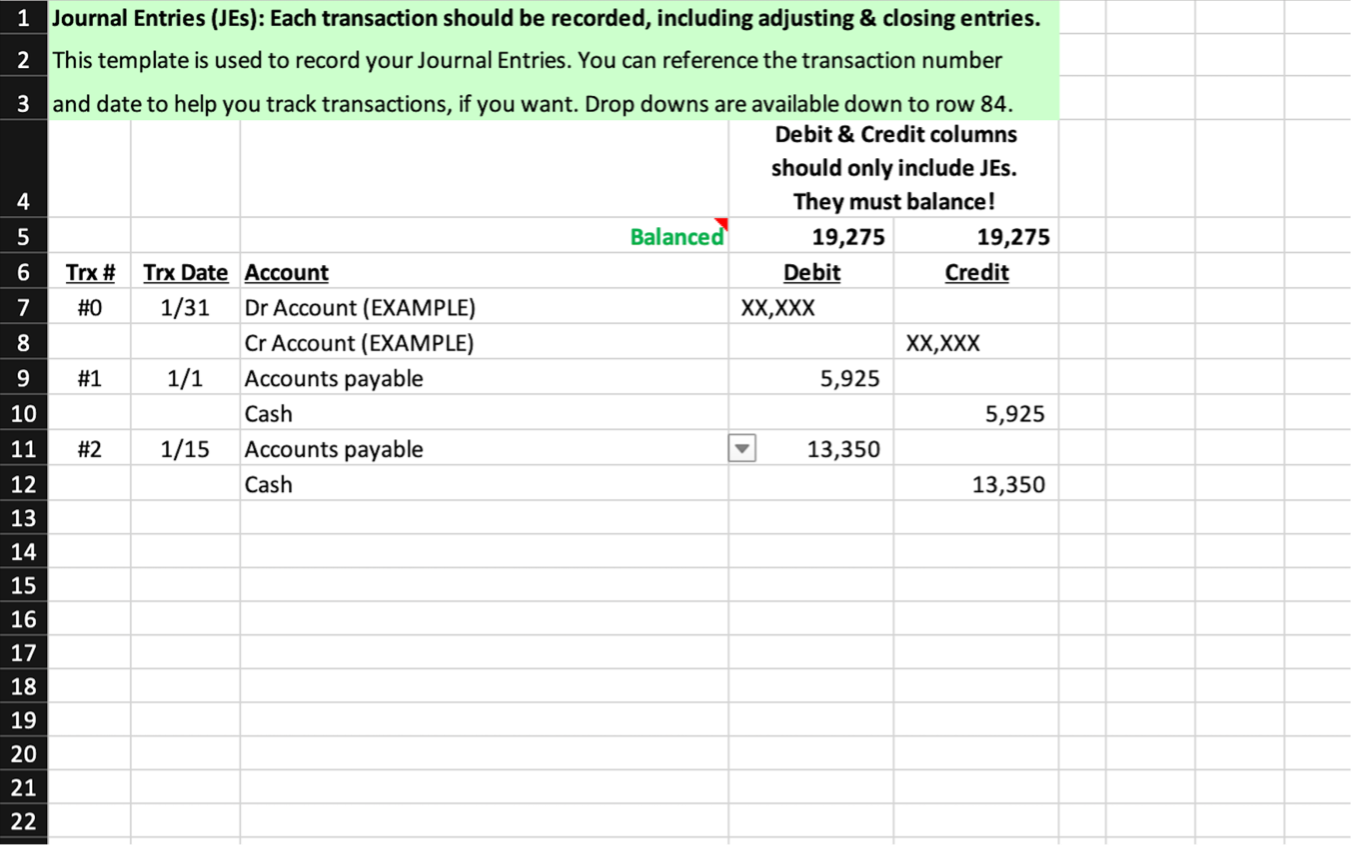

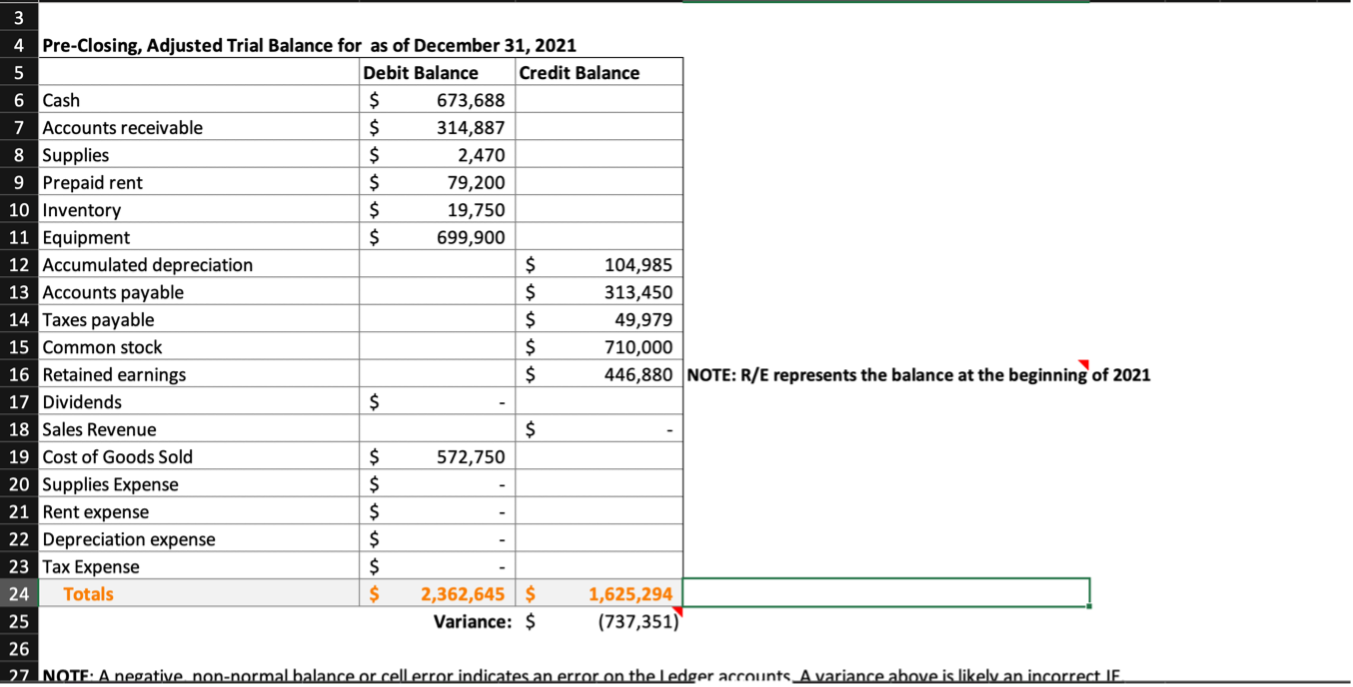

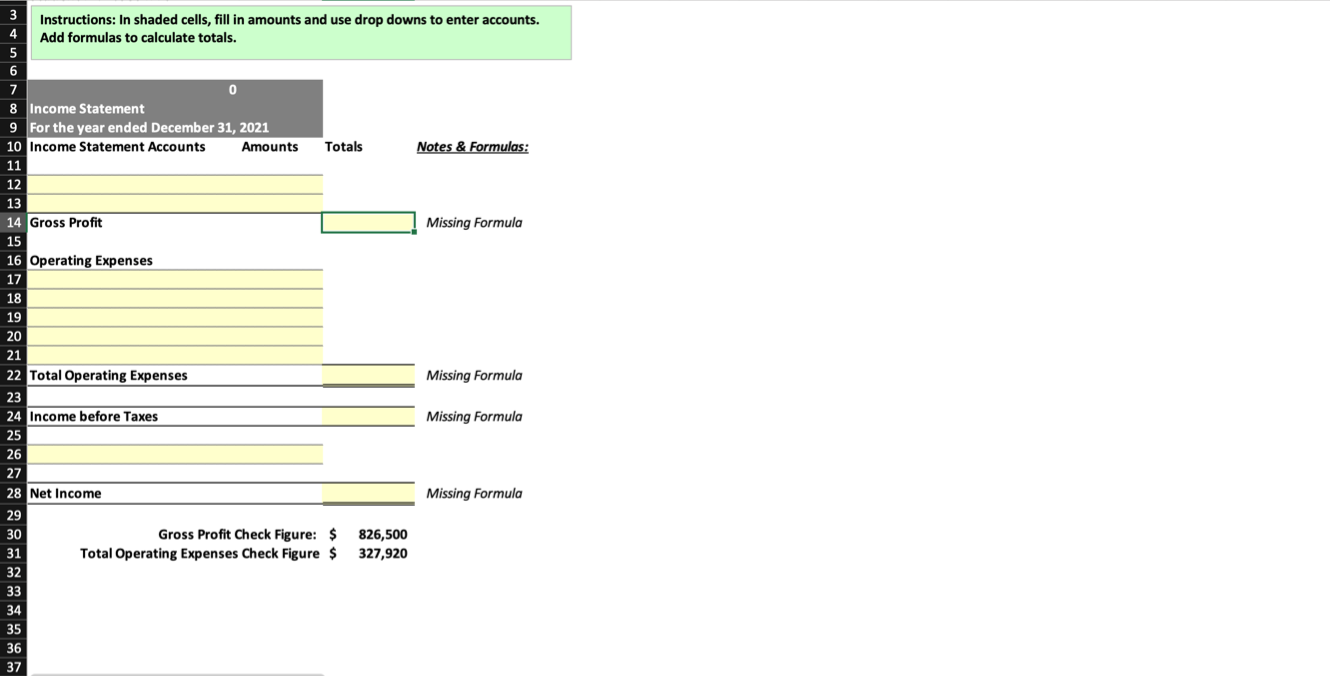

D E G H I 9 11 A B C F J L M 1 Ref 's transactions during 2021: 2 #1 On Jan 1, pays cash of $5,925 towards their Accounts Payable. 3 #2 On Jan 15, purchases $13,250 in supplies, on account. 4 #3 On Feb 15, the company purchases 149 units of inventory for $3,950 each, half with accounts payable and the rest with cash. 5 Note: had 1 unit of inventory on hand at the beginning of the year. 6 #4 On Apr 15, sells