Answered step by step

Verified Expert Solution

Question

1 Approved Answer

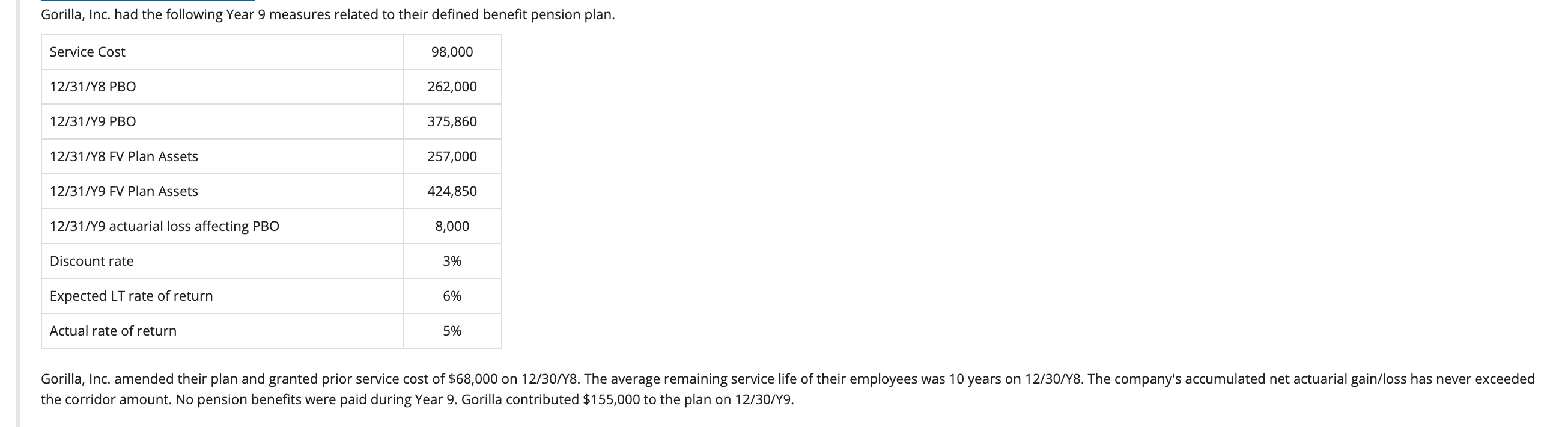

I need some help solving these problem. Gorilla, Inc. had the following Year 9 measures related to their defined benefit pension plan. Service Cost 98,000

I need some help solving these problem.

