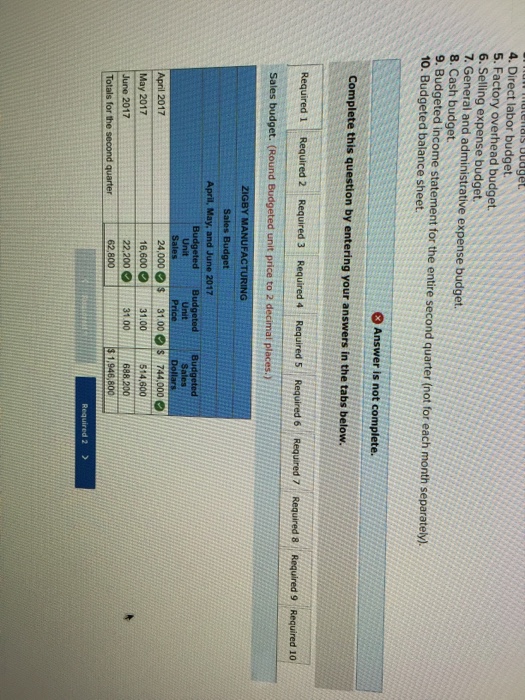

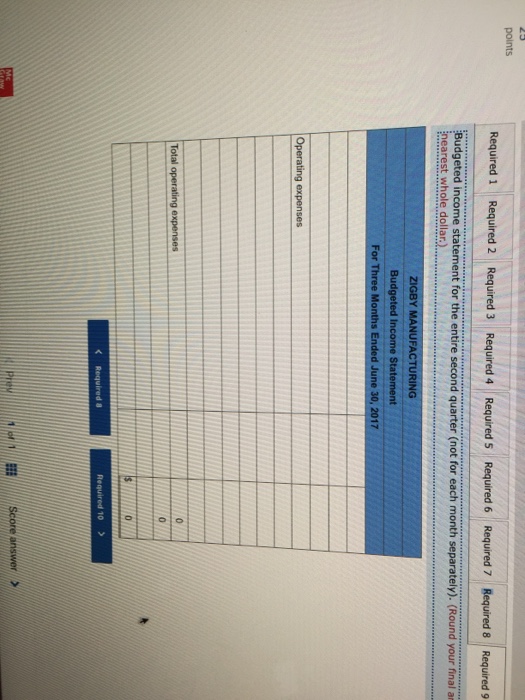

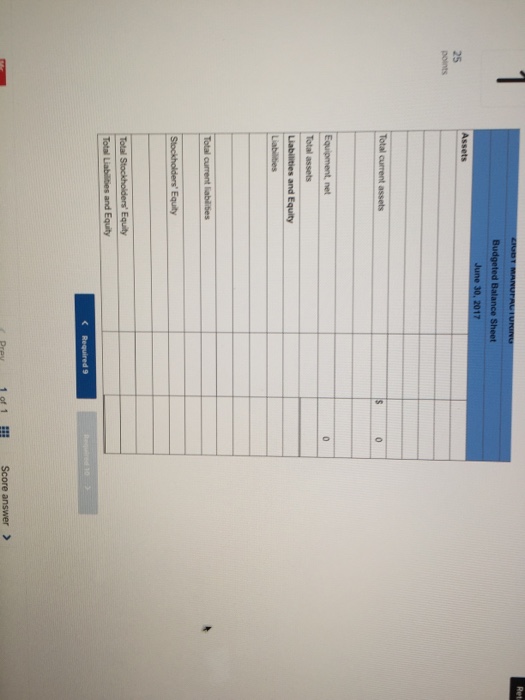

I need help wth sections 8,9, and 10.

