I need help with this Question. Thank You!

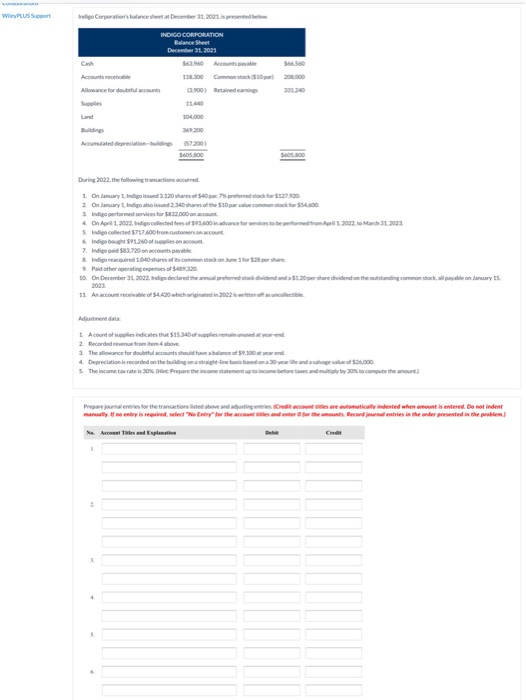

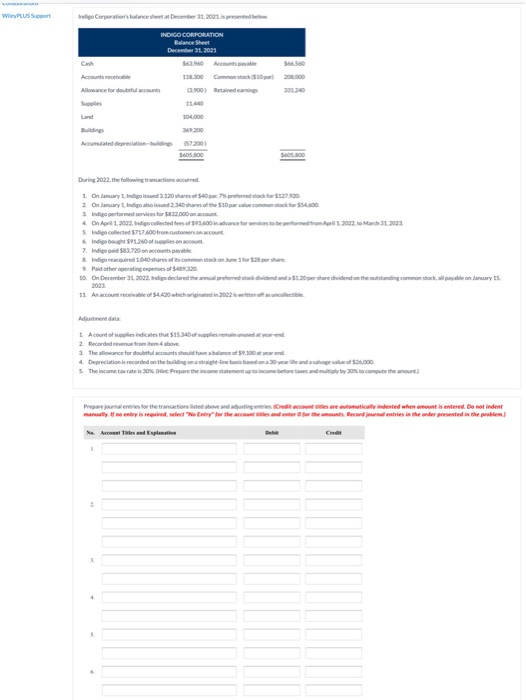

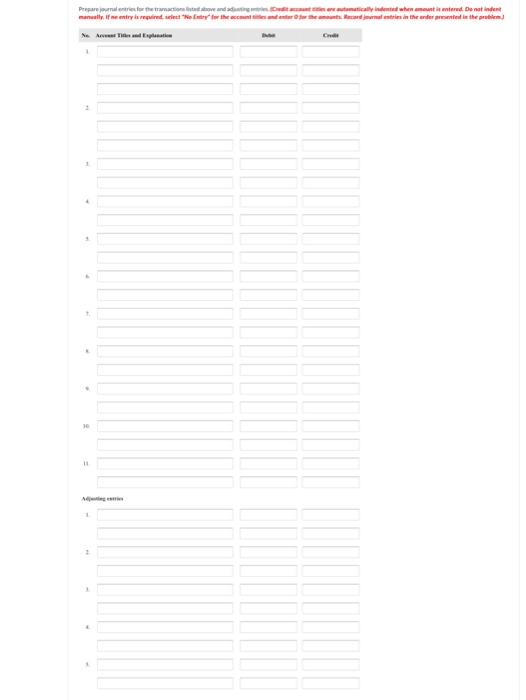

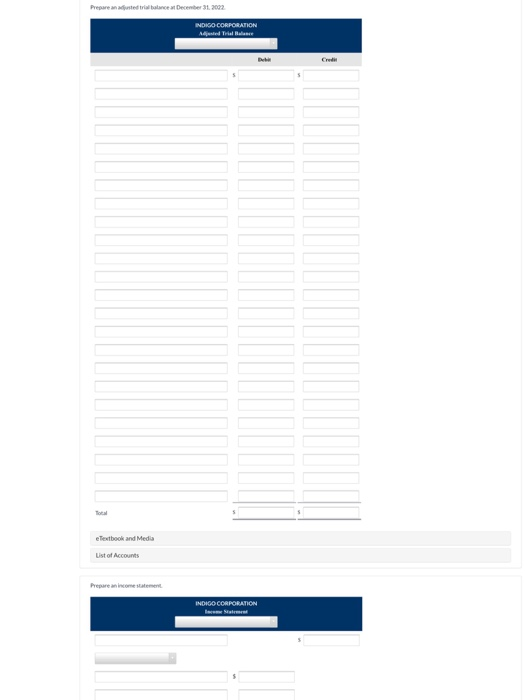

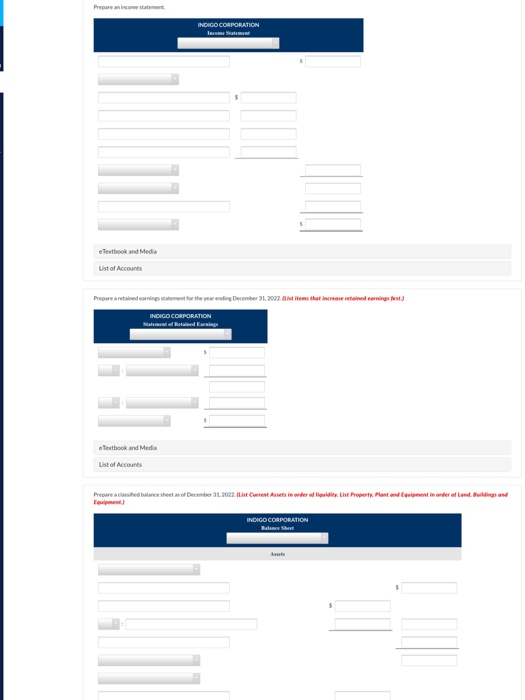

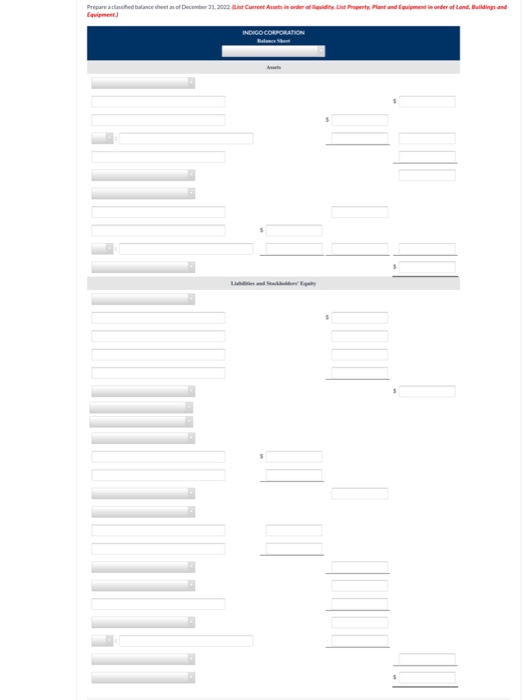

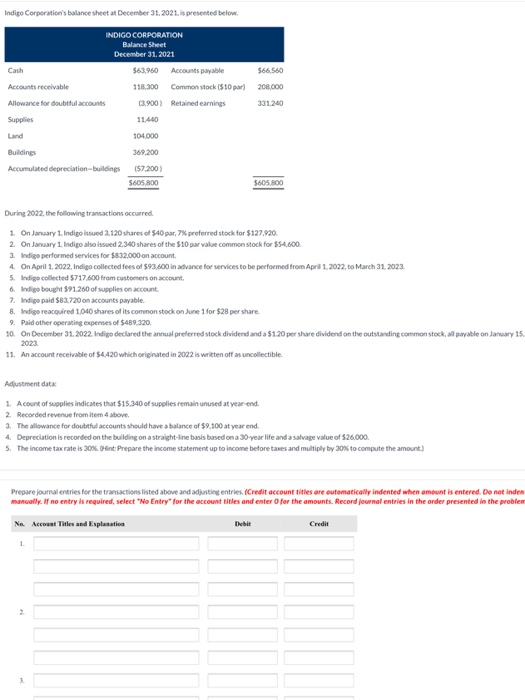

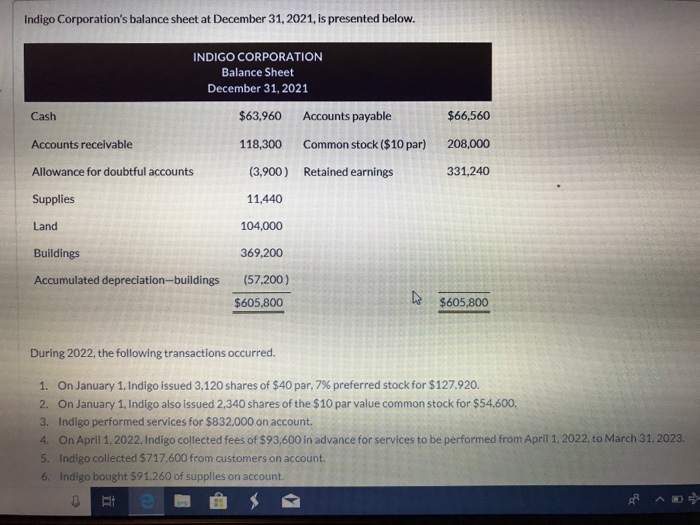

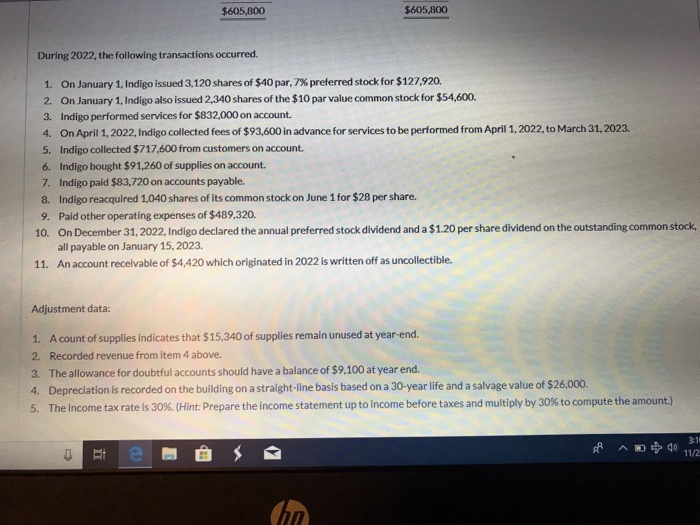

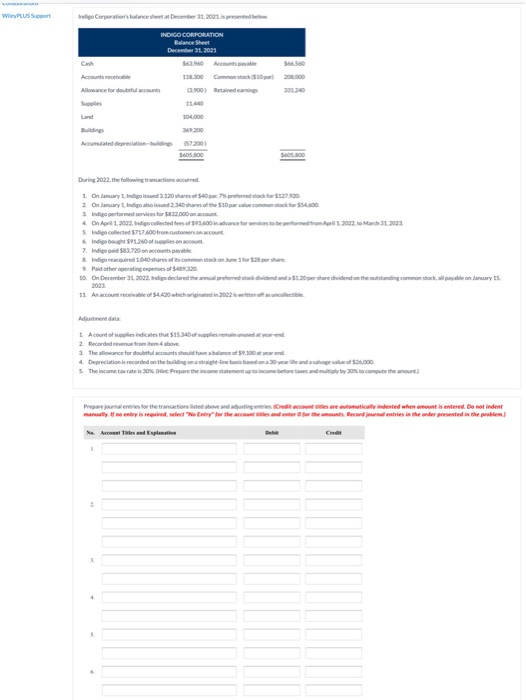

WilePLUS Support Indigo Corpora t e 1.2001 INDIGO CORPORATION Balance Sheet December 31, 2021 56360 Account 104.000 During 2022. the following tractions occurred 5 12230 o r4500 1 Only Indigo 3.12040 2. On January 1 Indioshow 2.340 the w Indigo performedvice for $132.000 4. On April 1. 2002. In collected of 93.40 Indige collected 577. frostomers ano s . 1 2022 March 31.2003 for share 7 Indio od 83.720 counts payable & indigo record 164 shares of common stone Pald otherwipes of $49320 10. On December 31, 2002. Indiec i ded the common stock, wil plenary 15 11. An outre of $4420 which are in 2002 w o ce Adjustment 4 The lowance for downl o Depreciation corded on the building on l The income tax rates 30%. Prepare the income ine ad a to come before n d and m $36.000 compute the amount y by Prepare journal entries or the transactions listed above n ge many is required. select "Cry for thes e d and are automatically indeed when amount is entered. Do not indent the amounts Recorde rs in the order presented in the problem Prepare journal manually. If ne entry for the transactions above anda wired. The Entry for the soun e