all but 5 units of inventory at a price of $9,650 each. Half are sold on account, the rest for cash. 7 #5 On Apr 30, you record the 4 month's of rent used - this amount is shown in your prepaid rent beginning balance. 8 #6 On May 1, you pre-pay 12 months of rent. Your rent has increased $500 per month over your initial monthly payment of $19,300. #7 On Dec 1, you collect $489,738 from customers related to previous sales. 10 #8 On Dec 31, you declare and pay dividends equal to 40% of the outstanding common stock value. 12 's adjusting entries at December 31, 2021: 13 #11 A count of supplies shows you have $2,470 supplies on hand at the end of the year. 14 #A2 Perform an adjusting entry to account for any additional rent from May until year end. 15 #A3 Record depreciation on equipment, based on the original value. The expected life is 10 years, with no salvage value. 16 #A4 Record tax expense of $49,979, to be paid next April. 17 *** Based on the above transactions, complete your Income Statement and Balance Sheet. 19 Once the financial statements are prepared, perform closing entries. 20 #C1 Close all revenue accounts to retained earnings. 21 #C2 Close all expense accounts to retained earnings. 22 #C3 Close all dividend accounts to retained earnings. 23 24 25 18 26 1 Journal Entries (JES): Each transaction should be recorded, including adjusting & closing entries. 2 This template is used to record your Journal Entries. You can reference the transaction number 3 and date to help you track transactions, if you want. Drop downs are available down to row 84. Debit & Credit columns should only include JES. 4 They must balance! 