Question

I need someone to verify the numbers I have on Form 1120 are correct based on the Excel Data provided below. All the data and

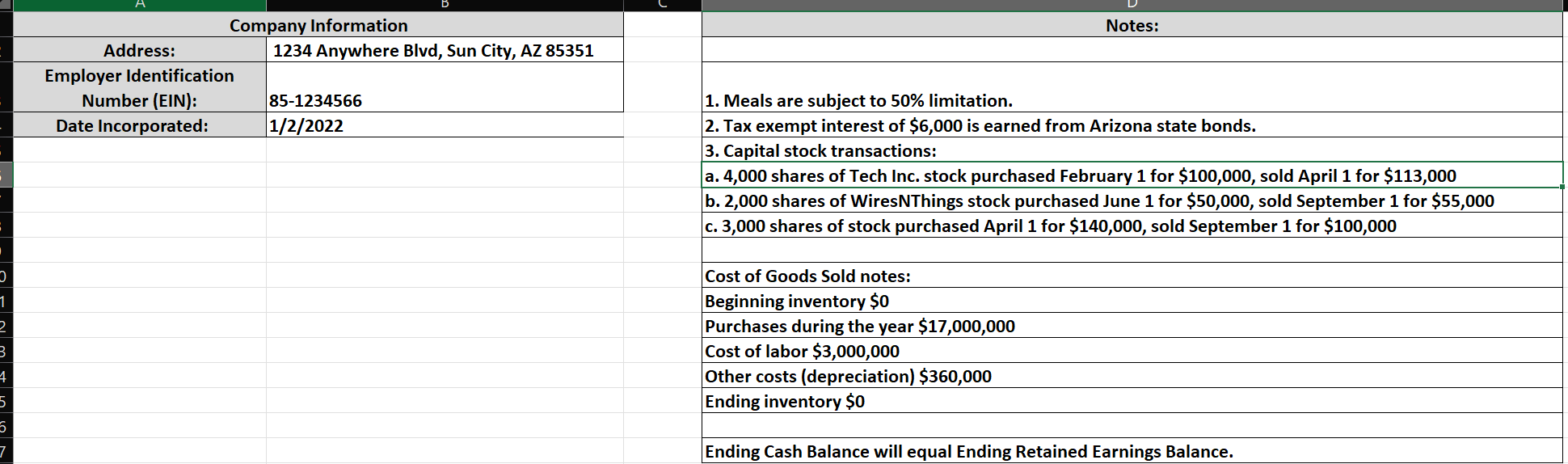

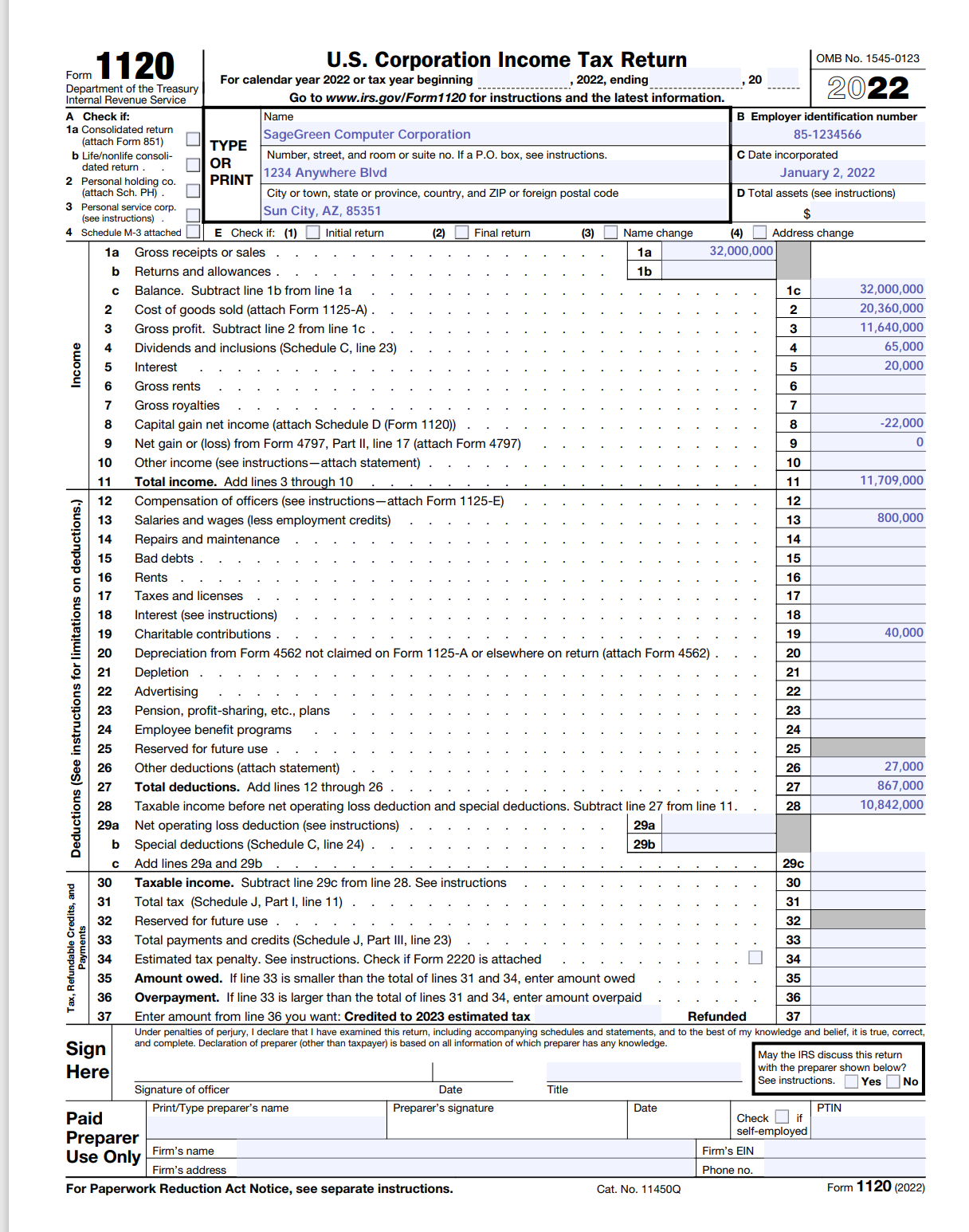

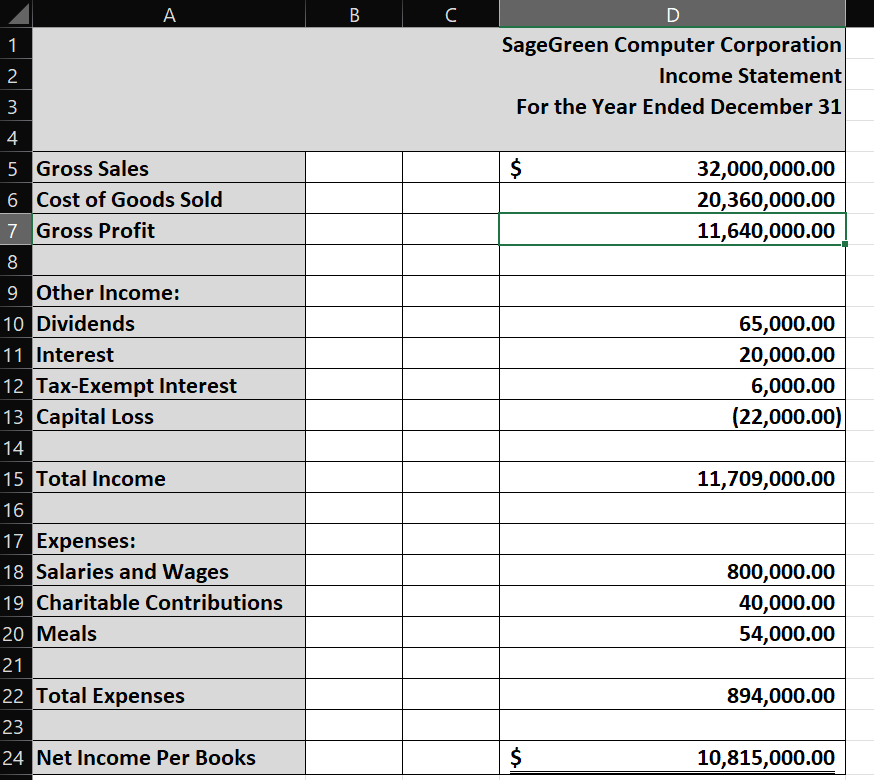

I need someone to verify the numbers I have on Form 1120 are correct based on the Excel Data provided below. All the data and information that I have for this is provided below. I was supposed to fill in the business information, including address, etc. I had to go through the Excel data and match it up with the form, and if additional information is available outside of the income statement ( the other Excel document with the notes header), I had to include that as well. This is all the information I have and I believe it's all correct. I just need someone to help verify my work is correct. This is written in my own words and there's no other tables or attachments to this question.

D 1 2 3 4 5 5 7 Address: Company Information Employer Identification Number (EIN): Date Incorporated: 1234 Anywhere Blvd, Sun City, AZ 85351 85-1234566 1/2/2022 Notes: 1. Meals are subject to 50% limitation. 2. Tax exempt interest of $6,000 is earned from Arizona state bonds. 3. Capital stock transactions: a. 4,000 shares of Tech Inc. stock purchased February 1 for $100,000, sold April 1 for $113,000 b. 2,000 shares of WiresNThings stock purchased June 1 for $50,000, sold September 1 for $55,000 c. 3,000 shares of stock purchased April 1 for $140,000, sold September 1 for $100,000 Cost of Goods Sold notes: Beginning inventory $0 Purchases during the year $17,000,000 Cost of labor $3,000,000 Other costs (depreciation) $360,000 Ending inventory $0 Ending Cash Balance will equal Ending Retained Earnings Balance.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided lets verify the numbers on Form 1120 1 Gross Receipts or Sales Line 1a 32000000 Matches 2 Returns and Allowances Lin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started