Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer for part 2, 3. PLEASE NOT PART 1. Calibri BIU - * General - 11 - AA EE - A Wrap

I need the answer for part 2, 3. PLEASE NOT PART 1.

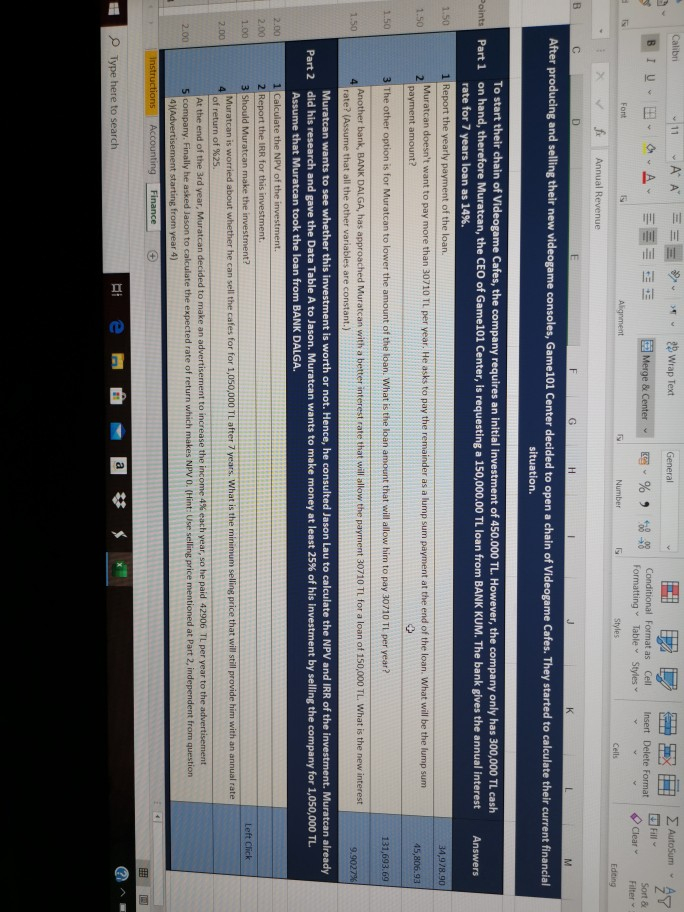

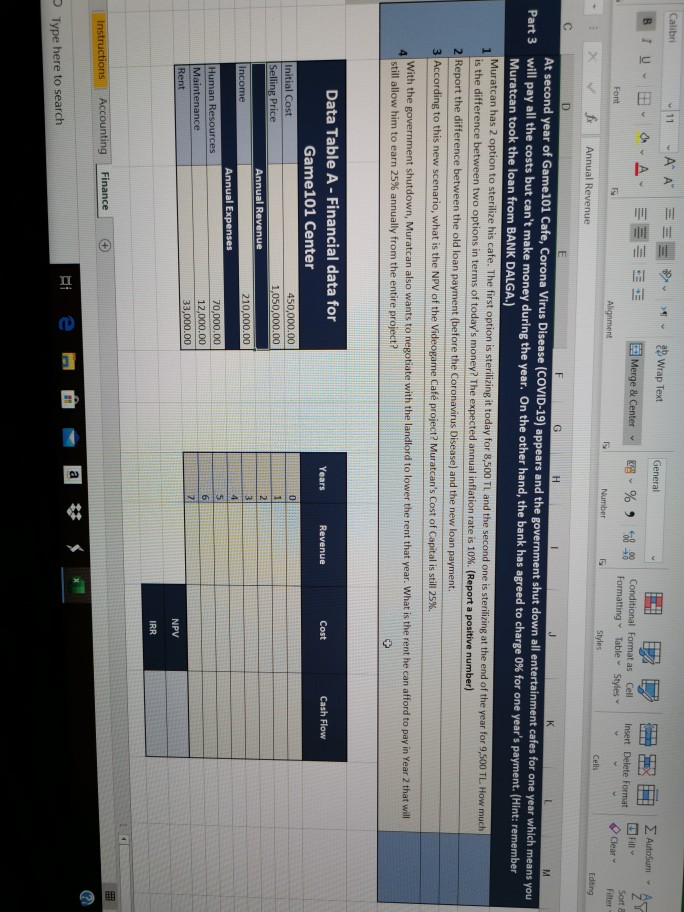

Calibri BIU - * General - 11 - AA EE - A Wrap Text Merge & Center S HEX E Insert Delete Format 2 AutoSum P L Conditional Format as Cell Formatting Table Styles 2Y 47 Sort & Egy E% Clear Filter Font Alignment Number Styles Cells Editing B - 1 fx Annual Revenue C D LM After producing and selling their new videogame consoles, Game101 Center decided to open a chain of Videogame Cafes. They started to calculate their current financial situation. Answers To start their chain of Videogame Cafes, the company requires an initial investment of 450.000 TL. However, the company only has 300,000 TL cash Points Part 1 on hand, therefore Muratcan, the CEO of Game101 Center, is requesting a 150,000.00 TL loan from BANK KUM. The bank gives the annual interest rate for 7 years loan as 14%. 1.50 1 Report the yearly payment of the loan. 1.50 Muratcan doesn't want to pay more than 30710 TL per year. He asks to pay the remainder as a lump sum payment at the end of the loan. What will be the lump sum payment amount? 34,978,90 45,806.93 1.50 3 The other option is for Muratcan to lower the amount of the loan. What is the loan amount that will allow him to pay 30710 TL per year? 131,693.69 1.50 2.00 2,00 1.00 Another bank, BANK DALGA, has approached Muratcan with a better interest rate that will allow the payment 30710 TL for a loan of 150,000 TL. What is the new interest rate? (Assume that all the other variables are constant.) 9.9027% Muratcan wants to see whether this investment is worth or not. Hence, he consulted Jason Lau to calculate the NPV and IRR of the investment. Muratcan already Part 2 did his research and gave the Data Table A to Jason. Muratcan wants to make money at least 25% of his Investment by selling the company for 1,050,000 TL Assume that Muratcan took the loan from BANK DALGA. Calculate the NPV of the investment. 2 Report the IRR for this investment. 3 Should Muratcan make the investment? Left Click Muratcan is worried about whether he can sell the cafes for for 1,050,000 TL after 7 years. What is the minimum selling price that will still provide him with an annual rate of return of %25. At the end of the 3rd year, Muratcan decided to make an advertisement to increase the income 4% each year, so he paid 42906 TL per year to the advertisement 5 company. Finally he asked Jason to calculate the expected rate of return which makes NPV O. (Hint: Use selling price mentioned at Part 2, independent from question 4) Advertisement starting from year 4) Instructions Accounting Finance 2.00 2.00 Type here to search - 11 Calibri BIU - B A A == = E General A 2 Wrap Text Merge & Center utou - - % , 4 8-98 .02 Conditional