Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question Thank you! ... Young Foundry uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on

I need help with this question

Thank you!

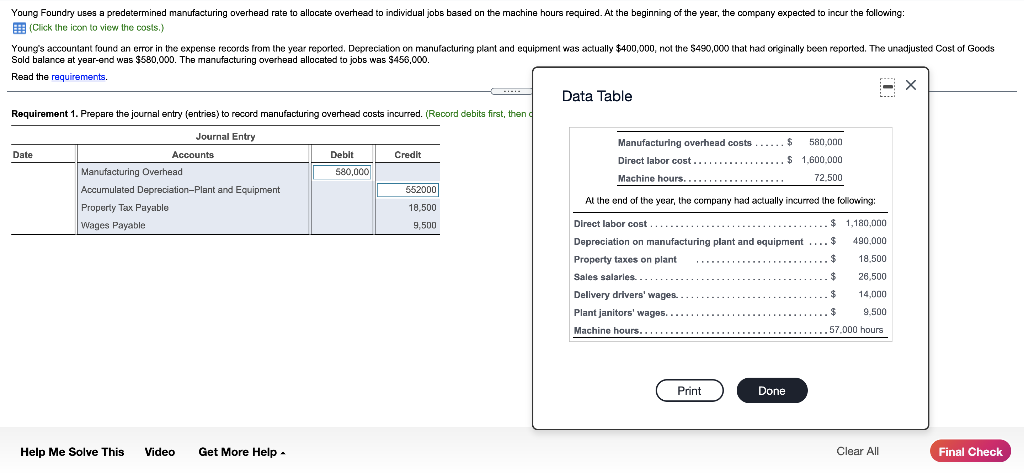

... Young Foundry uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning of the year, the company expected to incur the following: (Click the icon to view the costs.) Young's accountant found an error in the expense records from the year reported. Depreciation on manufacturing plant and equipment was actually $400,000, not the $490,000 that had originally been reported. The unadjusted Cost of Goods Sold balance at year-end was $580,000. The manufacturing overhead allocated to jobs was $456,000. Read the requirements. Data Table Requirement 1. Prepare the journal entry (entries) to record manufacturing overhead costs incurred. (Record debits first, then Journal Entry Manufacturing overhead costs.... $ 580,000 Date Accounts Debit Credit Direct labor cost..... $ 1.600.000 Manufacturing Overhead 580,000 Machine hours.... . 72.500 Accumulated Depreciation-Plant and Equipment 552000 Property Tax Payable 18.500 At the end of the year, the company had actually incurred the following: Wages Payable 9,500 Direct labor cost ............. $ 1.180,000 Depreciation on manufacturing plant and equipment .... $ 490,000 Property taxes on plant $ 18,500 Sales salaries...... $ 26,500 Delivery drivers' wages. $ 14,000 Plant janitors' wages.... $ 9.500 Machine hours... 57.000 hours Print Done Help Me Solve This Video Get More Help Clear All Final Check Final CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started