Answered step by step

Verified Expert Solution

Question

1 Approved Answer

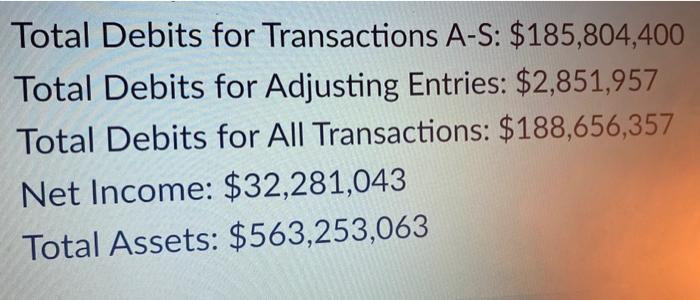

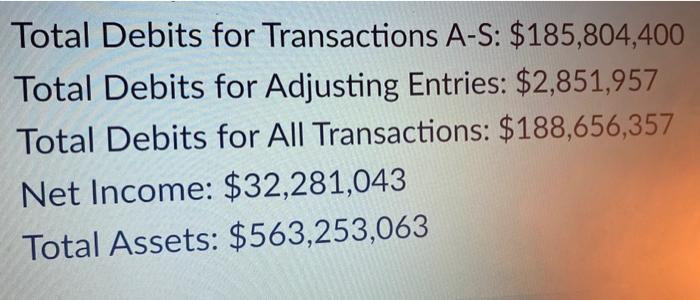

I need my work to be checked please !! The total debits for all transcations needs to be at $188,656,357 but I'm at $188,653,447. Please

I need my work to be checked please !! The total debits for all transcations needs to be at $188,656,357 but I'm at $188,653,447. Please check to see if I have the correct journal entries and numbers. Thank you