Format as Cell Formatting Table Styles Insert Delete Format Font . Clear Alignment Conta Number Filter - Styles X Fi Annual Revenue Editing At second year of Game101 Cafe, Corona Virus Disease (COVID-19) appears and the government shut down all entertainment cafes for one year which means you Part 3 will pay all the costs but can't make money during the year. On the other hand, the bank has agreed to charge 0% for one year's payment. (Hint: remember Muratcan took the loan from BANK DALGA.) Muratcan has 2 option to sterilize his cafe. The first option is sterilizing it today for 8,500 TL and the second one is sterilizing at the end of the year for 9,500 TL. How much is the difference between two options in terms of today's money? The expected annual inflation rate is 10% (Report a positive number) 2 Report the difference between the old loan payment before the Coronavirus Disease) and the new loan payment. 3 According to this new scenario, what is the NPV of the Videogame Caf project? Muratcan's Cost of Capital is still 25%. With the government shutdown, Muratcan also wants to negotiate with the landlord to lower the rent that year. What is the rent he can afford to pay in Year 2 that will still allow him to earn 25% annually from the entire project? Years Revenue Cost Cash Flow Data Table A - Financial data for Game101 Center Initial Cost 450,000.00 Selling Price 1,050,000.00 Annual Revenue Income 210,000.00 Annual Expenses Human Resources 70,000.00 Maintenance 12,000.00 Rent 33,000.00 NPV IRR Instructions Accounting Finance + Type here to search Calibri BIU - * General - 11 - AA EE - A Wrap Text Merge & Center S HEX E Insert Delete Format 2 AutoSum P L Conditional Format as Cell Formatting Table Styles 2Y 47 Sort & Egy E% Clear Filter Font Alignment Number Styles Cells Editing B - 1 fx Annual Revenue C D LM After producing and selling their new videogame consoles, Game101 Center decided to open a chain of Videogame Cafes. They started to calculate their current financial situation. Answers To start their chain of Videogame Cafes, the company requires an initial investment of 450.000 TL. However, the company only has 300,000 TL cash Points Part 1 on hand, therefore Muratcan, the CEO of Game101 Center, is requesting a 150,000.00 TL loan from BANK KUM. The bank gives the annual interest rate for 7 years loan as 14%. 1.50 1 Report the yearly payment of the loan. 1.50 Muratcan doesn't want to pay more than 30710 TL per year. He asks to pay the remainder as a lump sum payment at the end of the loan. What will be the lump sum payment amount? 34,978,90 45,806.93 1.50 3 The other option is for Muratcan to lower the amount of the loan. What is the loan amount that will allow him to pay 30710 TL per year? 131,693.69 1.50 2.00 2,00 1.00 Another bank, BANK DALGA, has approached Muratcan with a better interest rate that will allow the payment 30710 TL for a loan of 150,000 TL. What is the new interest rate? (Assume that all the other variables are constant.) 