I need the answer for 2.a

all necessary info can be found from part1

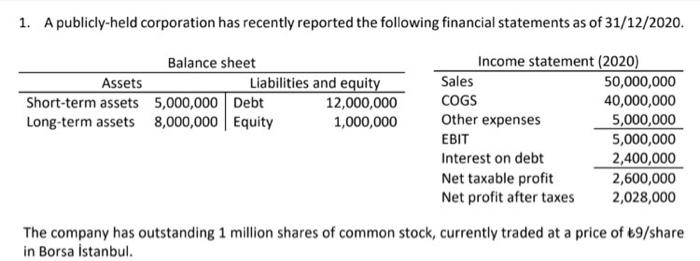

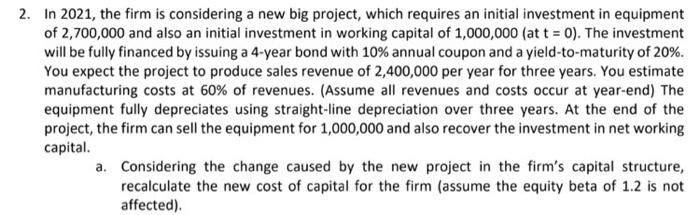

1. A publicly-held corporation has recently reported the following financial statements as of 31/12/2020. Balance sheet Income statement (2020) Assets Liabilities and equity Sales 50,000,000 Short-term assets 5,000,000 Debt 12,000,000 COGS 40,000,000 Long-term assets 8,000,000 Equity 1,000,000 Other expenses 5,000,000 EBIT 5,000,000 Interest on debt 2,400,000 Net taxable profit 2,600,000 Net profit after taxes 2,028,000 The company has outstanding 1 million shares of common stock, currently traded at a price of 9/share in Borsa stanbul. 2. In 2021, the firm is considering a new big project, which requires an initial investment in equipment of 2,700,000 and also an initial investment in working capital of 1,000,000 (at t = 0). The investment will be fully financed by issuing a 4-year bond with 10% annual coupon and a yield-to-maturity of 20%. You expect the project to produce sales revenue of 2,400,000 per year for three years. You estimate manufacturing costs at 60% of revenues. (Assume all revenues and costs occur at year-end) The equipment fully depreciates using straight-line depreciation over three years. At the end of the project, the firm can sell the equipment for 1,000,000 and also recover the investment in net working capital. a. Considering the change caused by the new project in the firm's capital structure, recalculate the new cost of capital for the firm (assume the equity beta of 1.2 is not affected). 1. A publicly-held corporation has recently reported the following financial statements as of 31/12/2020. Balance sheet Income statement (2020) Assets Liabilities and equity Sales 50,000,000 Short-term assets 5,000,000 Debt 12,000,000 COGS 40,000,000 Long-term assets 8,000,000 Equity 1,000,000 Other expenses 5,000,000 EBIT 5,000,000 Interest on debt 2,400,000 Net taxable profit 2,600,000 Net profit after taxes 2,028,000 The company has outstanding 1 million shares of common stock, currently traded at a price of 9/share in Borsa stanbul. 2. In 2021, the firm is considering a new big project, which requires an initial investment in equipment of 2,700,000 and also an initial investment in working capital of 1,000,000 (at t = 0). The investment will be fully financed by issuing a 4-year bond with 10% annual coupon and a yield-to-maturity of 20%. You expect the project to produce sales revenue of 2,400,000 per year for three years. You estimate manufacturing costs at 60% of revenues. (Assume all revenues and costs occur at year-end) The equipment fully depreciates using straight-line depreciation over three years. At the end of the project, the firm can sell the equipment for 1,000,000 and also recover the investment in net working capital. a. Considering the change caused by the new project in the firm's capital structure, recalculate the new cost of capital for the firm (assume the equity beta of 1.2 is not affected)