Answered step by step

Verified Expert Solution

Question

1 Approved Answer

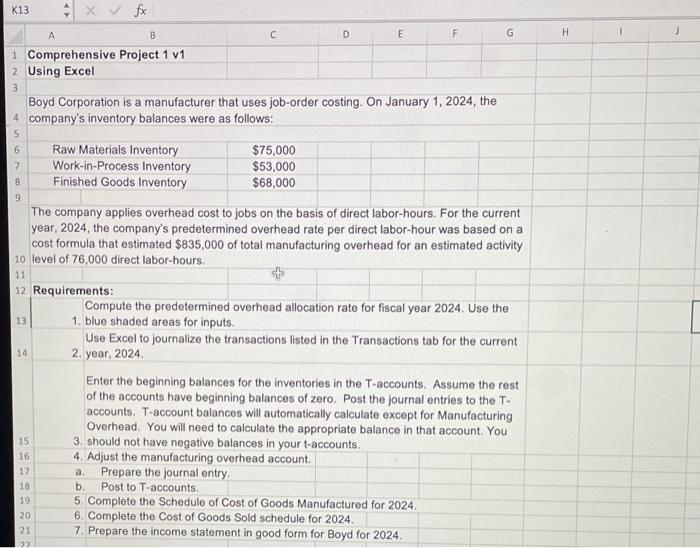

i need requirements 3 and 4 pls 2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the

