Answered step by step

Verified Expert Solution

Question

1 Approved Answer

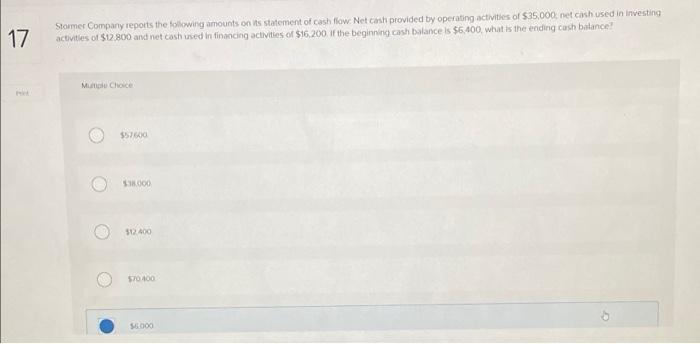

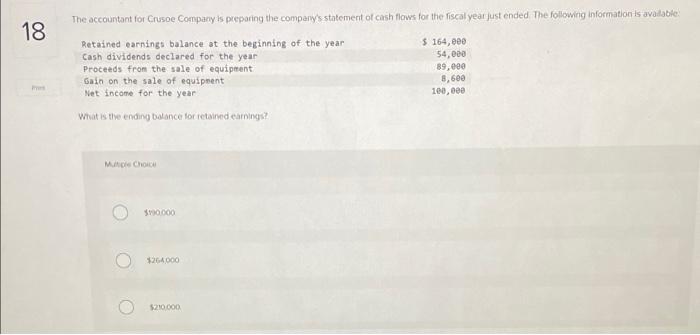

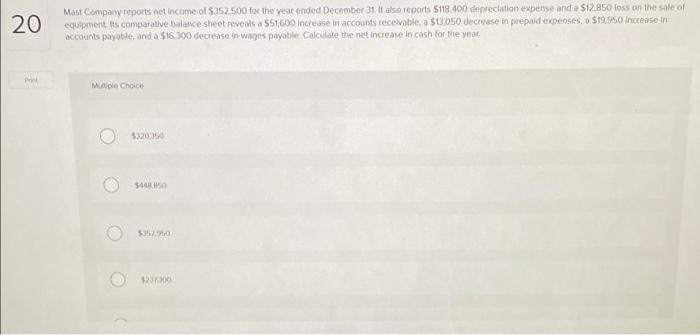

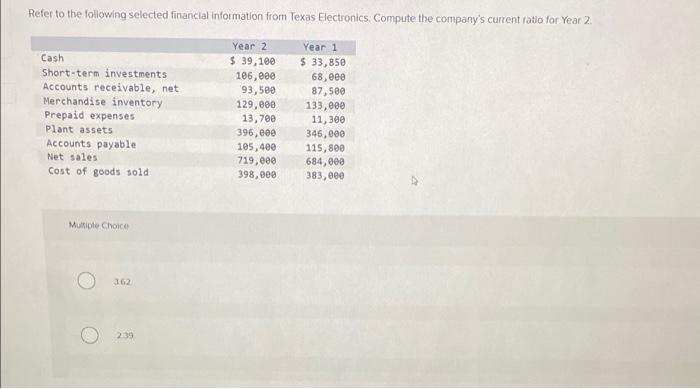

i need help with this questions please !thank you so much! 17 Stormer Company reports the following amounts on its statement of cash flow. Net

i need help with this questions please !thank you so much!