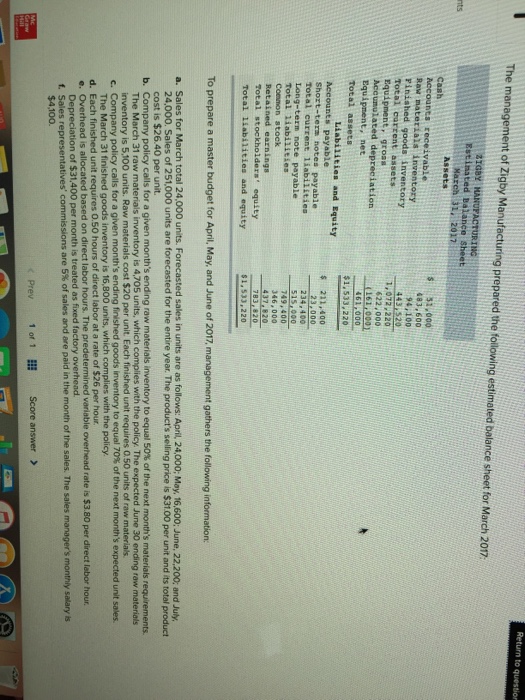

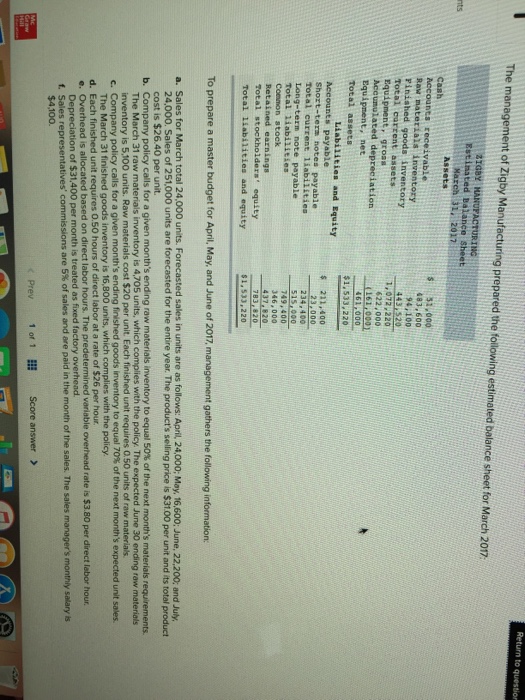

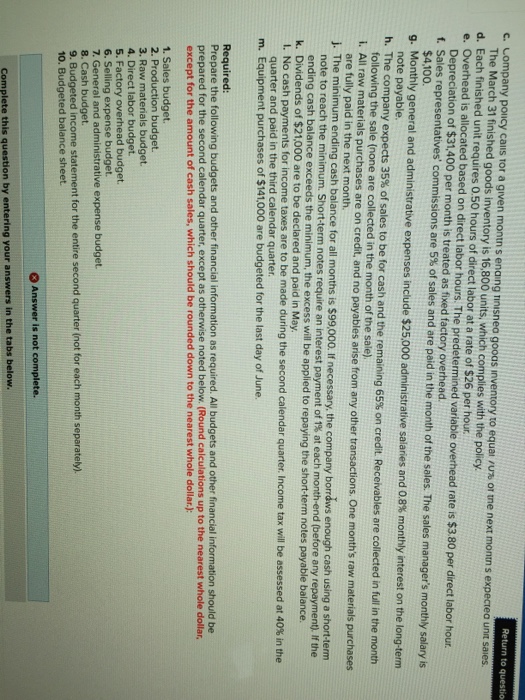

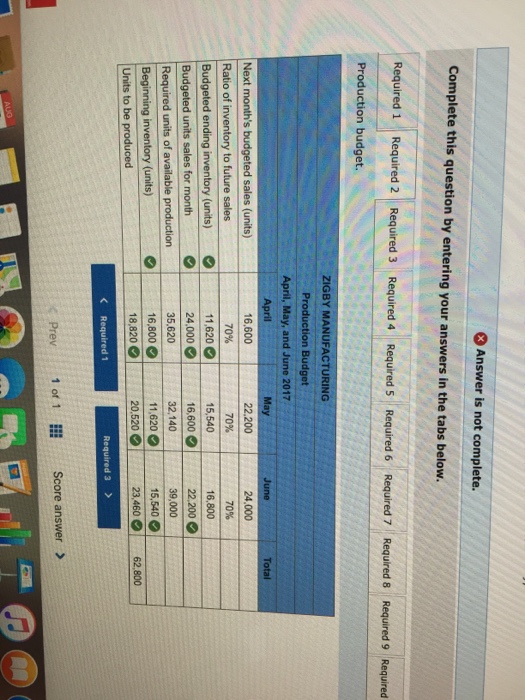

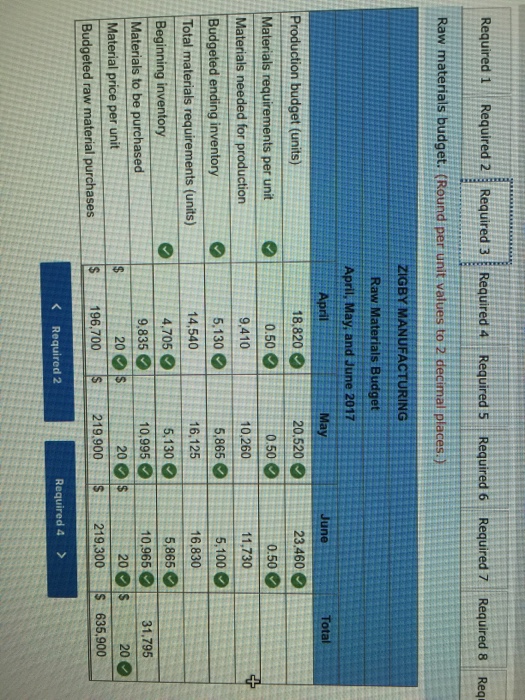

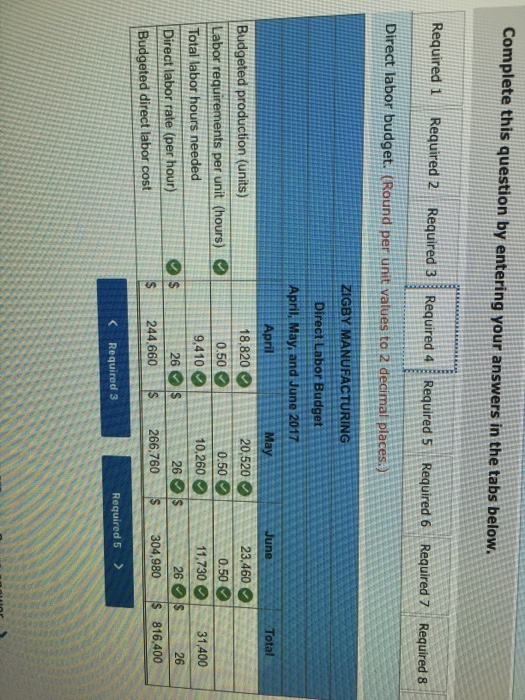

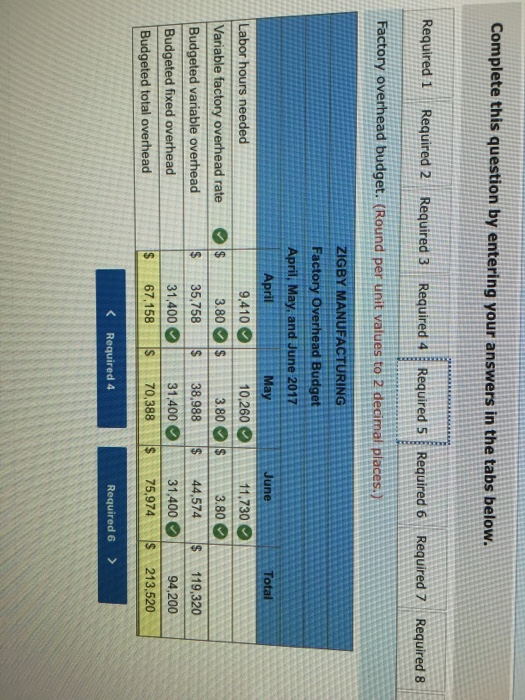

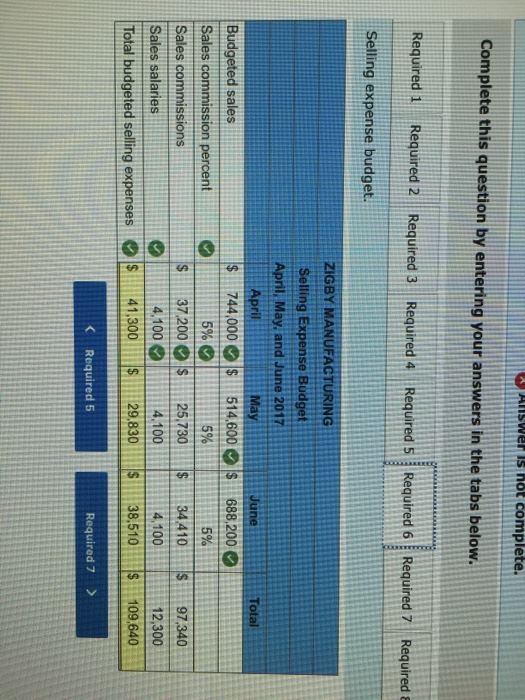

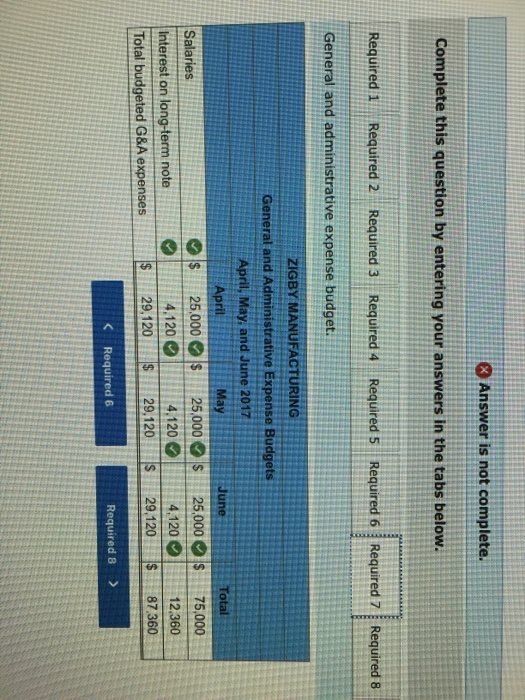

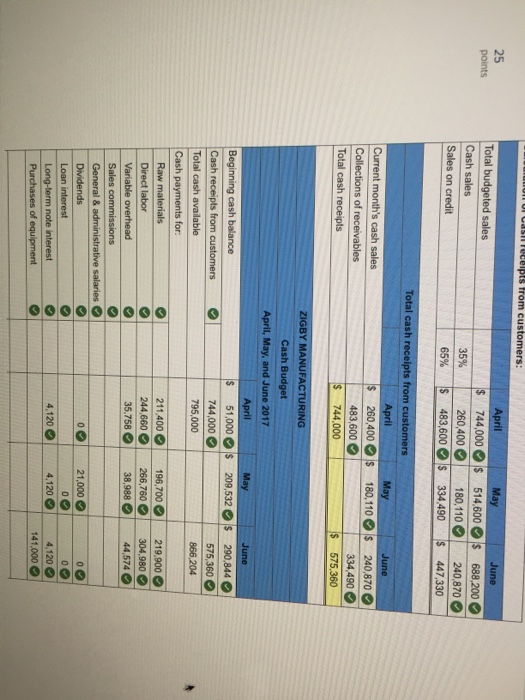

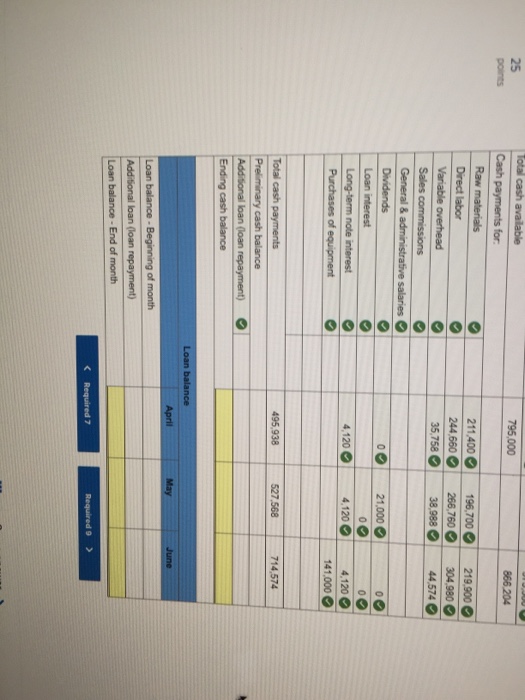

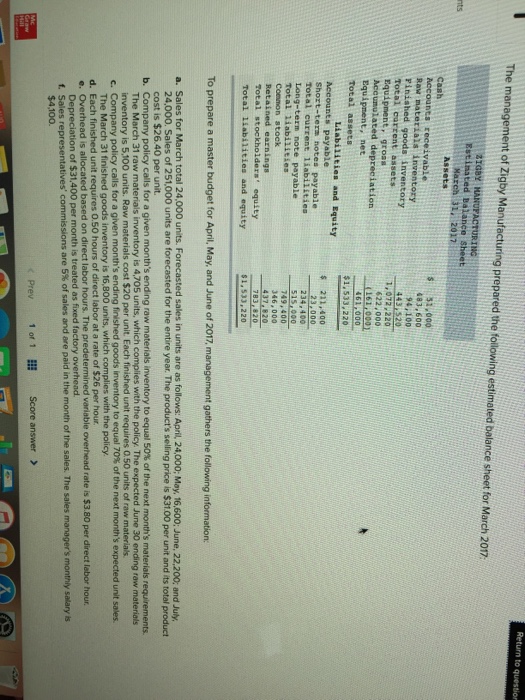

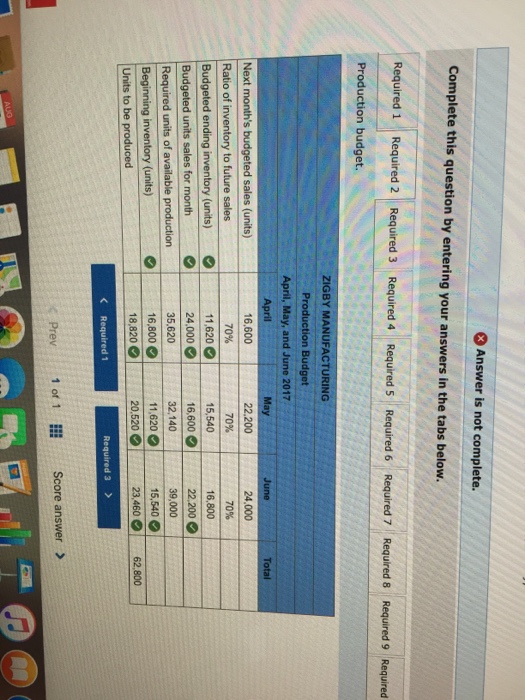

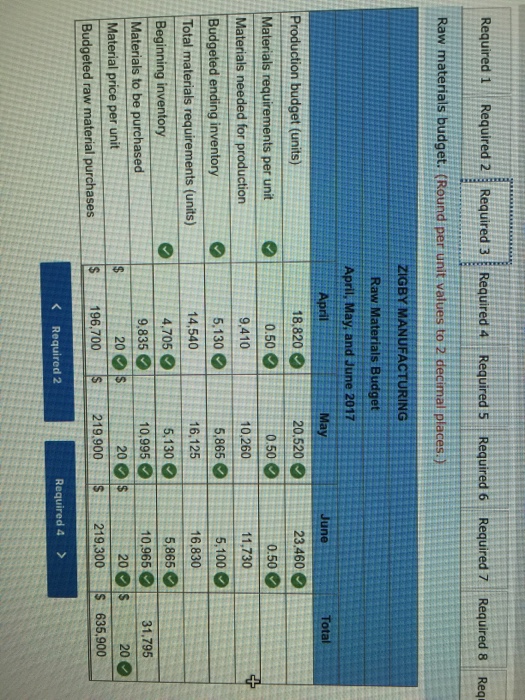

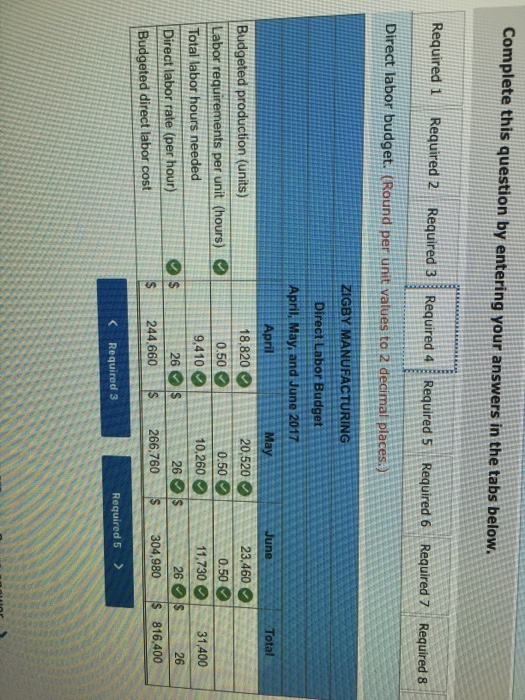

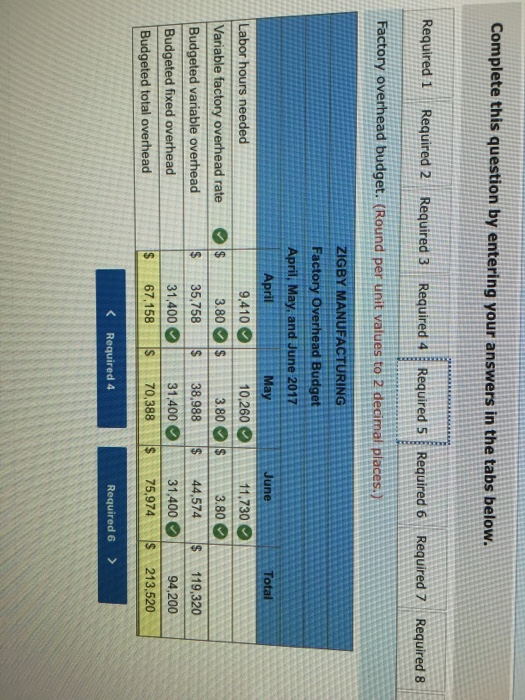