i need requirements 3 and 4 pls

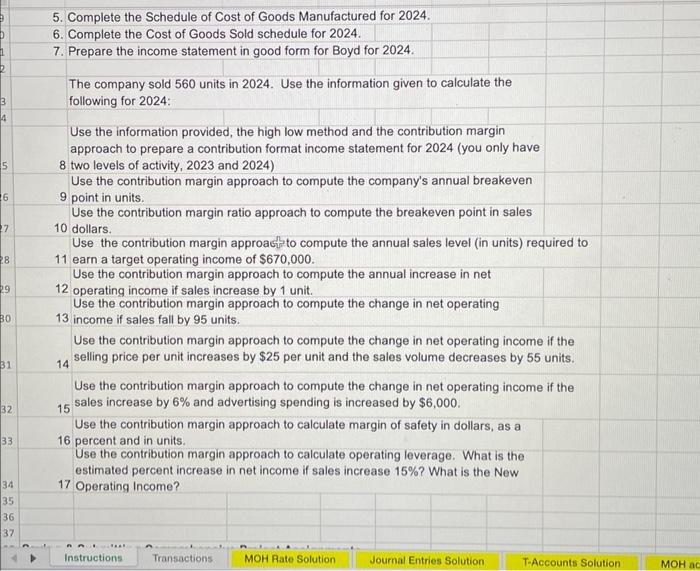

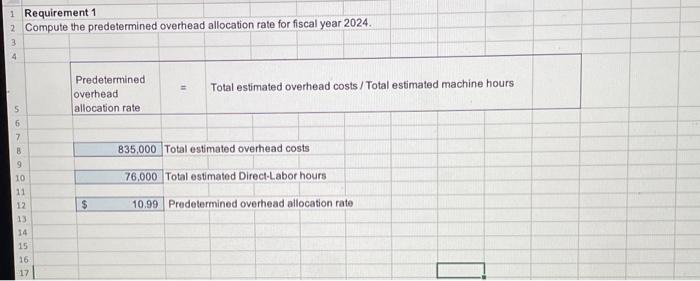

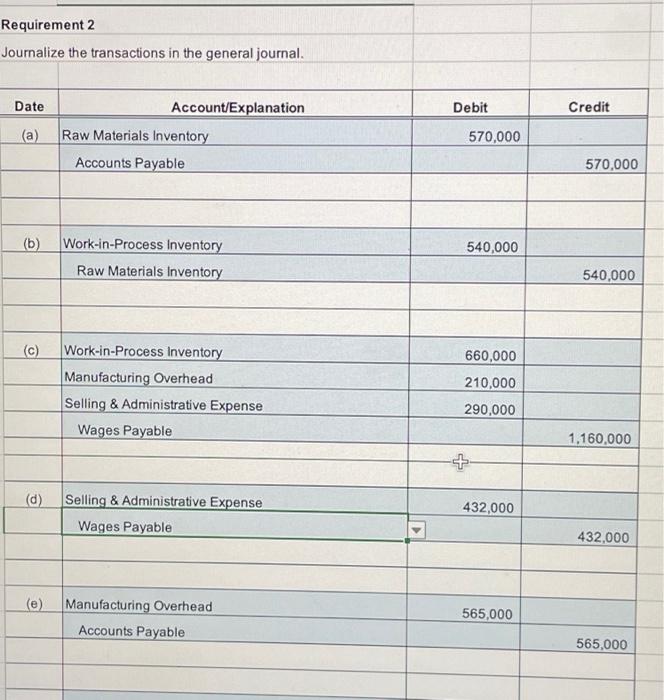

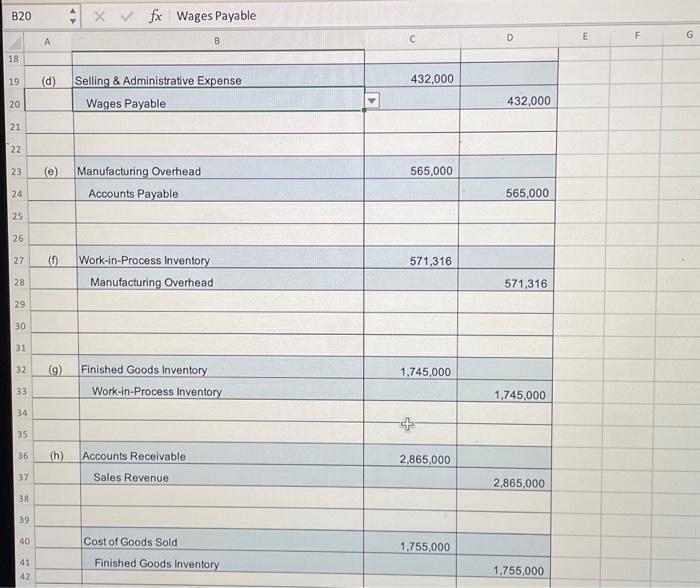

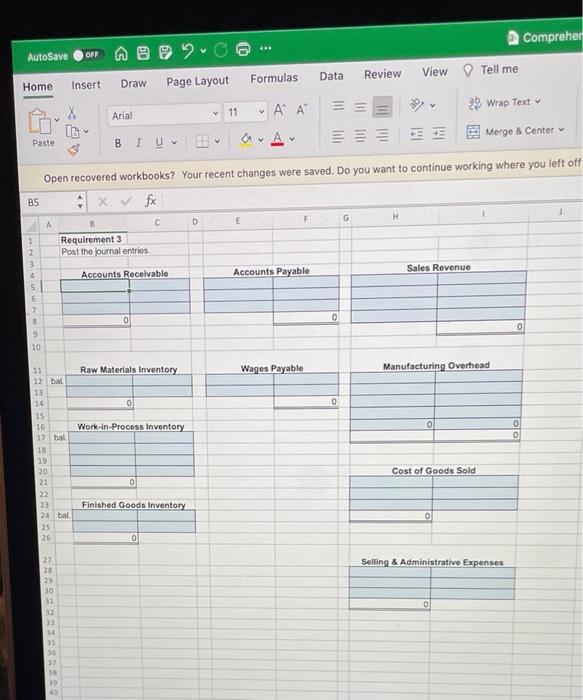

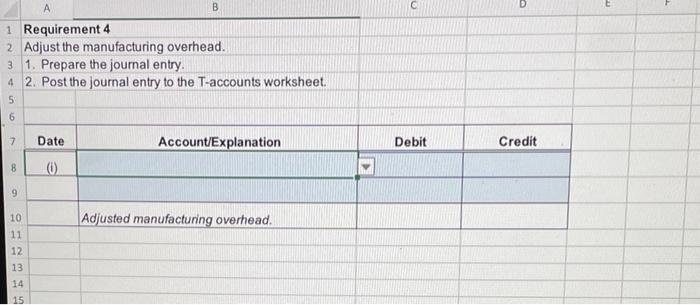

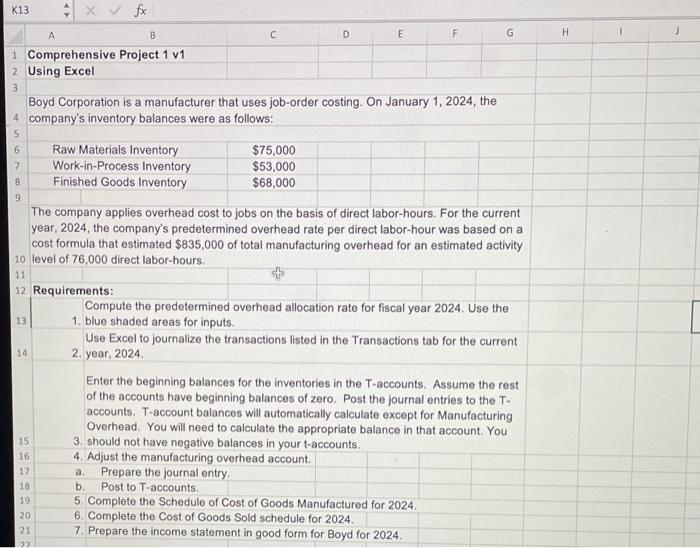

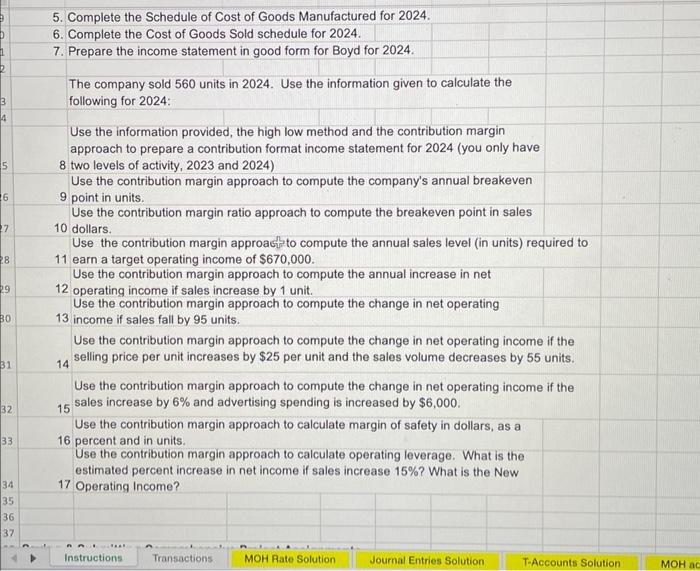

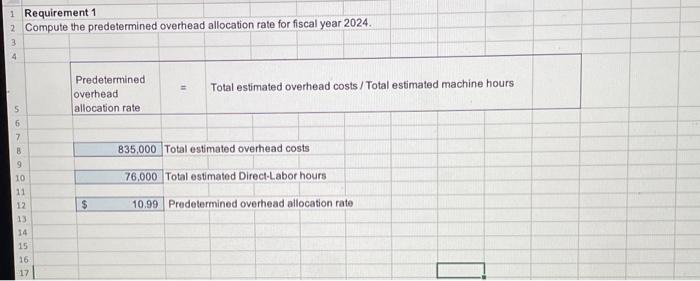

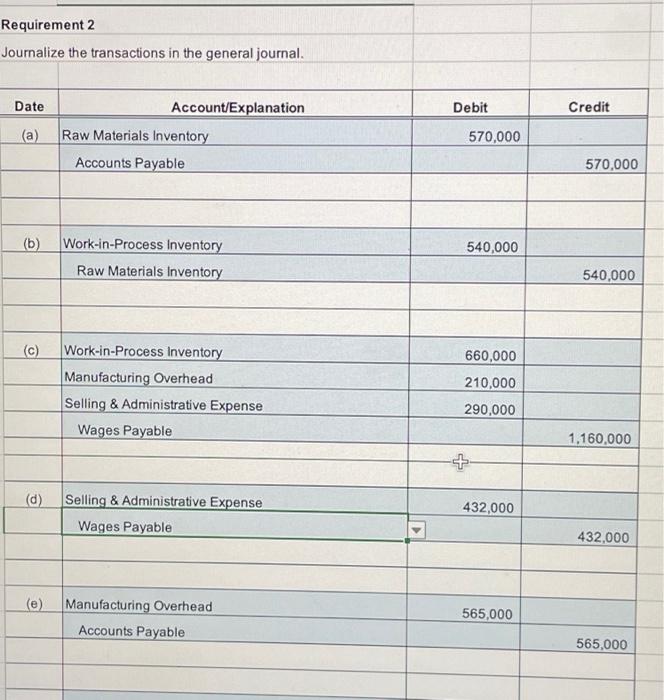

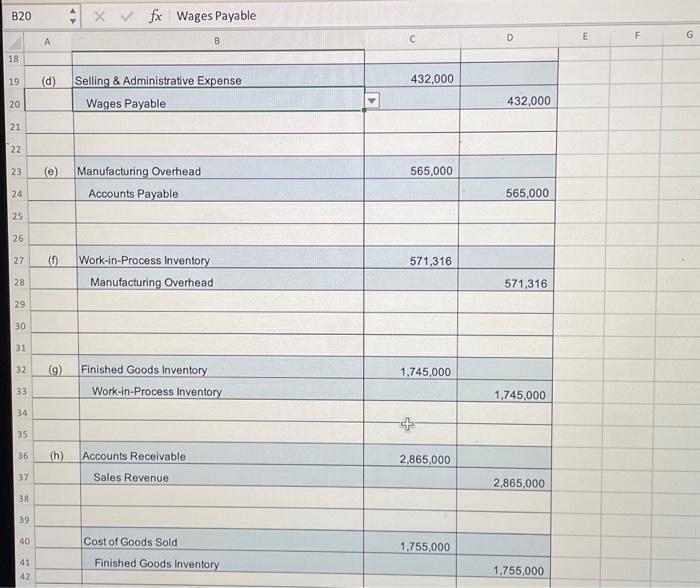

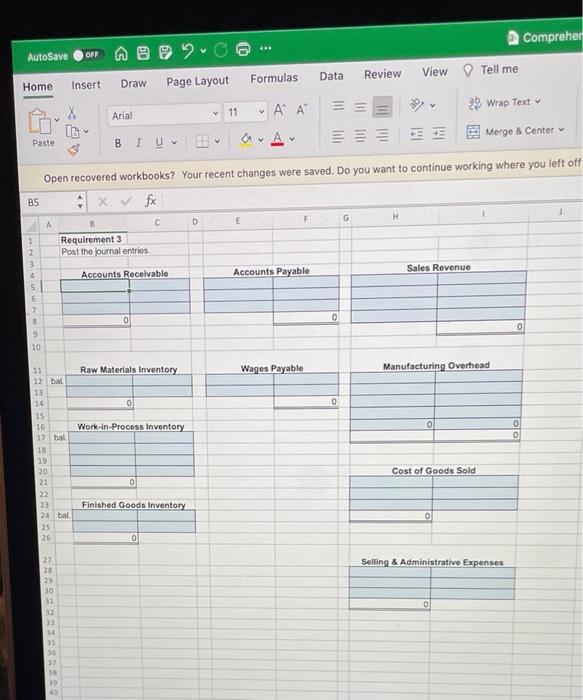

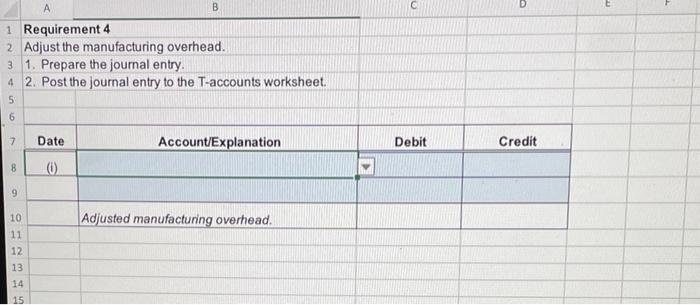

2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the 4 company's inventory balances were as follows: \begin{tabular}{|l|l|l|l|} \hline 5 & & & \\ \hline 6 & Raw Materials Inventory & $75,000 \\ \hline 7 & Work-in-Process Inventory & $53,000 \\ \hline 8 & Finished Goods Inventory & $68,000 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $835,000 of total manufacturing overhead for an estimated activity 10 level of 76,000 direct labor-hours. 