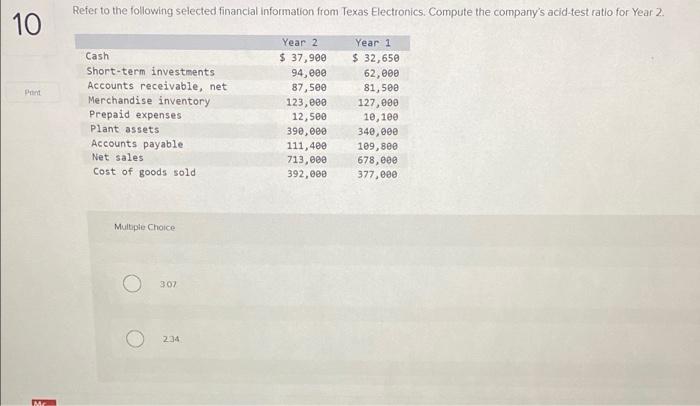

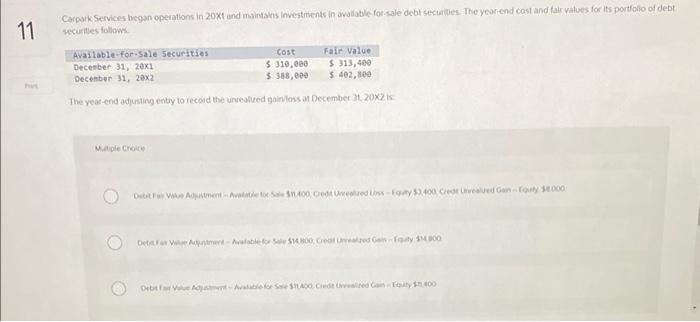

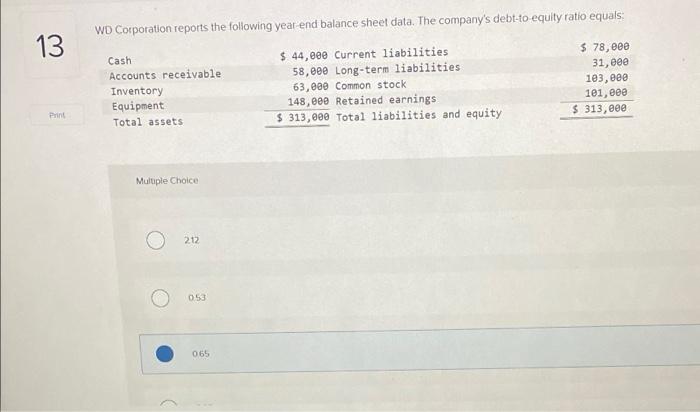

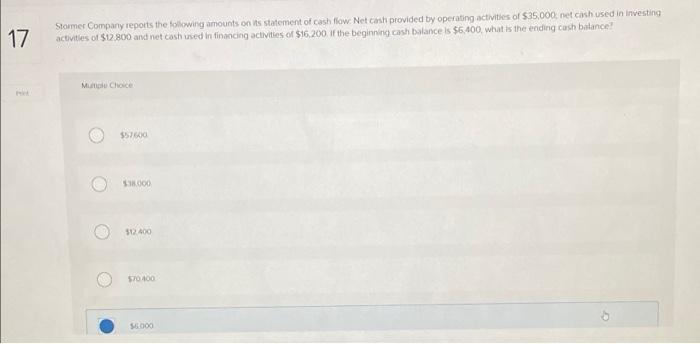

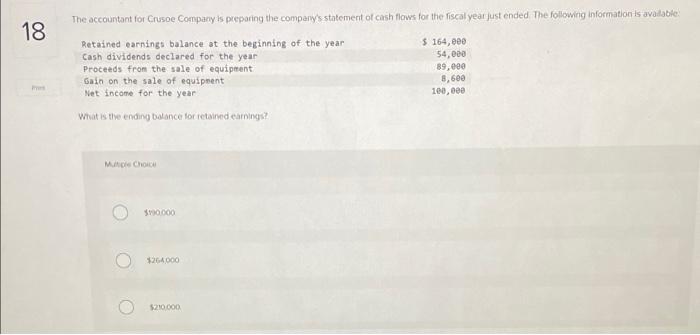

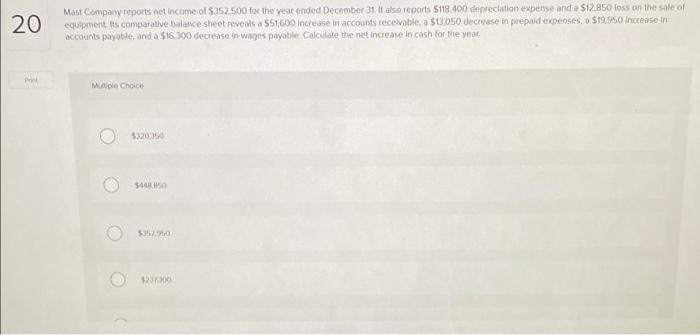

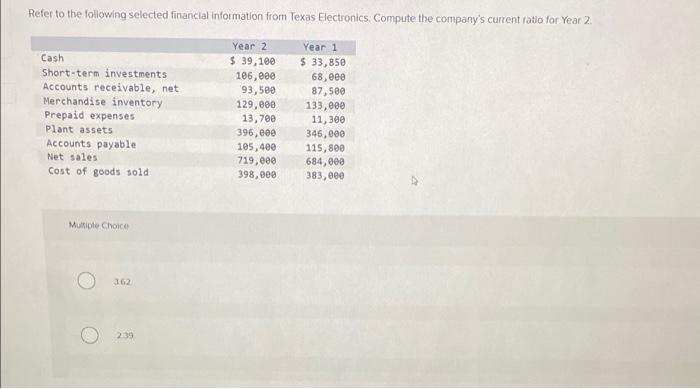

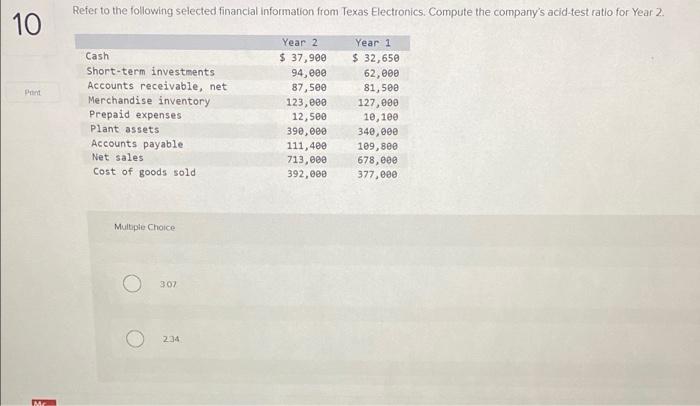

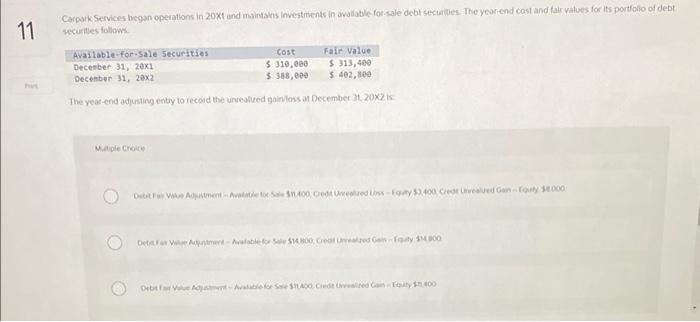

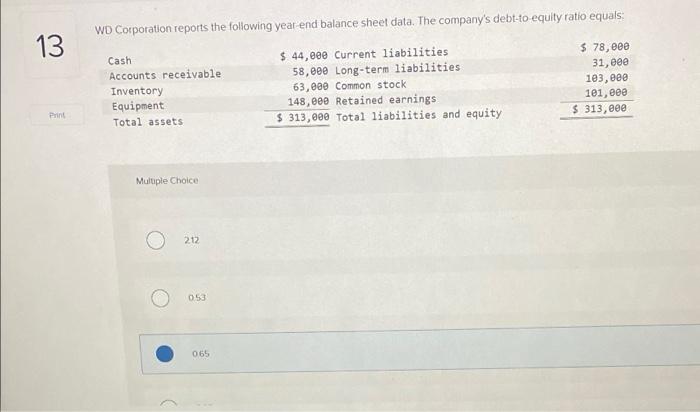

17 Stormer Company reports the following amounts on its statement of cash flow. Net cash provided by operating activities of $35.000 net cash used in investing activities of $12.800 and net cash used in financing activities of $16.200 if the beginning cash balance is $6,400, what is the ending cash balance! M Choc $57500 550.000 312,400 570400 000 The accountant for Crusoe Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available 18 Retained earning balance at the beginning of the year Cash dividends declared for the year Proceeds from the sale of equipment Gain on the sale of equipent Net income for the year What is the ending balance for retained earnings? $164,00 54,000 89,000 8,6ee 100,000 Me Choice 300.000 o 264000 5210 000 20 Mast Company reports net income of $352,500 for the year ended December 31. It also reports S118 400 depreciation expense and a $12.850 loss on the sale of equipment is comparative balance sheet reveals a $51600 increase in accounts receivable, a $13.050 decrease in prepaid expenses, a $19.950 Increase in accounts payable, and a $16.300 decrease in wages payable Calculate the net increase in cash for the year. Mic Choice $320.350 SA 350 33130 Refer to