Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answers 1 to 8 Table Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages

I need the answers 1 to 8

Table

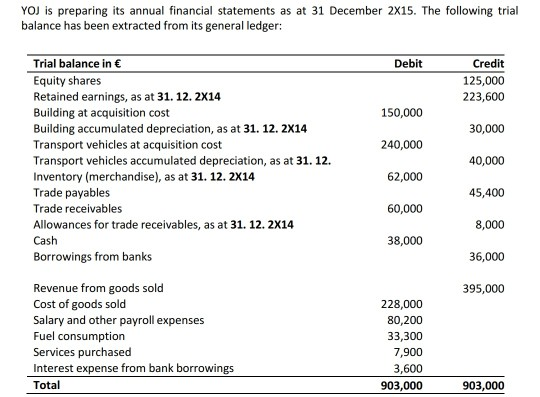

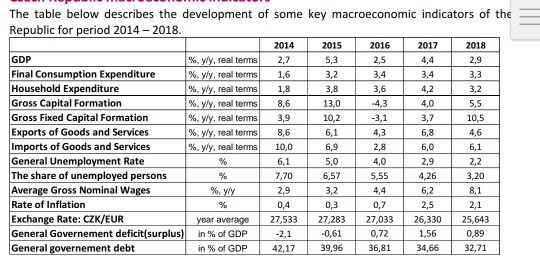

Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; water, enhanced water, and sports drinks; juice, dairy, and plant-based beverages; teas and coffees; and energy drinks. It also offers concentrates, syrups, beverage bases, source waters, and powders/minerals, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products primarily under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Schweppes, Sprite, Thums Up, Aquarius, Dasani, glacau smartwater, glacau vitaminwater, Ice Dew, I LOHAS, Powerade, AdeS, Del Valle, innocent, Minute Maid, Minute Maid Pulpy, Simply, ZICO, Ayataka, Costa, FUZE TEA, Georgia, Gold Peak, and HONEST TEA brands. The Coca-Cola Company offers its beverage products through a network of company-owned or controlled bottling and distribution operators, as well as through independent bottling partners, distributors, wholesalers, and retailers. The company was founded in 1886 and is headquartered in Atlanta, Georgia. Please answer these questions: 1. Present in a table(s) The Coca-Cola Company general financial data (incl. Balance Sheet and Income Statement important items) between 2014 and 2018. 2. Break down (analyse) the structure of The Coca-Cola Company Balance Sheet (important) items between 2014 and 2018. Describe the sources of The Coca-Cola Company Revenues. Analyse the development of The Coca-Cola Company main Income statement and Balance Sheet items between 2014 and 2018 Find at least 2 competitors of The Coca-Cola Company and make a reasoning for your choice. What was the profitability of The Coca-Cola Company? Compare to the competitors. What was the company's market capitalization as of the end of each year? If you were financial investor, would you currently suggest to buy/sell The Coca-Cola Company shares and why? Discuss the reasons for price turns of The Coca-Cola Company shares within last 5 years. 3. 4. 5. 6. 7. 8. YOJ is preparing its annual financial statements as at 31 December 2X15. The following trial balance has been extracted from its general ledger: Trial balance in Equity shares Retained earnings, as at 31. 12. 2X14 Building at acquisition cost Building accumulated depreciation, as at 31. 12. 2X14 Transport vehicles at acquisition cost Transport vehicles accumulated depreciation, as at 31. 12. Inventory (merchandise), as at 31. 12. 2X14 Trade payables Trade receivables Allowances for trade receivables, as at 31. 12. 2X14 Cash Borrowings from banks Debit Credit 125,000 223,600 150,000 240,000 62,000 60,000 38,000 30,000 40,000 45,400 8,000 36,000 395,000 Revenue from goods sold Cost of goods sold Salary and other payroll expen Fuel consumption Services purchased Interest expense from bank borrowings Total 228,000 80,200 33,300 7,900 3,600 903,000 ses 903,000 1 The table below describes the development of some key macroeconomic indicators of the Republic for period 2014- 2018 20142015 2016 2017 2,7 1,6 1.8 8,6 3,9 8,6 10,0 2018 2,9 3,3 3,2 5,5 10,5 6846 %. yy, real termal %, y/y, real terms | %, yy, real terms! %, y/y, real terms | %. yy, real termal %. y/y, real terms | %, yy, real terms | GDP Final Consumption E Household Expenditure Gross Capital Formation Gross Fixed Capital Formation Exports of Goods and Services Imports of Goods and Services General Unemployment Rate The share of unemployed persons Average Gross Nominal Wages Rate of Inflation Exchange Rate: CZK/EUR General Governement deficit(surplus) General governement debt 4,4 3,4 4,2 4,0 3,7 5,3 3,2 3,8 13,0 10,2 8,6 6,143 2,5 3,4 3,6 4,3 3,1 diture 10,0 6,9 2,86,06,1 % | 6,1 | 5,0 | 4,0 | 2,9 2,2 7,706,57 5,55 4263,20 2.93,244 6,281 0,7 0,4 0,3 2,5 2,1 year average 27,533 27.283 27033 26,330 