Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer EXERCISE 7-2 Dropping or Retaining a Segment 11.07-31 The Regal Cycle Company manufactures three types of bicycles-adirt bike, a mountain bike,

I need the answer

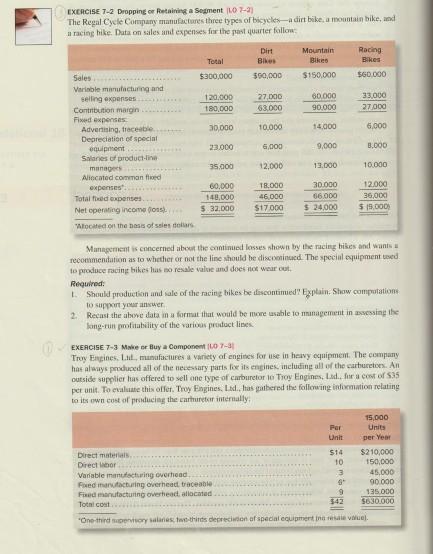

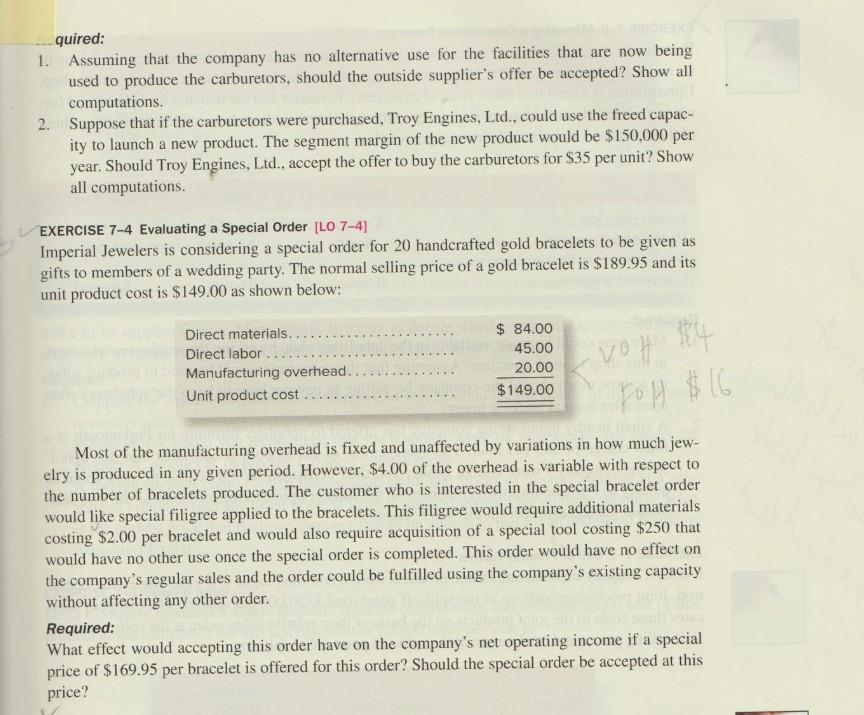

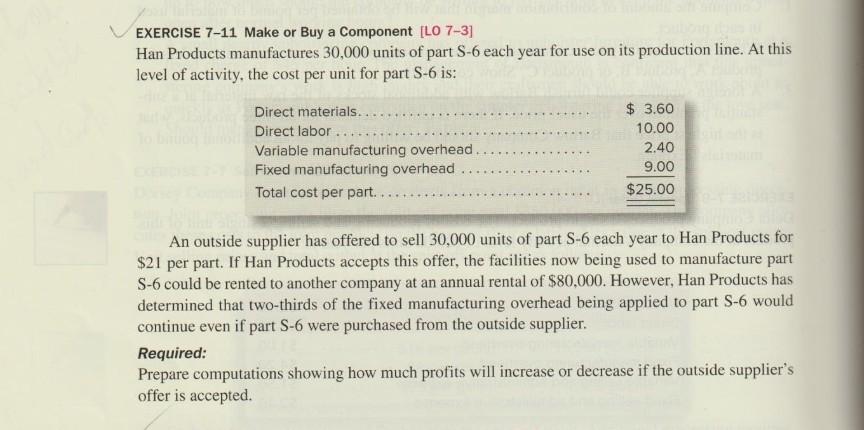

EXERCISE 7-2 Dropping or Retaining a Segment 11.07-31 The Regal Cycle Company manufactures three types of bicycles-adirt bike, a mountain bike, and a racing hike. Data on sales and expenses for the past quarter follow Dirt Mountain Bikes $150,000 Racing Bikes Total $300,000 550.000 $60.000 120,000 180.000 27,000 63,000 60.000 90.000 33 000 27.000 30,000 10.000 14.000 6.000 23.000 6,000 9.000 B,000 Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses Advertising, traceable Depreciation of special equipment Salaries of product managers Alicated command expenses Total expenses Net operating income Wrocated on the basis of sales Dollars 35.000 12.000 13.000 10.000 60.000 140,000 32.000 # 0 46000 $17.000 30.000 06 ODO $ 24,000 12.000 36,000 515,000 Management is concerned about the continued losses shown by the racing bikes and wants recommendation as to whether or not the line should be discried. The special equipment used to produce racing bikes hus no resale value and does not wear out, Required: Should production and sale of the racing bikes be descontimedExplain. Show computation to support your answer 2 Recast the above data in format that would be more usable to management in assessing the Jongeren profitability of the various product lines EXERCISE 7-3 Mnie or Buy a Component |L07-31 Truy Engines. Lat., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the cutes. An outside supplier has offered to sell one type of carburetor Tray Engines, Lad for a cost of as per unit. To evaluate this offer. Troy Engines. Lad has gathered the following information relating to its own cost of producing the enthuretar internally $14 15.000 Por Units Unit Der Yes Direct materials $210,000 Director 10 150,000 Variable manufacturing overhead 3 45.000 Fored hacturing overheat traceable 90.000 Fred manufacturing overhead allocated 9 135.000 Total cost 342 $630,000 "One-third or are two-thirds depreciation of special equipment in reve. quired: 1. Assuming that the company has no alternative use for the facilities that are now being used to produce the carburetors, should the outside supplier's offer be accepted? Show all computations. 2. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capac- ity to launch a new product. The segment margin of the new product would be $150,000 per year. Should Troy Engines, Ltd., accept the offer to buy the carburetors for $35 per unit? Show all computations. EXERCISE 7-4 Evaluating a Special Order [LO 7-4) Imperial Jewelers is considering a special order for 20 handcrafted gold bracelets to be given as gifts to members of a wedding party. The normal selling price of a gold bracelet is $189.95 and its unit product cost is $149.00 as shown below: $4 Direct materials. Direct labor... Manufacturing overhead.. Unit product cost $ 84.00 45.00 20.00 $149.00 vot Most of the manufacturing overhead is fixed and unaffected by variations in how much jew- elry is produced in any given period. However, $4.00 of the overhead is variable with respect to the number of bracelets produced. The customer who is interested in the special bracelet order would like special filigree applied to the bracelets. This filigree would require additional materials costing $2.00 per bracelet and would also require acquisition of a special tool costing $250 that would have no other use once the special order is completed. This order would have no effect on the company's regular sales and the order could be fulfilled using the company's existing capacity without affecting any other order. Required: What effect would accepting this order have on the company's net operating income if a special price of $169.95 per bracelet is offered for this order? Should the special order be accepted at this price? EXERCISE 7-11 Make or Buy a Component [LO 7-31 Han Products manufactures 30,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is: Direct materials. Direct labor.. Variable manufacturing overhead. Fixed manufacturing overhead Total cost per part... $ 3.60 10.00 2.40 9.00 $25.00 An outside supplier has offered to sell 30,000 units of part S-6 each year to Han Products for $21 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $80,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part 5-6 would continue even if part 5-6 were purchased from the outside supplier. Required: Prepare computations showing how much profits will increase or decrease if the outside supplier's offer is accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started