5 Balanced 19,275 19,275 6 Trx # Trx Date Account Debit Credit 7 #0 1/31 Dr Account (EXAMPLE) XX,XXX 8 Cr Account (EXAMPLE) XX,XXX 9 #1 1/1 Accounts payable 5,925 10 Cash 5,925 11 1/15 Accounts payable 13,350 12 Cash 13,350 13 14 15 16 17 18 19 20 21 22 #2 IV

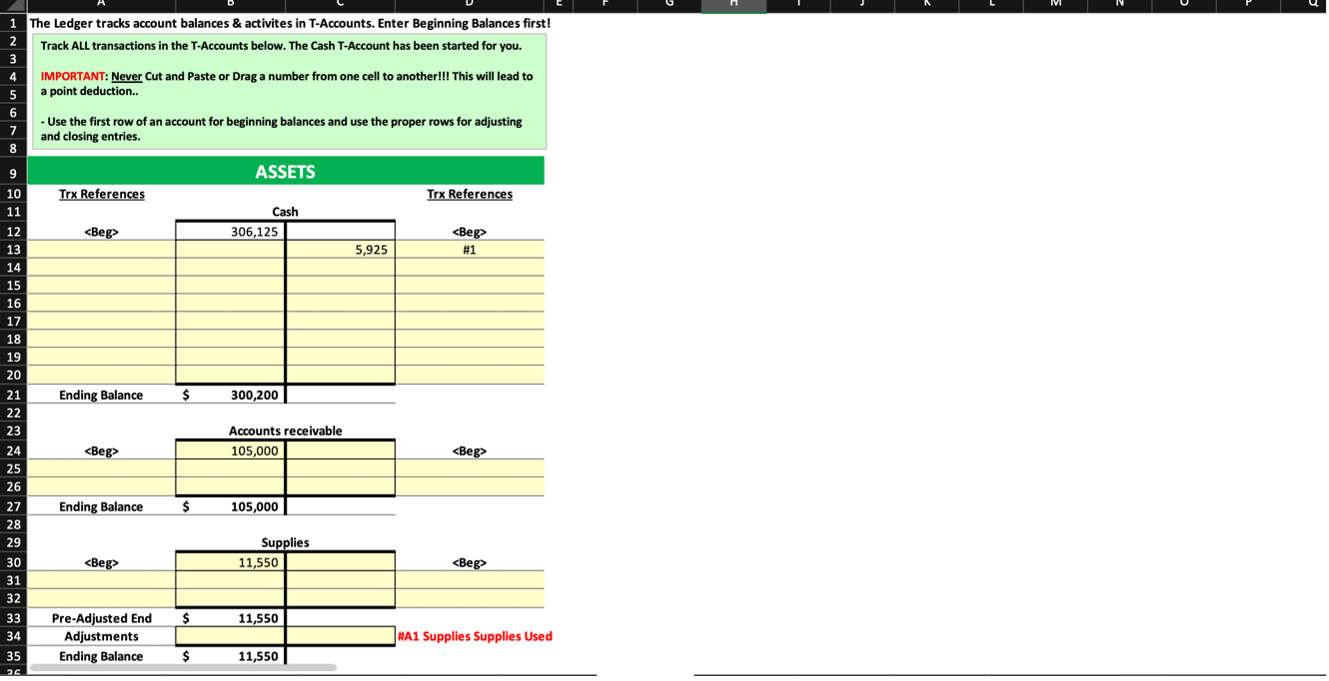

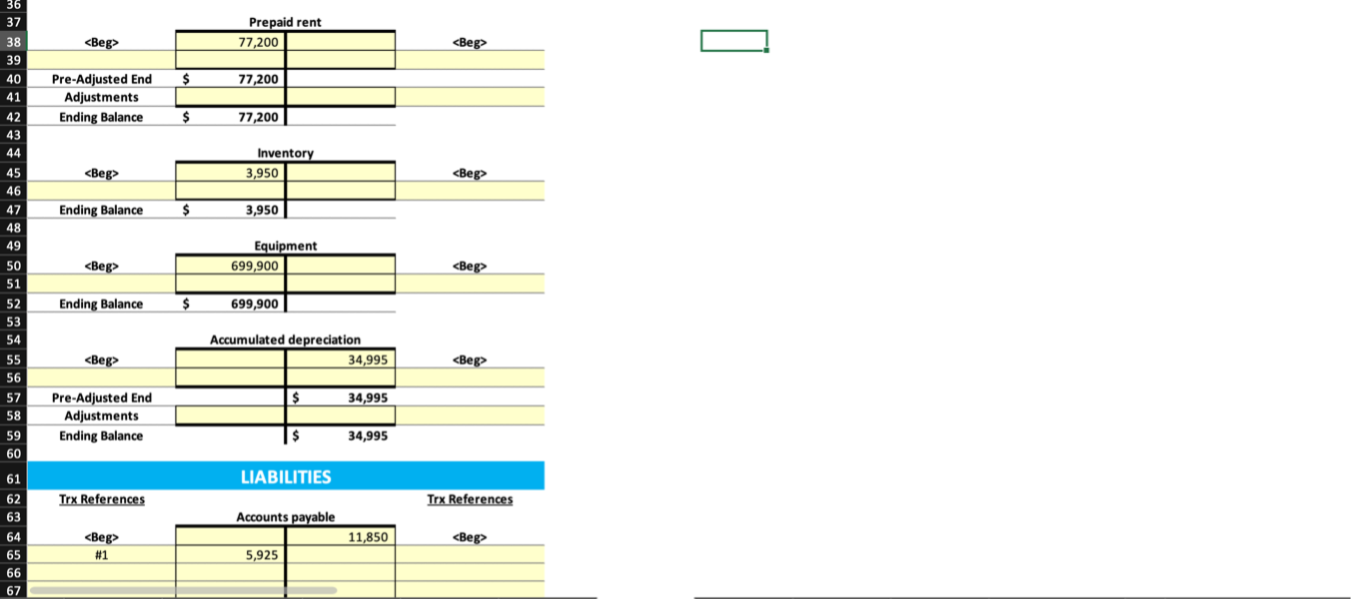

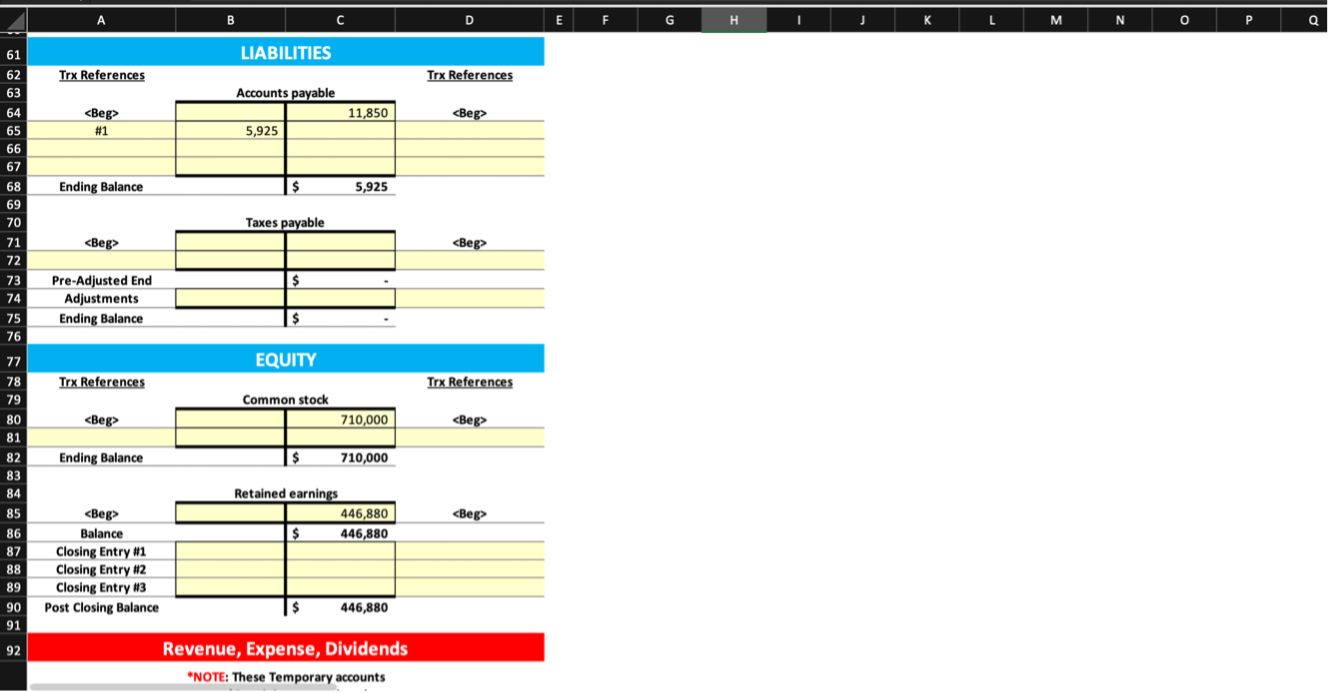

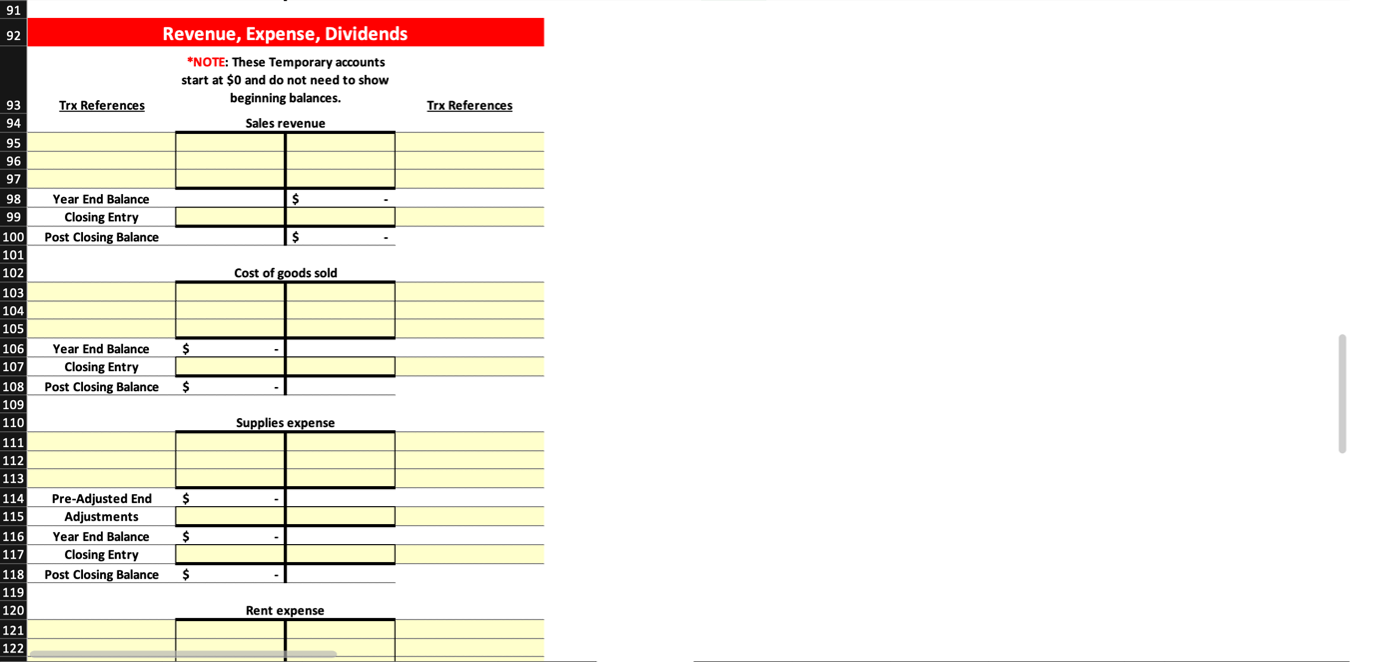

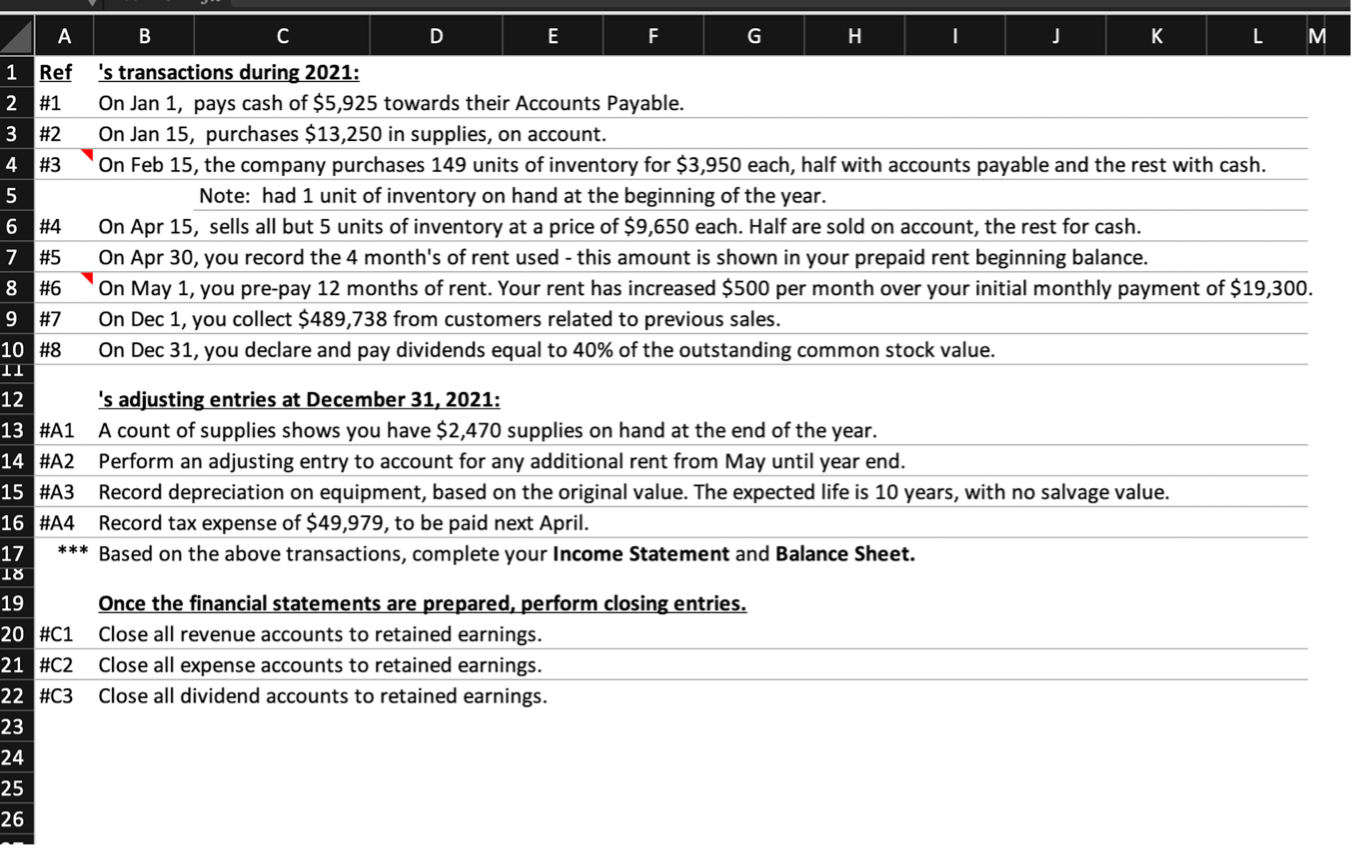

