Answered step by step

Verified Expert Solution

Question

1 Approved Answer

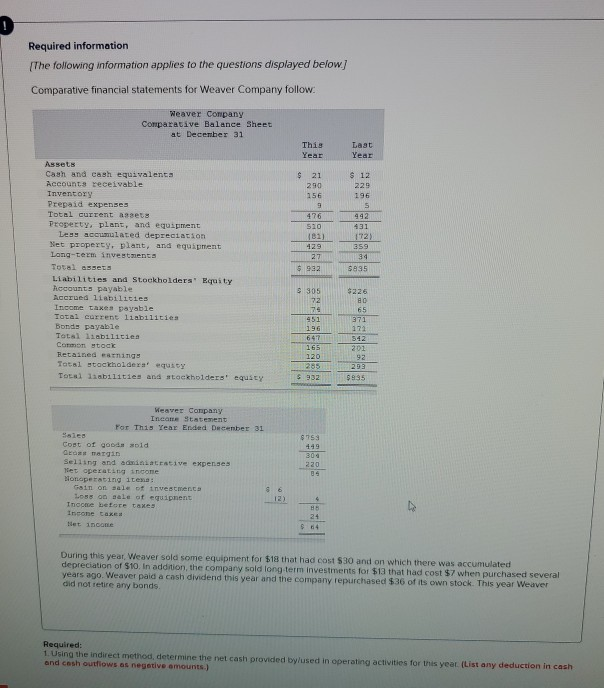

I need some help with these questions, please. Thanks. D Required information The following information applies to the questions displayed below] Comparative financial statements for

I need some help with these questions, please. Thanks.