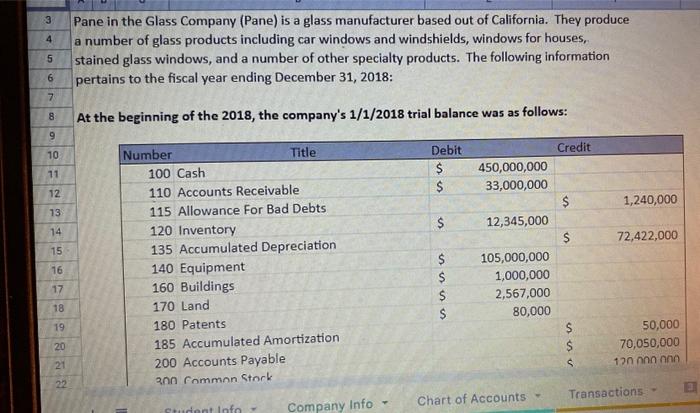

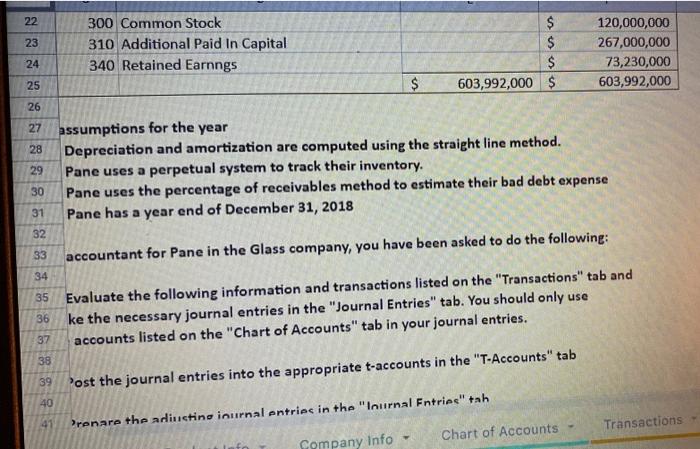

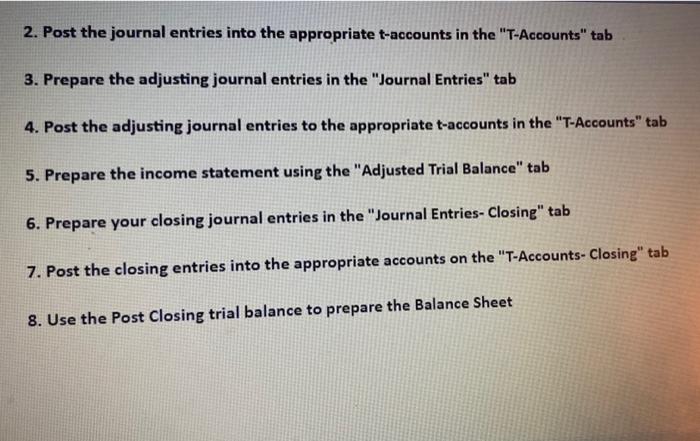

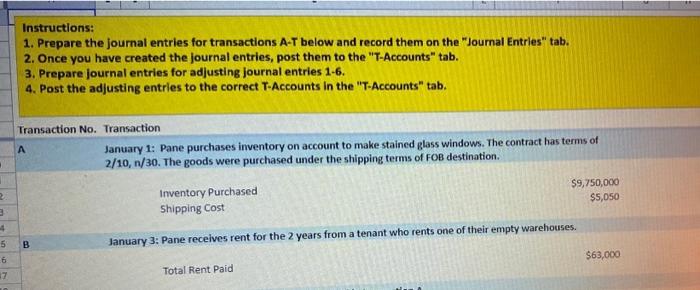

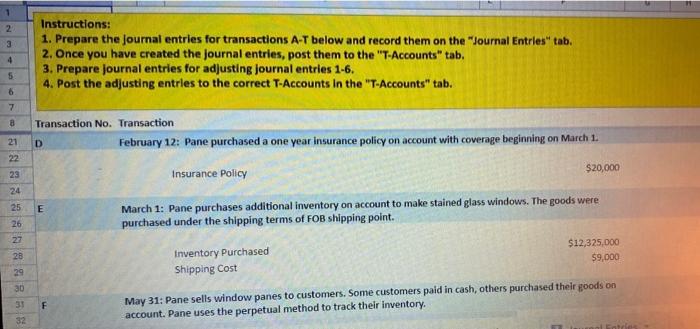

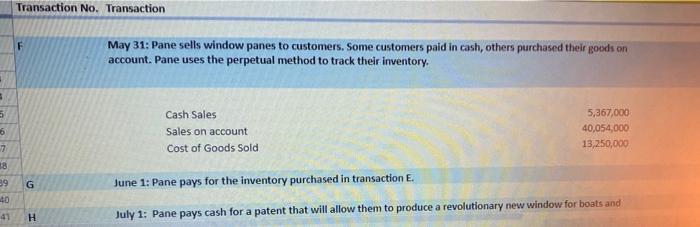

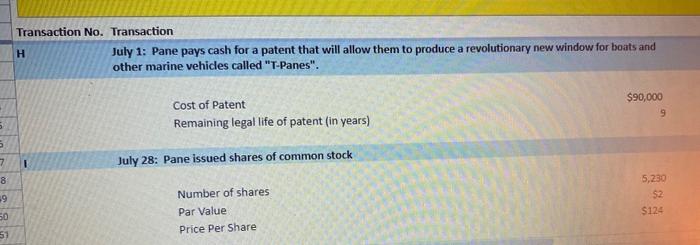

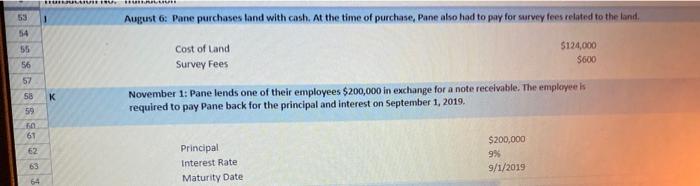

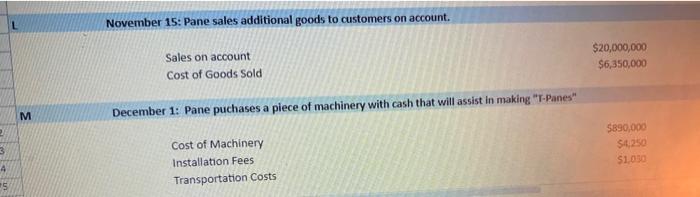

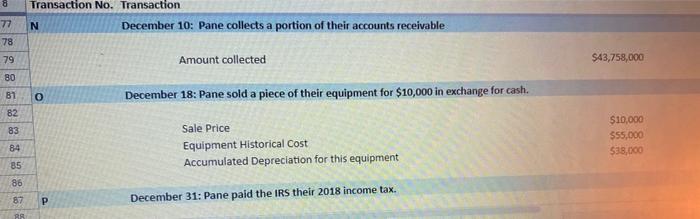

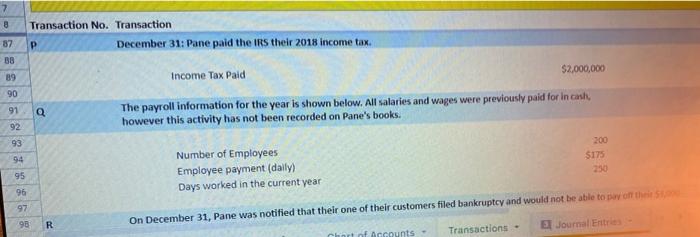

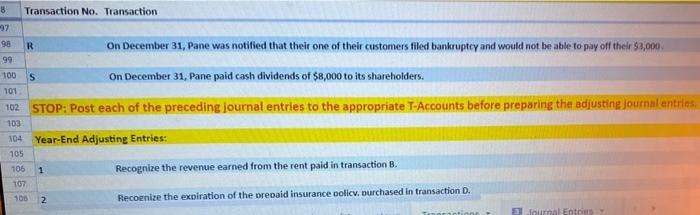

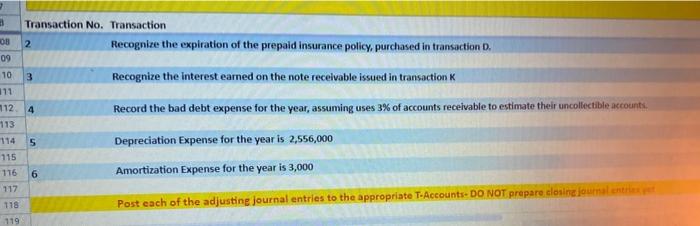

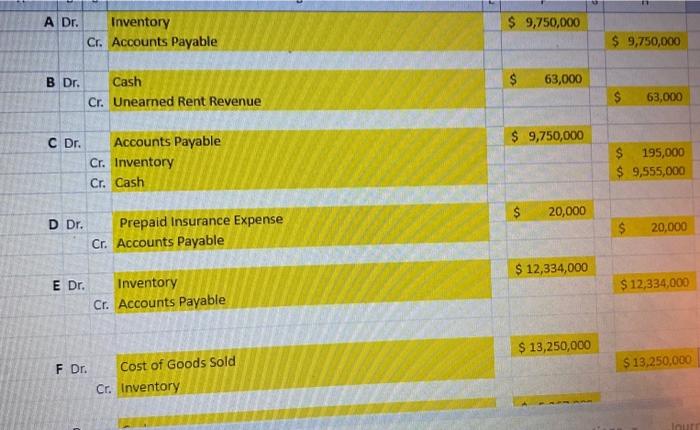

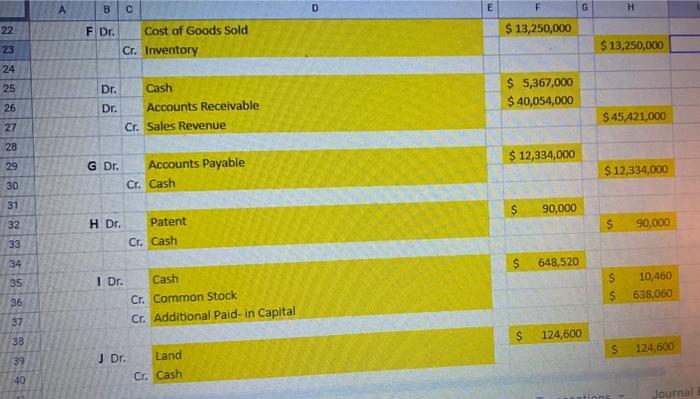

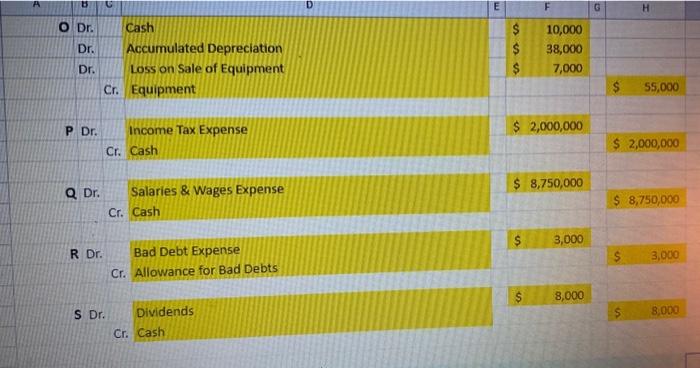

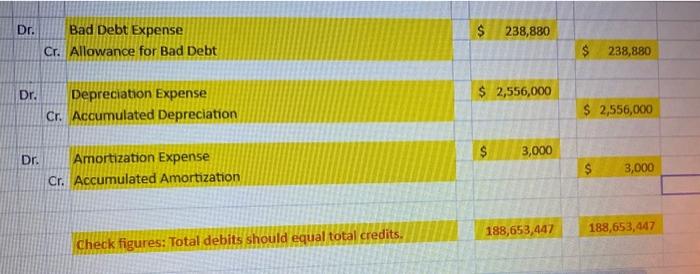

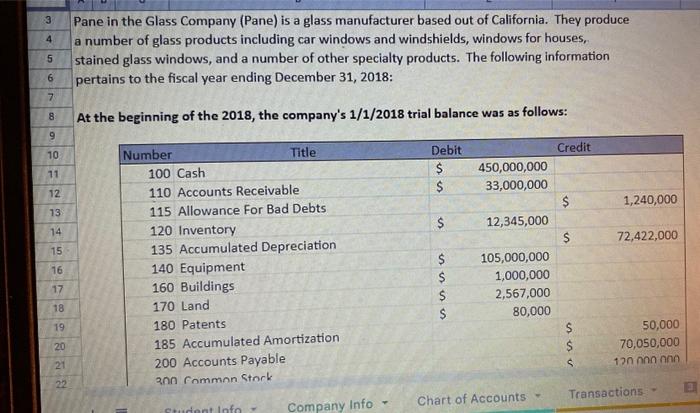

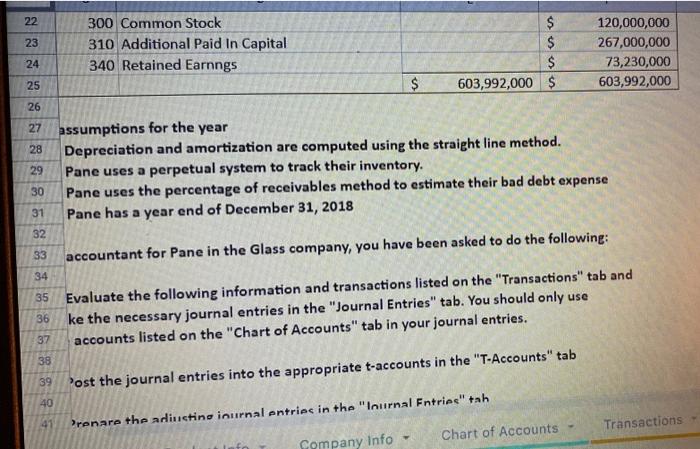

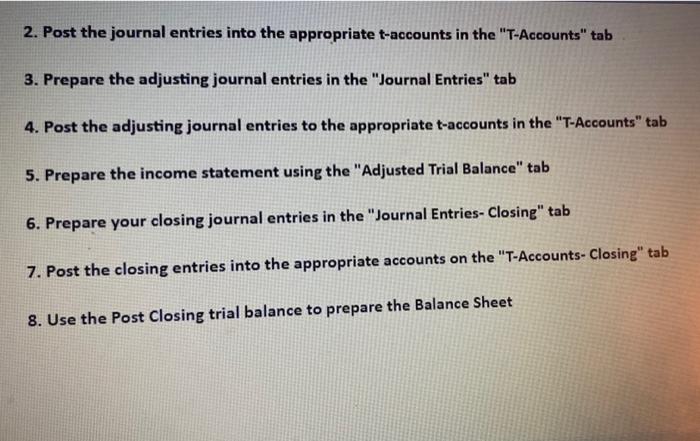

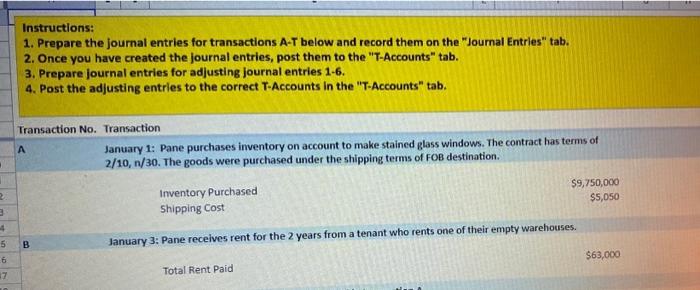

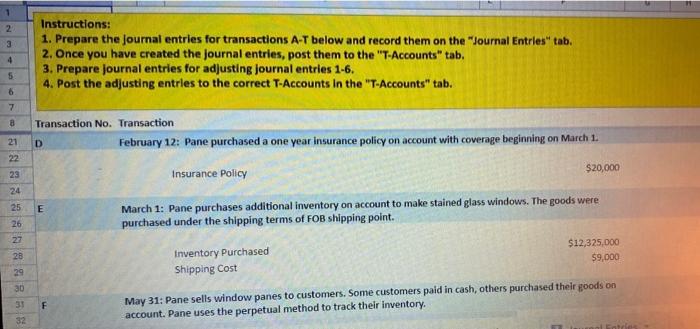

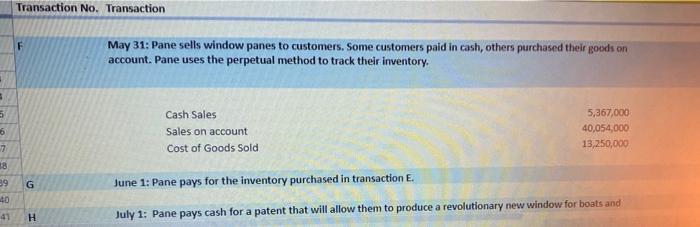

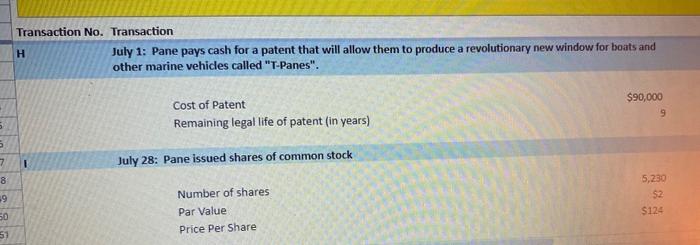

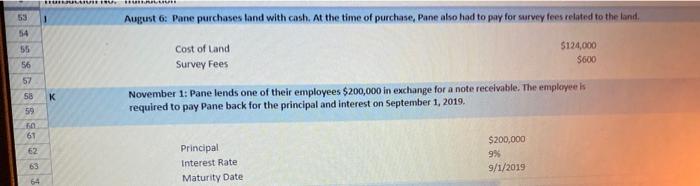

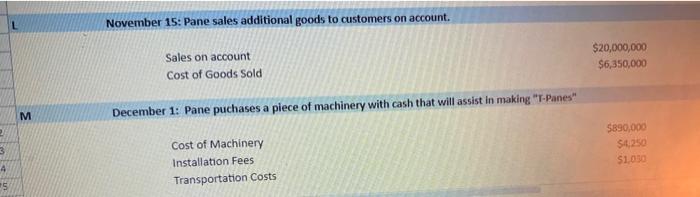

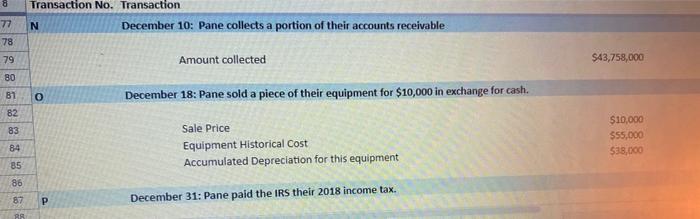

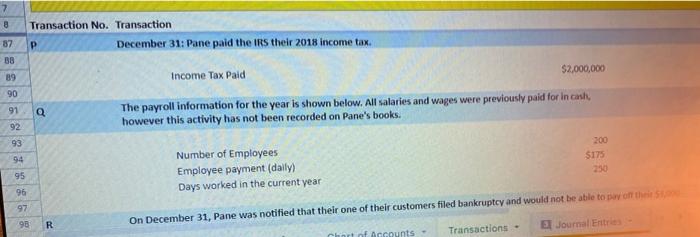

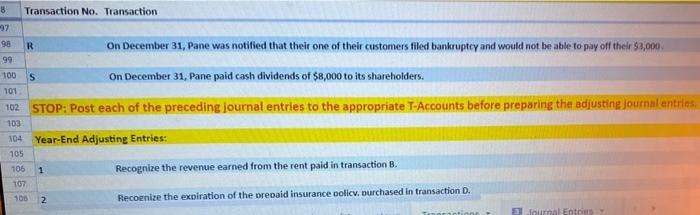

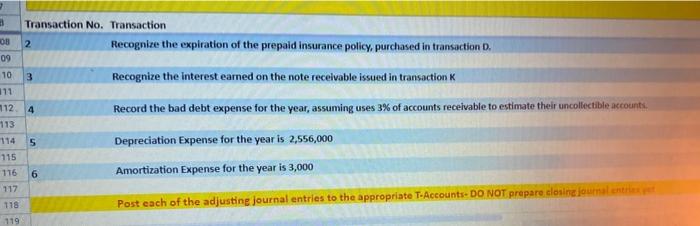

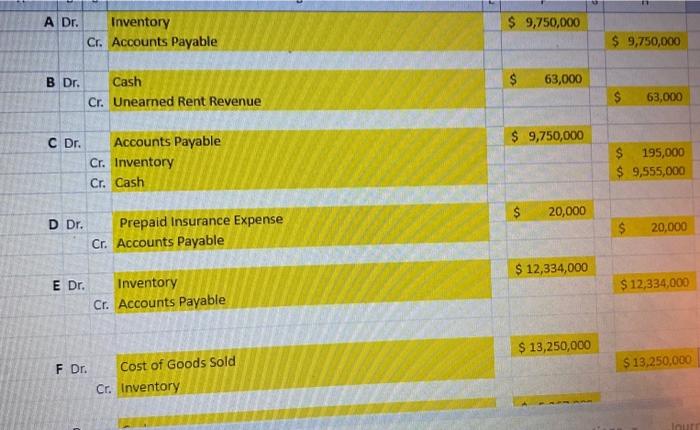

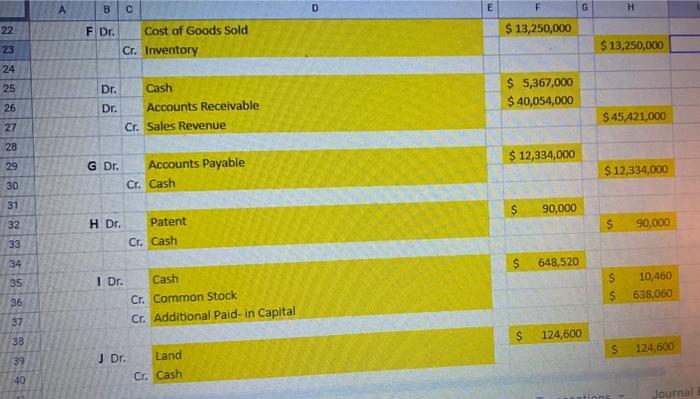

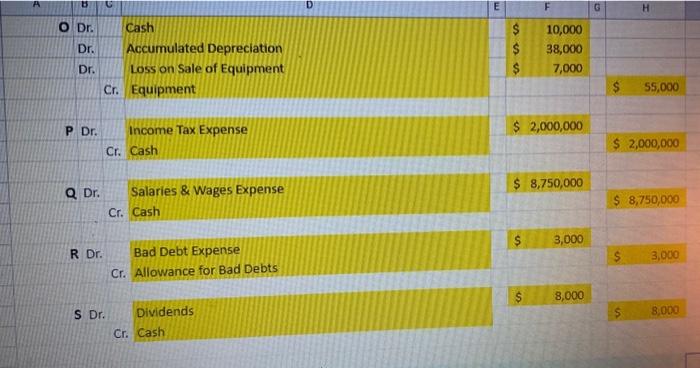

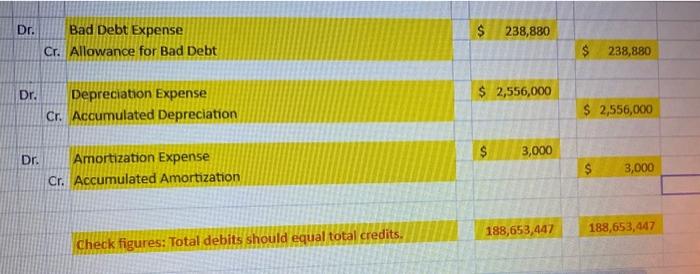

Pane in the Glass Company (Pane) is a glass manufacturer based out of California. They produce a number of glass products including car windows and windshields, windows for houses, stained glass windows, and a number of other specialty products. The following information pertains to the fiscal year ending December 31,2018 : At the beginning of the 2018 , the company's 1/1/2018 trial balance was as follows: assumptions for the year Depreciation and amortization are computed using the straight line method. Pane uses a perpetual system to track their inventory. Pane uses the percentage of receivables method to estimate their