Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the answers for this questions WEEK 4 TUTORIAL: TIME VALUE OF MONEY PART 2 Question 1 You are evaluating three investment schemes: X,

i need the answers for this questions

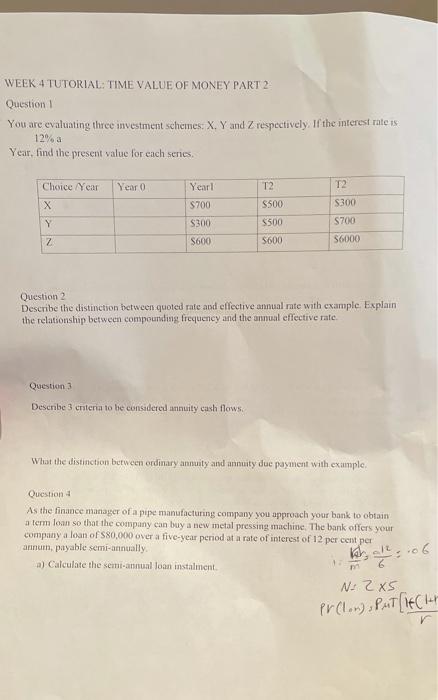

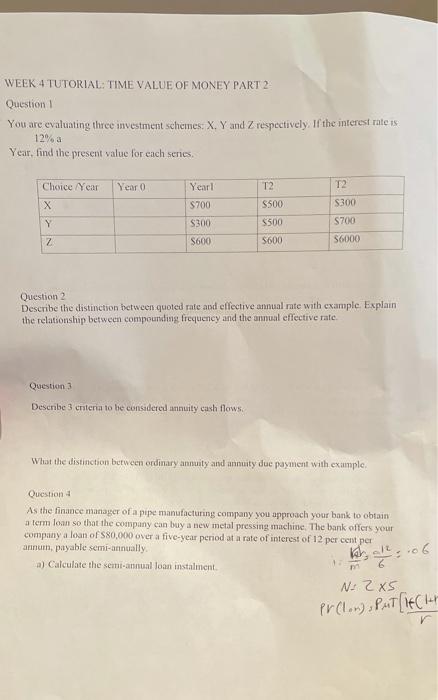

WEEK 4 TUTORIAL: TIME VALUE OF MONEY PART 2 Question 1 You are evaluating three investment schemes: X, Y and Z respectively. If the interest rate is 12% a Year, find the present value for each series Year0 T2 T2 Choice Year Y Year! 700 S300 S500 S300 5700 $500 5600 Z $600 56000 Question 2 Describe the distinction between quoted rate and effective annual rate with example Explain the relationship between compounding frequency and the annual effective rate. Question 3 Describe 3 criteria to be considered annuity cash flows What the distinction between ordinary annuity and annuity duc payment with example, Question As the finance manager of a pipe manufacturing company you approach your bank to obtain a term loan so that the company can buy a new metal pressing machine. The bank offers your company a loan of $80,000 over a five-year period at a rate of interest of 12 per cent per annun, payable semi-annually. a) Calculate the semi-annual loan instalment N: 2XS Web, 06 12 PreLer) sPuT [TECH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started