I need help with this problem. Also, can you help me with the September 14 part of the journal for the next problem? Thank You!

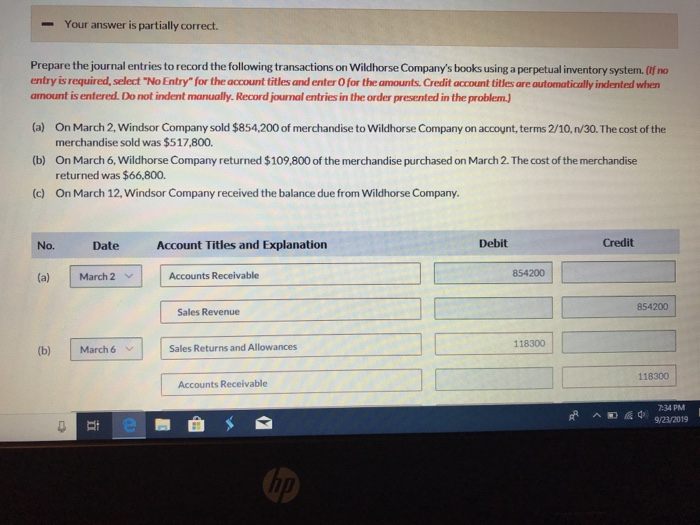

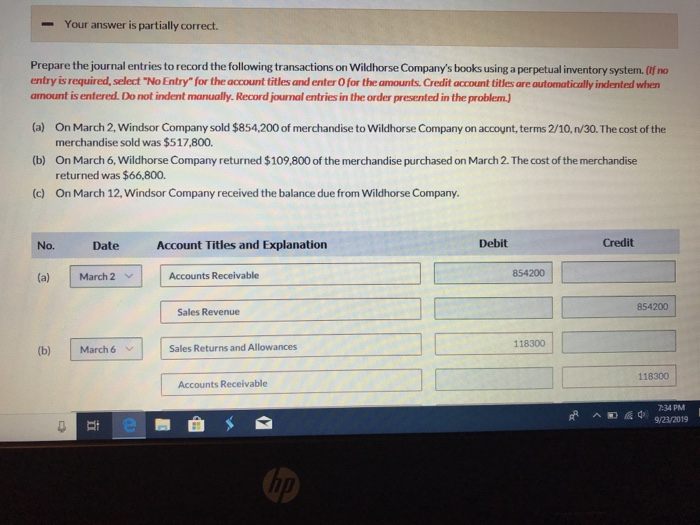

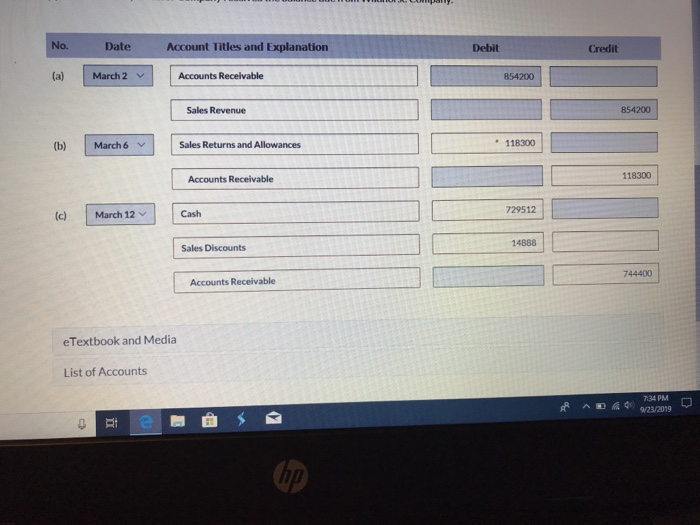

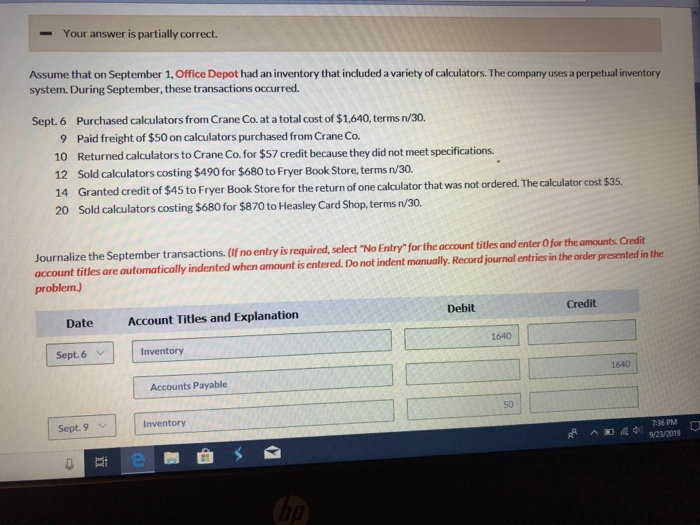

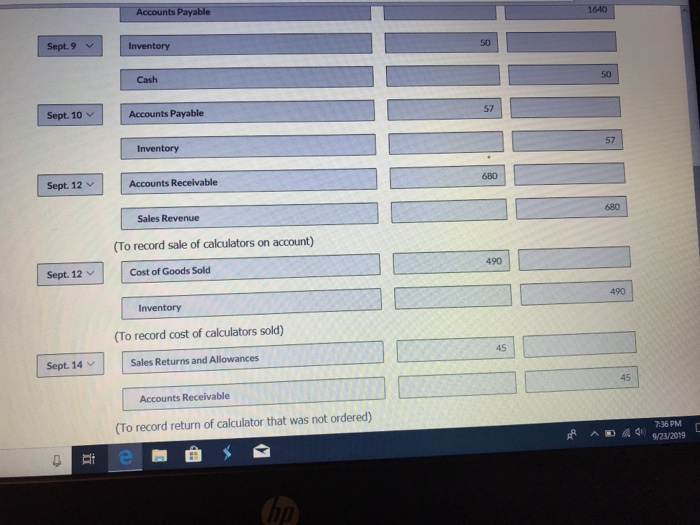

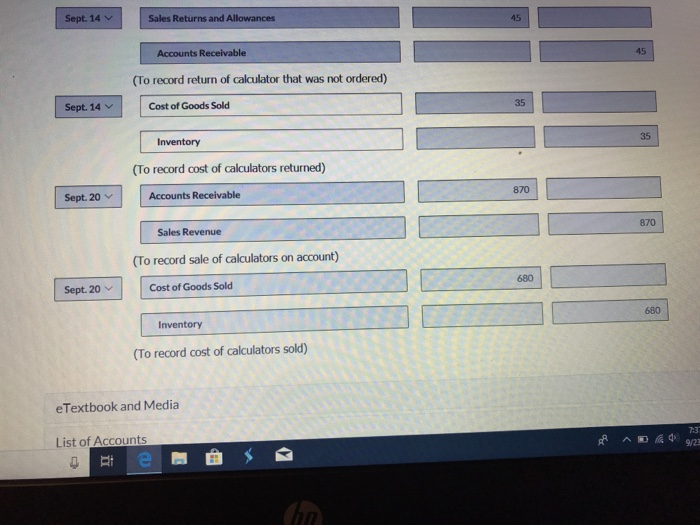

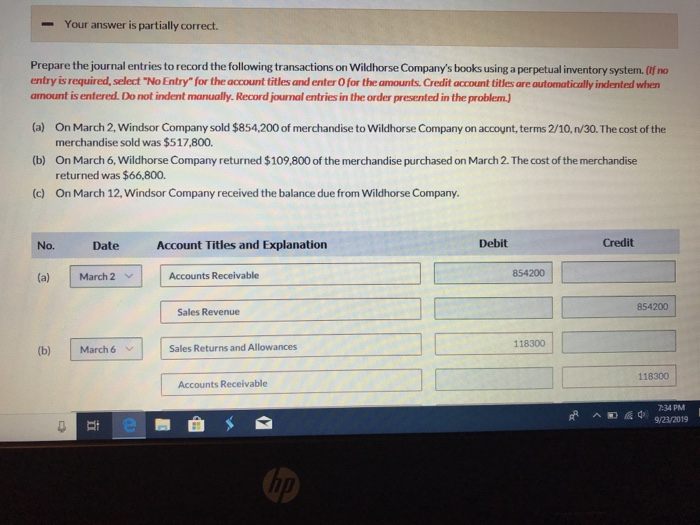

Your answer is partially correct. Prepare the journal entries to record the following transactions on Wildhorse Company's books using a perpetual inventory system. (f no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when armount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Windsor Company sold $854,200 of merchandise to Wildhorse Company on account, terms 2/10, n/30. The cost of the merchandise sold was $517,800. (b) On March 6, Wildhorse Company returned $109,800 of the merchandise purchased on March 2. The cost of the merchandise returned was $66,800. On March 12, Windsor Company received the balance due from Wildhorse Company. (c) Credit Debit Account Titles and Explanation No. Date 854200 March 2 Accounts Receivable (a) 854200 Sales Revenue 118300 March 6 Sales Returns and Allowances (b) 118300 Accounts Receivable 7:34 PM 9/23/2019 hp No. Account Titles and Explanation Date Debit Credit March 2 Accounts Receivable (a) 854200 854200 Sales Revenue 118300 March 6 Sales Returns and Allowances (b) 118300 Accounts Receivable 729512 March 12 Cash (c) 14888 Sales Discounts 744400 Accounts Receivable eTextbook and Media List of Accounts 734 PM 9/23/2019 hp Your answer is partially