the following selected financial information from Texas Electronics Compute the company's current ratio for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 $ 39,100 106,000 93,500 129,00 13,700 396, eee 105,400 719,000 398,000 Year 1 $ 33,850 68, 87,500 133,00 11,300 346,000 115,800 684,000 383,000 Multiple Choice 362 239 Refer to the following selected financial information from Texas Electronics. Compute the company's acid-test ratio for Year 2. 10 Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 $ 37,900 94,000 87,500 123,000 12,500 390,000 111,400 713, eee 392,000 Year 1 $ 32,650 62 , 81,500 127,000 10,100 340, eee 109,800 678,000 377.ee Multiple Choice 307 234 M 11 Carpark Services began operations in 20Xt and maintains Investments in available for sale debt securities. The year end cost and fair values for its portfolio of debt securities follow Available for sale Securities December 31, 201 December 31, 20x2 Cost $ 310,000 $388,000 Fair Value $ 313,400 $ 402,800 The year end adjusting entry to record the realized in loss of December 2002 Mile Cro Debele 600 et led to y52.600 Created on 1000 Detrolable to Created DEVASTADO Cited: 400 WD Corporation reports the following year end balance sheet data. The company's debt-to equity ratio equals. 13 Cash Accounts receivable Inventory Equipment Total assets $ 44,eee Current liabilities 58,000 Long-term liabilities 63,000 Common stock 148,eee Retained earnings $ 313,000 Total liabilities and equity $ 78, eee 31, eee 103, eee 101, eee $ 313,000 Print Multiple Choice 212 053 065

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started