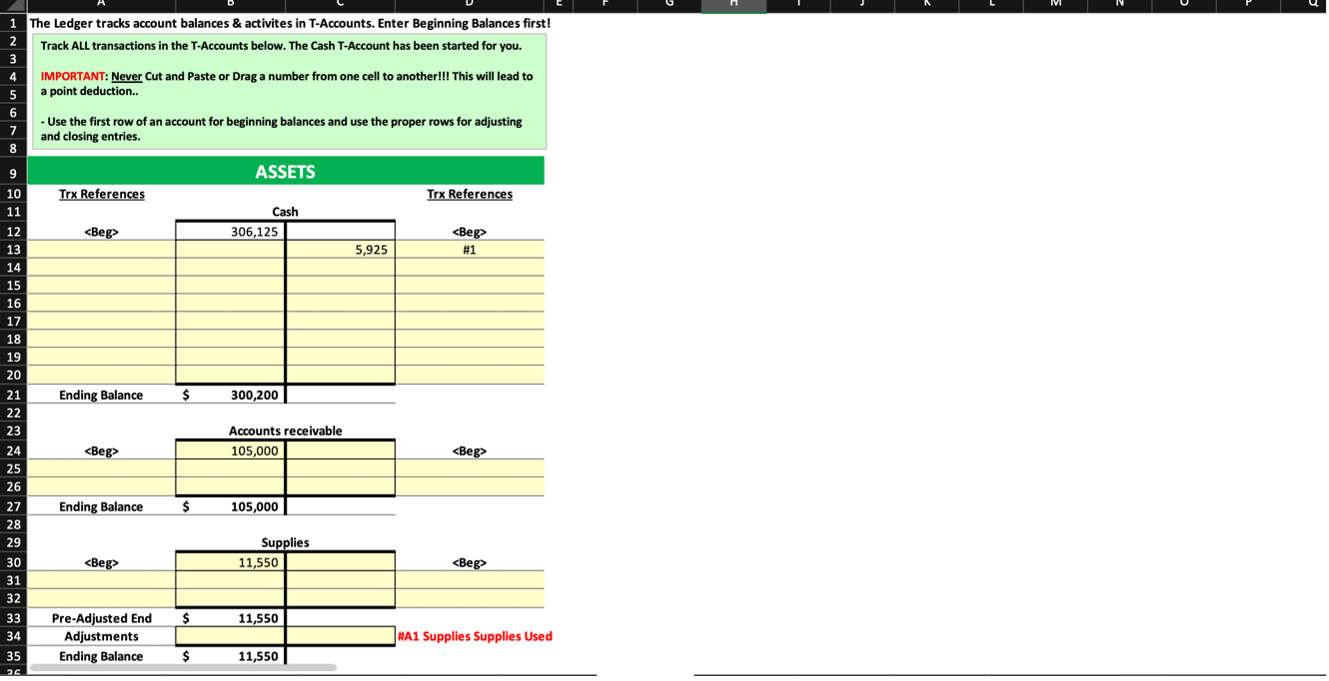

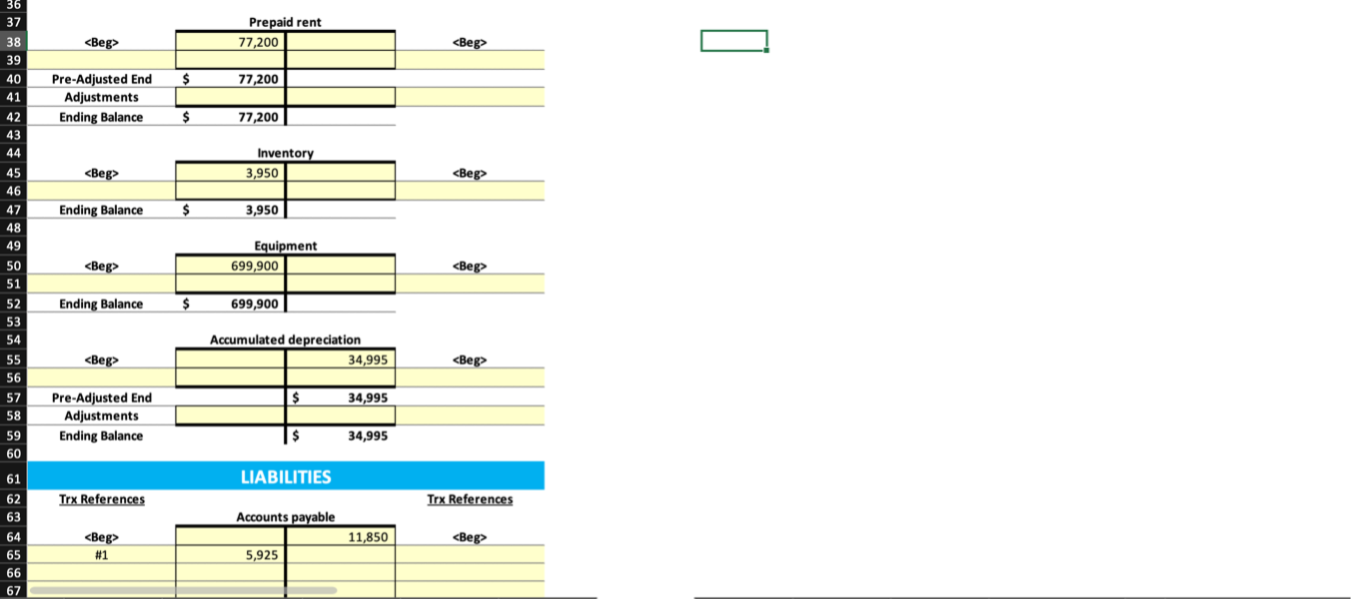

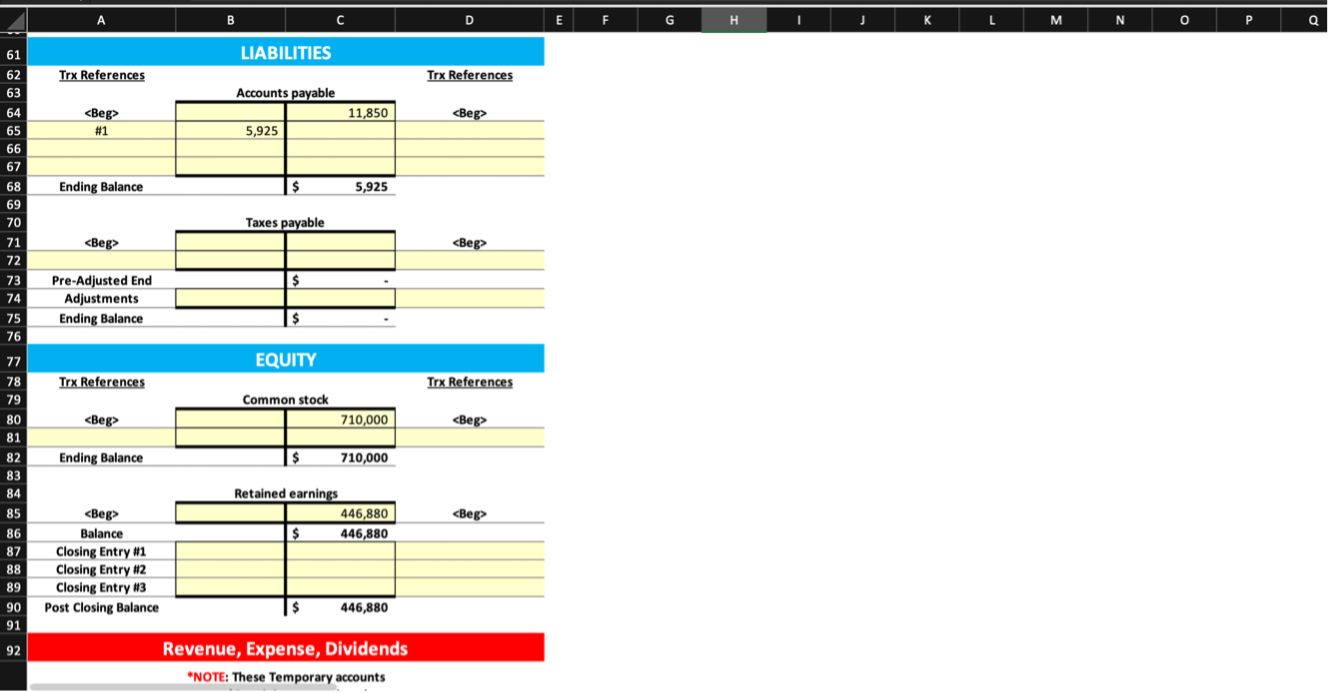

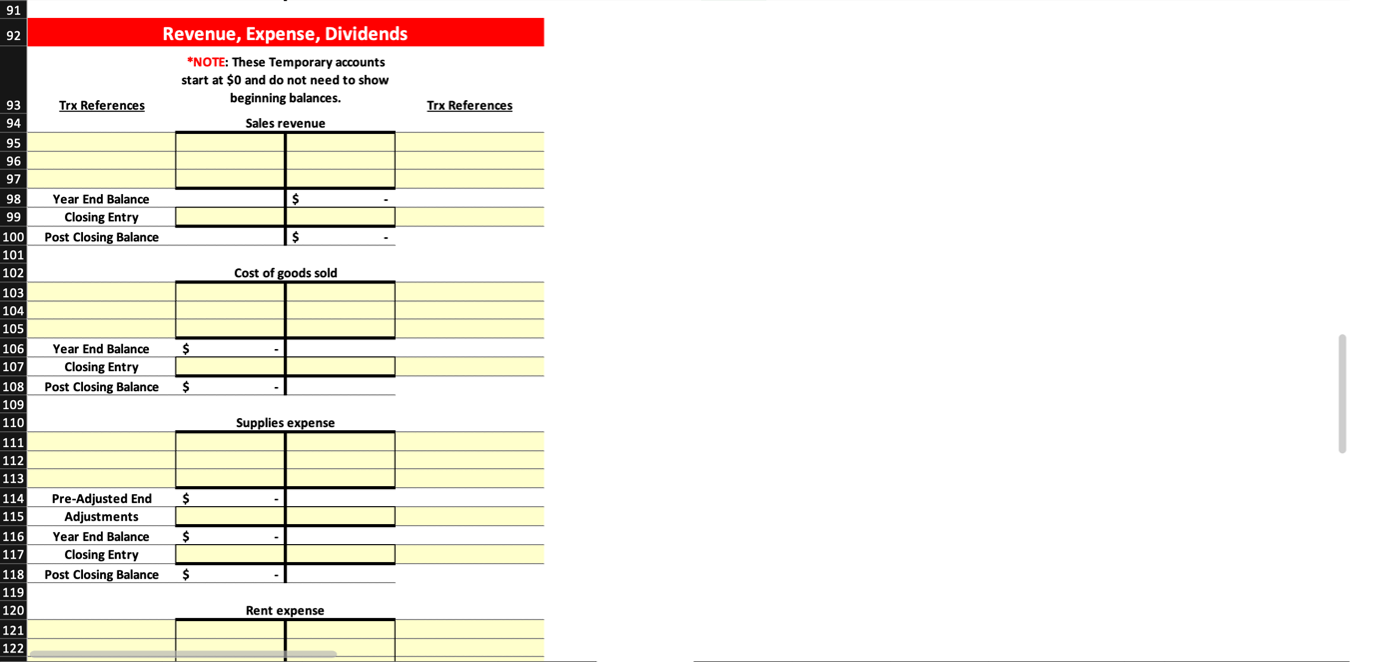

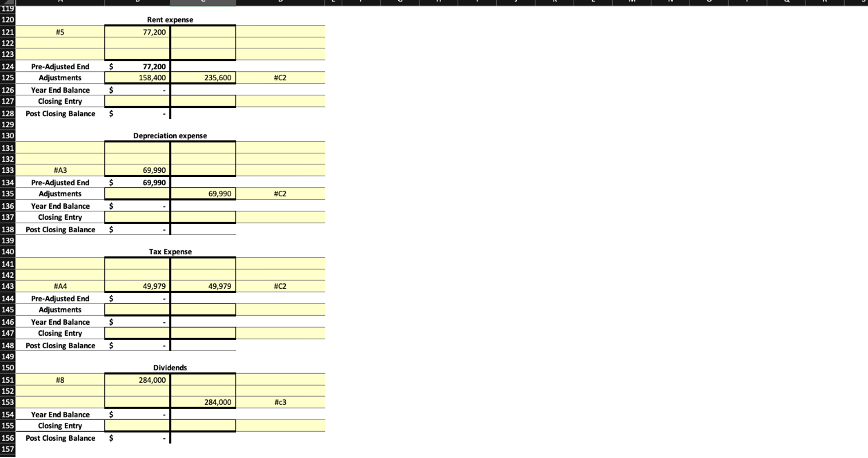

1 The Ledger tracks account balances & activites in T-Accounts. Enter Beginning Balances first! 2 Track ALL transactions in the T-Accounts below. The Cash T-Account has been started for you. 3 4 IMPORTANT: Never Cut and Paste or Drag a number from one cell to another!!! This will lead to 5 a point deduction.. 