Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need some help with question one. Could you please calculate the accumulated values for both people? I did it already but I am not

I need some help with question one. Could you please calculate the accumulated values for both people? I did it already but I am not sure if I have the right answers.

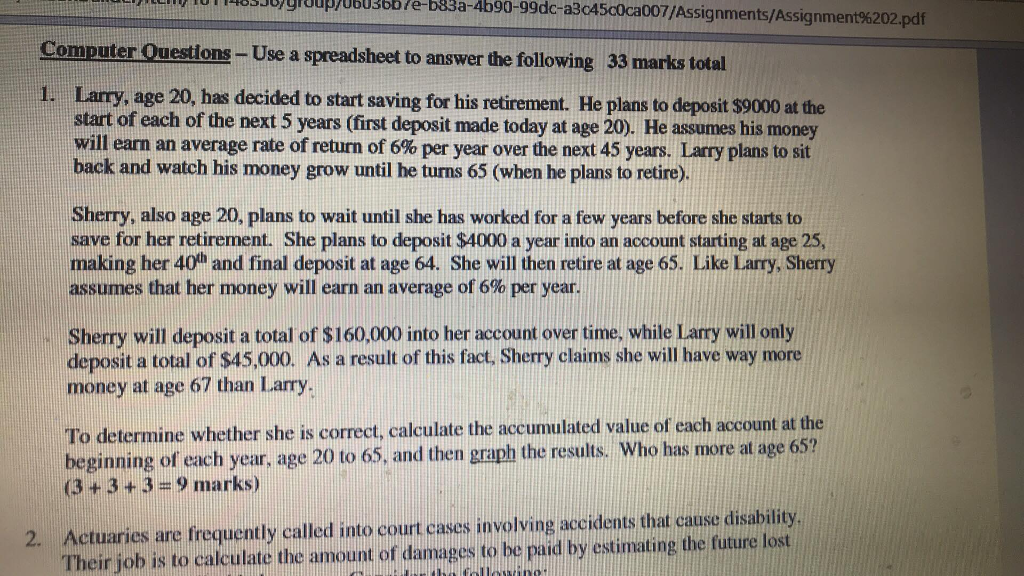

group / obusbre - b83a - 4b90-99dc -a3c45c0ca007/Assignments/Assignment%202.pdf Computer Questions- Use a spreadsheet to answer the following 33 marks total 1. Larry, age 20, has decided to start saving for his retirement. He plans to deposit $9000 at the start of each of the next 5 years (first deposit made today at age 20). He assumes his money will earn an average rate of return of 6% per year over the next 45 years. Larry plans to sit back and watch his money grow until he turns 65 (when he plans to retire). Sherry, also age 20, plans to wait until she has worked for a few years before she starts to save for her retirement. She plans to deposit $4000 a year into an account starting at age 25, making her 40h and final deposit at age 64. She will then retire at age 65. Like Larry, Sherry assumes that her money will earn an average of 6% per year. Sherry will deposit a total of $160,000 into her account over time, while Lary will only deposit a total of $45,000. As a result of this fact. Sherry claims she will have way more money at age 67 than Larry To determine whether she is correct, calculate the accumulated value of each account at the beginning of each year, age 20 to 65, and then graph the results. Who has more at age 65? (3 + 3+3 9 marks) ctuaries are frequently called into court cases involving aceidents that cause disability Their job is to calculate the amount of damages to be paid by estimating the future lost group / obusbre - b83a - 4b90-99dc -a3c45c0ca007/Assignments/Assignment%202.pdf Computer Questions- Use a spreadsheet to answer the following 33 marks total 1. Larry, age 20, has decided to start saving for his retirement. He plans to deposit $9000 at the start of each of the next 5 years (first deposit made today at age 20). He assumes his money will earn an average rate of return of 6% per year over the next 45 years. Larry plans to sit back and watch his money grow until he turns 65 (when he plans to retire). Sherry, also age 20, plans to wait until she has worked for a few years before she starts to save for her retirement. She plans to deposit $4000 a year into an account starting at age 25, making her 40h and final deposit at age 64. She will then retire at age 65. Like Larry, Sherry assumes that her money will earn an average of 6% per year. Sherry will deposit a total of $160,000 into her account over time, while Lary will only deposit a total of $45,000. As a result of this fact. Sherry claims she will have way more money at age 67 than Larry To determine whether she is correct, calculate the accumulated value of each account at the beginning of each year, age 20 to 65, and then graph the results. Who has more at age 65? (3 + 3+3 9 marks) ctuaries are frequently called into court cases involving aceidents that cause disability Their job is to calculate the amount of damages to be paid by estimating the future lostStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started