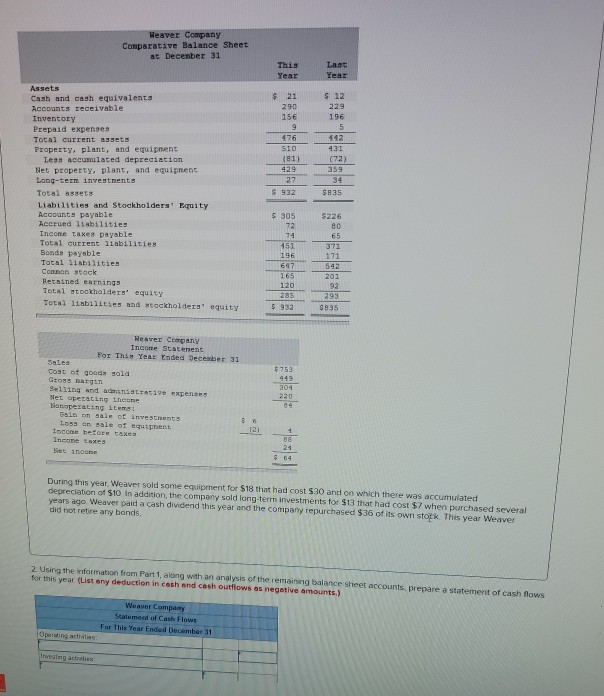

D Required information The following information applies to the questions displayed below] Comparative financial statements for Weaver Company follow Weaver Company Comparative Balance Sheet at December 31 This Year Laat Year $ 12 229 196 S 412 Assets Cash and cash equivalenta Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Les acelated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Rccounts payable Accrued liabilities Income taxes payable Total Current liabilities Bonds payable Total libilities Common stock Betained earnings Total stockholders' equiry Total liabilities and stockholders' equity $ 21 290 156 9 476 510 181) 429 27 6932 431 172) 359 94 S895 $226 80 65 371 172 9 905 72 76 951 196 647 165 120 205 S 932 201 92 299 $9.95 Weaver Company Income Statement For This Year Ended December 31 $753 449 304 220 Cost of goods sold GEO margin Selling and administrative expenses let operating neone Monoperating itens Gain on sale of investments Los on sale of equipment Ihone before taxes Income taxe Het income 12) 25 24 During this year, Weaver sold some equipment for $18 that had cost $30 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $13 that had cost $7 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $36 of its own stock. This year Weaver did not retire any bonds Required: 1. Using the indirect method, determine the net cash provided by used in operating activities for this year (List any deduction in cash and cash outflows as negative amounts.) Weaver Company Comparative Balance Sheet at December 31 This Year Lass Year $ 12 229 196 5 142 $ 21 290 156 9 476 510 (81) 429 27 $ 932 431 (72) 359 34 $835 Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Les accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total 11 abilities Cowon stack Betained earnings Total stockholders' equity Total Itabilities and stockholders' equity $ 305 72 74 451 196 617 165 120 285 $ 933 -al- $226 80 65 372 171 542 201 92 293 $935 $ 753 Weaver Company Income Statement For This Year Ended December 31 Sales COIL ot good sold Gros margin Selling and administrative expenses Net operating income Banoperating Items Gain on sale of investments Los on sale of equipment Iocco hetore taxes Income taxes Bet 1 304 220 121 88 24 During this year Weaver sold some equipment for $18 that had cost $30 and on which there was accumulated depreciation of $10 In addition, the company sold long-term investments for $13 that had cost $7 when purchased several years ago Weaver paid a cash dividend this year and the company repurchased $36 of its own stock. This year Weaver did not retire any bands 2 Using the information from Part 1, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year (List any deduction in cash and cash outflows as negative amounts) Weaver Company Statement of Cash Flows For This Year Ended December 31 Operating activities D Required information The following information applies to the questions displayed below] Comparative financial statements for Weaver Company follow Weaver Company Comparative Balance Sheet at December 31 This Year Laat Year $ 12 229 196 S 412 Assets Cash and cash equivalenta Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Les acelated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Rccounts payable Accrued liabilities Income taxes payable Total Current liabilities Bonds payable Total libilities Common stock Betained earnings Total stockholders' equiry Total liabilities and stockholders' equity $ 21 290 156 9 476 510 181) 429 27 6932 431 172) 359 94 S895 $226 80 65 371 172 9 905 72 76 951 196 647 165 120 205 S 932 201 92 299 $9.95 Weaver Company Income Statement For This Year Ended December 31 $753 449 304 220 Cost of goods sold GEO margin Selling and administrative expenses let operating neone Monoperating itens Gain on sale of investments Los on sale of equipment Ihone before taxes Income taxe Het income 12) 25 24 During this year, Weaver sold some equipment for $18 that had cost $30 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $13 that had cost $7 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $36 of its own stock. This year Weaver did not retire any bonds Required: 1. Using the indirect method, determine the net cash provided by used in operating activities for this year (List any deduction in cash and cash outflows as negative amounts.) Weaver Company Comparative Balance Sheet at December 31 This Year Lass Year $ 12 229 196 5 142 $ 21 290 156 9 476 510 (81) 429 27 $ 932 431 (72) 359 34 $835 Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Les accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total 11 abilities Cowon stack Betained earnings Total stockholders' equity Total Itabilities and stockholders' equity $ 305 72 74 451 196 617 165 120 285 $ 933 -al- $226 80 65 372 171 542 201 92 293 $935 $ 753 Weaver Company Income Statement For This Year Ended December 31 Sales COIL ot good sold Gros margin Selling and administrative expenses Net operating income Banoperating Items Gain on sale of investments Los on sale of equipment Iocco hetore taxes Income taxes Bet 1 304 220 121 88 24 During this year Weaver sold some equipment for $18 that had cost $30 and on which there was accumulated depreciation of $10 In addition, the company sold long-term investments for $13 that had cost $7 when purchased several years ago Weaver paid a cash dividend this year and the company repurchased $36 of its own stock. This year Weaver did not retire any bands 2 Using the information from Part 1, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year (List any deduction in cash and cash outflows as negative amounts) Weaver Company Statement of Cash Flows For This Year Ended December 31 Operating activitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started