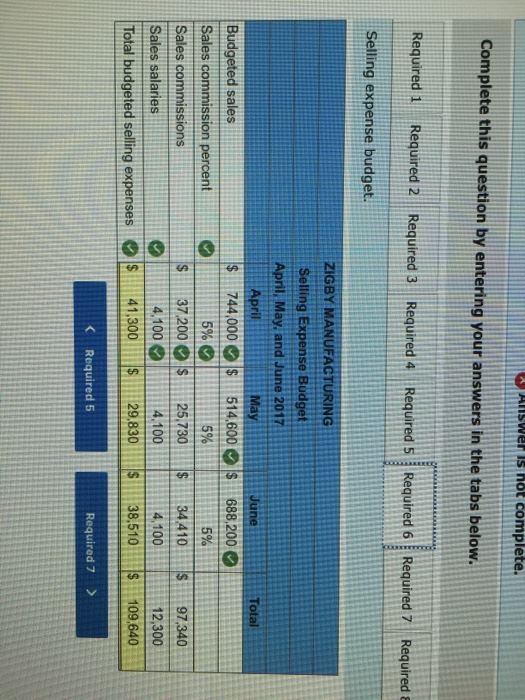

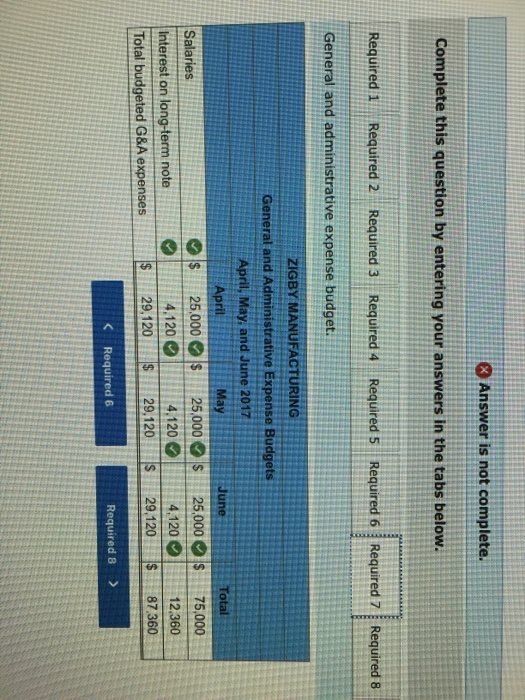

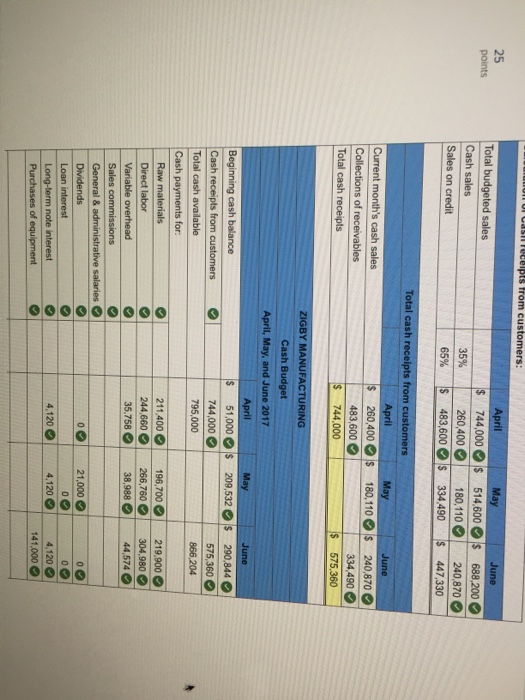

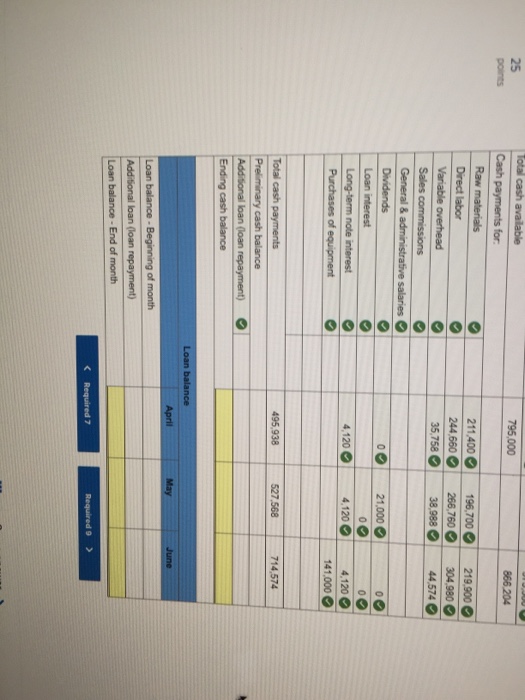

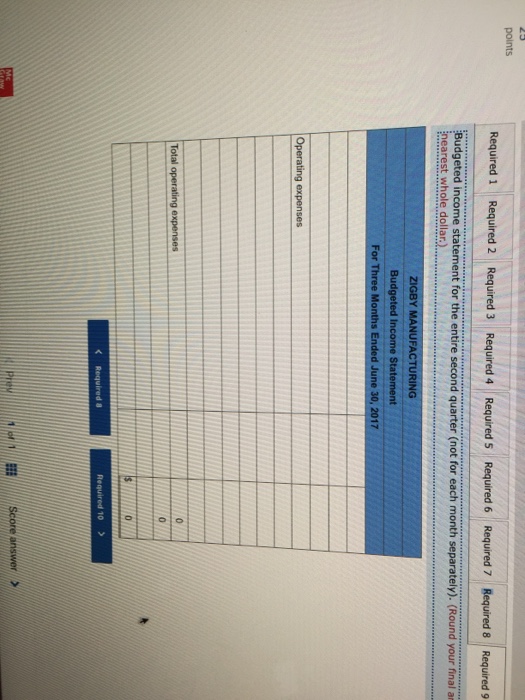

Return to question The management of Zigby Manufacturing prepared the foilowing estimated balance sheet for March 2017 Sheet nts March 31, 2017 ; 3,00d 483,600 94,100 inventory Pinished goods inventory Total carrent assets Equipment, groas 1,072,220 622,000 Equipment,net Total assets $1,533,220 Liabilities and Equity Short-ters notes payable total current liabilities 211,400 23,000 234,400 515,000 Total 14abilities Common stock 46,000 Total stockholders' equity Total