6 7 - Use the first row of an account for beginning balances and use the proper rows for adjusting and closing entries. 8 9 ASSETS 10 Trx References Trx References 11 Cash 12 306,125 13 5,925 #1 14 15 16 17 18 19 20 21 Ending Balance $ 300,200 22 23 Accounts receivable 24 105,000 25 26 27 Ending Balance $ 105,000 28 29 Supplies 30 11,550 31 32 33 Pre-Adjusted End $ 11,550 34 Adjustments #A1 Supplies Supplies Used 35 Ending Balance $ 11,550 36 37 Prepaid rent 77,200 38 O $ 77,200 39 40 41 42 43 44 Pre-Adjusted End Adjustments Ending Balance $ 77,200 Inventory 3,950 #1 61 LIABILITIES 62 Trx References 63 Accounts payable 64 11,850 65 # #1 5,925 66 67 68 Ending Balance $ 5,925 69 70 Taxes payable 71 72 73 Pre-Adjusted End $ 74 Adjustments 75 Ending Balance $ 76 77 EQUITY 78 Trx References 79 Common stock 80 710,000 81 82 Ending Balance $ 710,000 83 84 Retained earnings 85 446,880 86 Balance $ 446,880 87 Closing Entry #1 88 Closing Entry #2 89 Closing Entry #3 90 Post Closing Balance $ 446,880 91 92 Revenue, Expense, Dividends *NOTE: These Temporary accounts Trx References