all indend when amount interd. De natinden the amounts Record journals in the order presented in the problem d o f NA TE Prepare sted tr e at December 31, 2002 INDIGO CORPORATION eTextbook and Media Ust of Accounts Pre INDIGO CORPORATION INDIGO CORPORATION Ust of Accounts Prepare a retinedingsta r the ending December 31, 2002. list items that i s inderings INDIGO CORPORATION Statement of Retained Euring eTextbook and Media Prepare a classified balance sheets of December 31, 2022 ist Current Assets in der of die List Property Plantand e r INICO CORPORATION Indigo Corporation's balance sheet at December 31, 2021. is presented below INDIGO CORPORATION Balance Sheet December 31, 2021 Cash Accounts receivable $66,560 208.000 331.240 Allowance for doubtfuccounts Supplies $63.960 Accounts payable 118,300 Common stock $10 par) (3,900) Retained earnings 11.440 104.000 369.200 57.200) 5605,800 Land Buildings Accumulated depreciation-buildings During 2022, the following transactions occurred 1. On January 1. Indigo issued 3.120 shares of $40 par, preferred stock for $127.920 2. On January 1, Indigo also issued 2,340 shares of the $10 par value common stock for $54.600. 3. Indige performed services for $832.000 on account 4. On April 1, 2022, Indigo collected fees of $93.600 in advance for services to be performed from April 1.2022. to March 31, 2023 5. Indige collected $717600 From customers on account 6. Indige bought $91.260 of supplies on account 7. Indice paid $83.720 on accounts payable. 