bad debt expense Pane has a year end of December 31, 2018 accountant for Pane in the Glass company, you have been asked to do the following: Evaluate the following information and transactions listed on the "Transactions" tab and ke the necessary journal entries in the "Journal Entries" tab. You should only use accounts listed on the "Chart of Accounts" tab in your journal entries. 37 39 "ost the journal entries into the appropriate t-accounts in the "T-Accounts" tab 40 Prenare the adiuctine inurnal ontries in the "Inurnal Fntries" tah 2. Post the journal entries into the appropriate t-accounts in the "T-Accounts" tab 3. Prepare the adjusting journal entries in the "Journal Entries" tab 4. Post the adjusting journal entries to the appropriate t-accounts in the "T-Accounts" tab 5. Prepare the income statement using the "Adjusted Trial Balance" tab 6. Prepare your closing journal entries in the "Journal Entries- Closing" tab 7. Post the closing entries into the appropriate accounts on the "T-Accounts- Closing" tab 8. Use the Post Closing trial balance to prepare the Balance Sheet Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entrles" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entrles to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction D February 12: Pane purchased a one year insurance policy on account with coverage beginning on March 1 . Insurance Policy March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of fOB shipping point. Inventory Purchased Shipping Cost F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Transaction No. Transaction F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold June 1: Pane pays for the inventory purchased in transaction E. G July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and Transaction No. Transaction H July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehicles called "T-Panes". Cost of Patent Remaining legal life of patent (in years) July 28: Pane issued shares of common stock Number of shares Par Value Price Per Share \begin{tabular}{|l|l|} \hline 