correct. September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory Assume that on system. During September, these transactions occurred. Sept. 6 Purchased calculators from Crane Co. at a total cost of $1,640, terms n/30. Paid freight of $50 on calculators purchased from Crane Co. Returned calculators to Crane Co. for $57 credit because they did not meet specifications. Sold calculators costing $490 for $680 to Fryer Book Store, terms n/30. Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $35 Sold calculators costing $680 for $870 to Heasley Card Shop, terms n/30. 9 10 12 14 20 Journalize the September transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Credit Debit Account Titles and Explanation Date 1640 Inventory Sept. 6 1640 Accounts Payable 50 Inventory Sept. 9 7:36 PM 9/23/2019 hp Accounts Payable 1640 Sept. 9 Inventory 50 Cash 50 Sept. 10 Accounts Payable 57 Inventory 57 Sept. 12 Accounts Receivable 680 680 Sales Revenue (To record sale of calculators on account) 490 Sept. 12 Cost of Goods Sold 490 Inventory (To record cost of calculators sold) 45 Sales Returns and Allowances Sept. 14 45 Accounts Receivable (To record return of calculator that was not ordered) 7:36 PM 9/23/2019 hp Sept. 14 Sales Returns and Allowances 45 Accounts Receivable 45 (To record return of calculator that was not ordered) Sept. 14 Cost of Goods Sold 35 Inventory 35 (To record cost of calculators returned) Sept. 20 Accounts Receivable 870 Sales Revenue 870 (To record sale of calculators on account) Sept. 20 Cost of Goods Sold 680 680 Inventory (To record cost of calculators sold) eTextbook and Media List of Accounts 7:3 9/23