8. Indigo reacquired 1.040 shares of its common stock on June 1 for $28 per share 9. Paid other operating expenses of $489.320 10. On December 31, 2022. Indigo declared the annual preferred stock dividend and a $1.20 per share dividend on the outstanding common stock, all payable on January 11. An account receivable of $4420 which originated in 2022 is written off as uncollectible. Adjustment dat 1. A count of supplies indicates that $15.340 of supplies remain unused at year-end. 2. Recorded revenue from item 4 above. 1. The allowance for doubt accounts should have a balance of $9.100 at year end. 4 Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $26,000. 5. The income tax rate is 30%Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) Prepare journal entries for the transactions listed above and adjusting entries (Credit account titles are automatically indented when amount is entered. Do not inden manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem No. Access The Explanatica Dehir Indigo Corporation's balance sheet at December 31, 2021, is presented below. INDIGO CORPORATION Balance Sheet December 31, 2021 Cash $63,960 Accounts payable $66,560 Accounts receivable 118,300 Common stock ($10 par) 208,000 Allowance for doubtful accounts (3,900) Retained earnings 331,240 Supplies 11,440 Land 104,000 Buildings 369,200 Accumulated depreciation--buildings (57,200) $605,800 $605,800 During 2022, the following transactions occurred. 1. On January 1, Indigo issued 3,120 shares of $40 par, 7% preferred stock for $127.920. 2. On January 1, Indigo also issued 2,340 shares of the $10 par value common stock for $54,600. 3. Indigo performed services for $832,000 on account. 