i need it asappppp plzzzzz and thank u

my company is "ACLOA CORPORATION"

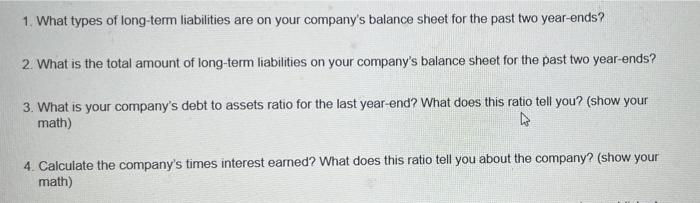

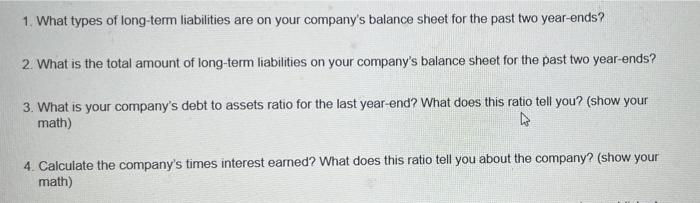

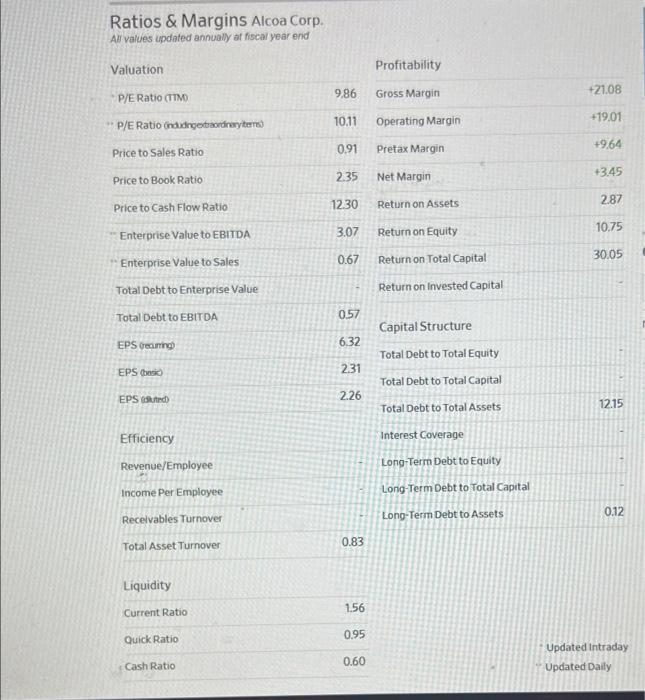

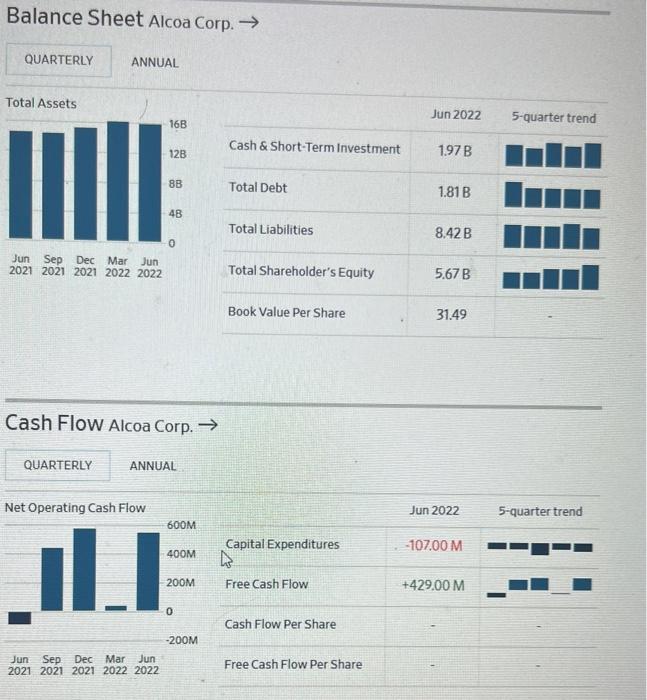

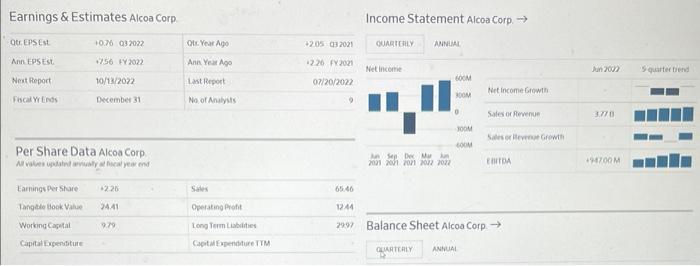

1. What types of long-term liabilities are on your company's balance sheet for the past two year-ends? 2. What is the total amount of long-term liabilities on your company's balance sheet for the past two year-ends? 3. What is your company's debt to assets ratio for the last year-end? What does this ratio tell you? (show your math) 4. Calculate the company's times interest earned? What does this ratio tell you about the company? (show your math) Ratios \& Margins Alcoa Corp. All values updated annually at fiscal year end Valuation Profitability P/ERatio (TMO Efficiency Revenue/Employee Long-Term Debt to Equity Long-Term Debt to Total Capital Long-Term Debt to Assets Total Asset Turnover 0.83 Liquidity Current Ratio 1.56 Quick Ratio 0.95 Cash Ratio 0.60 Updated intraday Updated Daily ANNUAL Earnings \& Estimates Alcoa Corp Per Share Data Alcoa Corp \begin{tabular}{l|c|ccc|} \hline Breakdown & 12/31/2021 & 12/31/2020 & 12/31/2019 & 12/31/2018 \\ \hline Total Assets & 15,025,000 & 14,860,000 & 14,631,000 & 15,938,000 \\ \hline Total Liabilities Net Minority Int ... & 8,741,000 & 9,844,000 & 8,745,000 & 8,544,000 \\ \hline Total Equity Gross Minority Inte... & 6,284,000 & 5,016,000 & 5,886,000 & 7,394,000 \\ \hline Total Capitalization & 6,398,000 & 5,774,000 & 5,911,000 & 7,190,000 \\ \hline Common Stock Equity & 4,672,000 & 3,311,000 & 4,112,000 & 5,389,000 \\ \hline Capital Lease Obligations & 64,000 & 82,000 & 100,000 & \\ \hline Net Tangible Assets & 4,492,000 & 3,121,000 & 3,910,000 & 5,181,000 \\ \hline Working Capital & 1,803,000 & 1,759,000 & 967,000 & 1,215,000 \\ \hline Invested Capital & 6,474,000 & 5,776,000 & 5,912,000 & 7,191,000 \\ \hline Tangible Book Value & 4,492,000 & 3,121,000 & 3,910,000 & 5,181,000 \\ \hline Total Debt & 1,866,000 & 2,547,000 & 1,900,000 & 1,802,000 \\ \hline Net Debt & 5 & 858,000 & 921,000 & 689,000 \\ \hline