53 & 1 \\ \hline 54 \\ \hline 55 \\ \hline 56 \\ \hline 57 \\ \hline 58 & K \\ \hline 59 \\ \hline 60 \\ \hline 61 \\ \hline 62 \\ \hline 63 \\ \hline 64 \\ \hline \end{tabular} August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for sarvey fees related to the land. Cost of Land Survey Fees November 1: Pane lends one of their employees $200,000 in exchange for a note receivable. The employee is required to pay Pane back for the principal and interest on September 1, 2019. Principal Interest Rate Maturity Date L November 15: Pane sales additional goods to customers on aocount. Sales on account Cost of Goods Sold m December 1: Pane puchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery Installation Fees Transportation Costs 8 Transaction No. Transaction Amount collected $43,758,000 December 18: Pane sold a piece of their equipment for $10,000 in exchange for cash. Sale Price Equipment Historical cost Accumulated Depreciation for this equipment December 31: Pane paid the IRS their 2018 income tax. Transaction No. Transaction p December 31: Pane paid the Ifs their 2018 income tax. Income Tax Paid $2,000,000 The payroll information for the year is shown below. All salaries and wages were previously paid for in cail, however this activity has not been recorded on Pane's books. Number of Employees Employee payment (daily) Days worked in the current year. R. R On December 31, Pane was notified that their one of their customers filed bankruptcy and would not be able to pay off their $3,000. On December 31, Pane paid cash dividends of $8,000 to its shareholders. STOP: Post each of the preceding journal entries to the appropriate T-Accounts before preparing the adjusting journal entries. Year-End Adjusting Entries: 1 Recognize the revenue earned from the rent paid in transaction B. 1082 Recoenize the expiration of the oreoaid insurance bolicv, ourchased in transaction D. Transaction No. Transaction 2 Recognize the expiration of the prepaid insurance policy, purchased in transaction D. 3 Recognize the interest