Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question. Brad's Fish and Chips Restaurant is booming and as such he needs an automated beer pouring machine. He is

I need help with this question.

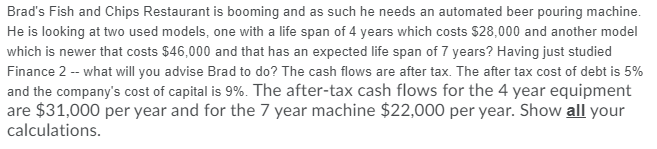

Brad's Fish and Chips Restaurant is booming and as such he needs an automated beer pouring machine. He is looking at two used models, one with a life span of 4 years which costs $28,000 and another model which is newer that costs $46,000 and that has an expected life span of 7 years? Having just studied Finance 2 -- what will you advise Brad to do? The cash flows are after tax. The after tax cost of debt is 5% and the company's cost of capital is 9%. The after-tax cash flows for the 4 year equipment are $31,000 per year and for the 7 year machine $22,000 per year. Show all your calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started