25,643 0,89 -0,61 0,72 in % of GDP 2,1 1,56 n % of GDP | 42,17 | 39,96 | 36,81 | 34,66 | 32,71 Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; water, enhanced water, and sports drinks; juice, dairy, and plant-based beverages; teas and coffees; and energy drinks. It also offers concentrates, syrups, beverage bases, source waters, and powders/minerals, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products primarily under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Schweppes, Sprite, Thums Up, Aquarius, Dasani, glacau smartwater, glacau vitaminwater, Ice Dew, I LOHAS, Powerade, AdeS, Del Valle, innocent, Minute Maid, Minute Maid Pulpy, Simply, ZICO, Ayataka, Costa, FUZE TEA, Georgia, Gold Peak, and HONEST TEA brands. The Coca-Cola Company offers its beverage products through a network of company-owned or controlled bottling and distribution operators, as well as through independent bottling partners, distributors, wholesalers, and retailers. The company was founded in 1886 and is headquartered in Atlanta, Georgia. Please answer these questions: 1. Present in a table(s) The Coca-Cola Company general financial data (incl. Balance Sheet and Income Statement important items) between 2014 and 2018. 2. Break down (analyse) the structure of The Coca-Cola Company Balance Sheet (important) items between 2014 and 2018. Describe the sources of The Coca-Cola Company Revenues. Analyse the development of The Coca-Cola Company main Income statement and Balance Sheet items between 2014 and 2018 Find at least 2 competitors of The Coca-Cola Company and make a reasoning for your choice. What was the profitability of The Coca-Cola Company? Compare to the competitors. What was the company's market capitalization as of the end of each year? If you were financial investor, would you currently suggest to buy/sell The Coca-Cola Company shares and why? Discuss the reasons for price turns of The Coca-Cola Company shares within last 5 years. 3. 4. 5. 6. 7. 8. YOJ is preparing its annual financial statements as at 31 December 2X15. The following trial balance has been extracted from its general ledger: Trial balance in Equity shares Retained earnings, as at 31. 12. 2X14 Building at acquisition cost Building accumulated depreciation, as at 31. 12. 2X14 Transport vehicles at acquisition cost Transport vehicles accumulated depreciation, as at 31. 12. Inventory (merchandise), as at 31. 12. 2X14 Trade payables Trade receivables Allowances for trade receivables, as at 31. 12. 2X14 Cash Borrowings from banks Debit Credit 125,000 223,600 150,000 240,000 62,000 60,000 38,000 30,000 40,000 45,400 8,000 36,000 395,000 Revenue from goods sold Cost of goods sold Salary and other payroll expen Fuel consumption Services purchased Interest expense from bank borrowings Total 228,000 80,200 33,300 7,900 3,600 903,000 ses 903,000 1 The table below describes the development of some key macroeconomic indicators of the Republic for period 2014- 2018 20142015 2016 2017 2,7 1,6 1.8 8,6 3,9 8,6 10,0 2018 2,9 3,3 3,2 5,5 10,5 6846 %. yy, real termal %, y/y, real terms | %, yy, real terms! %, y/y, real terms | %. yy, real termal %. y/y, real terms | %, yy, real terms | GDP Final Consumption E Household Expenditure Gross Capital Formation Gross Fixed Capital Formation Exports of Goods and Services Imports of Goods and Services General Unemployment Rate The share of unemployed persons Average Gross Nominal Wages Rate of Inflation Exchange Rate: CZK/EUR General Governement deficit(surplus) General governement debt 4,4 3,4 4,2 4,0 3,7 5,3 3,2 3,8 13,0 10,2 8,6 6,143 2,5 3,4 3,6 4,3 3,1 diture 10,0 6,9 2,86,06,1 % | 6,1 | 5,0 | 4,0 | 2,9 2,2 7,706,57 5,55 4263,20 2.93,244 6,281 0,7 0,4 0,3 2,5 2,1 year average 27,533 27.283 27033 26,330 25,643 0,89 -0,61 0,72 in % of GDP 2,1 1,56 n % of GDP | 42,17 | 39,96 | 36,81 | 34,66 | 32,71Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started