I need some homework help please.

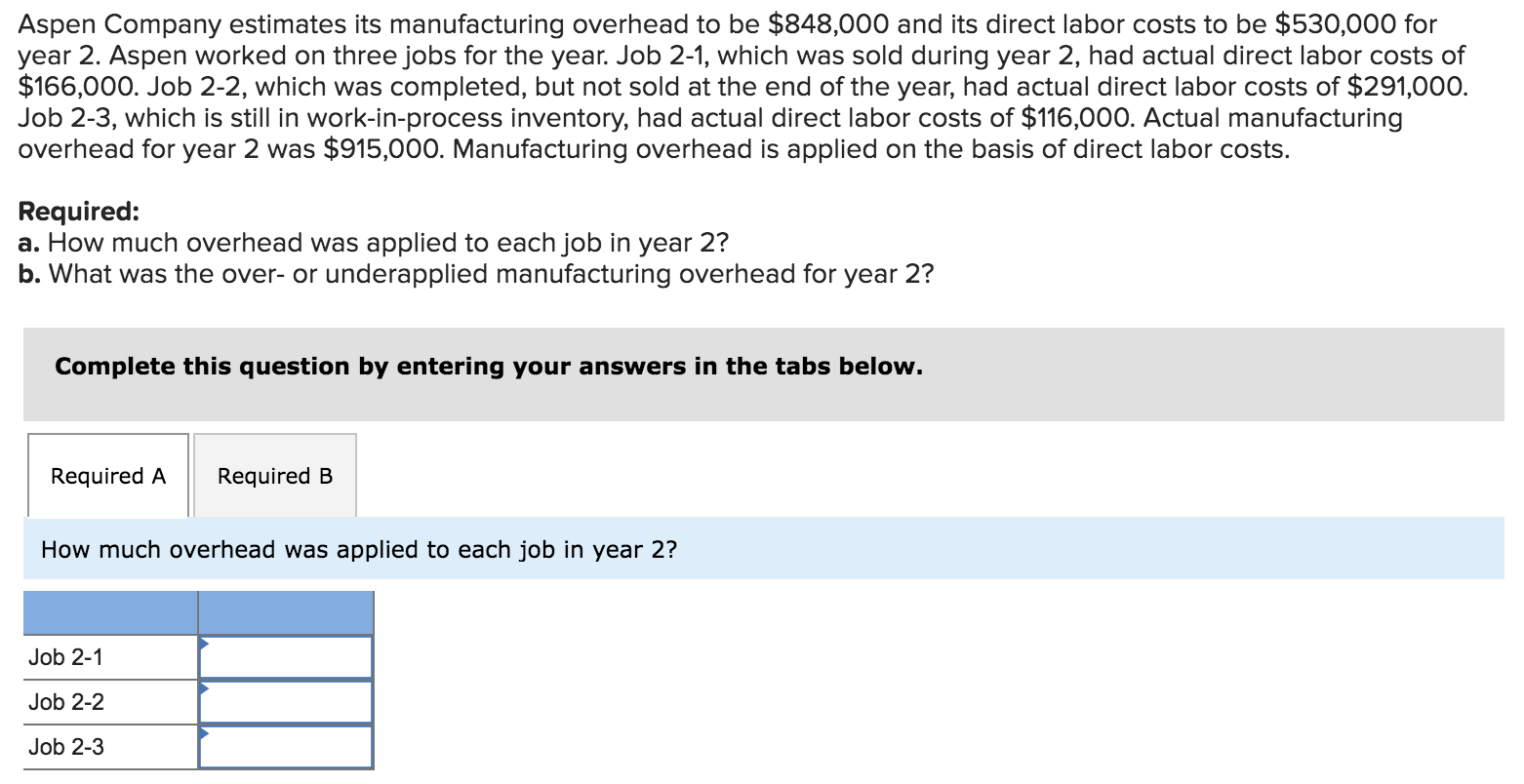

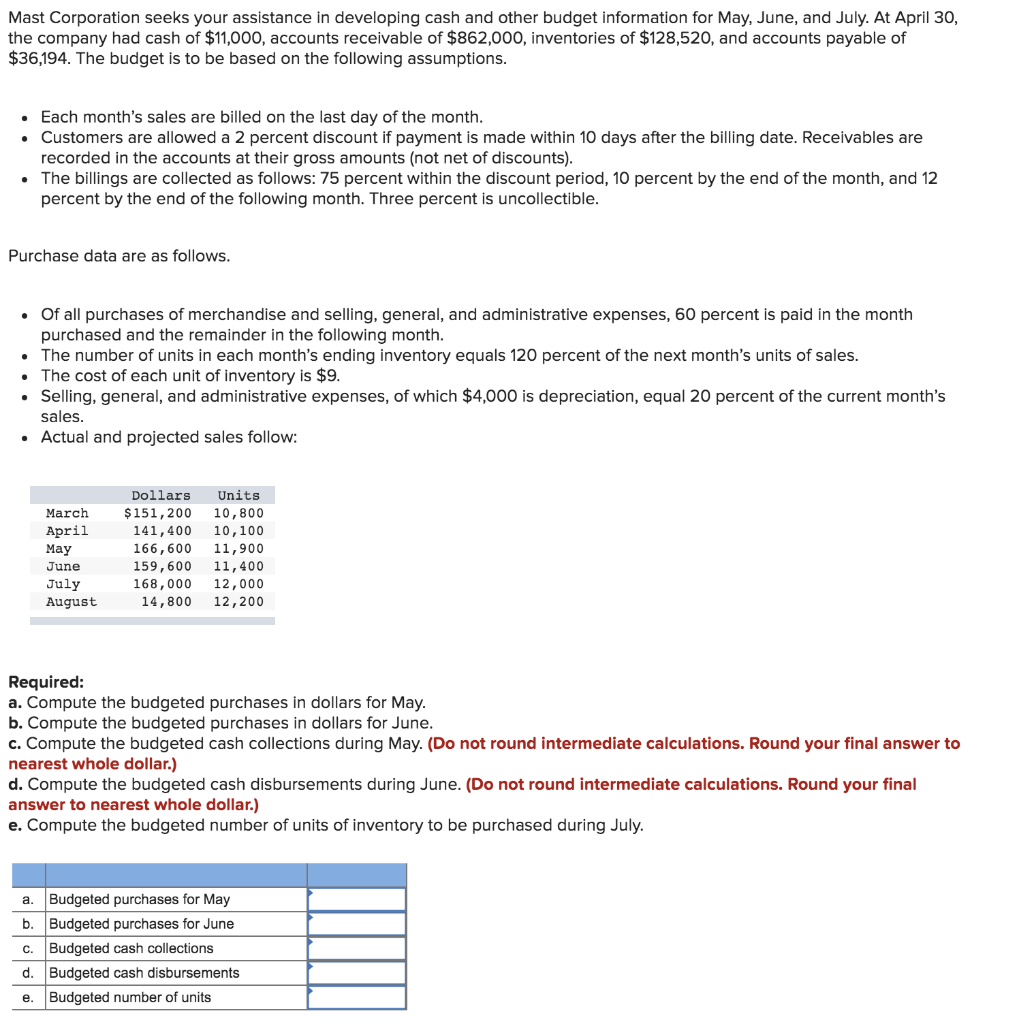

Aspen Company estimates its manufacturing overhead to be $848,000 and its direct labor costs to be $530,000 for year 2. Aspen worked on three jobs for the year. Job 2-1, which was sold during year 2, had actual direct labor costs of $166,000. Job 2-2, which was completed, but not sold at the end of the year, had actual direct labor costs of $291,000. Job 2-3, which is still in work-in-process inventory, had actual direct labor costs of $116,000. Actual manufacturing overhead for year 2 was $915,000. Manufacturing overhead is applied on the basis of direct labor costs. Required: a. How much overhead was applied to each job in year 2? b. What was the over- or underapplied manufacturing overhead for year 2? Complete this question by entering your answers in the tabs below. Required A Required B How much overhead was applied to each job in year 2? Job 2-1 Job 2-2 Job 2-3 Mast Corporation seeks your assistance in developing cash and other budget information for May, June, and July. At April 30, the company had cash of $11,000, accounts receivable of $862,000, inventories of $128,520, and accounts payable of $36,194. The budget is to be based on the following assumptions. Each month's sales are billed on the last day of the month. Customers are allowed a 2 percent discount if payment is made within 10 days after the billing date. Receivables are recorded in the accounts at their gross amounts (not net of discounts). The billings are collected as follows: 75 percent within the discount period, 10 percent by the end of the month, and 12 percent by the end of the following month. Three percent is uncollectible. Purchase data are as follows. Of all purchases of merchandise and selling, general, and administrative expenses, 60 percent is paid in the month purchased and the remainder in the following month. The number of units in each month's ending inventory equals 120 percent of the next month's units of sales. The cost of each unit of inventory is $9. Selling, general, and administrative expenses, of which $4,000 is depreciation, equal 20 percent of the current month's sales. Actual and projected sales follow: March April May Dollars $ 151,200 141,400 166,600 159,600 168,000 14,800 Units 10,800 10,100 11,900 11,400 12,000 12,200 June July August Required: a. Compute the budgeted purchases in dollars for May. b. Compute the budgeted purchases in dollars for June. c. Compute the budgeted cash collections during May. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) d. Compute the budgeted cash disbursements during June. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) e. Compute the budgeted number of units of inventory to be purchased during July. a. Budgeted purchases for May b. Budgeted purchases for June Budgeted cash collections d. Budgeted cash disbursements e. Budgeted number of units