Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need solution to all 4 parts of this question Rf = 0 and underlying at 100. Annual stdev of $60.28 trading days left for

I need solution to all 4 parts of this question

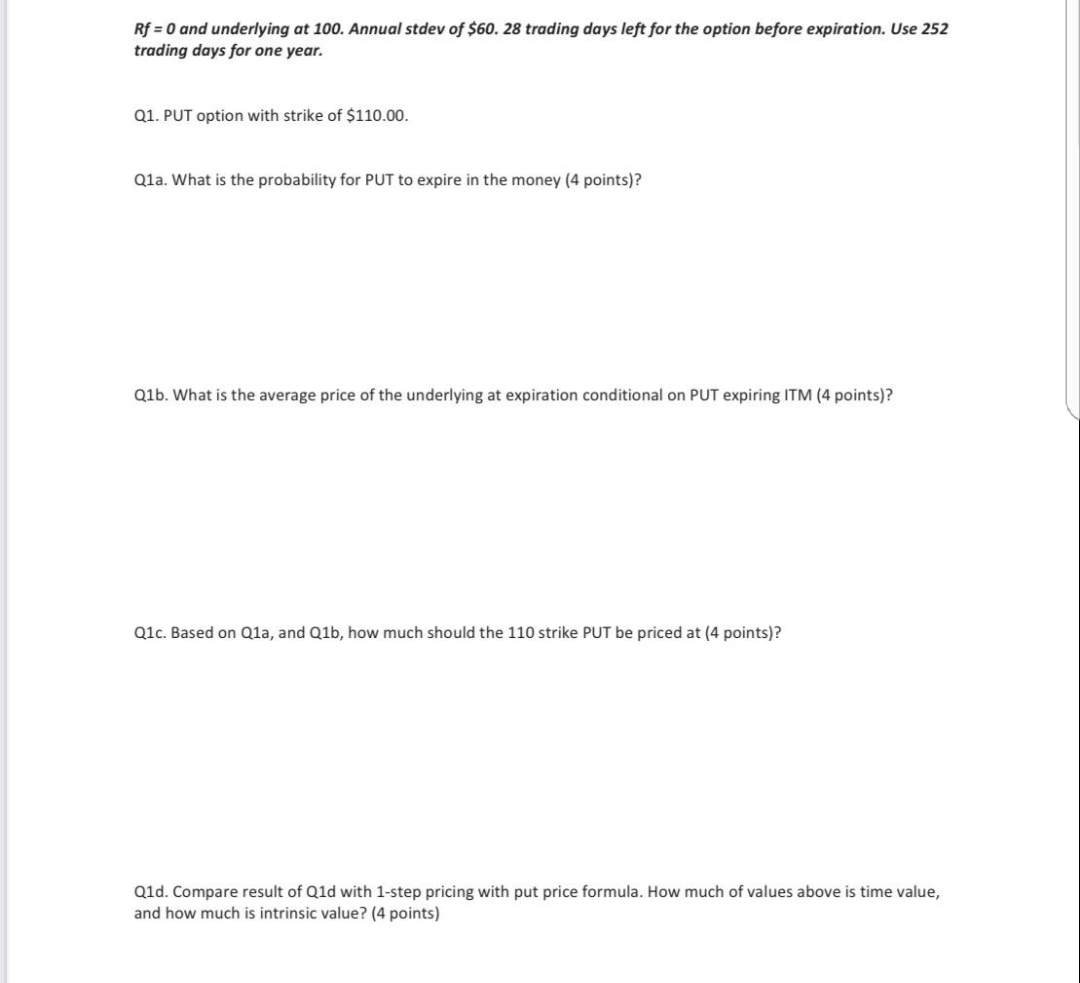

Rf = 0 and underlying at 100. Annual stdev of $60.28 trading days left for the option before expiration. Use 252 trading days for one year. Q1. PUT option with strike of $110.00. Q1a. What is the probability for PUT to expire in the money (4 points)? Q1b. What is the average price of the underlying at expiration conditional on PUT expiring ITM (4 points)? Q1c. Based on Q1a, and Q1b, how much should the 110 strike PUT be priced at (4 points)? Q1d. Compare result of Qld with 1-step pricing with put price formula. How much of values above is time value, and how much is intrinsic value? (4 points) Rf = 0 and underlying at 100. Annual stdev of $60.28 trading days left for the option before expiration. Use 252 trading days for one year. Q1. PUT option with strike of $110.00. Q1a. What is the probability for PUT to expire in the money (4 points)? Q1b. What is the average price of the underlying at expiration conditional on PUT expiring ITM (4 points)? Q1c. Based on Q1a, and Q1b, how much should the 110 strike PUT be priced at (4 points)? Q1d. Compare result of Qld with 1-step pricing with put price formula. How much of values above is time value, and how much is intrinsic value? (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started