eamed on the note receivable issued in transaction K 4 Record the bad debt expense for the year, assuming uses 3% of accounts receivable to estimate their uncollectible accounts. Depreciation Expense for the year is 2,556,000 6 Amortization Expense for the year is 3,000 A Dr. Inventory Cr. Accounts Payable $9,750,000 B Dr. Cash $63,000 Cr. Unearned Rent Revenue C Dr. Accounts Payable Cr. Inventory Cr. Cash D Dr. Prepaid Insurance Expense Cr. Accounts Payable E Dr. Inventory $12,334,000 Cr. Accounts Payable F Dr. Cost of Goods Sold $13,250,000 $13,250,000 Cr. Inventory Cr. Inventory Dr. Cash Dr. Accounts Receivable Cr. Sales Revenue G Dr. Accounts Payable Cr. Cash H Dr. Patent Cr. Cash I Dr. Cash Cr. Common Stock Cr. Additional Paid- in Capital J Dr. Land $648,520 $12,334,000 K Dr. Notes Receivable Cr. Cash L. Dr. Accounts Receivable $20,000,000 Cr. Sales Revenue $20,000,000 Dr. Cost of Goods Sold Cr. Inventory M Dr. Equipment Cr. Cash N Dr. Cash $43,758,000 Cr. Accounts Receivable $43,758,000 Dr. Accumulated Depreciation Dr. Loss on Sale of Equipment Cr. Equipment P Dr. Income Tax Expense Cr. Cash Q Dr. Salaries \& Wages Expense Cr. Cash R Dr. Bad Debt Expense Cr. Allowance for Bad Debts S Dr. Dividends $8,000 Cr. Cash Dr. Bad Debt Expense Cr. Allowance for Bad Debt $238,880 Dr. Depreciation Expense Cr. Accumulated Depreciation $2,556,000 $238,880 Dr. Amortization Expense Cr. Accumulated Amortization $3,000 $2,556,000 Check figures: Total debits should equal total credits. 188,653,447188,653,447 Total Debits for Transactions A-S: $185,804,400 Total Debits for Adjusting Entries: $2,851,957 Total Debits for All Transactions: $188,656,357 Net Income: $32,281,043 Total Assets: $563,253,063 Pane in the Glass Company (Pane) is a glass manufacturer based out of California. They produce a number of glass products including car windows and windshields, windows for houses, stained glass windows, and a number of other specialty products. The following information pertains to the fiscal year ending December 31,2018 : At the beginning of