Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answers for the three questions (6-7-8). 6. Suppose that a 23-year-old accountant wishes to retire as a millionaire based on her retirement

I need the answers for the three questions (6-7-8).

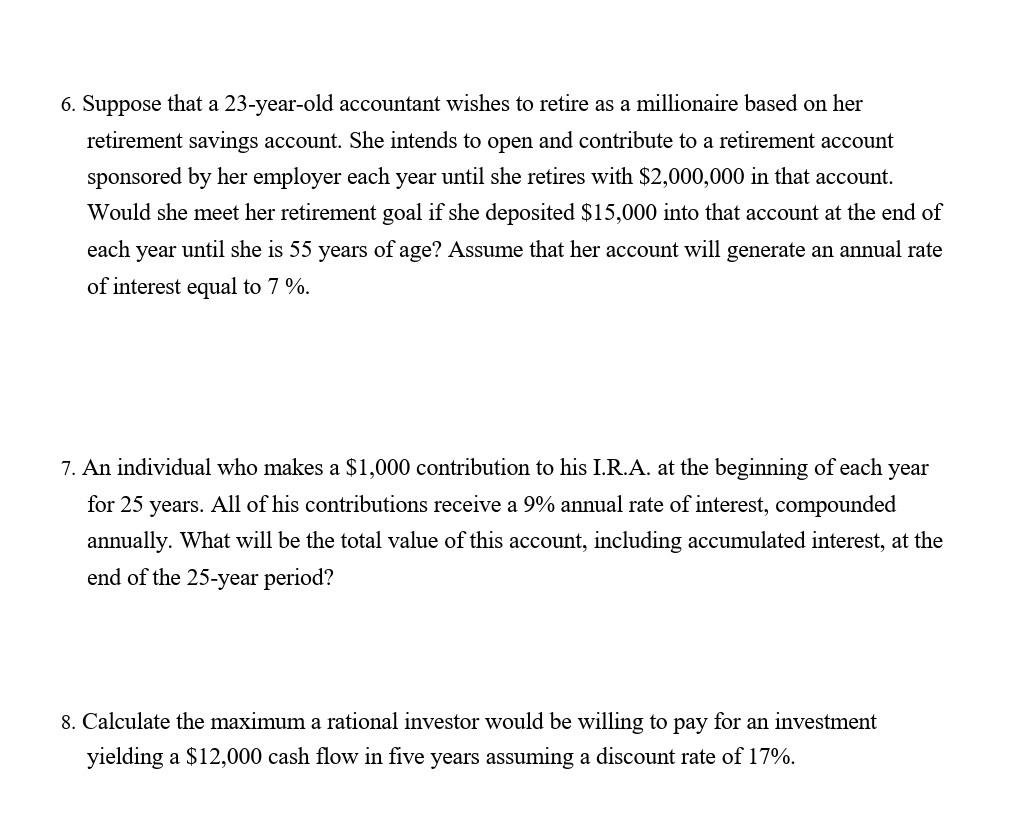

6. Suppose that a 23-year-old accountant wishes to retire as a millionaire based on her retirement savings account. She intends to open and contribute to a retirement account sponsored by her employer each year until she retires with $2,000,000 in that account. Would she meet her retirement goal if she deposited $15,000 into that account at the end of each year until she is 55 years of age? Assume that her account will generate an annual rate of interest equal to 7%. 7. An individual who makes a $1,000 contribution to his I.R.A. at the beginning of each year for 25 years. All of his contributions receive a 9% annual rate of interest, compounded annually. What will be the total value of this account, including accumulated interest, at the end of the 25 -year period? 8. Calculate the maximum a rational investor would be willing to pay for an investment yielding a $12,000 cash flow in five years assuming a discount rate of 17%. 6. Suppose that a 23-year-old accountant wishes to retire as a millionaire based on her retirement savings account. She intends to open and contribute to a retirement account sponsored by her employer each year until she retires with $2,000,000 in that account. Would she meet her retirement goal if she deposited $15,000 into that account at the end of each year until she is 55 years of age? Assume that her account will generate an annual rate of interest equal to 7%. 7. An individual who makes a $1,000 contribution to his I.R.A. at the beginning of each year for 25 years. All of his contributions receive a 9% annual rate of interest, compounded annually. What will be the total value of this account, including accumulated interest, at the end of the 25 -year period? 8. Calculate the maximum a rational investor would be willing to pay for an investment yielding a $12,000 cash flow in five years assuming a discount rate of 17%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started