9.9027% Muratcan wants to see whether this investment is worth or not. Hence, he consulted Jason Lau to calculate the NPV and IRR of the investment. Muratcan already Part 2 did his research and gave the Data Table A to Jason. Muratcan wants to make money at least 25% of his Investment by selling the company for 1,050,000 TL Assume that Muratcan took the loan from BANK DALGA. Calculate the NPV of the investment. 2 Report the IRR for this investment. 3 Should Muratcan make the investment? Left Click Muratcan is worried about whether he can sell the cafes for for 1,050,000 TL after 7 years. What is the minimum selling price that will still provide him with an annual rate of return of %25. At the end of the 3rd year, Muratcan decided to make an advertisement to increase the income 4% each year, so he paid 42906 TL per year to the advertisement 5 company. Finally he asked Jason to calculate the expected rate of return which makes NPV O. (Hint: Use selling price mentioned at Part 2, independent from question 4) Advertisement starting from year 4) Instructions Accounting Finance 2.00 2.00 Type here to search - 11 Calibri BIU - B A A == = E General A 2 Wrap Text Merge & Center utou - - % , 4 8-98 .02 Conditional Format as Cell Formatting Table Styles Insert Delete Format Font . Clear Alignment Conta Number Filter - Styles X Fi Annual Revenue Editing At second year of Game101 Cafe, Corona Virus Disease (COVID-19) appears and the government shut down all entertainment cafes for one year which means you Part 3 will pay all the costs but can't make money during the year. On the other hand, the bank has agreed to charge 0% for one year's payment. (Hint: remember Muratcan took the loan from BANK DALGA.) Muratcan has 2 option to sterilize his cafe. The first option is sterilizing it today for 8,500 TL and the second one is sterilizing at the end of the year for 9,500 TL. How much is the difference between two options in terms of today's money? The expected annual inflation rate is 10% (Report a positive number) 2 Report the difference between the old loan payment before the Coronavirus Disease) and the new loan payment. 3 According to this new scenario, what is the NPV of the Videogame Caf project? Muratcan's Cost of Capital is still 25%. With the government shutdown, Muratcan also wants to negotiate with the landlord to lower the rent that year. What is the rent he can afford to pay in Year 2 that will still allow him to earn 25% annually from the entire project? Years Revenue Cost Cash Flow Data Table A - Financial data for Game101 Center Initial Cost 450,000.00 Selling Price 1,050,000.00 Annual Revenue Income 210,000.00 Annual Expenses Human Resources 70,000.00 Maintenance 12,000.00 Rent 33,000.00 NPV IRR Instructions Accounting Finance + Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started