Question

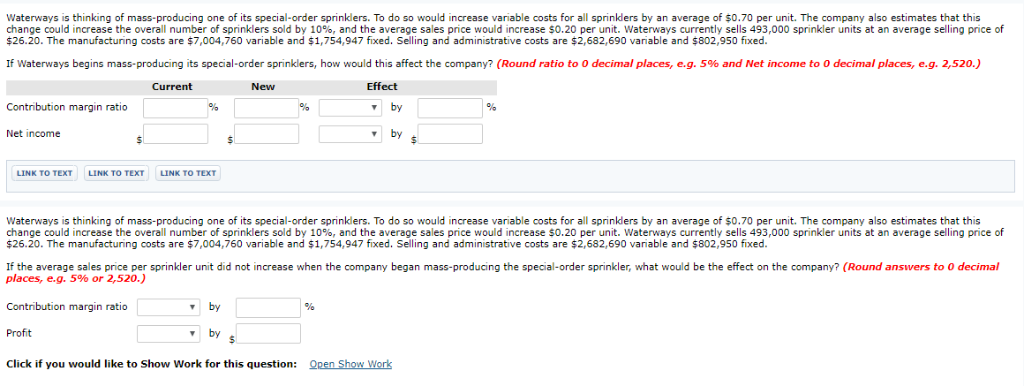

I need help with this question. Please make sure to type the answer in the exact form that I shared. Not hand written.It's all just

I need help with this question. Please make sure to type the answer in the exact form that I shared. Not hand written.It's all just one question. I'll make sure to rate the work. Thank you so much.

The Vice President for Sales and Marketing at Waterways Corporation is planning for production needs to meet sales demand in the coming year. He is also trying to determine how the companys profits might be increased in the coming year. This problem asks you to use cost-volume-profit concepts to help Waterways understand contribution margins of some of its products and decide whether to mass-produce any of them. Waterways markets a simple water control and timer that it mass-produces. Last year, the company sold 657,000 units at an average selling price of $4.40 per unit. The variable costs were $1,734,480, and the fixed costs were $809,424.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started