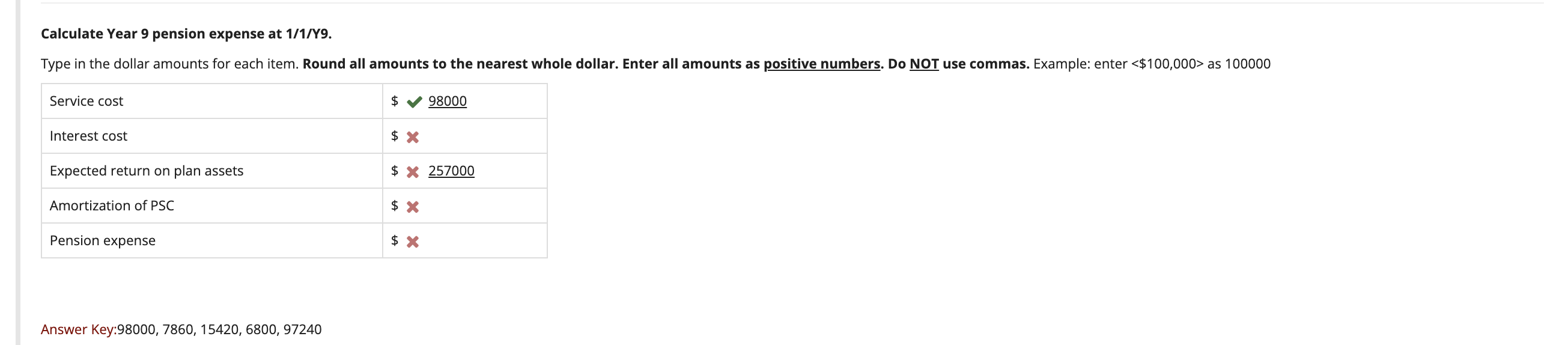

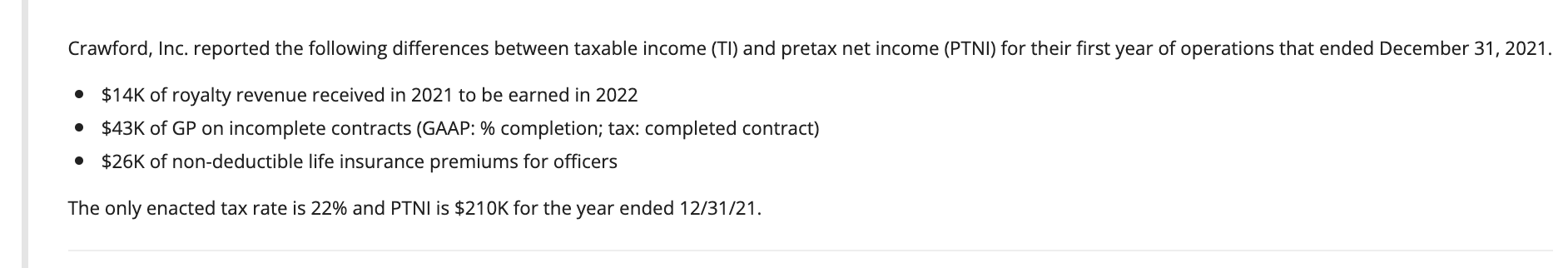

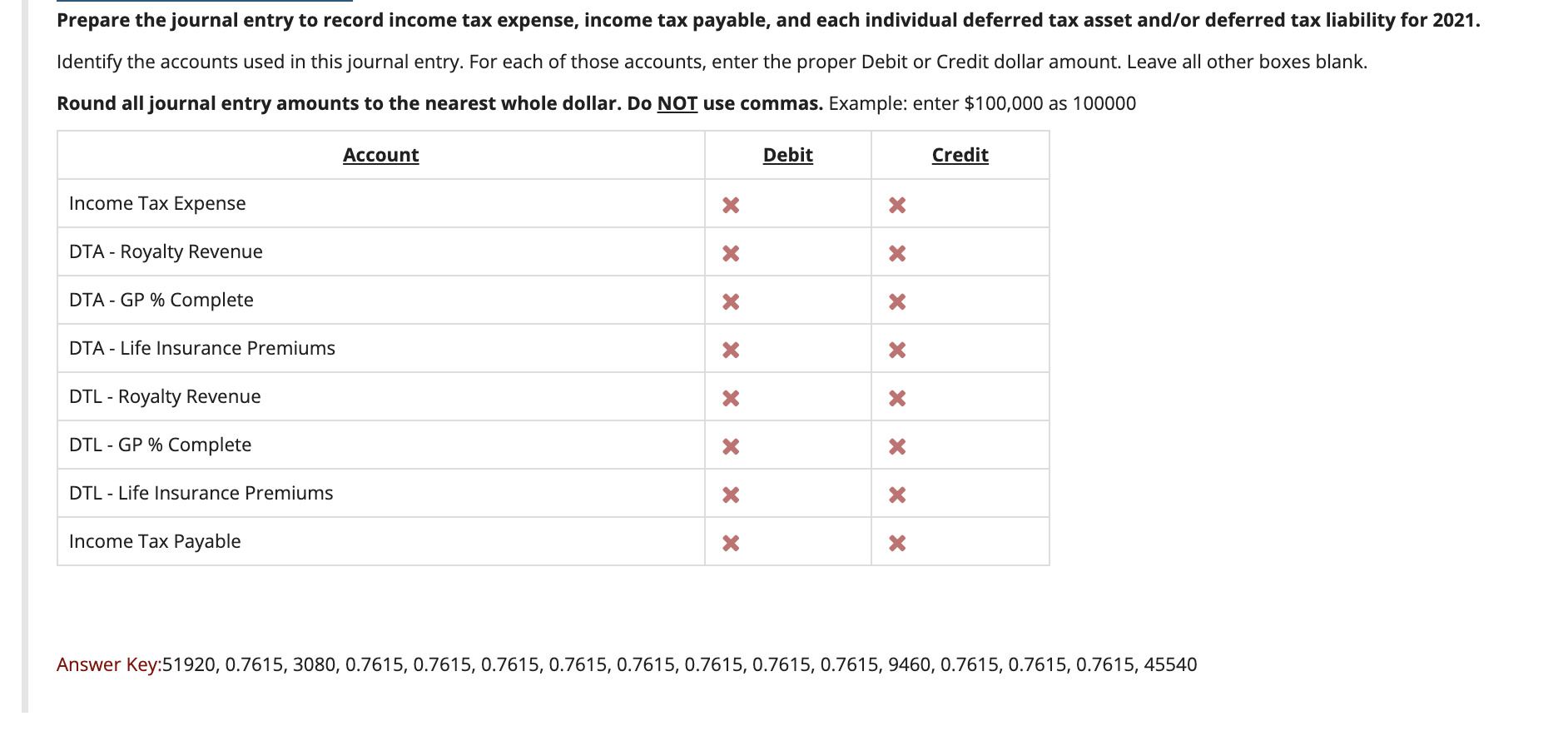

Gorilla, Inc. had the following Year 9 measures related to their defined benefit pension plan. Service Cost 98,000 12/31/48 PBO 262,000 12/31/49 PBO 375,860 12/31/48 FV Plan Assets 257,000 12/31/49 FV Plan Assets 424,850 12/31/49 actuarial loss affecting PBO 8,000 Discount rate 3% Expected LT rate of return 6% Actual rate of return 5% Gorilla, Inc. amended their plan and granted prior service cost of $68,000 on 12/30/Y8. The average remaining service life of their employees was 10 years on 12/30/Y8. The company's accumulated net actuarial gain/loss has never exceeded the corridor amount. No pension benefits were paid during Year 9. Gorilla contributed $155,000 to the plan on 12/30/29. Calculate Year 9 pension expense at 1/1/89. Type in the dollar amounts for each item. Round all amounts to the nearest whole dollar. Enter all amounts as positive numbers. Do NOT use commas. Example: enter as 100000 Service cost $ 98000 Interest cost $ x Expected return on plan assets $ x 257000 Amortization of PSC $ x Pension expense $ x Answer Key:98000, 7860, 15420, 6800, 97240 Crawford, Inc. reported the following differences between taxable income (TI) and pretax net income (PTNI) for their first year of operations that ended December 31, 2021. . $14K of royalty revenue received in 2021 to be earned in 2022 $43K of GP on incomplete contracts (GAAP: % completion; tax: completed contract) $26K of non-deductible life insurance premiums for officers The only enacted tax rate is 22% and PTNI is $210K for the year ended 12/31/21. Prepare the journal entry to record income tax expense, income tax payable, and each individual deferred tax asset and/or deferred tax liability for 2021. Identify the accounts used in this journal entry. For each of those accounts, enter the proper Debit or Credit dollar amount. Leave all other boxes blank. Round all journal entry amounts to the nearest whole dollar. Do NOT use commas. Example: enter $100,000 as 100000 Account Debit Credit Income Tax Expense DTA - Royalty Revenue DTA - GP % Complete X X X X X x X X X X X DTA - Life Insurance Premiums DTL - Royalty Revenue DTL - GP % Complete DTL - Life Insurance Premiums X X X X X X x Income Tax Payable Answer Key:51920, 0.7615, 3080, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 9460, 