the 2018 , the company's 1/1/2018 trial balance was as follows: assumptions for the year Depreciation and amortization are computed using the straight line method. Pane uses a perpetual system to track their inventory. Pane uses the percentage of receivables method to estimate their bad debt expense Pane has a year end of December 31, 2018 accountant for Pane in the Glass company, you have been asked to do the following: Evaluate the following information and transactions listed on the "Transactions" tab and ke the necessary journal entries in the "Journal Entries" tab. You should only use accounts listed on the "Chart of Accounts" tab in your journal entries. 37 39 "ost the journal entries into the appropriate t-accounts in the "T-Accounts" tab 40 Prenare the adiuctine inurnal ontries in the "Inurnal Fntries" tah 2. Post the journal entries into the appropriate t-accounts in the "T-Accounts" tab 3. Prepare the adjusting journal entries in the "Journal Entries" tab 4. Post the adjusting journal entries to the appropriate t-accounts in the "T-Accounts" tab 5. Prepare the income statement using the "Adjusted Trial Balance" tab 6. Prepare your closing journal entries in the "Journal Entries- Closing" tab 7. Post the closing entries into the appropriate accounts on the "T-Accounts- Closing" tab 8. Use the Post Closing trial balance to prepare the Balance Sheet Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entrles" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entrles to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction D February 12: Pane purchased a one year insurance policy on account with coverage beginning on March 1 . Insurance Policy March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of fOB shipping point. Inventory Purchased Shipping Cost F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Transaction No. Transaction F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold June 1: Pane pays for the inventory purchased in transaction E. G July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and