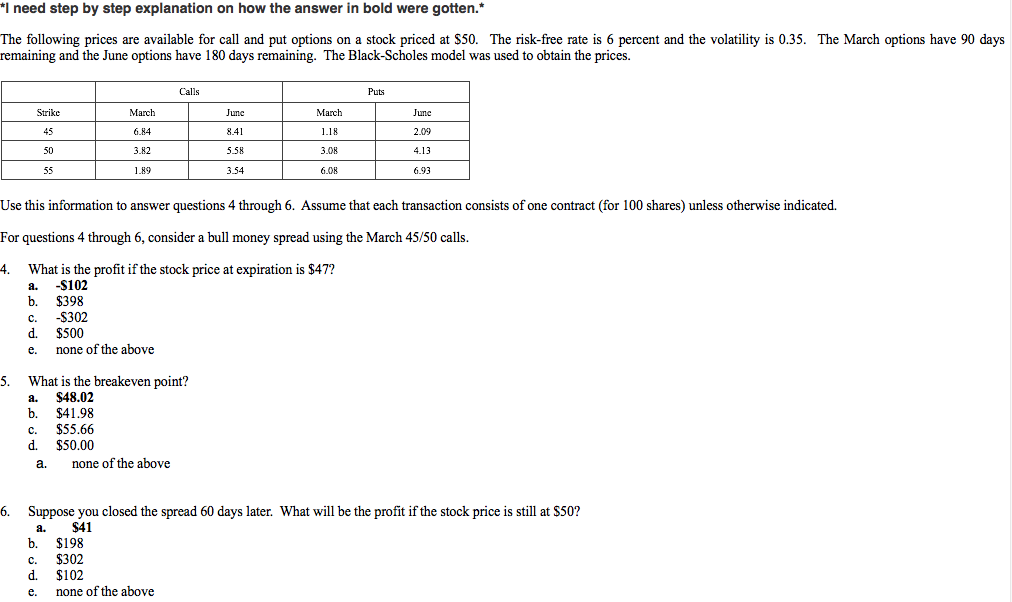

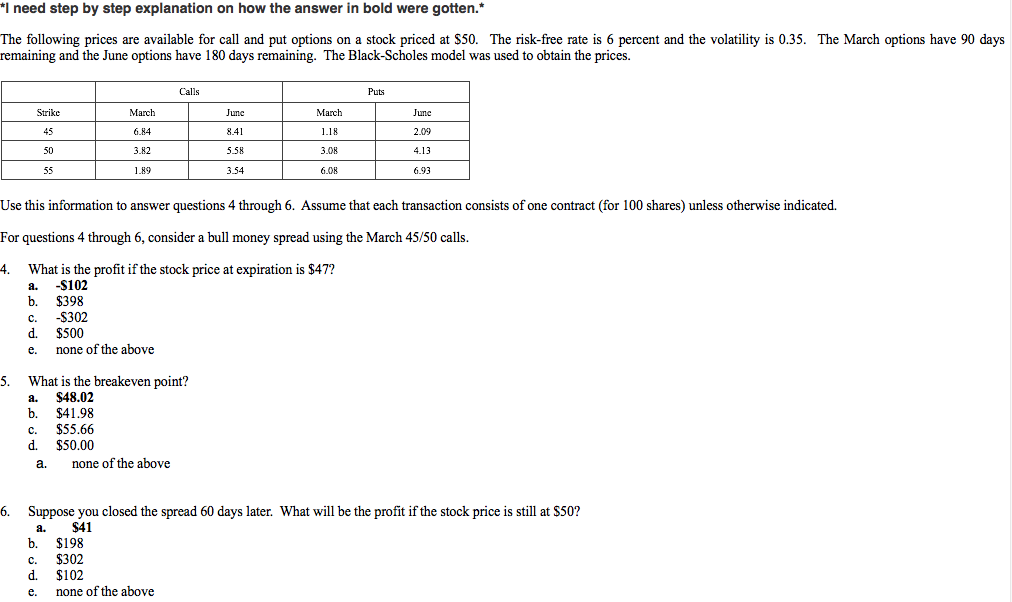

*I need step by step explanation on how the answer in bold were gotten.* The following prices are available for call and put options on a stock priced at $50. The risk -free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices. Calls Putt Strike March June March June 45 6.84 8.41 1.18 2.09 50 3.82 5.58 3.08 4.13 55 1.89 3.54 6.08 6.93 Use this information to answer questions 4 through 6. Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated. For questions 4 through 6, consider a bull money spread using the March 45/50 calls. 4. What is the profit if the stock price at expiration is $47? a. -$102 b. $398 c. -$302 d. $500 e. none of the above 5. What is the breakeven point? a. $48.02 b. $41.98 c. $55.66 d. $50.00 a. none of the above 6. Suppose you closed the spread 60 days later. What will be the profit if the stock price is still at $50? a. $41 b. $198 c. $302 d. $102 e. none of the above *I need step by step explanation on how the answer in bold were gotten.* The following prices are available for call and put options on a stock priced at $50. The risk -free rate is 6 percent and the volatility is 0.35. The March options have 90 days remaining and the June options have 180 days remaining. The Black-Scholes model was used to obtain the prices. Calls Putt Strike March June March June 45 6.84 8.41 1.18 2.09 50 3.82 5.58 3.08 4.13 55 1.89 3.54 6.08 6.93 Use this information to answer questions 4 through 6. Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated. For questions 4 through 6, consider a bull money spread using the March 45/50 calls. 4. What is the profit if the stock price at expiration is $47? a. -$102 b. $398 c. -$302 d. $500 e. none of the above 5. What is the breakeven point? a. $48.02 b. $41.98 c. $55.66 d. $50.00 a. none of the above 6. Suppose you closed the spread 60 days later. What will be the profit if the stock price is still at $50? a. $41 b. $198 c. $302 d. $102 e. none of the above