Share Issued & 184,100 & 185,978 & 185,580 & 184,770 \\ \hline Ordinary Shares Number & 185,978 & 185,580 & 184,770 \\ \hline \end{tabular} 1. What types of long-term liabilities are on your company's balance sheet for the past two year-ends? 2. What is the total amount of long-term liabilities on your company's balance sheet for the past two year-ends? 3. What is your company's debt to assets ratio for the last year-end? What does this ratio tell you? (show your math) 4. Calculate the company's times interest earned? What does this ratio tell you about the company? (show your math) Ratios \& Margins Alcoa Corp. All values updated annually at fiscal year end Valuation Profitability P/ERatio (TMO Efficiency Revenue/Employee Long-Term Debt to Equity Long-Term Debt to Total Capital Long-Term Debt to Assets Total Asset Turnover 0.83 Liquidity Current Ratio 1.56 Quick Ratio 0.95 Cash Ratio 0.60 Updated intraday Updated Daily ANNUAL Earnings \& Estimates Alcoa Corp Per Share Data Alcoa Corp \begin{tabular}{l|c|ccc|} \hline Breakdown & 12/31/2021 & 12/31/2020 & 12/31/2019 & 12/31/2018 \\ \hline Total Assets & 15,025,000 & 14,860,000 & 14,631,000 & 15,938,000 \\ \hline Total Liabilities Net Minority Int ... & 8,741,000 & 9,844,000 & 8,745,000 & 8,544,000 \\ \hline Total Equity Gross Minority Inte... & 6,284,000 & 5,016,000 & 5,886,000 & 7,394,000 \\ \hline Total Capitalization & 6,398,000 & 5,774,000 & 5,911,000 & 7,190,000 \\ \hline Common Stock Equity & 4,672,000 & 3,311,000 & 4,112,000 & 5,389,000 \\ \hline Capital Lease Obligations & 64,000 & 82,000 & 100,000 & \\ \hline Net Tangible Assets & 4,492,000 & 3,121,000 & 3,910,000 & 5,181,000 \\ \hline Working Capital & 1,803,000 & 1,759,000 & 967,000 & 1,215,000 \\ \hline Invested Capital & 6,474,000 & 5,776,000 & 5,912,000 & 7,191,000 \\ \hline Tangible Book Value & 4,492,000 & 3,121,000 & 3,910,000 & 5,181,000 \\ \hline Total Debt & 1,866,000 & 2,547,000 & 1,900,000 & 1,802,000 \\ \hline Net Debt & 5 & 858,000 & 921,000 & 689,000 \\ \hline Share Issued & 184,100 & 185,978 & 185,580 & 184,770 \\ \hline Ordinary Shares Number & 185,978 & 185,580 & 184,770 \\ \hline \end{tabular}