Transaction No. Transaction H July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehicles called "T-Panes". Cost of Patent Remaining legal life of patent (in years) July 28: Pane issued shares of common stock Number of shares Par Value Price Per Share \begin{tabular}{|l|l|} \hline 53 & 1 \\ \hline 54 \\ \hline 55 \\ \hline 56 \\ \hline 57 \\ \hline 58 & K \\ \hline 59 \\ \hline 60 \\ \hline 61 \\ \hline 62 \\ \hline 63 \\ \hline 64 \\ \hline \end{tabular} August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for sarvey fees related to the land. Cost of Land Survey Fees November 1: Pane lends one of their employees $200,000 in exchange for a note receivable. The employee is required to pay Pane back for the principal and interest on September 1, 2019. Principal Interest Rate Maturity Date L November 15: Pane sales additional goods to customers on aocount. Sales on account Cost of Goods Sold m December 1: Pane puchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery Installation Fees Transportation Costs 8 Transaction No. Transaction Amount collected $43,758,000 December 18: Pane sold a piece of their equipment for $10,000 in exchange for cash. Sale Price Equipment Historical cost Accumulated Depreciation for this equipment December 31: Pane paid the IRS their 2018 income tax. Transaction No. Transaction p December 31: Pane paid the Ifs their 2018 income tax. Income Tax Paid $2,000,000 The payroll information for the year is shown below. All salaries and wages were previously paid for in cail, however this activity has not been recorded on Pane's books. Number of Employees Employee payment (daily) Days worked in the current year. R. R On December 31, Pane was notified that their one of their customers filed bankruptcy and would not be able to pay off their $3,000. On December 31, Pane paid cash dividends of $8,000 to its shareholders. STOP: Post each of the preceding journal entries to the appropriate T-Accounts before preparing the adjusting journal entries. Year-End Adjusting Entries: 1 Recognize the