4. On April 1, 2022. Indigo collected fees of $93,600 in advance for services to be performed from April 1.2022. to March 31, 2023 5. Indigo collected $717.600 from customers on account. 6. Indigo bought $91.260 of supplies on account AD $605,800 $605,800 During 2022, the following transactions occurred. 1. On January 1, Indigo issued 3,120 shares of $40 par, 7% preferred stock for $127.920. 2. On January 1, Indigo also issued 2,340 shares of the $10 par value common stock for $54,600. 3. Indigo performed services for $832,000 on account. 4. On April 1, 2022, Indigo collected fees of $93,600 in advance for services to be performed from April 1, 2022, to March 31, 2023. 5. Indigo collected $717,600 from customers on account. 6. Indigo bought $91,260 of supplies on account. 7. Indigo paid $83,720 on accounts payable. 8. Indigo reacquired 1,040 shares of its common stock on June 1 for $28 per share. 9. Paid other operating expenses of $489,320. 10. On December 31, 2022, Indigo declared the annual preferred stock dividend and a $1.20 per share dividend on the outstanding common stock, all payable on January 15, 2023. 11. An account receivable of $4,420 which originated in 2022 is written off as uncollectible. Adjustment data: 1. A count of supplies indicates that $15,340 of supplies remain unused at year-end. 2. Recorded revenue from item 4 above. 3. The allowance for doubtful accounts should have a balance of $9,100 at year end. 4. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $26,000. 5. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) A A 41172