Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer be clearly,please AaBb Cedbe AalbCodec AaBbCcDdE AaBbCcbc Heading 1 abe X2 XP PE Emphasis Normal Strong The following statement of financial

I need the answer be clearly,please

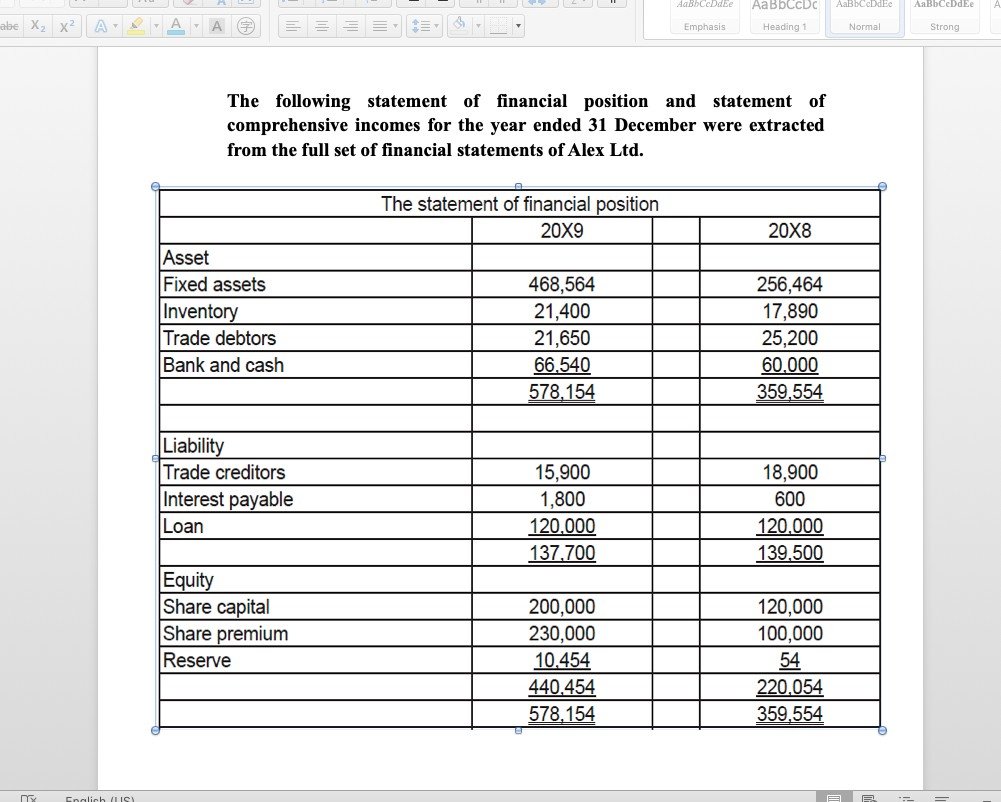

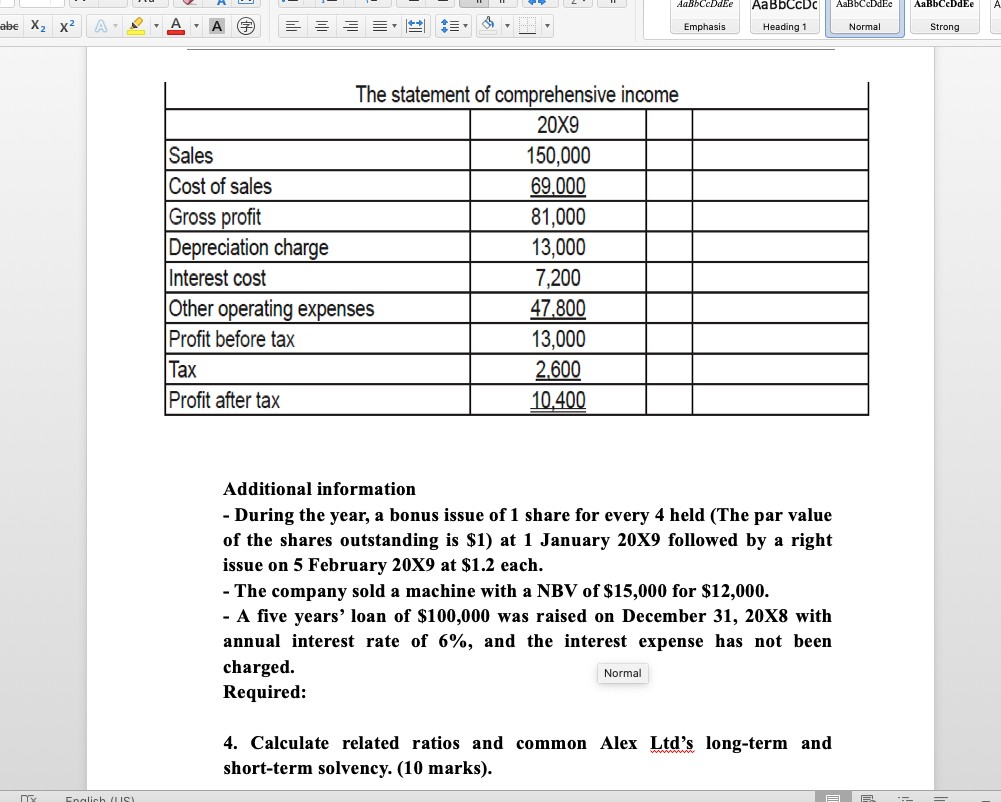

AaBb Cedbe AalbCodec AaBbCcDdE AaBbCcbc Heading 1 abe X2 XP PE Emphasis Normal Strong The following statement of financial position and statement of comprehensive incomes for the year ended 31 December were extracted from the full set of financial statements of Alex Ltd. The statement of financial position 20X9 20X8 Asset Fixed assets Inventory Trade debtors Bank and cash 468,564 21,400 21,650 66.540 578,154 256,464 17,890 25,200 60.000 359,554 Liability Trade creditors Interest payable Loan 15,900 1,800 120.000 137.700 18,900 600 120.000 139.500 Equity Share capital Share premium Reserve 200,000 230,000 10.454 440.454 578,154 120,000 100,000 54 220,054 359,554 CoalichUS) dabbdebele cDEc AaBbCeDdEe AaBbCcDc Heading 1 abe X2 X A VE Emphasis Normal Strong The statement of comprehensive income 20X9 Sales 150,000 Cost of sales 69.000 Gross profit 81,000 Depreciation charge 13,000 Interest cost 7,200 Other operating expenses 47.800 Profit before tax 13,000 Tax 2.600 Profit after tax 10,400 Additional information - During the year, a bonus issue of 1 share for every 4 held (The par value of the shares outstanding is $1) at 1 January 20X9 followed by a right issue on 5 February 20X9 at $1.2 each. - The company sold a machine with a NBV of $15,000 for $12,000. - A five years' loan of $100,000 was raised on December 31, 20X8 with annual interest rate of 6%, and the interest expense has not been charged. Required: Normal 4. Calculate related ratios and common Alex Ltd's long-term and short-term solvency. (10 marks). 5 Calich US)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started