12 Requirements: Compute the predetermined overhead allocation rate for fiscal year 2024. Use the 1. blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current 2. year, 2024. Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to the T. accounts. T-account balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. You 3. should not have negative balances in your t-accounts. 4. Adjust the manufacturing overhead account. a. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the Cost of Goods Sold schedule for 2024. 7. Prepare the income statement in good form for Boyd for 2024. The company sold 560 units in 2024. Use the information given to calculate the following for 2024 : Use the information provided, the high low method and the contribution margin approach to prepare a contribution format income statement for 2024 (you only have 8 two levels of activity, 2023 and 2024) Use the contribution margin approach to compute the company's annual breakeven 9 point in units. Use the contribution margin ratio approach to compute the breakeven point in sales 10 dollars. Use the contribution margin approasts to compute the annual sales level (in units) required to 11 earn a target operating income of $670,000. Use the contribution margin approach to compute the annual increase in net 12 operating income if sales increase by 1 unit. Use the contribution margin approach to compute the change in net operating 13 income if sales fall by 95 units. Use the contribution margin approach to compute the change in net operating income if the 14 selling price per unit increases by $25 per unit and the sales volume decreases by 55 units. Use the contribution margin approach to compute the change in net operating income if the 15 sales increase by 6% and advertising spending is increased by $6,000. Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 15% ? What is the New 17 Operating Income? 1 Requirement 1 2 Compute the predetermined overhead allocation rate for fiscal year 2024. Requirement 2 Journalize the transactions in the general journal. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off 1 Requirement 4 2 Adjust the manufacturing overhead. 3 1. Prepare the journal entry. 4 2. Post the journal entry to the T-accounts worksheet. 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started