Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need some help. I could use an explination on B). Thanks in advance! On April 23, Mrs. Yu purchased a taxi business from Mr.

I need some help. I could use an explination on B). Thanks in advance!

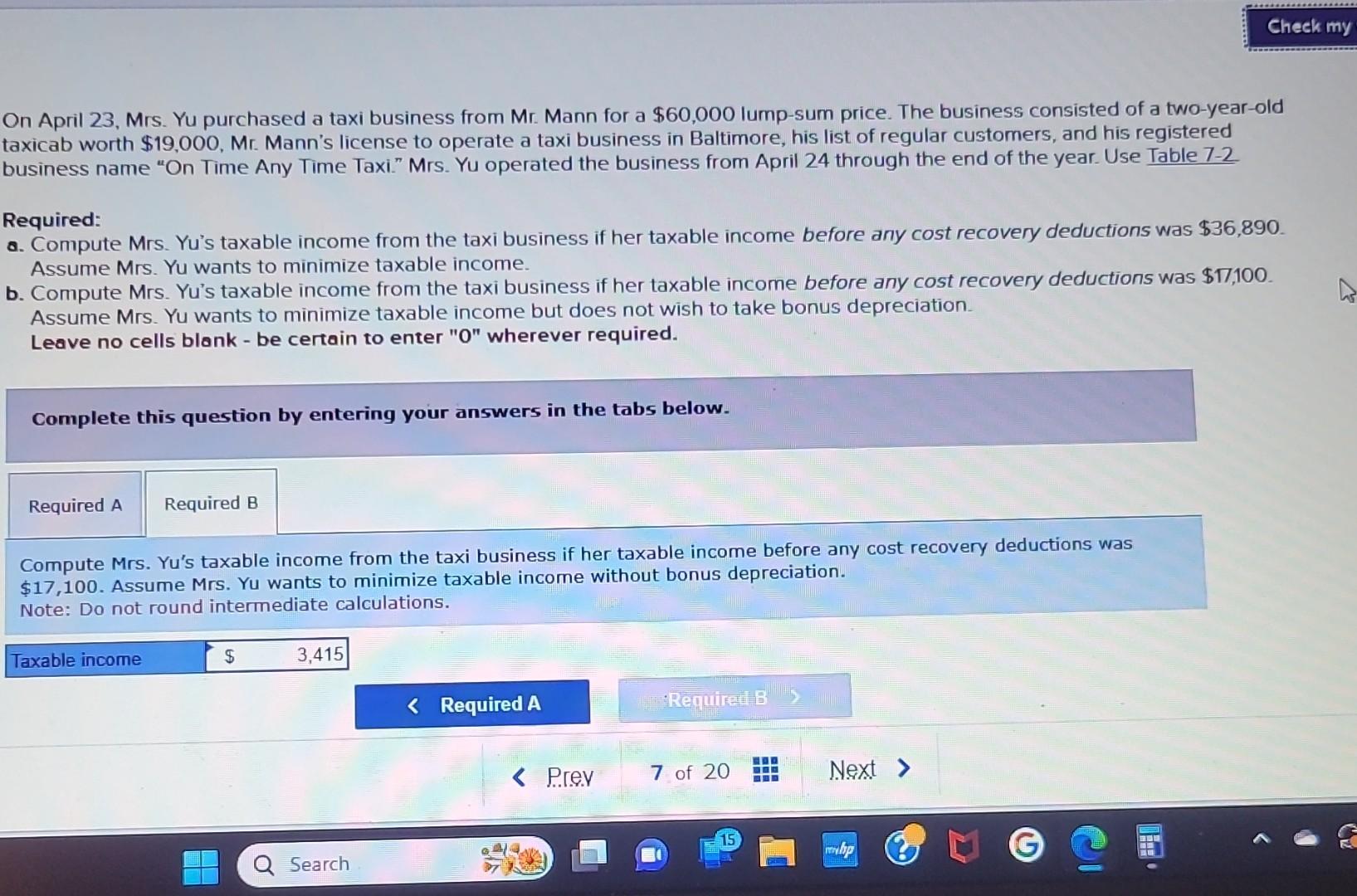

On April 23, Mrs. Yu purchased a taxi business from Mr. Mann for a $60,000 lump-sum price. The business consisted of a two-year-old taxicab worth $19,000, Mr. Mann's license to operate a taxi business in Baltimore, his list of regular customers, and his registered business name "On Time Any Time Taxi." Mrs. Yu operated the business from April 24 through the end of the year. Use Table 7-2 Required: a. Compute Mrs. Yus taxable income from the taxi business if her taxable income before any cost recovery deductions was $36,890. Assume Mrs. Yu wants to minimize taxable income. b. Compute Mrs. Yu's taxable income from the taxi business if her taxable income before any cost recovery deductions was $7,100. Assume Mrs. Yu wants to minimize taxable income but does not wish to take bonus depreciation. Leave no cells blank - be certain to enter "0" wherever required. Complete this question by entering your answers in the tabs below. Compute Mrs. Yu's taxable income from the taxi business if her taxable income before any cost recovery deductions was $17,100. Assume Mrs. Yu wants to minimize taxable income without bonus depreciation. Note: Do not round intermediate calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started