0.7615, 0.7615, 0.7615, 45540 Gorilla, Inc. had the following Year 9 measures related to their defined benefit pension plan. Service Cost 98,000 12/31/48 PBO 262,000 12/31/49 PBO 375,860 12/31/48 FV Plan Assets 257,000 12/31/49 FV Plan Assets 424,850 12/31/49 actuarial loss affecting PBO 8,000 Discount rate 3% Expected LT rate of return 6% Actual rate of return 5% Gorilla, Inc. amended their plan and granted prior service cost of $68,000 on 12/30/Y8. The average remaining service life of their employees was 10 years on 12/30/Y8. The company's accumulated net actuarial gain/loss has never exceeded the corridor amount. No pension benefits were paid during Year 9. Gorilla contributed $155,000 to the plan on 12/30/29. Calculate Year 9 pension expense at 1/1/89. Type in the dollar amounts for each item. Round all amounts to the nearest whole dollar. Enter all amounts as positive numbers. Do NOT use commas. Example: enter as 100000 Service cost $ 98000 Interest cost $ x Expected return on plan assets $ x 257000 Amortization of PSC $ x Pension expense $ x Answer Key:98000, 7860, 15420, 6800, 97240 Crawford, Inc. reported the following differences between taxable income (TI) and pretax net income (PTNI) for their first year of operations that ended December 31, 2021. . $14K of royalty revenue received in 2021 to be earned in 2022 $43K of GP on incomplete contracts (GAAP: % completion; tax: completed contract) $26K of non-deductible life insurance premiums for officers The only enacted tax rate is 22% and PTNI is $210K for the year ended 12/31/21. Prepare the journal entry to record income tax expense, income tax payable, and each individual deferred tax asset and/or deferred tax liability for 2021. Identify the accounts used in this journal entry. For each of those accounts, enter the proper Debit or Credit dollar amount. Leave all other boxes blank. Round all journal entry amounts to the nearest whole dollar. Do NOT use commas. Example: enter $100,000 as 100000 Account Debit Credit Income Tax Expense DTA - Royalty Revenue DTA - GP % Complete X X X X X x X X X X X DTA - Life Insurance Premiums DTL - Royalty Revenue DTL - GP % Complete DTL - Life Insurance Premiums X X X X X X x Income Tax Payable Answer Key:51920, 0.7615, 3080, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 0.7615, 9460, 0.7615, 0.7615, 0.7615, 45540Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started