I need help with this question if possible please

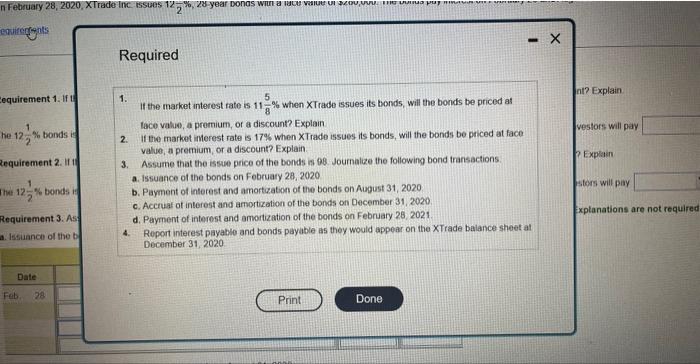

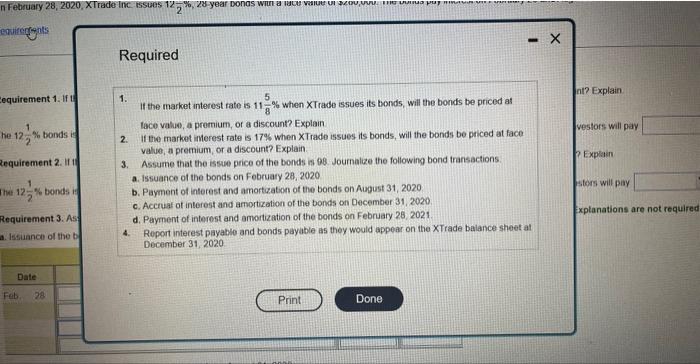

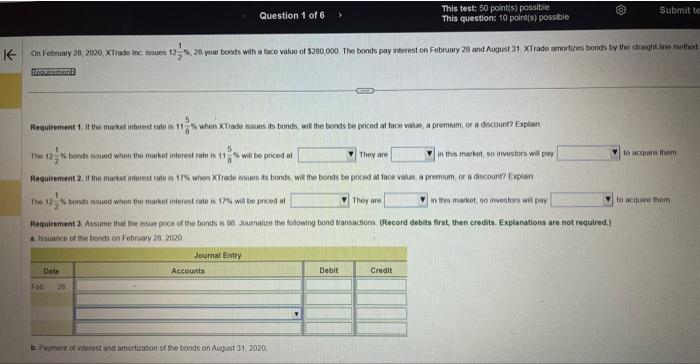

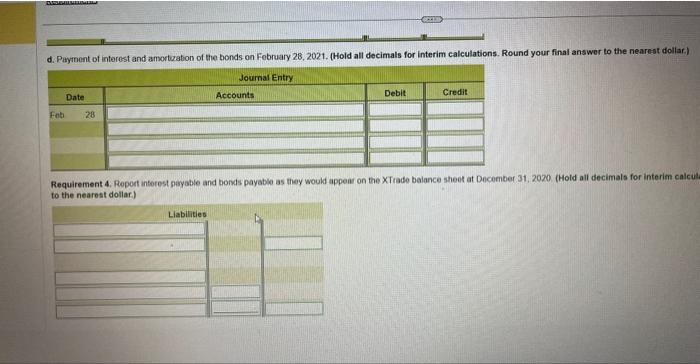

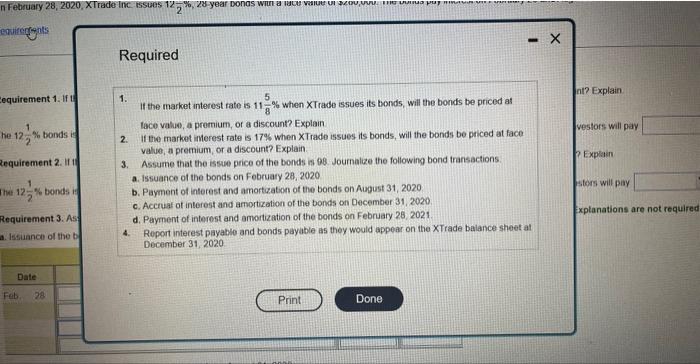

Required 1. If the market interest rate is 1185% when XTrade issues its bonds, will the bonds be priced at tace valus, a promium, of a discount? Explain 2. If tie market interest rate is 17% when XT Trade issues its bonds, will the bonds be priced at face value, a premium, or a discount? Explain 3. Assume that the issue price of the bonds in 08 . Joumalize the following bond transactions. a. Issuance of the bonds on Fobruary 28, 2020 b. Payment of interest and amortaation of the bonds on August 31, 2020 c. Accruat of interest and amorization of the bonts on December 31,2020 . d. Payment of interest and amortization of the bonds on February 28, 2021. xptanations are not required 4. Roport interest payable and bonds payable as they would appear on the XTrade balance sheet at December 31, 2020 They are in thes makekt, so investors wis por to accucire them The 1221 bonds nsued weten the maket interest rate is 17% will bo priced at They are in thes makat, 60 invostors will pay to actiate thents Requirement 3. Assume that the issize prike of the bonits is 96 Jounalce the toloaing bond tansachons (Fecord debits first, then crecits. Explanations are not required.) -. issuance of the bonds on Fotruary 20,2020 b. Payment of interest and amoxtzabon of the bonds on August 31, 2020. Requirement 4, Report interest peysable and bonds payabie as they woukd appen on the XTrade balance shent at Dncember. 31,2020 (Hold all decimals for interim calcu to the nearest dollar) Required 1. If the market interest rate is 1185% when XTrade issues its bonds, will the bonds be priced at tace valus, a promium, of a discount? Explain 2. If tie market interest rate is 17% when XT Trade issues its bonds, will the bonds be priced at face value, a premium, or a discount? Explain 3. Assume that the issue price of the bonds in 08 . Joumalize the following bond transactions. a. Issuance of the bonds on Fobruary 28, 2020 b. Payment of interest and amortaation of the bonds on August 31, 2020 c. Accruat of interest and amorization of the bonts on December 31,2020 . d. Payment of interest and amortization of the bonds on February 28, 2021. xptanations are not required 4. Roport interest payable and bonds payable as they would appear on the XTrade balance sheet at December 31, 2020 They are in thes makekt, so investors wis por to accucire them The 1221 bonds nsued weten the maket interest rate is 17% will bo priced at They are in thes makat, 60 invostors will pay to actiate thents Requirement 3. Assume that the issize prike of the bonits is 96 Jounalce the toloaing bond tansachons (Fecord debits first, then crecits. Explanations are not required.) -. issuance of the bonds on Fotruary 20,2020 b. Payment of interest and amoxtzabon of the bonds on August 31, 2020. Requirement 4, Report interest peysable and bonds payabie as they woukd appen on the XTrade balance shent at Dncember. 31,2020 (Hold all decimals for interim calcu to the nearest dollar)