liabilities and equity $1,533,220 To prepare a master budget for April, May, and June of 2017, management gathers the following information a. Sales for March total 24,000 units. Forecasted sales in units are as follows: April, 24,000; May, 16,600; June, 22,200, and July 24,000. Sales of 251,000 units are forecasted for the entire year. The product's selling price is $31.00 per unit and its total product cost is $26.40 per unit b. Com pany policy calls for a given month's ending raw materials inventory to equal 50% of the next month's materials requirements. The March 31 raw materials inventory is 4,705 units, which complies with the policy. The expected June 30 ending raw materials inventory is 5,100 units. Raw materials cost $20 per unit. Each finished unit requires 0.50 units of raw materials c Company policy calls for a given month's ending finished goods inventory to equal 70% of the next month's expected unit sales d. Each finished unit requires 0.50 hours of direct labor at a rate of $26 per hour e. Overhead is allocated based on direct labor hours. The predetermined variable overhead rate is $3.80 per direct labor hour t. is 16,800 units, which complies with the policy The March 31 finished goods i h is treated as fixed factory overhead Depreciation of $31,400 per mont sales representatives' commissions are 5% of sales and a $4,100. are paid in the month of the sales. The sales manager's monthly salary is c Prev 1 of1l Score answer > Return to question The management of Zigby Manufacturing prepared the foilowing estimated balance sheet for March 2017 Sheet nts March 31, 2017 ; 3,00d 483,600 94,100 inventory Pinished goods inventory Total carrent assets Equipment, groas 1,072,220 622,000 Equipment,net Total assets $1,533,220 Liabilities and Equity Short-ters notes payable total current liabilities 211,400 23,000 234,400 515,000 Total 14abilities Common stock 46,000 Total stockholders' equity Total liabilities and equity $1,533,220 To prepare a master budget for April, May, and June of 2017, management gathers the following information a. Sales for March total 24,000 units. Forecasted sales in units are as follows: April, 24,000; May, 16,600; June, 22,200, and July 24,000. Sales of 251,000 units are forecasted for the entire year. The product's selling price is $31.00 per unit and its total product cost is $26.40 per unit b. Com pany policy calls for a given month's ending raw materials inventory to equal 50% of the next month's materials requirements. The March 31 raw materials inventory is 4,705 units, which complies with the policy. The expected June 30 ending raw materials inventory is 5,100 units. Raw materials cost $20 per unit. Each finished unit requires 0.50 units of raw materials c Company policy calls for a given month's ending finished goods inventory to equal 70% of the next month's expected unit sales d. Each finished unit requires 0.50 hours of direct labor at a rate of $26 per hour e. Overhead is allocated based on direct labor hours. The predetermined variable overhead rate is $3.80 per direct labor hour t. is 16,800 units, which complies with the policy The March 31 finished goods i h is treated as fixed factory overhead Depreciation of $31,400 per mont sales representatives' commissions are 5% of sales and a $4,100. are paid in the month of the sales. The sales manager's monthly salary is c Prev 1 of1l Score answer >