revenue earned from the rent paid in transaction B. 1082 Recoenize the expiration of the oreoaid insurance bolicv, ourchased in transaction D. Transaction No. Transaction 2 Recognize the expiration of the prepaid insurance policy, purchased in transaction D. 3 Recognize the interest eamed on the note receivable issued in transaction K 4 Record the bad debt expense for the year, assuming uses 3% of accounts receivable to estimate their uncollectible accounts. Depreciation Expense for the year is 2,556,000 6 Amortization Expense for the year is 3,000 A Dr. Inventory Cr. Accounts Payable $9,750,000 B Dr. Cash $63,000 Cr. Unearned Rent Revenue C Dr. Accounts Payable Cr. Inventory Cr. Cash D Dr. Prepaid Insurance Expense Cr. Accounts Payable E Dr. Inventory $12,334,000 Cr. Accounts Payable F Dr. Cost of Goods Sold $13,250,000 $13,250,000 Cr. Inventory Cr. Inventory Dr. Cash Dr. Accounts Receivable Cr. Sales Revenue G Dr. Accounts Payable Cr. Cash H Dr. Patent Cr. Cash I Dr. Cash Cr. Common Stock Cr. Additional Paid- in Capital J Dr. Land $648,520 $12,334,000 K Dr. Notes Receivable Cr. Cash L. Dr. Accounts Receivable $20,000,000 Cr. Sales Revenue $20,000,000 Dr. Cost of Goods Sold Cr. Inventory M Dr. Equipment Cr. Cash N Dr. Cash $43,758,000 Cr. Accounts Receivable $43,758,000 Dr. Accumulated Depreciation Dr. Loss on Sale of Equipment Cr. Equipment P Dr. Income Tax Expense Cr. Cash Q Dr. Salaries \& Wages Expense Cr. Cash R Dr. Bad Debt Expense Cr. Allowance for Bad Debts S Dr. Dividends $8,000 Cr. Cash Dr. Bad Debt Expense Cr. Allowance for Bad Debt $238,880 Dr. Depreciation Expense Cr. Accumulated Depreciation $2,556,000 $238,880 Dr. Amortization Expense Cr. Accumulated Amortization $3,000 $2,556,000 Check figures: Total debits should equal total credits. 188,653,447188,653,447 Total Debits for Transactions A-S: $185,804,400 Total Debits for Adjusting Entries: $2,851,957 Total Debits for All Transactions: $188,656,357 Net Income: $32,281,043 Total Assets: $563,253,063

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started